The Biden administration is phasing in a new, more affordable student loan repayment plan. And as payments are set to resume for millions of Americans in the coming weeks, the Education Department has launched a new application so borrowers can apply for the new program.

Here’s what borrowers should know.

New Repayment Plan As Student Loan Payments Resume

In the wake of last month’s Supreme Court decision striking down the Biden administration sweeping student loan forgiveness plan, the President unveiled a new income-driven repayment plan. The Saving on a Valuable Education plan, referred to as the “SAVE” program, is being billed by administration officials as the most affordable student loan repayment plan in history. The SAVE plan is replacing Revised Pay As You Earn (REPAYE), another income-driven repayment plan that has been available since 2016.

The SAVE plan will feature a number of benefits including a higher poverty exemption limit (meaning more of a borrower’s income will be excluded from consideration, which in turn will lower payments), and a waiver of excess interest accrual to end runaway balance growth, which has long been associated with income-driven repayment plans. The SAVE plan will also have a more affordable repayment formula, flexibilities that will allow married borrowers to exclude spousal income by filing taxes separately (unlike the REPAYE plan), and accelerated student loan forgiveness for borrowers with smaller initial balances. The program is expected to “help borrowers save $1,000/yr on payments” or more, according to top administration officials.

The Education Department will be phasing in the features of SAVE over the course of the next year. Official department guidance indicates that the higher poverty-based income exemption, waiver of excess interest, and marital tax filing flexibilities will go into effect this summer as student loan payments resume. The remaining benefits will be effective in 2024.

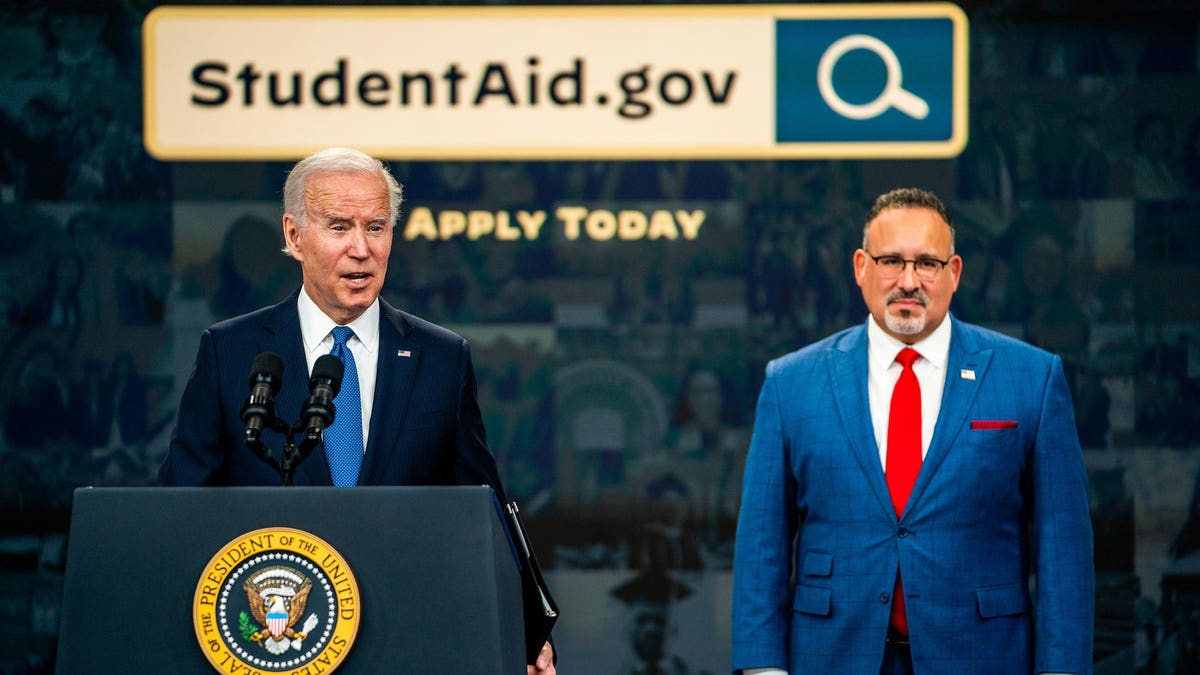

Biden Administration Launches New Application For Student Loan Payment Plan

As first reported by CNN, the Education Department launched the official application for the new student loan plan this weekend. The application is now available through the department’s online IDR application portal, which now has a message that, “A beta version of the updated IDR application is now available and includes the option to enroll in the new SAVE Plan – the most affordable repayment plan yet.”

The online application appears to provide a faster and simpler process to request an IDR plan than the earlier version of the application, and it allows borrowers to connect with the IRS online to import their income information. After confirming contact information and details about marital status and family size, borrowers are prompted to choose an IDR plan, which includes SAVE as one of the available options.

“The SAVE plan is the new name for the Revised Pay As You Earn (PREAYE) Repayment plan,” says a note in the application. Borrowers simply need to click “select” to choose SAVE as their plan, and then proceed with the remaining steps to finalize, electronically sign, and submit their application.

Other Student Loan Forgiveness And Relief Plans In The Works

The launch of the SAVE plan comes on the heels of other Biden administration initiatives to provide student debt relief to borrowers in the wake of the Supreme Court decision, even as student loan payments are on track to resume later this summer.

Earlier this month, the Biden administration began notifying over 800,000 borrowers that they qualify for billions in student loan forgiveness through the IDR Account Adjustment, and more loan forgiveness under that program is on the way. The administration also announced student debt relief for borrowers defrauded by their school, and took the first step in the process to develop a new student loan forgiveness plan.

Further Student Loan Forgiveness Reading

5 Student Loan Forgiveness Updates As Payments Resume In A Matter Of Weeks

New Changes Expand Student Loan Forgiveness For Public Service Borrowers

Your Student Loan Payment Plan Could Get Eliminated — Here’s Why

Here’s When Student Loan Payments Resume, And What Borrowers Should Do Now

Read the full article here