Investment thesis

Our current investment thesis is:

- PJT is positioned perfectly to steal more market share and continue to grow rapidly.

- Management has built a sustainable business model which has allowed the business to avoid a decline in FY22.

- Margins are unattractive, with the market pricing growth mainly. Other listed IBs look more attractive currently based on valuation.

Company description

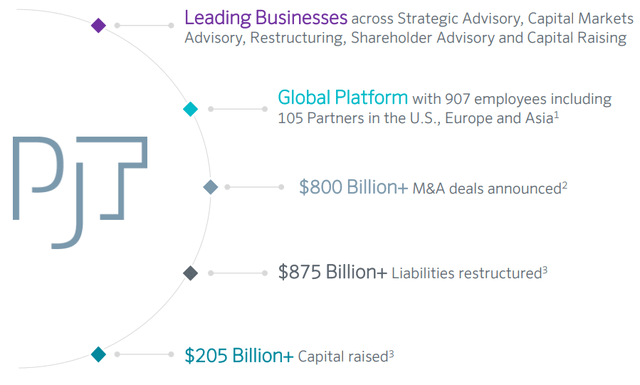

PJT Partners Inc. (NYSE:PJT) is an investment bank that provides various strategic and capital markets advisory services.

Their services include mergers and acquisitions, spin-offs, divestitures, and shareholder advisory services. Additionally, it also provides debt advisory, public and private equity raises, GP/LP solutions, and restructuring.

Share price

PJT’s share price has made impressive gains since it was listed in 2015, returning over 100% to shareholders. The company’s rapid gain is a reflection of its growth and market share gains.

PJT was founded by the former head of Morgan Stanley’s (MS) Global M&A team, being created as part of a merger between Blackstone’s (BX) advisory practice.

Financial analysis

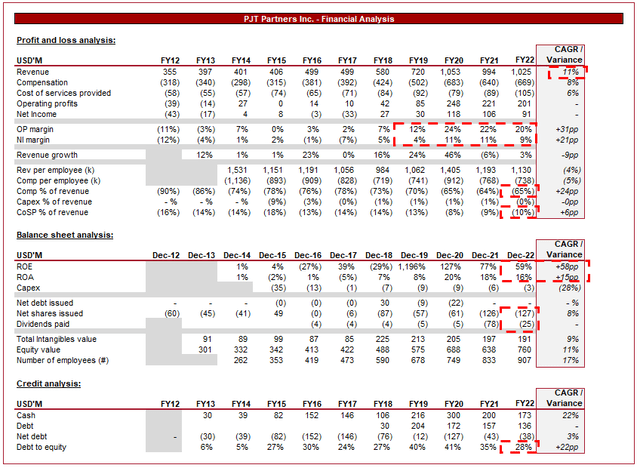

PJT financials (Tikr Terminal)

Presented above is PJT’s financial performance for the last decade. The company has grown aggressively, although has faced some volatility in earnings.

Revenue

Revenue has grown at an impressive 11%, with PJT rapidly gaining market share in an industry occupied by veteran companies, especially at the deal sizes the business advises. During this period, PJT has provided services for over $1TN in project value.

PJT

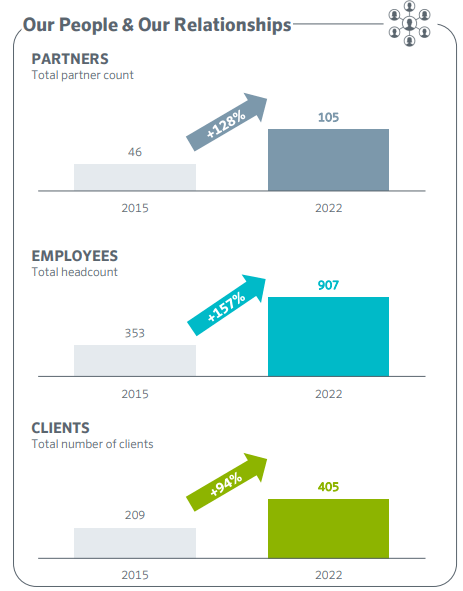

There are many reasons why PJT has been able to grow as it has, one of those being its leading recruitment of senior personnel. In the advisory/consulting business, the biggest driver of growth is personnel. Recruiting a highly regarded individual is akin to a successful takeover of a competitor. PJT is in a position to lure top talent to the business because of its roots. Led by the former head of arguably the premier global investment bank, while kicking off operations with BX as a client and access to its current clients, the business has positioned itself as the best alternative to the bulge bracket. As the following graphs illustrate, PJT has seen rapid growth in personnel, aligning with Client growth.

