The object of life is not to be on the side of the majority, but to escape finding oneself in the ranks of the insane.”― Marcus Aurelius, Meditations.

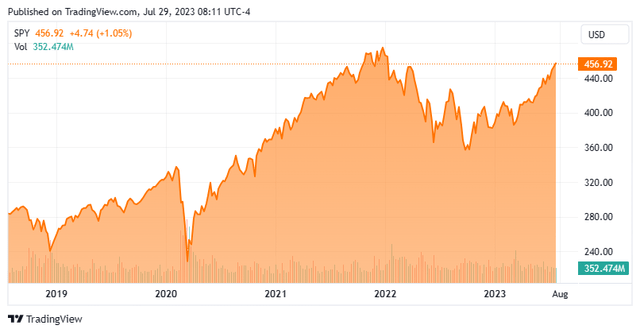

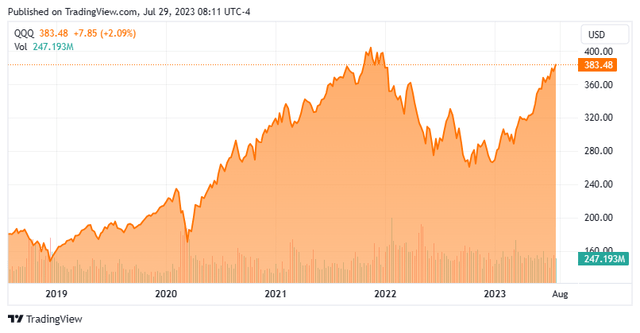

Markets have rallied sharply in 2023. The S&P 500 (SP500) and NASDAQ (COMP.IND) are almost back to their levels prior to the beginning of the current monetary tightening efforts by the Federal Reserve that began in March of 2022.

Seeking Alpha

Seeking Alpha

Unfortunately, the markets look significantly overbought here, and the huge recent rise of equities flies against well-known market axioms and common sense on many levels. Here are three key reasons the rally seems more than illogical and the next big move within equities is likely to be down.

Equities Now Seem Immune To Fed Policy:

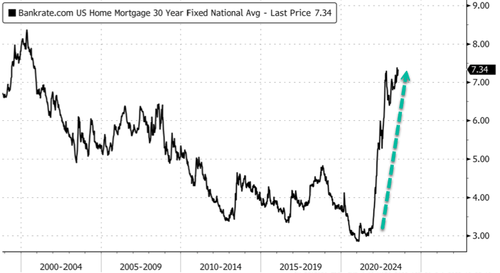

One of the best-known sayings on Wall Street is “Don’t Fight The Fed.” Equities rarely do well when interest rates are rising let alone when the central bank has implemented the most aggressive monetary regime since the days of Paul Volcker. This has led to a 525 bps rise in the Fed Funds rate in a little less than a year and a half.

Bankrate

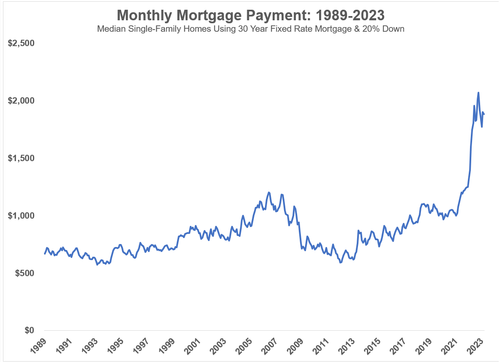

This has affected other interest rates throughout the economy. The average 30-year mortgage rate is right around seven percent, up massively from just over three percent at the start of 2022. The associated increase in borrowing costs has led to more than a doubling of the average mortgage payment for a median single-family home over the course of a year, assuming a 30-year fixed mortgage with a 20% down payment. The average rate for an auto loan is now north of 11%, and this for individuals with sparkling credit.

ZeroHedge

Chairman Powell and the oracles of the Federal Reserve have ratcheted up interest rates in an effort to slow down the economy, job creation and squash the highest inflation levels since the early 80s, which they helped unleash in 2020 and 2021. On the latter front, their efforts are bearing fruit as inflation levels are falling nicely. This has been a big factor in the recent rally in stocks.

