I have mentioned Western Copper and Gold (NYSE:WRN) in the past as an excellent copper/gold resource investment idea. The company owns the Casino mine project in the Yukon. Its stock valuation trades at a sizable discount to estimated NPV calculations at metals prices below current quotes. Even given the go ahead to build a mine from owners/partners including Rio Tinto (RIO) and Mitsubishi Materials (OTCPK:MIMTF), it will take 3-4 years for new production to actually begin.

While it may be hard to believe this resource will actually be developed any time soon, I am thinking a double and triple in copper prices during 2024-25 would change minds. In the process of a major bull run for both copper and gold (my baseline projection for a number of reasons), Western Copper’s miniscule cash-adjusted equity market capitalization around $200 million at $1.45 a share (after subtracting net cash of liabilities) could rise in value by 5x or even 10x, under the right circumstances.

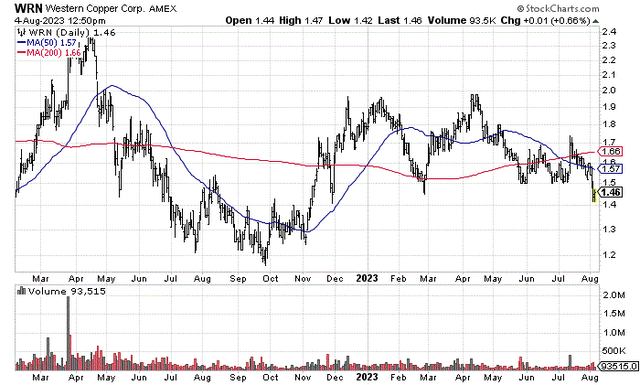

StockCharts.com – Western Copper, 18 Months of Daily Price & Volume Changes

Copper Industry Shortfall

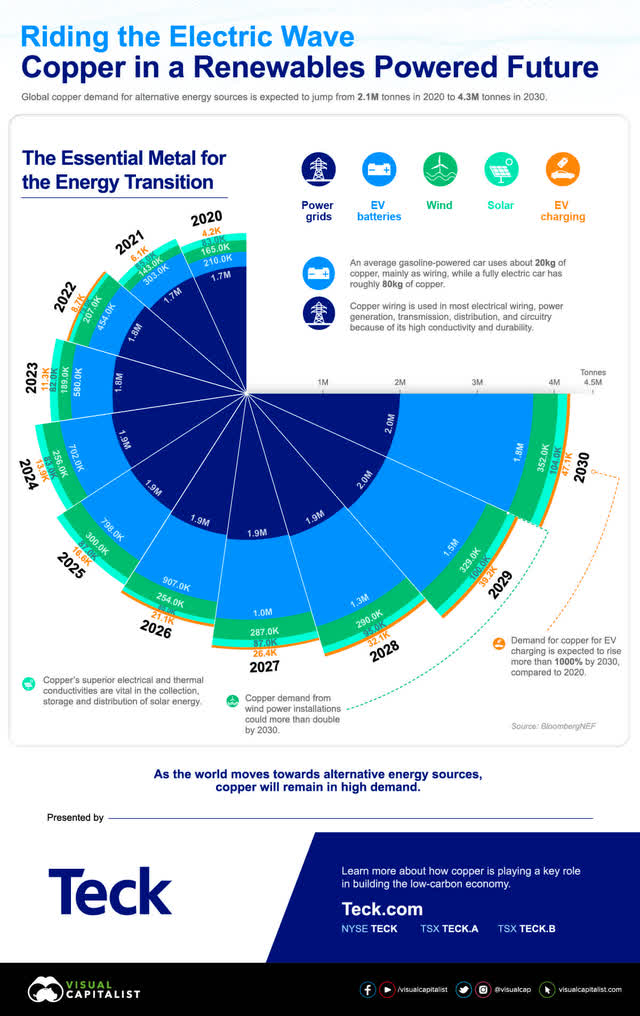

The copper supply/demand setup is incredibly skewed toward shortages after this year if we don’t experience a global recession in demand soon. Mined supply has only been able to rise by about 3% over the last 20 years, with Chile and Peru (accounting for 40% of newly mined supply) witnessing stagnate to lower production numbers in 2023. At the same time, green energy uses in electrical-grid buildout, EV vehicle motors and wiring, and expanding solar/wind installations have translated into copper demand growing in increasing total amounts, with the threat of net demand growth rates reaching well above 3% annually in the not-too-distant future.