Headcount growth (PJT)

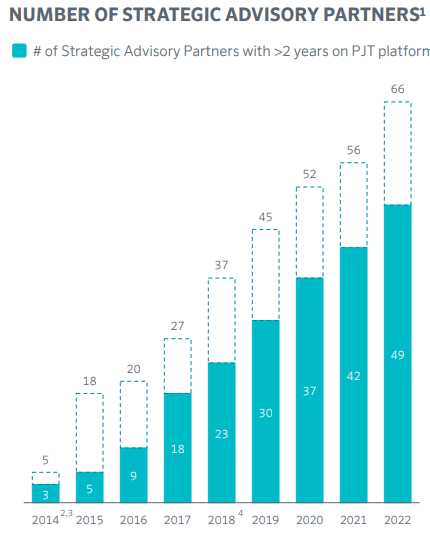

Further, we should see natural headwinds in the coming years as a noticeable number of Partners have only been in the business for <2 years. Many of these individuals will come across with non-compete agreements and generally need time to build their client base independently of their prior firm. This should mean a rapid acceleration of work won from these individuals in the coming years compared to their first 2.

Partner tenure (PJT)

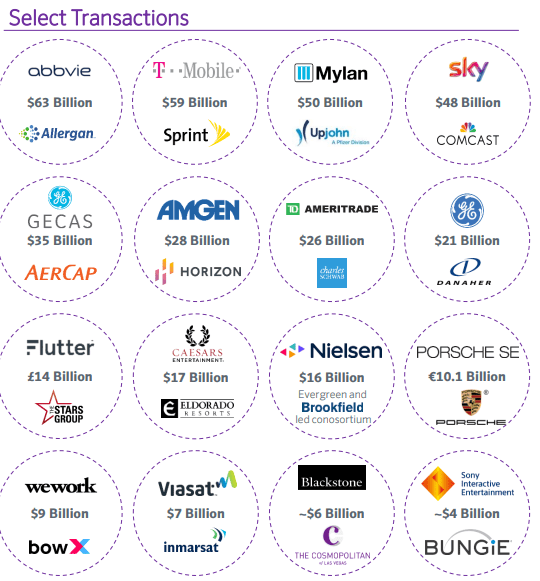

Further, as part of pitching for projects, the key for advisors is to sell their experience to the client, usually in the form of prior work they have conducted. This shows their ability to execute at the highest level. PJT has an impressive list of credentials across multiple service lines, as the following illustrates. This should assist with winning further work in the long term, especially in the large/mega-cap segment of the market.

Credentials (PJT)

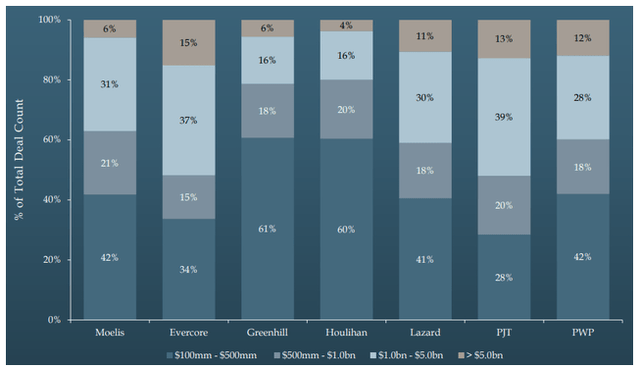

All IBs dream of winning these billion-dollar deals, as the fees associated with them are extremely high, in many cases in the double-digit millions. Historically, these deals have been retained by the few in the bulge bracket, with market belief that they were the only ones with the expertise to execute. With a greater number of MDs leaving to start their own shops, as well as being poached by elite boutiques, the distribution has improved. As the following graph illustrates, PJT has the largest share of $500M+ deals among the listed boutique cohort.

