First, about the spot-on thing…

I did not of course factor in the Fitch downgrade which started the selling on Thursday. My main premise last week was that the market was steeply overbought. To my mind, Apple (AAPL) was going to be the catalyst and it was subsequently, Fitch got in a day early and blew off a lot of the foam so-to-speak then AAPL did the rest. I got some moral outrage that I dared to throw shade on the sacred name of AAPL. AAPL is a great company, it is more than a consumer electronic company I was reminded of, it’s a whole ecosystem. Many argue that it is more than that, it’s a consumer necessity, a staple, and a consumer product. Yes, we all know these things, but the stock was way overvalued, now it’s just overvalued. Could it fall lower? Yes, if August and September act as advertised a lot of stocks will be lower. Now it might seem obvious but two weeks ago when we were looking ahead the S&P 500 broke over 4600 and hardly anyone made any kind of comment or carried the news on a headline, everyone was bullish. It was then I knew that it was time to put on the hedges and trim positions to generate cash but timed to AAPL’s earnings report. When Monday of last week came around the market was on an uptrend and I used long calls for quick trades to generate profits. When Fitch announced on Wednesday I decided to cover and take profits on my hedges. I thought that the next day the market would bounce back since the last downgrade 10 years ago didn’t affect anything. On Thursday, I was sitting with nearly 25% cash and thought that I might as well just sit tight and perhaps I could pick up some bargains on Friday. We can discuss what I picked up later. In the end, AAPL took the market down further, and now we are 3% from our recent intraday high.

Besides Apple and Fitch, the week gave us things to be happy about.

Amazon (AMZN) did spectacularly outperforming in earnings and revenue. Even AWS looks like it is turning around in growth. Andy Jassy seems to be pulling off the agenda of his own “era of efficiency”, cutting staff and unnecessary logistical expansion where it was necessary. Yet raising productivity via reduced delivery times for e-commerce. Earnings results elsewhere proved that we are in a stock-pickers market with Etsy (ETSY) underperforming in e-commerce. Expedia (EXPE) was another example of underperformance where Booking Holdings (BKNG) outperformed in the same sector. Uber (UBER) outperformed even the optimistic prognostications, and many commentators have put forward the notion that UBER’s best days are before it. Not so with its smaller rival that is currently trading at less than half of its 52WH, though 2nd quarter earnings are this Tuesday. DraftKings (DKNG) also outperformed and I believe (and I’m likely not alone) that there are a few leaders like Flutter’s Fan Duel, and perhaps one or two more that will end up with the lion’s share of the “App-Based” betting leaving the rest behind. DKNG is now self-funding expansion from older States that have opened up to DKNG years earlier. Yet as the CEO shared, the older states are still growing. DKNG stockholders and critics who once were losing patience with the time frame for profits now see free cash flow and a roadmap to profitability. All-in-all Q2 earnings is showing that there was no big downturn in consumer spending. Some companies did well and others didn’t, so far about 80% of reported earnings beat expectations, which is much better than usual. That said, earnings are lagging from the year earlier when consumers had deeper pockets filled with pandemic money. On the Friday before last, July 27th we learned that Q2 GDP grew at 2.4%, which is a better performance than Q1’s 2%. Where am I going with this? Things are pretty dang good. So why do I have a worrying lack of visibility into next week?

Friday’s wild swings in the VIX and the 10-Y have thrown me off

If not for Friday’s wild swings, I would likely be expecting a nice rebound from Fitch and AAPL’s weight on the indexes, and perhaps be mildly hedged going into Thursday for the CPI. Chances are the pricier gasoline, and food costs haven’t found their way into the government’s statistics as yet. Not so for the PPI on Friday. PPI almost never has an effect on the market but if there is even a freckle on the CPI, the PPI will rise in importance and pressure the market. I guess if there were two freckles on the CPI that could take the S&P 500 down hard again. That wouldn’t perturb me at all, and I would be ready for it. Monday would then be if not recovering then at least on the flat side. That would give some of my long position enough alpha to be closed out and become part of my cash hoard again. However, I have much difficulty with these two powerful indicators and their predictive power of where the market is going. I haven’t seen much or actually any commentary on the movement of the 10-Y to start. If it slowly rose to 4.20% and held there I could explain it away as the rate is rising because it is clear that no recession is coming anytime soon. Instead on Wednesday, the 10-Y was at 4.04% thereabouts, then Thursday it blasted to 4.19. By Friday at 8 am it was still at 4.19, then peaking at 4.20 it proceeded to tumble. By 10.15 it was already 4.09% and then a bit more slowly drops to 4.06 at the close. I have often remarked how interest rates recently have been too volatile but to my memory, this 24-hour performance is the winner. So does the crash mean that July’s 187K jobs filled is a sign that the slowdown is coming and a recession soon after? Does it mean that recession has been vanquished so there’s no need for this level of interest rates? Do I just chalk it up to “dog days of summer” and low volume brings volatility? Okay, but this is the US Treasury debt we are talking about, the largest most liquid market on the planet. Some are saying that it was nerves that there is going to be a huge bond offering, but then the rate should have stayed at 4.20% not dropped like a rock.