Visual Capitalist, Renewable Energy Usage of Copper, 2020-2030 Estimates

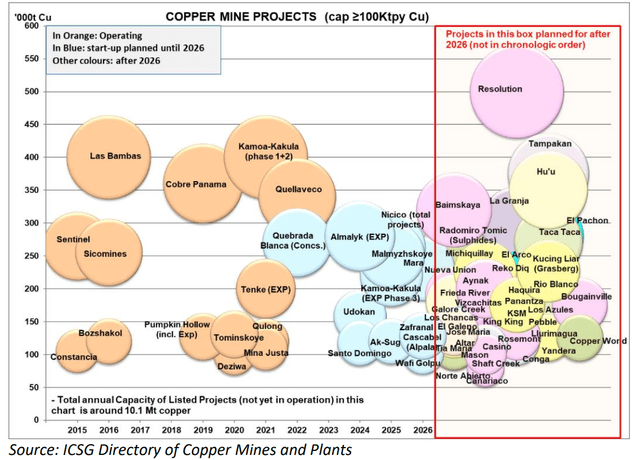

Goldmans Sachs and Wood Mackenzie over the last year have both projected a deficit in copper supply vs. demand to last into the 2030s, as fewer new mines are being developed to offset depleting supplies and now falling production in many nations, especially Chile and Peru. Goldman has projected a whopping 15% shortage in supply vs. demand pumped by renewable energy growth by the year 2030. For conceptual sizing, current estimates of supply growth to meet the gap will require building twice as many new mines over the next decade vs. what has been brought into production over the last 20 years. Basically, we are talking about developing new copper mines at 4x the annual average rate of the last two decades!

The problem is a very limited number of largescale quality-resource assets have been found, much less pushed into development through a quick buildout decision over the last couple of years. The massive Rio Tinto Oyu Tolgoi project in Mongolia and Barrick Gold (GOLD) Reko Diq asset in Pakistan have taken many years to reach approval in third-world countries. And, each business has had to give up roughly half of future income through government partnership agreements, despite taking on most all of the financial burden for building a new copper mine.

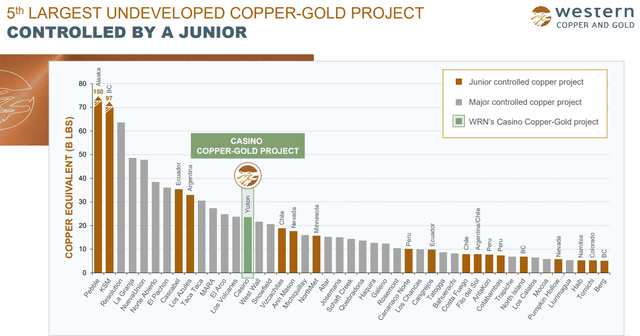

Honestly, without an extended and overwhelming jump in copper prices, it’s hard to envision the right financial incentives for government approvals and final stakeholder OKs to spend billions on bringing new production to market. My thinking is the handful of legitimate undeveloped copper resources in safer operating places like the U.S., Australia, and Canada will be quite valuable on a huge uptick in copper prices soon. Western Copper is one of the best “leverage” investment ideas I can find to copper, alongside the Seabridge Gold (SA) KSM project also in Canada.

