Research Brief

In today’s equity research analysis I am returning to a stock I covered several months ago, but still one of my favorites in the financial sector, Bank of New York Mellon (NYSE:BK).

This time, however, I am applying my new rating methodology and seeing if I get the same results. In my last coverage of BK in May, I rated this stock a buy and since then it has gone up over 14%.

BK – price change since May coverage (Seeking Alpha)

The question is, does it currently remain a value buy opportunity as well as a dividend play, particularly after the most recently quarterly results from July, but also after the latest Fed rate decisions?

So, this time we are going to dive somewhat more deeply into multiple metrics and give this bank an updated rating for August.

Some notables about this firm, from their official website, include: $46.9T assets under custody, $1.9T assets under management, in 35 countries.

Rating Method

I look for dividend opportunities & value plays among tech, financials, & innovation stocks. My rating analysis is broken down into rating 5 categories:

Valuation, Dividend Yield, Net Income Growth, Capital & Liquidity, Share Price.

To earn a “hold” rating the stock has to win on 3 of the 5 categories, and 4 out of 5 to earn a “buy” rating.

Valuation: Recommend

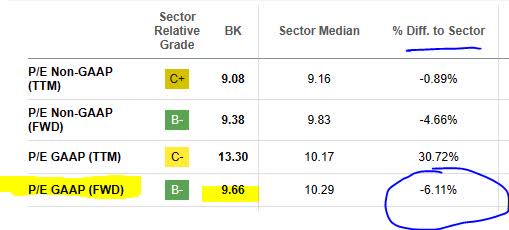

First off, let’s talk about current valuation as of August 4th. We will use the forward P/E ratio and forward P/B ratio, and compare to the sector median of this company’s industry, taken from Seeking Alpha data.

Considering the sector median is just over 10x price to earnings, I like a range of 8x to 10x earnings. Currently, BK is at 9.66, which is over 6% below the sector average. This is within my target range.

BK – PE ratio (Seeking Alpha)

Looking at the sector median again, it is at almost 1.10x price to book, whereas BK is at 0.95, putting it almost 11% below the sector average.

I like BK at somewhere in the range of 0.90 to 1.02, so it falls within this range.

BK – P/B ratio (Seeking Alpha)

Both valuation metrics make this a stock I would recommend on valuation, and especially when the market is valuing it at less than book value. This is a great opportunity, in my opinion, however I have seen several banks with attractive valuations lately, so it is always a good idea to compare a few.

For example, a peer in the financial sector, State Street (STT), is currently valued at closer to 10x price to earnings and over 1x price to book, thereby making BK look like a better valuation in this case.

Dividend Yield: Recommend

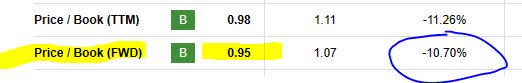

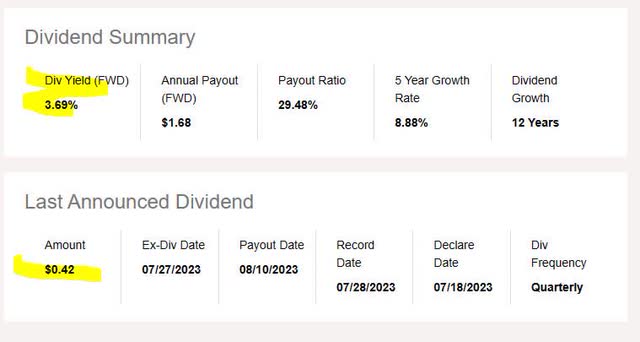

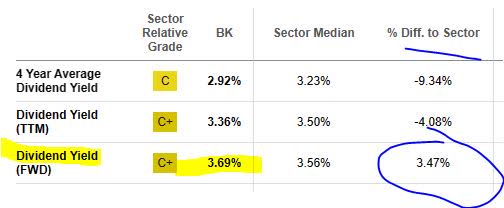

As of August 4th, the forward dividend yield is being reported by Seeking Alpha at 3.69%, with a dividend of $0.42 per share, and no upcoming ex dates:

BK – dividend yield (Seeking Alpha)

Later on, I will use this dividend in a simulated investing idea on this stock, to show how this can benefit dividend-income investors.

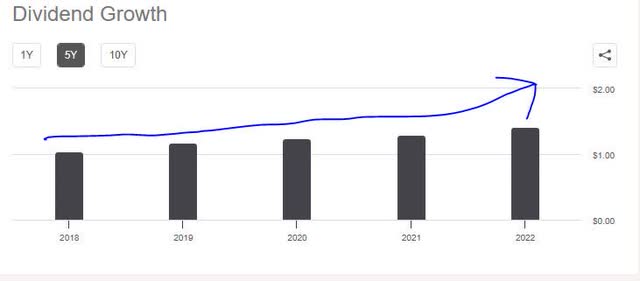

Notable also about BK is that they have a positive growth in dividends over 5 years, a sign that up until now they continually have the ability to return capital back to shareholders.