Deal count (Moelis)

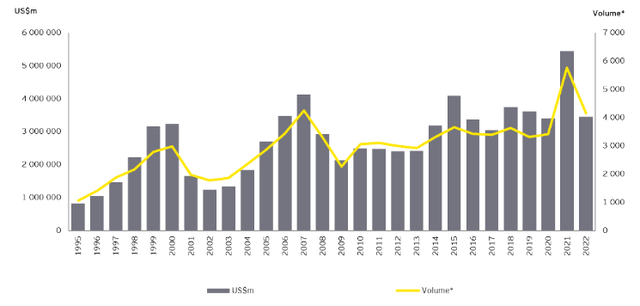

With PJT’s services primarily in the advisory space, it is worth us diving deeper into the current market conditions. As the following graph illustrates, we have seen a noticeable decline in activity during 2022, with this extending further into FY23, making it difficult to assess if we have seen the “bottom” yet.

M&A Vol/Val (EY)

There are two primary reasons for the decline in our view, recessionary fears and heightened interest rates. With fears around a recession, buyers are warier about transacting and the valuation at which they do. There is an understanding that companies are likely to see their performance decline, as well as their valuation. Further, higher interest rates mean the cost of capital has increased, contributing to a decline in the value of future cash flows, an increase in borrowing costs to finance deals, and more difficulty with securing financing. Further, the sell-side us usually less inclined to sell at what they perceive to be a discount, especially in the current conditions as we know rates are only high due to inflation, with a certainty that they will come down once inflation does. This leads to a widening of the valuation gap, reducing M&A volume. This is the key bearish issue for PJT, as the business will inevitably struggle with growing as there is a noticeable reduction in work.

For this reason, we are big fans of investment banks with a large counter-cyclical operation, which can benefit from a bear market. The classic service is restructuring, which usually performs well during such times as a greater number of businesses struggle. PJT has a highly regarded restructuring practice, being named the #1 advisory in both 2020 and 2021. This is one of the reasons why the company has seen growth in FY22, despite the reduced activity. Many of its peers who are reliant on advisory work have seen large declines in revenue, such as Evercore (EVR – 16%)

Restructuring award (PJT)

Margin

PJT’s margins have trended up in the last decade as the business has worked toward achieving consistent profitability.

The improvement in margins has been driven by improving revenue, which is driven by the factors discussed above, as well as a dilution of compensation as the company has continued to recruit. Unlike many of its peers, revenue has grown at a greater rate than compensation on an individual basis, ensuring that motivations are aligned with shareholders. Further, c.40% of the business is owned by shareholders, ensuring alignment of interests. Our view is that a compensation ratio of <63% is ideal, with the business slightly higher.

NI margins would be higher if not for the c.45% of PAT deducted due to non-controlling interests, with amounts split between partnership units and Class A shares.

Overall, the company’s cost base looks appropriate in our view and margins are quite attractive.

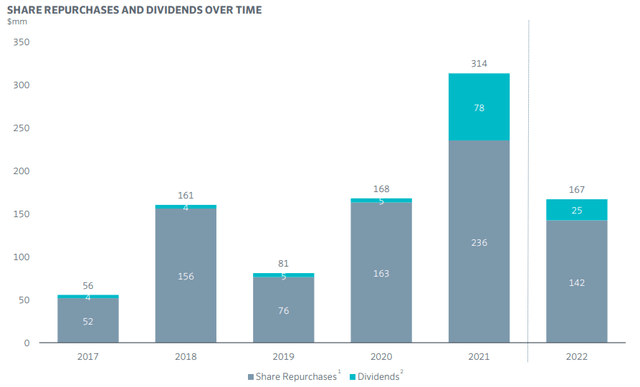

Balance sheet

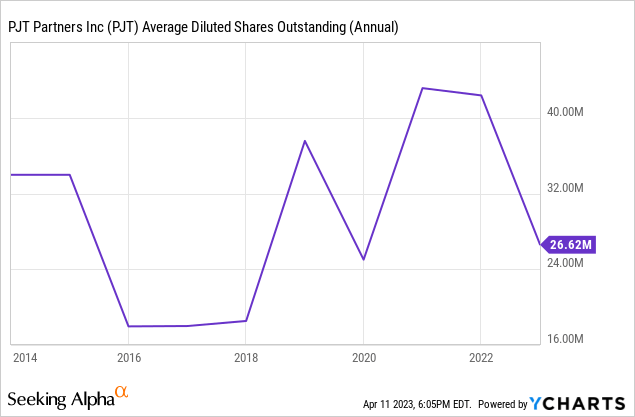

Management has done well to consistently distribute to shareholders, with strong buybacks and dividends in the last 2 years. Management has stated that it will continue to offset any dilution, as well as continue dividends.

