By Blu Putnam

At A Glance

- The U.S. unemployment rate has only been at or below 4% less than 15% of the time since 1960

- If a recession were to develop, rapidly rising new weekly unemployment insurance claims can be an early indicator

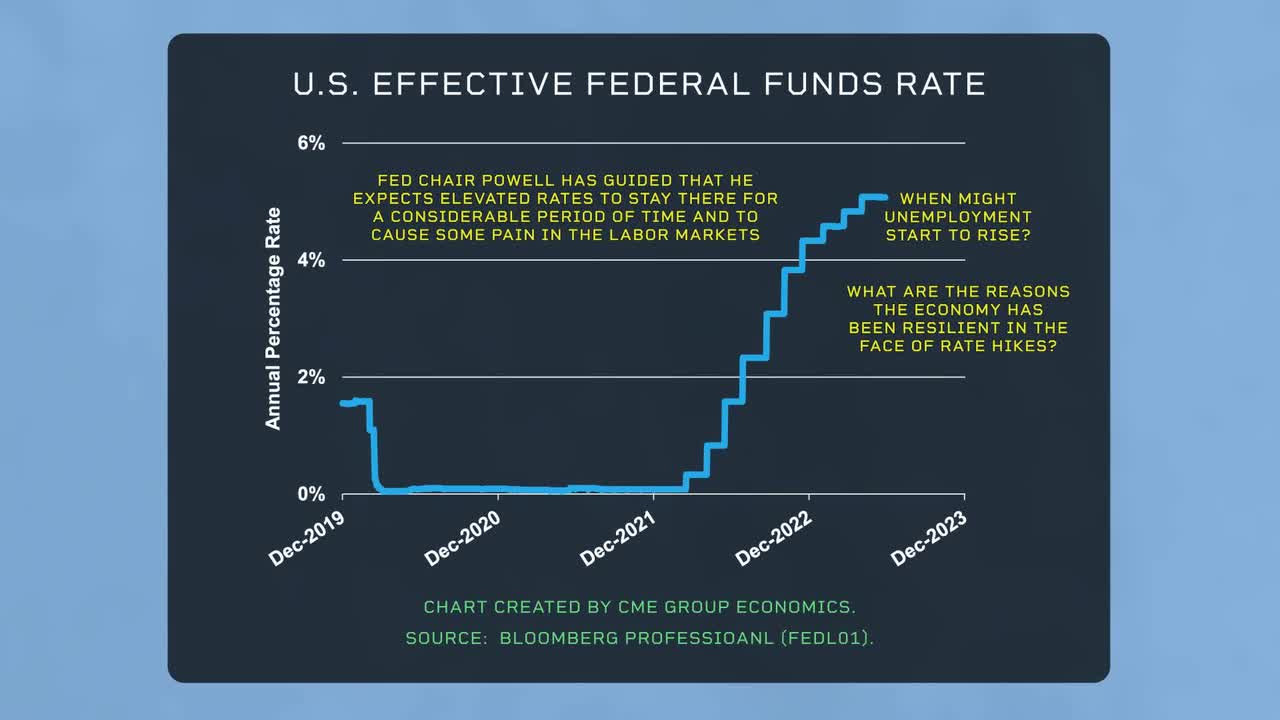

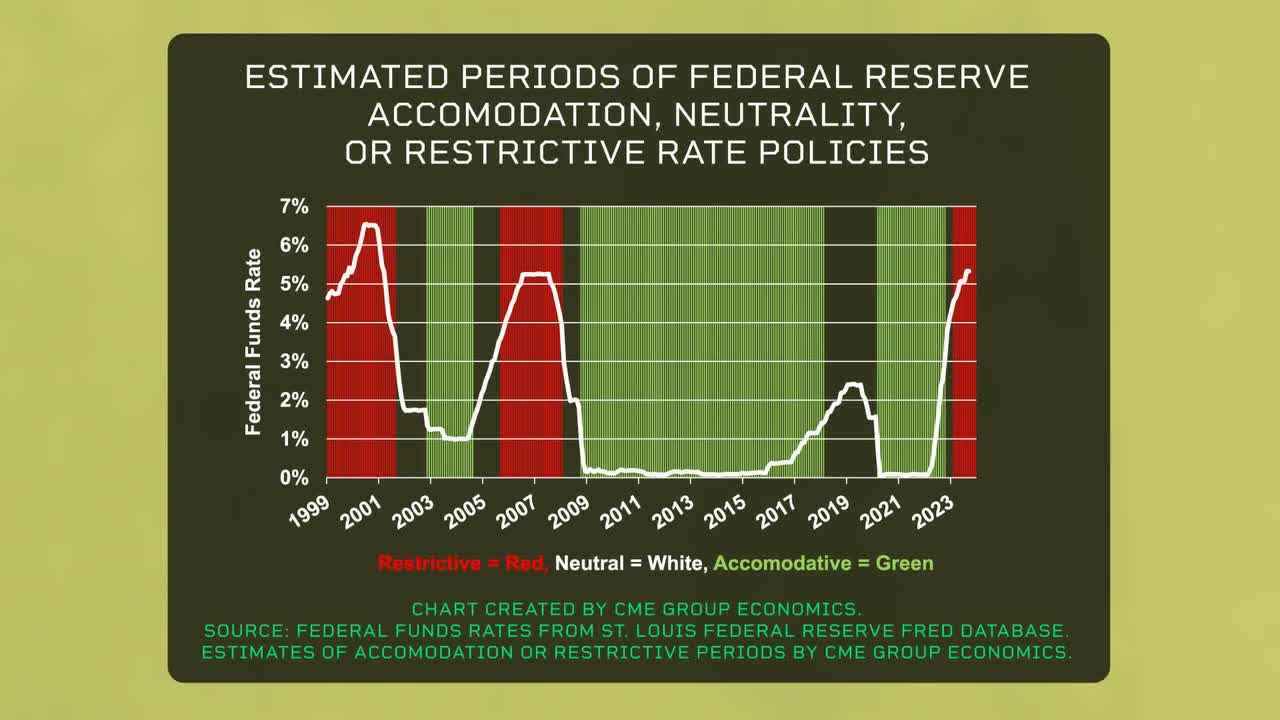

Despite the fastest rise in interest rates since 1981 and an inverted yield curve where short-term rates are much higher than long-term bond yields, the United States has not (at least yet) experienced the recession forecast by the vast majority of market pundits and economists. Why not?

The relatively few contrarians that did not forecast a recession, including myself, had many reasons for a more optimistic view. However, the most critical reason appears to have been an appreciation of how the U.S. economy has changed over decades and become much less sensitive to interest rates.

Bloomberg Professional

In the 1950s, 1960s, and 1970s, the U.S. economy was driven by housing and manufacturing. The only choice to finance a home was the 30-year fixed rate mortgage, provided by a savings and loan institution, that deliberately borrowed short-term from savers and lent long-term, taking considerable interest rate and yield curve risk. Further, there was no such thing as financial futures or interest rate swaps to allow for the efficient hedging of interest rate risk.

Fast forward to the modern economy of the 2020s. The U.S. is an economy driven by the service sector, and services are considerably less sensitive to interest rate swings than housing and automobiles. Home mortgages come in every size and flavor, from floating rates to fixed rates. Mortgages are originated by specialists and then packaged and sold to pensions, endowments, and investors willing to take the risk. There are no savings and loan institutions. Financial futures, swaps, and options are available for efficient hedging and management of interest rate risk.

In short, the U.S. economy does not dance to interest rates like it once did. Make no mistake, though; interest rate shifts have a profound impact on asset values, from equities to bonds, to housing. It is just that the impact on the real economy is much more subdued than it once was, and a rise in rates does not automatically mean a recession is around the corner.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here