The initial reaction to the beginning of the Fed’s new monetary policy was what would expect from a historical market perspective. The NASDAQ lost a third of its value in 2022 and the S&P 500 was off approximately 20% for the year as well. Higher beta parts of the market like all the IPOs and SPACs that came public in 2020 and 2021 were taken out to the woodshed and beaten like a rented mule.

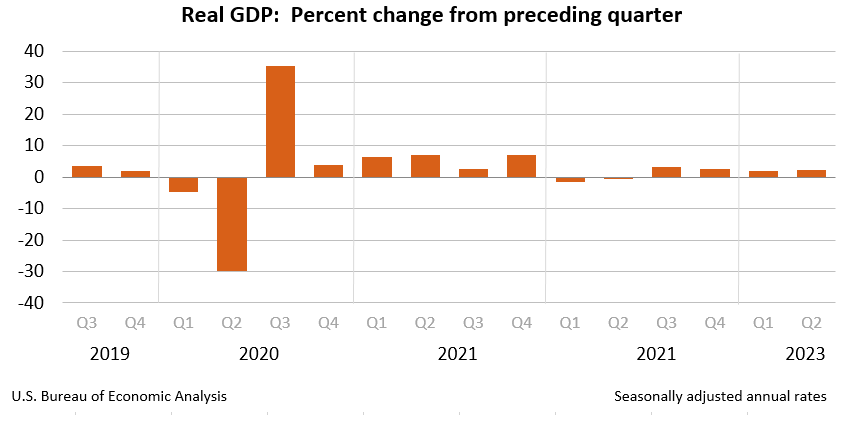

U.S. Bureau Of Economic Analysis

We have also seen some of unintended consequences of Fed policy as the country endured the second, third and fourth largest bank failures in U.S. history earlier in the year. Job growth has also slowed but still remains strong. The economy has done better than expected in the first half of 2023 with just over two percent GDP growth. Of course, this has been helped substantially by the Federal government running up a $1.4 trillion deficit in the first nine months of its fiscal year 2023 budget. Something that obviously is not sustainable over the long-term.

The S&P 500 and NASDAQ have ridden falling inflation levels and better than expected economic growth to nearly regain their levels at the start of monetary tightening some 16 months ago. This goes against market history and is unlikely to last. This is especially the case given there is an 18-month lag before changes in Fed Funds rates are fully felt throughout the economy.

Where’s The Growth?:

Now the rally in the stock market in 2023 would be more understandable if equities were delivering 10% or better earnings growth. However, that simply is not the case. While second quarter earnings have largely been better than expected with some 78% of the S&P 500 companies reporting so far beating consensus estimates, year-over-year profits for the S&P 500 will be down in 2023 compared to 2022. Despite this, the S&P 500 trades at approximately 20 times earnings.

Even earnings growth from the seventh largest mega cap stocks in the market known as ‘The Magnificent Seven‘ is not universal. This is important as these seven stocks accounted for all the S&P 500 gains in the first half of 2023, albeit breadth has improved some in the second half of this year to date. Yes, NVIDIA Corporation (NVDA), Alphabet (GOOG), Amazon (AMZN), Meta Platforms (META) and Microsoft (MSFT) will deliver solid profit growth in FY2023. That said, with NVDA selling at nearly 60 times forward earnings and AMZN priced at north of 80 times forward profits per share, valuations seem more than stretched here.

Let’s also look at the other two key components of this cohort that has been on the vanguard of this rally year to date as their earnings are projected to fall this year.

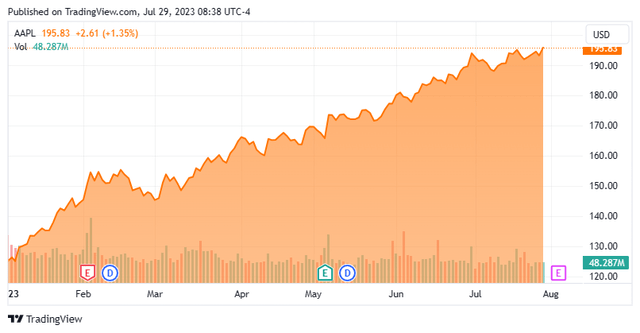

Seeking Alpha

Apple (AAPL) posted earnings of $6.11 a share in FY2022. Current projections have the Cupertino based tech giant with $5.98 a share of profits in FY2023. The slight earnings decline hasn’t stopped AAPL from gaining over 55% so far this year. The stock currently trades at nearly 33 times forward earnings.

