DISH Network (NASDAQ:DISH) jumped 12% on Friday, on rumors of a possible deal with Amazon (AMZN) to sell its Boost Mobile Infinity (Post Paid) on Amazon’s website, where it already sells its Boost Mobile Prepaid cards.

Earlier rumors had also swirled of Amazon bundling Prime with Boost. Amazon supposedly had been in talks with several mobile providers to get into mobility and bundle it with Prime subscriptions.

Let’s look at the two possibilities separately.

Selling on Amazon’s website – too little too late?

DISH is the baby of the mobile bunch and a distant fourth after AT&T Inc., (T) Verizon Communications (VZ) and T-Mobile US, Inc. (TMUS) — having bought Boost Mobile in 2019 after the justice department forced T-Mobile to divest some assets following its takeover of Sprint. Market leader AT&T had 217Mn subscribers compared to 8Mn for DISH’s Boost Mobile business.

In my opinion, DISH made a mistake spending over $30Bn trying to build its own 5G network as an MNO (Mobile Network Operator) instead of continuing to piggyback on T-Mobile and AT&T as a MVNO (Mobile Virtual Network Operator).

Regardless of the rumors and its benefits, DISH is in terrible shape in an industry where scale and business combinations are everything to survive, and being one of the smallest players is really, really hurting it in my opinion. DISH is the smallest in mobile, with Verizon, AT&T and T-Mobile way ahead in terms of subscribers, revenues, and market cap as we can see below.

In my opinion, DISH partnering with Amazon for selling Boost Mobile post-paid on its website is a good strategy and absolutely necessary, but possibly “too little too late”. I don’t believe it can survive in this industry unless it is part of a much larger organization.

DISH’s shaky financials

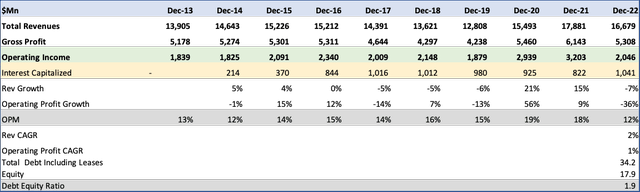

Dish Network Financials (Dish Network, Seeking Alpha, Fountainhead)

In the last ten years, DISH grew revenues at a CAGR of only 2% and operating profits at an even smaller CAGR of 1%. And this is after capitalizing interest, which was $1Bn last year. DISH’s total debt stands at $34Bn.

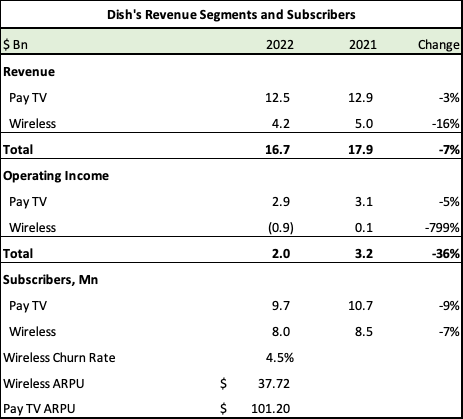

In 2022, DISH lost 9% of Pay Tv subscribers and 7% of mobile subscribers, further deteriorating what I see as an already precarious position.

Dish Network Revenues (Dish Network)

In Pay TV, both satellite and cable TV operators are losing business, with customers constantly cutting the cord and moving to streaming. The last mile connectivity, which carried the real value (recurring subscription revenue) gets relegated to internet service provider revenue which costs one third or half of the earlier phone, TV, and Internet bundle.

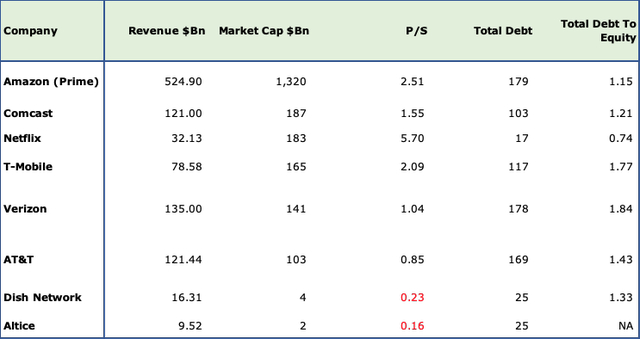

Looking at the giants below, we can see that this is an extremely tough and competitive industry.

Communication Industry Leaders (Seeking Alpha, Fountainhead)

DISH competes with giants in two telecom sectors, Mobile and Pay TV -Satellite/Cable. The markets reward the giants in both sectors, as scale is everything and consolidation is likely the only way forward. As we can see above, Verizon, AT&T and T-Mobile have the biggest market caps and P/S ratios compared to Dish which is at only 0.23 x Sales – and in constant danger of meeting its debt payment deadlines and its debt covenants. AT&T had 217Mn subscribers compared to 8Mn for DISH’s Boost Mobile business – That is 27 times!

Similarly in Pay TV – Comcast (CMCSA) is way ahead with a market cap of $187Bn compared to DISH and Altice (ATUS), another small competitor, struggling to stay afloat. Comcast had 15.5Mn subscribers, compared to DISH’s 9.7Mn in 2022.

Streaming competitors Amazon and Netflix (NFLX) are also valued so much better because they’re growing subscribers, mainly from cord cutters ditching DISH’s and Alice’s expensive bundled plans.