Consider that their annual dividend in 2018 was $1.04 and went up to $1.42 in 2022, a 37% increase.

BK – dividend 5 year growth (Seeking Alpha)

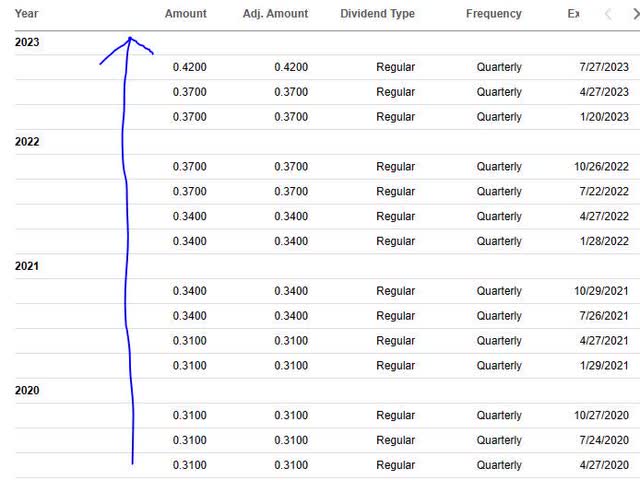

In addition, this bank has a history of regular quarterly dividend payments that have increased, as the table below shows going back to 2020. This is, in my opinion, a great way to predict quarterly income potential just from holding shares in this bank.

BK – dividend history (Seeking Alpha)

Finally, when comparing the dividend yield to the sector average, it is actually 3.47% higher than the sector average. I am looking for a bank that is at or above the sector average by a few points at least, so this stock fits that category as well.

BK – dividend yield vs sector average (Seeking Alpha)

Based on the evidence, I think it is a good bet to recommend this stock in the category of dividend yield.

Net Income Growth: Recommend

After its most recent Q2 2023 results in July, we can see that both net income and earnings per share went up YoY. In fact, from its income statement below, it appears there was a 28% YoY increase in net income, which is impressive.

BK – net income & EPS YoY growth (Seeking Alpha)

Digging into one key driver of income, from a top-line overview, we can see how much this firm has benefitted from the interest rate environment but also impacted by it as well.

In the table below, a significant YoY increase in total interest was achieved however a major increase in interest expense also took place. A positive net interest income was achieved, and that is a key metric I am following, to gauge how a firm can manage its spread between interest income and expense.

BK – interest income and expense (Seeking Alpha)

With rates staying elevated, and rate traders’ sentiment showing a high likelihood of the current environment continuing, according to CME Fedwatch, I think we will continue to see growth in net interest income in the next quarterly result as well, benefitting the company’s top-line revenue.

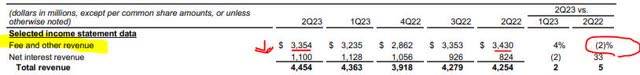

However, rather than simply doting on this bank, let me also mention concern that their non-interest revenue from fees has taken a small hit YoY, as the table below shows.

BK – fee revenue (BK – quarterly financial supplement Q2)

While YoY net interest revenue grew 33%, fee & other revenue actually went down by 2%.

I think Q3 could be a great opportunity for this bank to improve upon this segment. In fact, the QoQ trend is already improving, which is a good sign.

Capital & Liquidity: Recommend

BK is one of the bank’s named by the Financial Stability Board in 2022 as globally systematically important, so naturally even more eyes will be on the capital & liquidity situation of this bank, mine included.

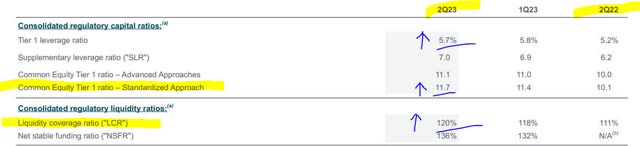

Two key metrics I usually look at are the CET1 ratio and Liquidity Coverage Ratio. In this case, both metrics actually went up YoY, which is another positive:

BK – CET1 and LCR (BK – q2 presentation)

Keep in mind, as you may already know, these are industry-specific metrics for banks, especially large global ones like BK.

Also worth mentioning, is the sheer amount of assets, $362B to be exact, that this firm holds and earns interest from, as the table below shows. I should point out that their HQLA (high quality liquid assets) of $112B are an important metric in times of potential bank stress, as regulators usually require a certain level of these assets held.

According to the Bank for Intl Settlements, “assets are considered to be HQLA if they can be easily and immediately converted into cash at little or no loss of value.”

BK – interest earning assets (BK – q2 presentation)

Also I should mention that BK was one of the banks taking part in the 2023 Fed Stress Test, and along with many peers it fared well.

According to a June article in the Associated Press:

The nation’s 23 largest banks passed the Federal Reserve’s so-called stress tests this year, a sign that the nation’s banking system remains resilient.

