Big shifts in global energy markets are putting new light on old problems. To see that in action, look to Iran.

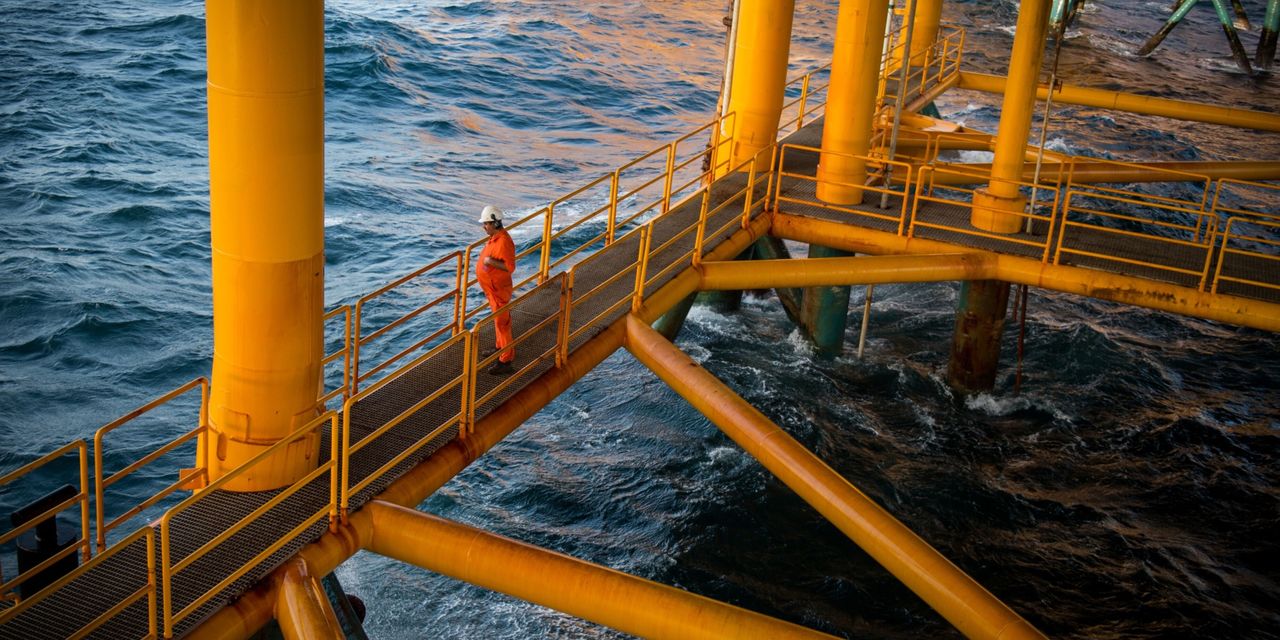

The U.S. is considering putting armed military personnel on civilian ships in the Persian Gulf to deter Iranian attacks, The Wall Street Journal and other outlets are reporting. That has raised fears of a return to the dark days of the 1980s, when the U.S. fought a brief naval war with Iran in retaliation for mining the Persian Gulf. And that concern over oil security is coming up, even though the U.S. produces vastly more oil and gas than it used to—and is in the midst of a big shift toward renewable energy. How much has really changed?

“The United States exports a lot more energy than it did in the past, but at least in my view, it hasn’t really affected the U.S. commitment to the security of the Persian Gulf,” said Gregory Brew, an oil historian and energy analyst with the political-risk firm Eurasia Group. Brew spoke Friday in an interview on Barron’s Live.

A lot of diplomatic and legal wrangling would need to happen before any U.S. troops set foot on private ships. It doesn’t seem imminent. Still, “the U.S. is responding to what they see as being a consistent Iranian threat to shipping in the Gulf,” Brew said. Despite recent talk of some kind of new understanding between the U.S. and Iran, tensions are getting worse, not better, he said.

Iran has the power to shut down oil shipments through the Strait of Hormuz, an action that would have major consequences for the global economy. But that’s also what holds Iran back. “It has a willing customer in China, who’s taking more than a million barrels a day in Iranian oil exports,” Brew said. China recently helped Iran reduce tensions with Saudi Arabia. Middle East energy issues still have a big influence on global geopolitics.

This back-to-the-future episode gets at the analytical messiness of the so-called energy transition. That phrase comes up constantly these days. You’ll find talk of the “energy transition” in everything from the earnings calls of oil majors such as Exxon, to President Joe Biden’s speeches, to the demands of environmental activists.

They can’t all mean the same thing. A transition to what? Trying to answer that question is revealing, Brew said.

“Fossil fuels—oil, gas, and coal—still account for the majority of global energy consumption,” Brew said. “We know that a transition is happening, and we know that it’s going to affect the world. But the problem comes in determining where the attention should be fixed,” he said.

He continued: “Should we be putting our attention toward electrifying the grid, building as much wind and solar and nuclear and geothermal capacity as possible? Should we be focusing on hydrogen and the production of clean hydrogen for decarbonizing steel or decarbonizing cement and fertilizer manufacturing? Should we be thinking about oil and gas and coal, as they still form an important part of our energy mix?”

That last point is important. Oil prices have risen for six straight weeks. Brew expects them to stay in the $85-to-$90 a barrel range for the second half of the year, barring major shocks. Longer term, the Biden administration and other governments are trying to kick their carbon addictions by promoting electric vehicles and other strategies. But it isn’t clear that means we’ll be using less oil any time soon.

“Economic growth driven by decarbonization or driven by a desire to move away from a dependence on fossil fuels, that could see an increase in oil consumption,” Brew said. “Oil isn’t just used for gasoline. It’s an input in practically everything. As we use less gasoline, we might very well need more benzene or kerosene or bitumen or petrochemical feedstock.”

Governments have become more willing to intervene in natural resource markets. But there’s another big difference from the earlier era of Middle East oil fights: It isn’t just big, energy-consuming countries like the U.S. trying to make sure they have enough to fuel their economies. “Resources nationalism,” Brew said, is affecting how countries think about resources they produce and export as well as what they consume. Chile is a good example. It recently decided to nationalize production of lithium, a material much in demand for the production of EV batteries. Investors are watching closely.

“This is arguably the largest or one of the largest economic transformations in human history,” Brew said. The shake-up is just beginning.

Write to Matt Peterson at [email protected]

Read the full article here