Capital allocations (PJT)

Outlook

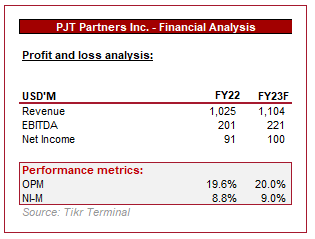

Wall St. Outlook (TIkr Terminal)

Presented above is Analysts’ consensus view on PJT’s FY23. Given the cyclical nature of IB, the forecasts are not to be relied on, however, they can provide some useful directional information given analysts speak to Management.

Interestingly, PJT is expected to grow, although marginally. Having looked at quite a few of the listed boutique investment banks, this is a rare sight. Those expected to grow have large loan books, allowing them to benefit from higher interest rates. The factor PJT is expected to grow shows the quality of its advisory practice, as its likely offsetting business from restructuring will support resilient equity work.

Peer comparison

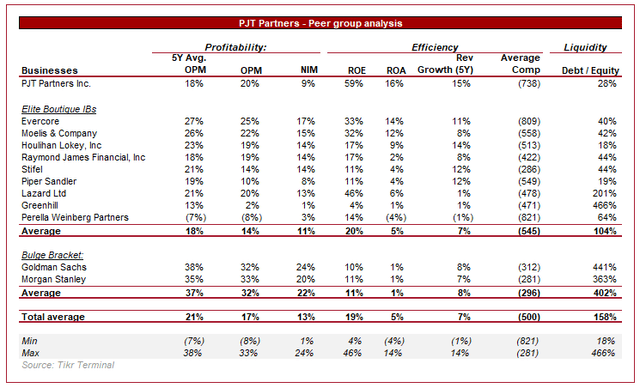

Investment banking peers (Tikr Terminal)

Presented above is a comparison of PJT to its boutique investment bank peers on a financial basis.

PJT is performing relatively well, without standing out on a profitability basis. The positives are that the company has seen margin expansion in the last period, whereas the majority of its peers have seen a decline due to softer business. Conversely, NIM is disappointing, especially compared to the leading comps such as Evercore (EVR).

Growth is where the value is. PJT is growing at a superior rate, with our commercial analysis suggesting this is sustainable going forward.

Valuation

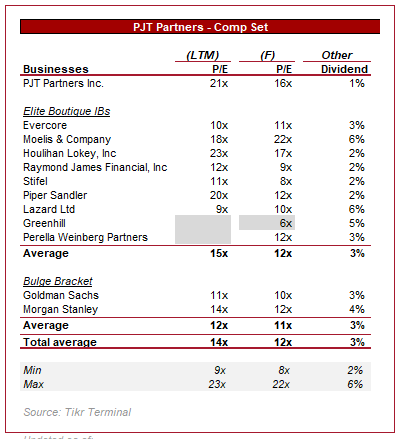

Valuation (Tikr Terminal)

PJT is valued at the top end of the peer group, with markets likely reflecting a premium from the average on its superior growth. This is a difficult trade-off as the 5/6ppt. profitability delta between Houlihan (HLI) / Moelis (MC) and PJT is to some extent offset by commercial superiority and better growth.

Our view is that the valuation is likely slightly rich, only because investors can get a “better” deal on the cheaper end with Raymond James (RJF) or Stifel (SF), or similar growth but better profitability with Houlihan or Moelis.

Final thoughts

PJT is the definition of an elite boutique. The partners are prestigious circles and have been able to win projects destined for firms with much longer track records. We really like the commercials of the business and believe strong growth is sustainable. The only real issue with the business is margins. At the current valuation, it is difficult to not see value elsewhere.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here