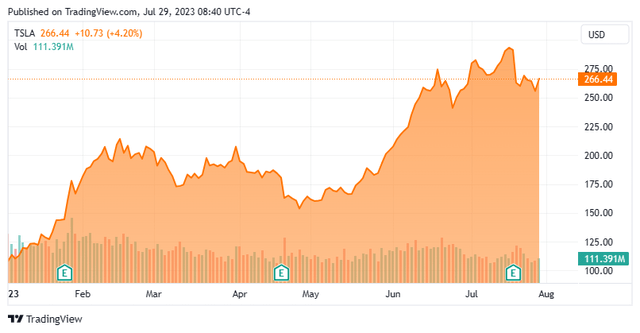

Seeking Alpha

Tesla, Inc. (TSLA) makes Apple look like a piker as its stock is up over 145% so far in 2023. The electric vehicle juggernaut printed out $4.07 a share in profits in FY2022. The latest analyst firm consensus has the company producing $3.44 a share in earnings in FY2023. The stock currently fetches just over 77 times forward earnings.

Does any of this make sense in a world where the ‘risk free‘ rate has shot up north of five percent?

Ignoring Collapsing Commercial Real Estate Values:

As I noted in a recent article, values of many sectors of the commercial real estate sector are collapsing. This is especially true in the office space due to impacts of rising interest rates and the explosion of the virtual workforce since the Covid pandemic and the associated lockdowns. There have also been some of high-profile recent defaults in hotel buildings and retail properties in NYC and San Francisco.

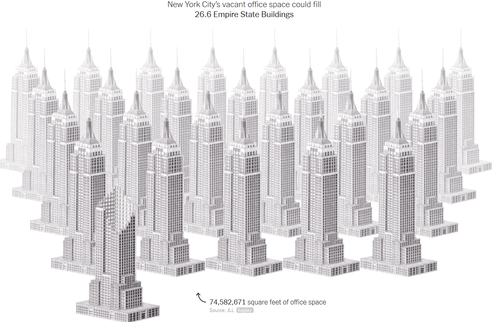

Office vacancy rates have hit over 20% in NYC and D.C. and are still higher in Los Angeles and San Francisco where they sit at record highs. According to the chair of Harvard Economics Department, Edward Glaeser as well as MIT’s Carlo Ratti there is now enough empty office space in New York City to accommodate 26 Empire State Buildings.

ZeroHedge

Over $200 billion in commercial real estate or CRE loans need to be rolled over by year-end, $1.5 trillion worth of CRE loans are due to be refinanced over the next three years and $2.5 trillion over the next half decade. Just over 30% of this debt is around office properties. From the aftermath of the Financial Crisis to the beginning of Fed tightening in 2022, these loans typically went for four to six percent, now they are generally priced in the nine to 12% range.

Falling office values are wiping out equity in these buildings. Combined with much higher interest rates to refinance this debt, many owners will conclude their only course of action is to “turn in the keys” when debt maturities come due. This is already happening to some extent as the default rate for commercial backed mortgage securities or CMBS hit 4.5% in June, up sharply from just 1.6% at the end of 2022.

Some 70% of CRE loans are provided by regional banks and both private equity and hedge funds are major players in the CMBS markets. So, while the overall amount of debt on office properties may be small compared to the overall economy, investors have to some concerns about potential ripple effects along with counter party and even derivative risk. After all, back in 2007, subprime was relatively a small niche of the market whose risk was “contained” according to Fed Chairman Ben Bernanke at the time.

Given this view on the overall market, my portfolio is positioned quite conservatively. Given both 3-month and 6-month Treasury bills yield over 5.2%, half my portfolio is in short-term treasuries. 40% of my portfolio is around holdings with great balance sheets within covered call positions for the additional downside risk mitigation. I also have 7% to 8% of my portfolio in cash with the rest made up of very small bets on overvalued stocks in the market via out of the money bear put spreads. I also now employing that same strategy against the SPDR® S&P 500 ETF Trust (SPY) and Invesco QQQ Trust ETF (QQQ) as well.

With the S&P VIX Index (VIX) at/near all-time lows, it has never been cheaper to hedge your portfolio against a potential market correction. Something that was just noted by Bank of America’s equity derivatives team.

In a mad world, only the mad are sane.”― Akira Kurosawa.

Read the full article here