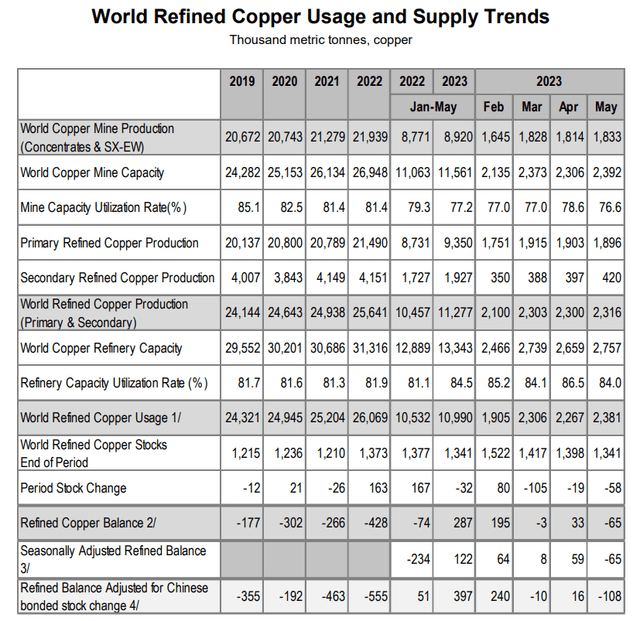

A slowing western-world economy on top of a sputtering COVID reopening in China have both led to weaker demand growth for copper in the first half of 2023 than anticipated. The end result has been copper prices consolidating the price gains of 2020-22. According to industry estimates, a slight surplus in refined, melted scrap, and mined supply has existed in 2023 (mostly from January and February stats) vs. deficits since 2019.

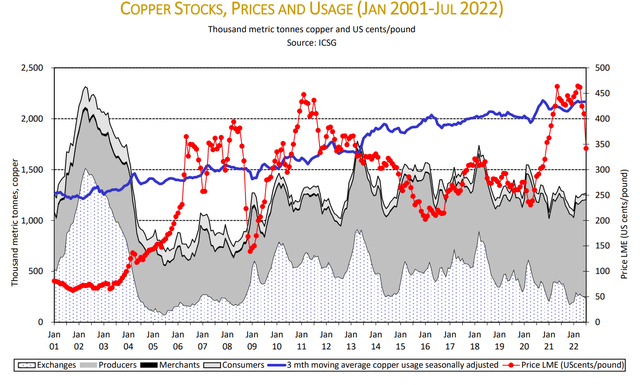

International Copper Study Group – July 2023 Press Release

However, relentless growth in EV production and solar/wind power installations could combine with a soft-landing economy to increase demand enough to deplete already sliding above-ground stocks/inventory of copper in the world.

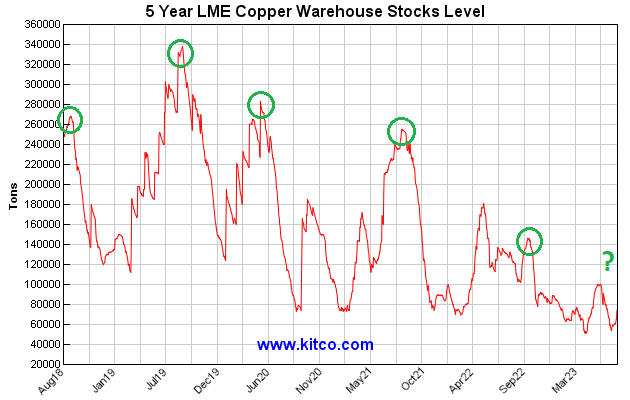

On the 5-year graph below of London Metal Exchange physical inventory, you can review how late summer has often marked the high point for stocks during each year (circled in green). This year’s almost nonexistent LME supply for copper buyers is a real worry for next year.

Kitco.com – London Metal Exchange, Weekly Copper Inventory, 5 Years, Author Reference Points

Plus, total global usage vs. available stocks since 2022 have returned to the equivalent bullish ratio as the last boom in copper prices during 2004-08 (dividing the blue line by the top light-grey line on the graph below). All told, there is no room for error. Either unexpected mining problems or faster copper consumption could turn price into a rocket ride.

