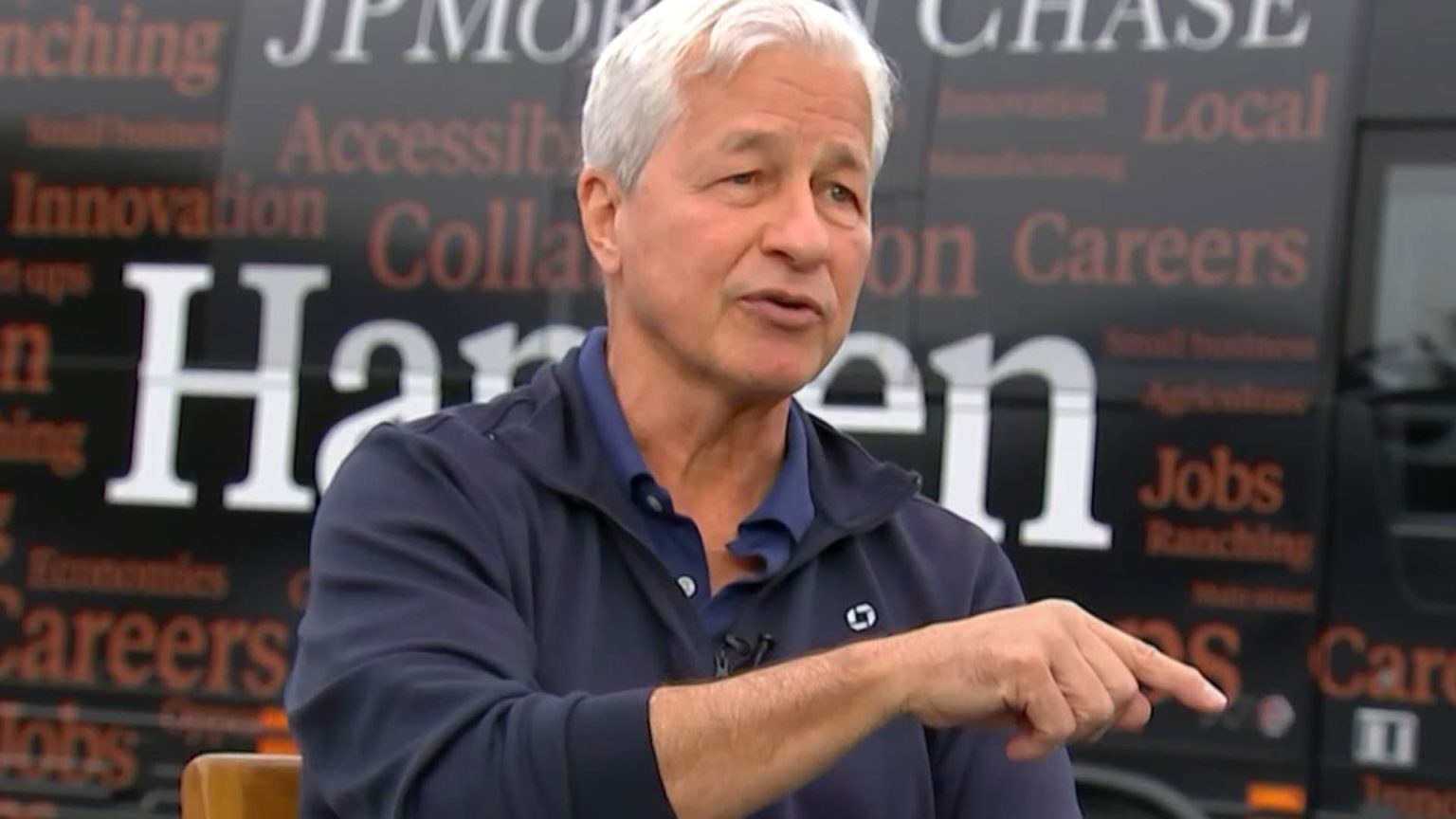

The Fitch Ratings downgrade of the United States’ long-term credit rating ultimately doesn’t matter, JPMorgan Chase CEO Jamie Dimon told CNBC on Wednesday.

“It doesn’t really matter that much” because it’s the market, not rating agencies, that determines borrowing costs, Dimon told CNBC’s Leslie Picker.

related investing news

Still, it’s “ridiculous” that other countries have higher credit ratings than the U.S. when they depend on the stability created by the U.S. and its military, Dimon added.

“To have them be triple-A and not America is kind of ridiculous,” Dimon said. “It’s still the most prosperous nation on the planet, it’s the most secure nation on the planet.”

Fitch downgraded the country’s rating to AA+ from AAA on Tuesday, pointing to “expected fiscal deterioration over the next three years,” an erosion of governance and a growing general debt burden.

The agency put the U.S. rating on watch in May after members of Congress butted heads over raising the debt ceiling and brought the country to near-default.

“We should get rid of the debt ceiling,” Dimon said. “It’s used by both parties” in ways that sow uncertainty for markets, he said.

Fed, A.I. and Ukraine

In the wide-ranging interview, Dimon touched on topics including artificial intelligence, the U.S. economy, bank regulation and geopolitics.

He called artificial intelligence technology such as ChatGPT “a game changer” that will likely help future generations live longer, better lives.

“It needs to be done right,” Dimon added. “I do worry about it because bad guys are going to use it too.”

The U.S. economy, he said, is being supported by consumer and business strength, low unemployment and healthy balance sheets.

“It’s pretty good, even if we go into recession,” Dimon said. “The storm cloud part is still there,” he added, referring to a warning he gave last year on the economy.

What worries Dimon most are the geopolitical risks created by the Ukraine war and the Federal Reserve’s effort to rein in its balance sheet known as quantitative tightening, he said.

Consumer impact

Dimon lambasted regulators’ efforts to tighten standards on U.S. banks, saying the proposals unveiled last week were “hugely disappointing.” At one point, he held up a chart showing the web of regulators that banks deal with.

Banks will be forced to hold more capital as a cushion against a variety of risks, which will affect consumers, because the industry will cede more products to nonbank players, Dimon warned. That’s what happened in the U.S. mortgage market, which is dominated by firms including Rocket Mortgage.

Part of the changes involve banks ditching internal risk models for more standardized versions from the Federal Reserve.

“If I was the Fed, I’d be careful about saying their models are perfect,” Dimon said. “Remember, their models didn’t show inflation and didn’t show 5% interest rates.”

Read the full article here