OII’s Growth And Challenges

I discussed Oceaneering International (NYSE:OII) in the past, and you can read the latest article here.

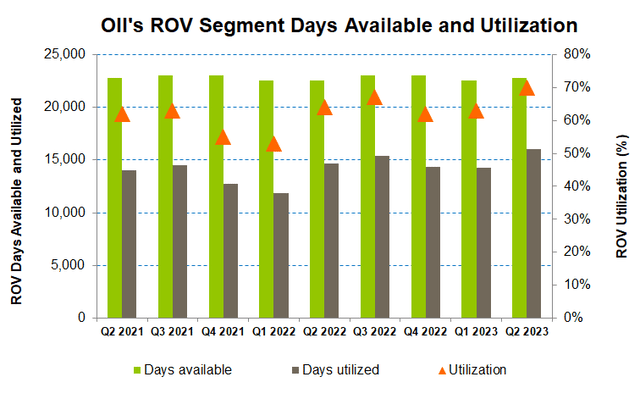

Look forward, I think OII will benefit from increasing offshore activity. ROV utilization increased steeply in Q2 and can hover around that level in 2023. Improved terms of contract and better pricing should also help the Subsea Robotics segment. Over the medium time, higher bidding activity in the Aerospace and Defense Technologies and the autonomous mobile robotics business can boost its topline in 2023 and 2024 in my view.

OII faces challenges from a decline in backlog and adverse project mix. Its operating income could stay under pressure in 2023. An elevated leverage ratio reflects financial risks in the balance sheet. The stock is mildly overvalued versus its peers. Investors might want to “hold” it for a medium-term gain from the stock price.

Outlook And Estimates

OII’s Filings

At the start of 2H 2023 on July 27th, the company’s management hosted a robust outlook on the offshore market in the near term. Higher bidding and increased activity in the company’s energy-related businesses support this view. It also has a bullish take on its Aerospace and Defense Technologies operation and the autonomous mobile robotics business.

Based on the factors above, the company has recently increased its Q3 revenue growth estimates to a “high single-digit percentage” compared to Q2. Adjusted EBITDA can increase by “low- to mid-teens percentage” in Q3.

ycharts

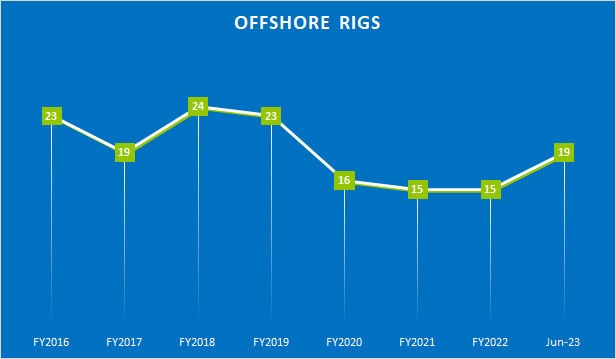

In the long term, the positive momentum in the energy sector is expected to continue while offshore energy reaches higher activity levels. The US offshore rig count increased by 27% yearly after remaining docile in the past three years. The management also expects ADTech and mobility solutions businesses to outperform. So, the company’s financial performance should improve beyond 2023.

Subsea Robotics Segment: Outlook And Performance

OII’s Filings

In FY2023, OII’s tooling-based services and ROV days on hire can improve following growing geophysical activity in 2H 2023. So, the segment operating income margin can increase by a “high-teens percentage.” At the start of Q3, it had 23 ROVs on board 21 floating drilling rigs. By the end of the year, it can reach 46 ROVs on 38 floating rigs with slightly extended contracts.

In Q3, revenues and operating profit margin will likely improve in this segment compared to Q2 due to a more robust ROV survey and tooling businesses. The segment can benefit from improving contract terms and better pricing. ROV utilization can stick around the “high 60% to low 70% range”. EBITDA margin in this segment is expected to remain in the “low 30% range.”

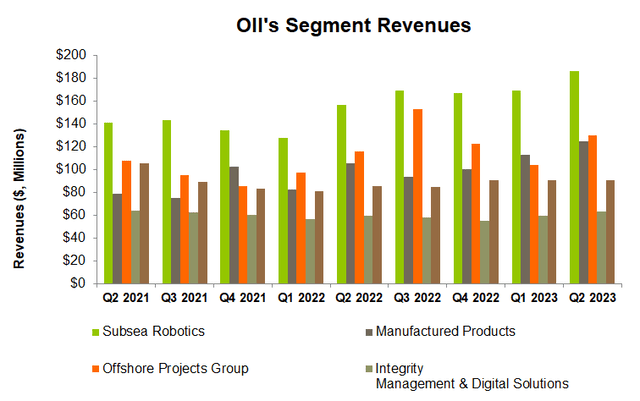

During Q2, revenues in this segment increased by 10% quarter-over-quarter due to increased ROV days and higher demand for tooling services. The ROV utilization level (70%) increased in Q2 compared to 63% in Q1. The revenue share from ROVS increased marginally to 78% from the prior quarter.

Manufactured Products Segment: Performance And Outlook

In Q3, operating income in the Manufactured segment can decrease due to adverse changes in the project mix. In Q2, the backlog in this segment decreased by 6% compared to Q1. However, its book-to-bill ratio can improve steadily to 1.2x-1.4x from 1.1x a year ago. The operating income weakness will likely continue in 2H 2023 as the project mix underdelivers. For FY2023, the operating income margin can reach a “mid-single-digit range.” This will be an improvement compared to 1H 2023 as bidding activity in the energy and AMR (autonomous mobile robotics) businesses strengthens. It may continue to improve in 2024.

In Q2, revenues in this segment increased by 11% quarter-over-quarter. However, its operating income suffered from project losses in the entertainment business.