International Copper Study Group – 2022 Factbook

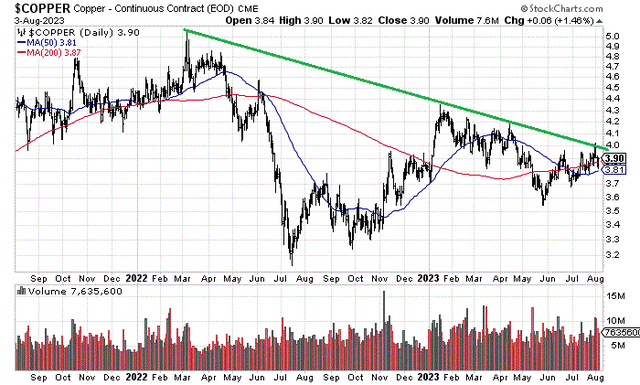

Copper Price Breakout Approaching?

The first sign that a serious copper shortage imbalance has started may come from a price breakout above US$4 per pound in coming weeks. I have drawn this tripwire idea below, using a green trendline running through the price peaks since $5 in March 2022.

StockCharts.com – Copper Futures, 24 Months of Daily Price & Volume Changes, Author Reference Point

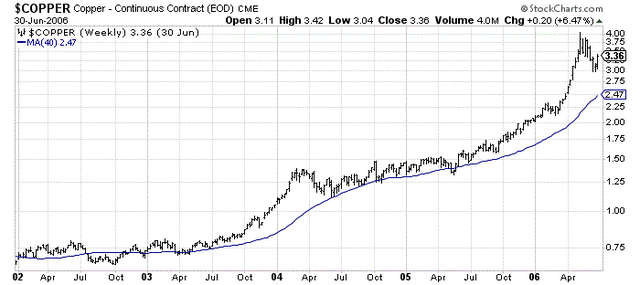

How far can copper climb in a severe shortage situation? Let’s go back to the record breaking 2002-06 price advance. From 60 cents in January 2002, copper exploded in price to $4 a pound a good four years later, a gain of better than +500%! With slack investment in new production during the 1980s and 1990s, a long-term shortage in supply was responsible for this monster upswing. The scary equivalent today is current projections are calling for an even bigger deficit setup in 5-6 years. It’s entirely possible we are sitting in the same price-cycle position as the summer of 2002 or 2003 right now. With copper prices today the same as 2006 (17 years ago), plenty of upside could be approaching.

StockCharts.com – Nearby Copper Futures, Weekly Price Changes, 2002 to June 2006

Western Copper and Gold

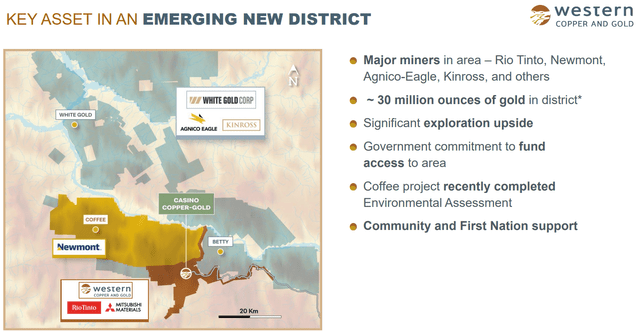

What grabs my attention about the Casino project is its simple heap leach, open pit design. Other projects of similar size like Seabridge’s KSM are in the mountains, with higher elevations and deeper, expensive underground mining plans. The biggest real-world issue with the Yukon location is it sits hundreds of miles from ports and a considerable distance from sustainable power supplies. Part of the mine-build proposal includes an effort to construct local sources of energy like liquid natural gas generators to support the operation.

Casino is one of a number of identified copper projects worldwide ready to bring into production on higher metals pricing in the near future.

