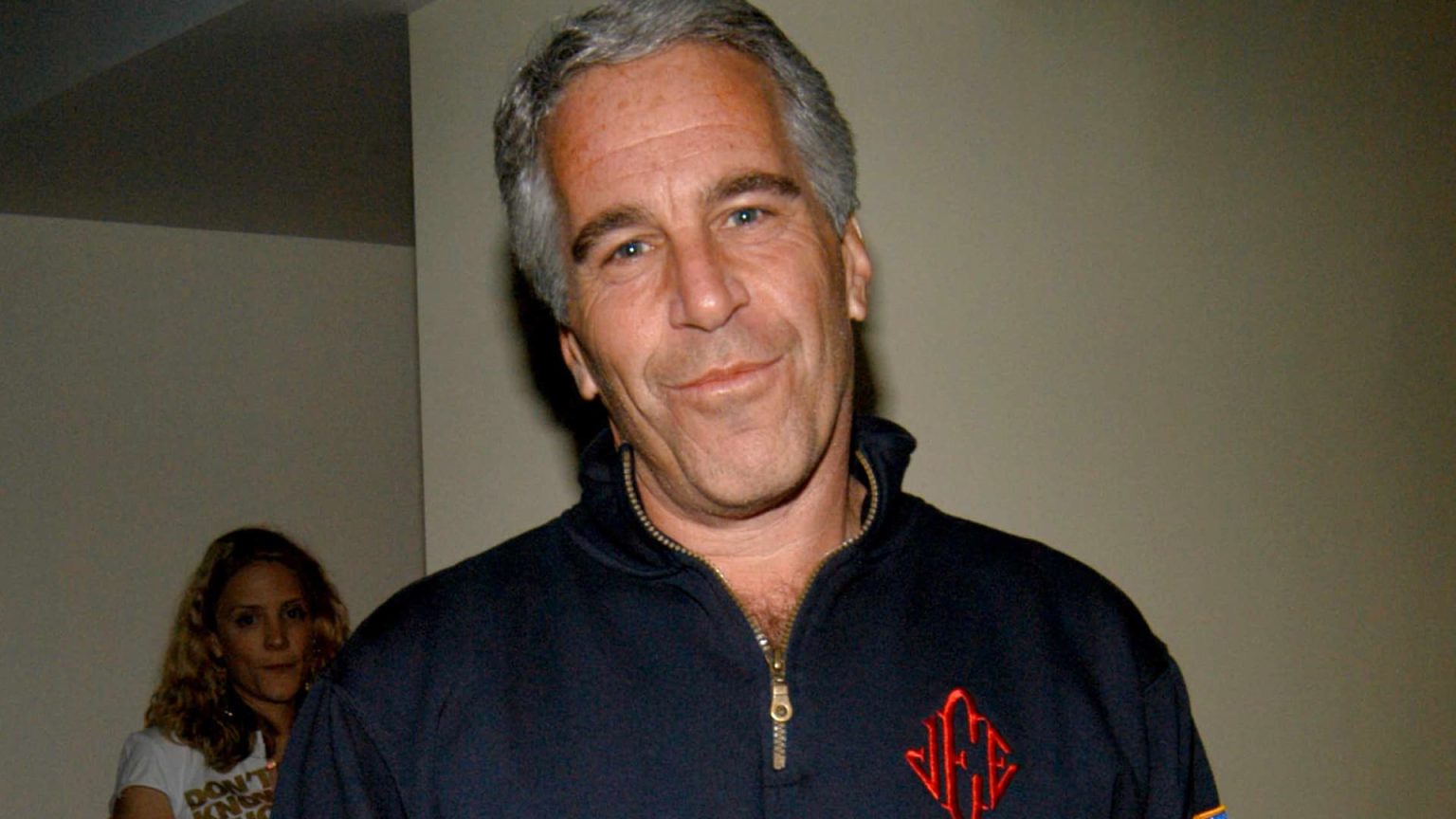

Jeffrey Epstein attends Launch of RADAR MAGAZINE at Hotel QT on May 18, 2005.

Patrick McMullan | Getty Images

JPMorgan Chase handled more than $1.1 million in payments from Jeffrey Epstein to “girls or women” after the giant bank says it fired the sex offender as a client, a lawyer for the U.S. Virgin Islands told a judge Monday.

Many of the girls or women had Eastern European surnames, the attorney, Linda Singer, wrote to Manhattan federal Judge Jed Rakoff.

And more than $320,000 of the payments were made to “numerous individuals for whom JPMorgan had no previously identified payments,” Singer wrote in the letter.

The letter accuses JPMorgan of failing to disclose the payments until after the end of discovery, the period during which the bank and the Virgin Islands exchanged evidence as part of an ongoing lawsuit.

Singer asked Rakoff to impose monetary sanctions on JPMorgan for not turning over the information when the Virgin Islands said it should have been disclosed, and to order the bank to turn over “all financial records for any newly disclosed girls or women to whom Epstein made payments.”

The Virgin Islands in its suit alleges that JPMorgan facilitated and financially benefited from sex trafficking by Epstein of young women during the years when he was a client.

Epstein maintained a residence on a private island in the American territory where he sexually abused scores of women, and during that time kept tens of millions of dollars on deposit at JPMorgan.

JPMorgan says it cut ties to Epstein in 2013. But Monday’s court filing challenges the bank’s timeline.

The bank denies any wrongdoing related to Epstein. JPMorgan spokeswoman Patricia Wexler, when asked about Singer’s letter, said, “There is no proof this is accurate.”

Singer wrote that documents recently turned over by JPMorgan contained information that had been previously sought by the Virgin Islands during the discovery period.

That information was assembled internally by the bank in October 2019, more than three months after Epstein was arrested on federal child sex trafficking charges. Epstein killed himself in jail in August 2019.

“There is no legitimate reason for JPMorgan failing to identify payments to girls or women the bank itself identified as being related to Epstein — and potential evidence of Epstein’s sex trafficking venture — years before receiving the USVI’s discovery requests,” the attorney wrote.

The letter says that a spreadsheet prepared by JPMorgan listing the dates and beneficiaries of more than 9,000 transactions payable to Epstein-related persons between 2005 and 2019 “had a combined value of over $2.4 billion.”

“Many of the entries reflected accounts and payments, numbering in the thousands and totaling in the hundreds of millions of dollars in value, of which USVI had no prior knowledge or information from JPMorgan’s responses and productions during the fact discovery period,” Singer wrote.

The letter says that JPMorgan has argued the information was not disclosed earlier “because it was not in a custodial production and/or did not relate to individuals specifically identified by the USVI as related to Epstein.”

But Singer noted, “The USVI has repeatedly made clear that its discovery requests are not limited to individuals it specifically identified as being related to Epstein.”

“The USVI specifically identified the individuals it knew were related to Epstein to make its discovery requests clearer — not relieve JPMorgan of its duty to produce known relevant documents,” the lawyer wrote.

Singer told Rakoff that it remains unclear whether JPMorgan has now disclosed all of the payments from Epstein to girls and women.

The lawyer asked the judge to order JPMorgan to produce, within five days, all documents and information concerning its 2019 review of its business with Epstein, and “all financial records for any newly disclosed girls or women to whom Epstein made payments.”

Read the full article here