Here was the sentiment from CEO Robin Vince in the Q2 commentary:

Following the release of the Federal Reserve’s 2023 bank stress test last month, we increased our common dividend by 14% starting this quarter, and our overall approach to maintaining a high-quality, resilient balance sheet and returning capital to shareholders remains unchanged.

From a forward-looking view, I expect in the next quarterly results for BK to continue this positive trend and meet or beat its capital & liquidity ratios further.

Share Price: Recommend

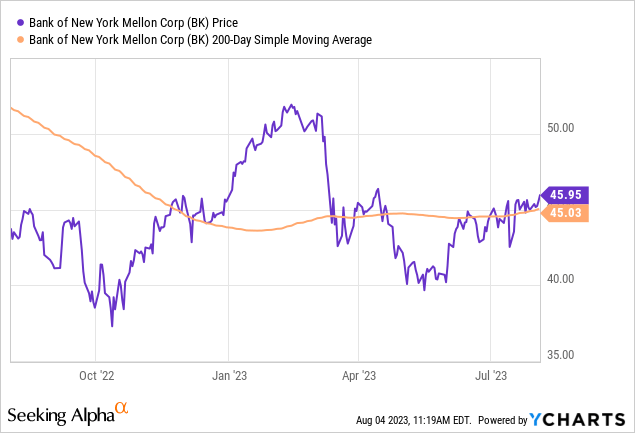

As of market open on Friday August 4th, the share price was trending around $45.95, as the YChart below shows. I am tracking the share price vs the 200 day simple moving average which sits at $45.03 right now.

My investing idea remains the same as in several previous articles: establish a trading “range” within 5% below & above the 200-day SMA, holding the equity longer term for 1 year to earn dividend income, and selling at a capital gain at that point.

The current share price as of the writing of this article is hovering at 2% above the 200-day SMA, so it is within my 5% buffer zone and I would recommend it as a buy opportunity. This idea depends on the moving average steadily continuing upward over the next year.

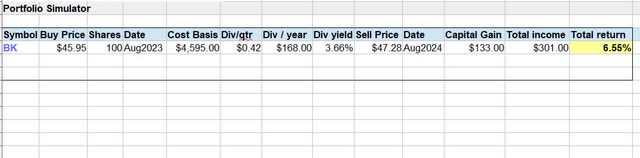

Here is how a simulated trade would look using my investing idea on this stock:

BK – trade idea simulation (Albert Anthony & Co. )

In this investing idea simulation, we are buying 100 shares at the currently trending price of $45.95, holding for 1 year and earning a 3.66% dividend yield, then selling at 5% above the current 200-day SMA. Our total return on capital invested is 6.55%.

Keep in mind this is not obviously a guaranteed prediction but rather a target entry & exit point, and target timeframe. This scenario can benefit an investor looking for both dividend income and capital gains income, and willing to tie up capital for 1 year or perhaps longer.

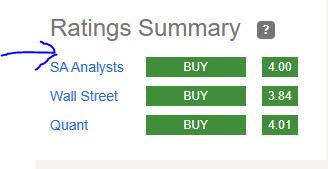

Ratings Score: Strong Buy

Today, BK won in all 5 of my ratings categories and earned a strong buy rating, which is an upgrade from my May rating of “buy,” and is more bullish than the consensus from Wall Street and Seeking Alpha, as shown below.

BK – ratings consensus (Seeking Alpha)

Risks to my Outlook: Missing Earnings Estimate

The only risk to my highly bullish outlook on this stock that I can think of is that the next quarterly results miss analyst estimates, thereby causing some bearish selling off of shares as a market reaction.

This is always a possibility, and could be driven by decreased fee revenue, increased interest expense, or other factors. The next earnings call, though, is a while off so in the meantime the share price could continue to climb, particularly benefitting those who bought BK during the spring dip in banks.

Also, if you look at the last 4 quarters, this stock has beat analyst estimates each time. Therefore, I expect in the next quarterly results which are due in October to see a high likelihood of another earnings beat somewhere around $0.09, the average of the last 4 earnings beats. This should give some more bullish tailwind to the share price in the run up to and right after the next earnings call. If they only meet estimates but do not beat them, I still think it will not cause any major selloff of shares.

BK – earnings beats (Seeking Alpha)

Analysis Wrap Up

Let’s go over the key points discussed in this analysis.

Today BK is getting a strong buy rating, which is slightly more bullish than the buy rating consensus from Wall Street and Seeking Alpha.

Positives: share price vs 200 day SMA, dividend yield vs sector average, valuation vs sector average, net income growth YoY, capital & liquidity strength.

Headwinds: none to mention.

Risk to outlook: an earnings miss for Q3 could trigger bearish sentiment among investors, however recent trends show a high likelihood of another earnings beat.

In conclusion, if someone asked me to pick just 5 equities to invest in, this stock would probably be one of them. As the world’s largest custodian bank and through its Bank of New York predecessor one of the oldest banks in the US, it has proven it can weather over 200 years of market turmoil and storms, and come out among the leaders in its sector.

Read the full article here