International Copper Study Group – 2022 Factbook

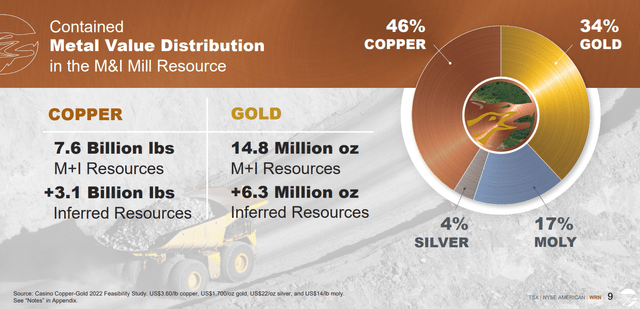

The resource is massive with roughly 10 billion pounds of copper (notational value of $40 billion at $3.90 per pound) and 20 million ounces of gold (another $38 billion in notational value at $1940 per ounce) estimated in the ground currently. The latest plan concept calls for a mine life of 27 years.

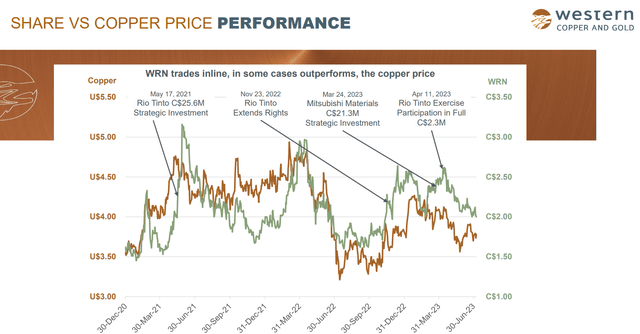

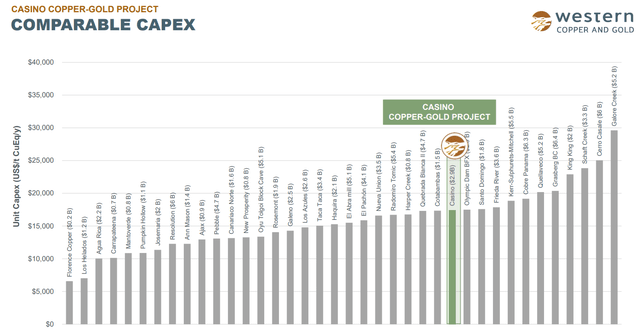

Below are graphs of the Wester Copper quote correlation to copper prices over the past few years, alongside a breakdown of important mining comparison stats to contemplate and research. The slides are taken from the July 2023 presentation available on the company website here.

Western Copper – July 2023 Corporate Presentation

Western Copper – July 2023 Corporate Presentation

Western Copper – July 2023 Corporate Presentation

Western Copper – July 2023 Corporate Presentation

Western Copper – July 2023 Corporate Presentation

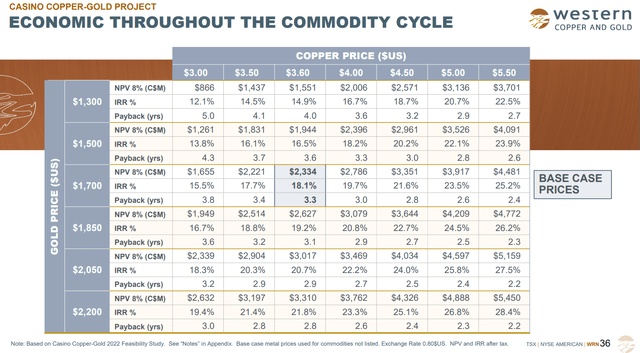

Of particular interest are the estimates for changing net present value with fluctuations in copper/gold bullion quotes. At super-low copper prices of $3 per pound and gold at $1,300 per ounce, the whole project might only be worth $866 million to its owners. This number clearly does not justify the $3 billion estimate to build a mine upfront. Using conservative bullion price estimates roughly 10% cheaper than spot quotes, this NPV number rises to $2.3 billion (shaded in grey below).