Non-Energy Business: Outlook

OII’s Offshore Projects Group segment in the non-energy businesses can see revenue and operating margin improvement in Q3 and FY2023. Despite the typical seasonal decline, efficient vessel utilization and increased international activity can contribute to the growth.

In Integrity Management and Digital Solutions (including ADTech), operating income and revenue can increase in FY2023 and FY2024 as growth potential in the defense and government markets expand in the future.

Debt And Cash Flows

OII’s debt-to-equity (1.27x) is much higher than the peers’ (OIS, HLX, FTI) but has decreased compared to a year ago average of 0.33x. As of June 30, 2023, its liquidity was ~$719 million (excluding working capital).

The company’s cash flow from operations remained negative in 1H 2023 but improved compared to the past year due to favorable timing of project milestones and customer payments. However, a higher working capital requirement due to increased activity in the Manufactured Products and Subsea Robotics kept cash flows negative. Despite remaining in the negative territory, its free cash flow (or FCF) showed improvement during this period. The company expects to yield a positive FCF of $90 million-$130 million in FY2023.

Relative Valuation And Analyst Recommendation

Seeking Alpha

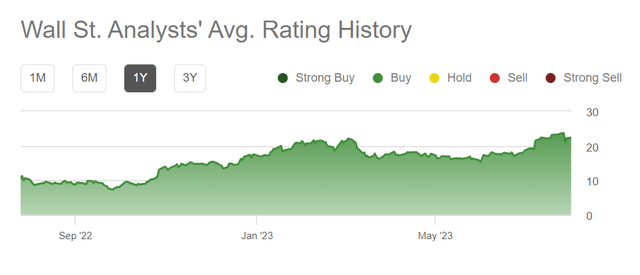

In the past 90 days, three sell-side analysts recommended a “Buy” (including “Strong Buy”) on the stock, while four recommended “Hold.” None of the analysts recommended a “Sell.” The consensus target price is $21.7, which, at the current stock price, yields a 3.3% downside.

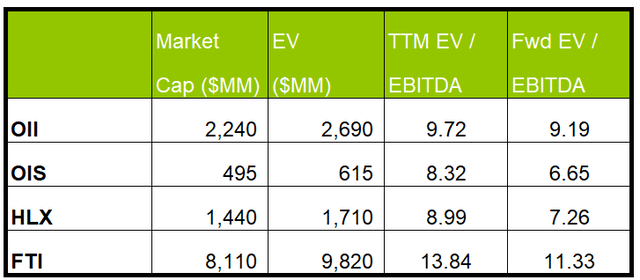

Author Created and Seeking Alpha

The company’s current EV/EBITDA multiple (9.7x) is lower than its peers’ (OIS, HLX, and FTI) average of 10.4x. Its forward EV/EBITDA multiple contractions versus the current EV/EBITDA is less steep than its peers. This indicates that its EBITDA can increase less sharply than its peers. This, in turn, typically results in a lower EV/EBITDA multiple. However, OII’s five-year average EV/EBITDA is nearly the same as its current EV/EBITDA. So, I think the stock is marginally overvalued on a relative valuation basis.

Why Do I Keep My Rating Unchanged?

In my previous article, I discussed mobile robotics business can become the most vital growth driver. The company forecasts to turn free cash flow positive by the end of FY2022. I expected the mobility solutions businesses to push the top line. At that time, there were also mild growth opportunities in the aerospace and defense segment. However, the ROV days on hire likely decreased in the Subsea Robotics segment. I wrote:

Oceaneering International will likely witness increased activity and improved operating performance in many of its segments, except the Offshore Projects Group. It will leverage its core robotics expertise into mobile robotics markets and clean energy, which will set its business on a growth path in the medium term.

After Q2 2023, OII’s energy business outlook brightened following a steady recovery in the US offshore rigs. The number of ROVs on floating rigs can increase significantly by the end of 2023. Its non-energy business, specifically mobile robotics, also sees robust growth potential. However, operating income in the Manufactured segment can decrease due to adverse changes in the project mix and lower backlog. The stock appears to be slightly overvalued. So, despite the growth factors, I keep my rating unchanged at “Hold.”

What’s The Take On OII?

Seeking Alpha

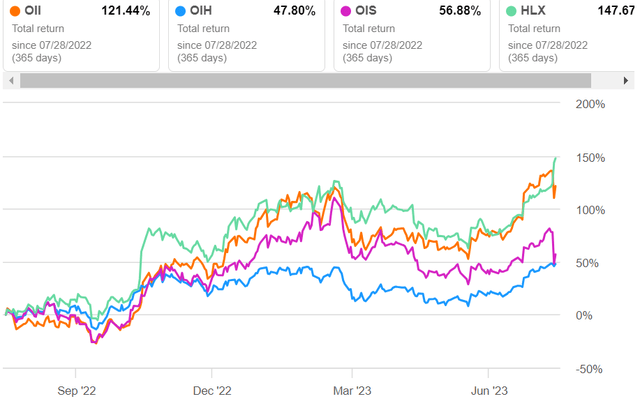

OII’s outlook is on a steadier platform at the start of 2H 2023. Higher bidding and increased activity in the energy-related business, coupled with aggressive defense and mobile robotics growth, can lead to steady topline and operating income growth in 2023 and beyond. Revenues and operating profit margins can improve in the Subsea Robotics segment because ROVs can increase substantially. The growth potential in the defense and government markets looks robust. So, the stock strongly outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, a declined backlog in the Manufactured Products segment and adverse changes in the project mix can put pressure on the operating margin. The company’s balance sheet has a higher-than-average leverage ratio. The steep stock price run-up over the past year has likely rendered the stock overvalued versus its peers. So, I would suggest investors “hold” it with an expectation of recovery later in the year.

Read the full article here