In this industry everyone has debt and Verizon’s debt to equity is almost 2 to 1, but with a market cap of $141Bn it is still valued at 1.04 X Sales.

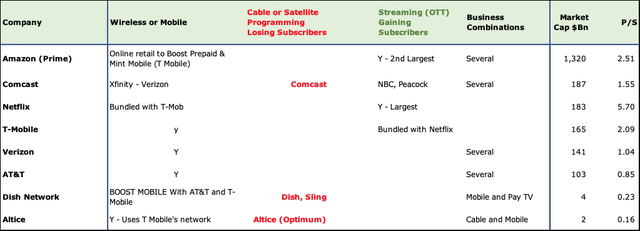

The consolidated nature of the industry

Markets seem to reward industry heavy weights that have several business combinations. DISH isn’t too far behind in Pay Tv as it is to the giants in Mobile; it has 9.7Mn subscribers to Comcast’s 15.5 but it gets no respect or valuation, I believe simply because the market rewards consolidated business combinations, which throws much more cash and de-risks some of the cyclicality inherent in media and telecom, besides adding bundled subscribers.

Comcast has cable, media, and studios. AT&T serves individuals and businesses in cell phones, internet and landlines and the Latin American market. Verizon also has mobile, last mile FIOS, Internet, individual and business customers. Amazon has AWS, Prime and 38% of the online market. As we can see below the highest market caps and valuations are for those with business combinations or growing streaming businesses like Netflix. Minnows, DISH and Altice are at the bottom.

Communications Industry Valuations (Seeking Alpha, Bloomberg, Statista, Cord Cutter, Fountainhead)

Amazon getting into Mobility by bundling Prime with Boost

Earlier, rumors had also swirled of Amazon, bundling Prime with Boost. Amazon, supposedly had been in talks with several mobile providers to get into mobility to bundle it with Prime.

I don’t believe Amazon will take on Boost to get into the cell phone business.

There are several reasons why Amazon’s getting into cell phones wouldn’t make sense and a strategic partnership may be its best bet instead.

1) This is a highly regulated industry and owning a mobile operator would come with the headache of several regulatory and compliance requirements.

2) All mobile operators have a boatload of debt including DISH, which has about $34Bn overall.

3) This is a cutthroat, commodity business with price being the only differentiator.

4) The industry needs significant amounts of Capex, to buy Spectrum and continuously migrate to more technologically advanced networks, 4G to 5G and so on, every 5 years.

5) High cost of debt.

6) This will be a very difficult anti-trust hurdle to clear and will drag on for years.

As for DISH’s biggest assets, the Pay TV business, of which it has about 10Mn subscribers including DISH and Sling at an ARPU of $101 appear to be dwindling by the day. Amazon Prime has about 170Mn members. There is precious little for Amazon to gain in an arguably dying business, and just getting the internet services last mile into customers’ homes may not be enough.

Cable subscribers lost 3.5Mn subscribers last year as more and more people cut the cord. A large number of the Gen Z and Gen Alpha generations have either cut the cord or never bought a cable/satellite subscription in their lives and even the bundles that they have are from cell phone makers.

DISH and Amazon

Given the high needs of Capex for constant improvements in this sector, such as buying spectrum, building data centers and towers, laying fiber networks, last mile connectivity (the most expensive) for cable operators and satellite for competitors like DISH Network, DISH was smart enough to partner with Amazon for its 5G strategy in 2021, using Amazon’s Web Services for its technology infrastructure – saving a few pennies in the process. This was comparatively capital light and DISH chose a pay per usage basis with AWS.

More importantly, there is a history of working together and speculation has been rife since then of further strategic partnerships between the two.

Amazon had close to 40% of online retail sales in 2022, leaving everybody in the dust and for sure can provide Boost Mobile the boost it so desperately needs. To be sure, selling Boost Mobile on Amazon’s website is a good idea and needs to be implemented soon.

Too little too late

What happens to the stock? Partnering with Amazon to sell on its website will increase revenues a little bit, but that doesn’t justify buying the stock in my view. This would be a Hail Mary trade and sure, while short covering will ensure sharp moves, especially now that meme stocks are seemingly back in vogue, this is temporary, therefore avoidable and for most a value trap. DISH had a short interest of 22.4% as of July 28th. For a longer-term investor this is nowhere close to a good investment in my opinion. Besides the shaky financials, high debt and insignificant position in an industry dominated by giants, there is the danger of dilution of 20% when 2024-2026 convertible notes come due. Given DISH’s cash position it would be impossible to repay and will most likely be converted.

Sure, for DISH shareholders, the best outcome would be to get folded into Amazon’s tent. But why would Amazon partner further with DISH? It will probably not be at current prices, Amazon would never overpay in my opinion, so I believe it would have to be at a significant discount and debt holders would potentially need to take a haircut. Even if Amazon took over DISH, new mobile subscribers would have to be acquired at the expense of the big three – this is a saturated market and waging a price war would be expensive even if it’s bundled with Prime. Besides, the justice department could easily prevent this given Amazon’s size and outsized influence.

Bottom line: a) selling on Amazon’s website will help DISH a little, but the longer-term scenario is still negative and a terrible long-term investment, b) the likelihood of Amazon taking over DISH to get into mobile is very, very low and never at this valuation, it would be significantly lower in my view.

I think it’s a hold for now, and a sell if short covering takes the price higher.

Read the full article here