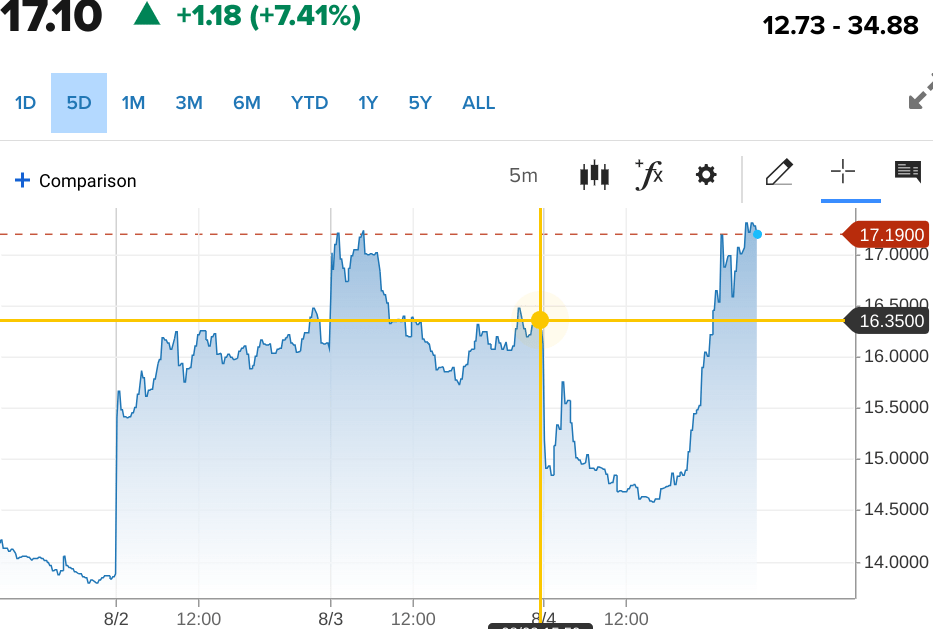

Now pile on the shenanigans of the VIX, how does that make sense? Here are the 5-day VIX futures.

CNBC

We have early Thursday open at 17.19 then it closes at 16.35 which is reasonable given the depth of the selling. I think Thursday was the worst selling since March. Then the strange thing happens, Friday Morning with the news of AAPL already out the VIX drops like a rock to 14.58. Ok, well maybe AAPL is not indicative of the entire market and this level is in the range of where the VIX was trading before, though at the highest range earlier in the week. So explain the parabolic jump into space we have after that. Does it mean that we sell off next week? Or that since this is the “Badlands” of the trading year the VIX will be permanently elevated. Or once again we can trot out the notion that this was all due to the summer weekend. Maybe, everyone, all at once decided that it would be wise to hedge going into next week, just to be on the safe side. Low volume brings high volatility, and 17 VIX those hedges are going to be more expensive. Hence the puzzling lack of visibility, and the worry that next week is going to bring surprises and not the pleasant kind. So what are we doing?

Right now as I’ve said, I am sitting with a nice slug of cash.

Depending on the futures and how high the VIX is I will likely start to hedge, if just a tiny bit. I will look to close out as much of my long Call Option from Monday to Wednesday as long as the climate is placid. If the futures are down 300 on the NDX Monday at 9:30 am, I might tough it out. That is if there’s selling without a cause. I have 20% cash and that gives me flexibility. I am operating under the notion that even though this is a bad time of year the economy is growing without inflation and that has got to put a floor under the indexes. Of course that makes the CPI and PPI all the more important. So let’s assume that the market is benign and the VIX slides back under 14. I will start my hedges. Pretty much in almost all circumstances, I will put some funds towards what I and many others call “insurance”. Insurance means you are paying that money out in the hope that you don’t need it. Then I will assume I can close out my long Call options with some profits. So what did I get long this week that I am going to want to take profits in? If you guessed DKNG you’d be correct, with that on the board you would likely assume that I got long UBER, and you’d be correct again. I am also long Datadog (DDOG) Call options again. I like that a big rival of theirs, New Relic (NEWR) is being acquired giving DDOG a higher scarcity value, and also it is a key component of developing AI applications. I rolled down Confluent (CFLT) Call options when it unexpectedly fell to 31, the next day it went back to 34 and I closed it out to bank some profits. I got back into Oracle (ORCL) Call options on Wednesday during the Fitch-induced portion of the sell-off thinking that it should rebound this week. I have a little Palantir (PLTR) in Call options going into earnings this week. I managed to snag a small amount of Yellow (YELL) Put options with the notion that it is likely to announce bankruptcy this week.

Well, that is it. Of all the names I’ve mentioned on the long Call options side, I have been adding shares as well. I would like to acquire some more equity as the market sells off to hold onto both for the medium and long term basis. I believe we will end the year at +4800 on the S&P 500, and I think that during this time, where we might have other selloffs, it’s not a bad time to nibble a few shares every day.

Good luck everyone, I hope my jitters are misplaced.

Read the full article here