However, if both metals enter robust price uptrends during 2024, using $5.50 copper and $2,200 gold (both record highs in nominal terms) would jump the underlying current value of the asset to $5.4 billion. Since I believe even higher metals pricing is likely in 2-3 years, it’s not hard to understand the upside argument with the whole company today worth only $200 million! Of course, these estimates do change over time and will likely fall some from higher mining cost estimates, rising with general inflation in the economy.

Western Copper – July 2023 Corporate Presentation

Final Thoughts

Dollar devaluations to meet America’s record debt obligations are a secondary reason to consider commodity investments like copper/gold and the other metal resources owned by Western Copper. I just wrote here about how this week’s Fitch downgrade of U.S. Treasury debt may cause foreigners to invest their capital elsewhere going forward, explaining the odds of even faster rates of inflation are now possible in America than the 3%-4% CPI range of 2023. One way to hedge currency weakness and future inflation is through owning metals historically.

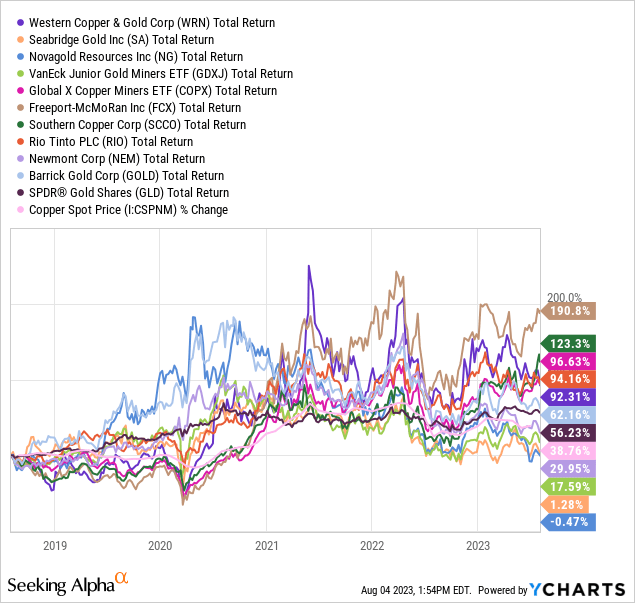

This investment suggestion is higher risk, no doubt, lacking revenue and operating profits. But, sound management of the Casino asset with new drilling finds have helped the stock to outperform many mining peers over the last five years, with only minor help from rising underlying bullion quotes.

YCharts – Western Copper vs. Peer Metals Investments, Total Returns over 5 Years

Holding almost no liabilities on the balance sheet, controlled spending costs, and slight equity dilution over the years, Western Copper should effectively trade like a “call option” on exaggerated gains for copper and gold going forward, without an expiration date. Newmont (NEM) holds the next-door Coffee project, which also makes WRN a smart consolidation takeover target.

The primary risk on investment at this stage would be an oversized drop in copper and gold bullion prices over the next 12 months, which I view as unlikely to say the least. For whatever reason (deep recession could be one), if copper prices do not rise materially, the bullish WRN argument would be degraded.

Another risk for Western Copper ownership is aluminum will be substituted for copper in some applications, especially with a much lower price in place today. However, aluminum is not exactly the safest or most efficient conductor in wiring. On the flip side of the argument, new solar panel inventions use twice as much silver as older designs, which could encourage a shift itself into copper as a substitute for silver. My view is both copper and silver are set to climb significantly in price over the next 3-5 years, as shortages are created by mushrooming industrial/manufacturing uses.

Confidence in the dollar as a long-term store of value is waning, and the Federal Reserve may have no choice but to eventually pivot to a new round of money printing (dollar devaluations) to prevent deep recession. Geopolitical risks are higher than ever in my 37 years of trading, with major wars underway in Europe and one possibly ready to start over Taiwan. Iran’s nuclear program has not gone away, and North Korea is threatening to nuke the U.S. daily. On top of this, a former U.S. president is about to go on trial in multiple felony cases, further dividing America politically. If you do not have heightened exposure to precious metals now, when will you?

Today’s sub-$1.50 WRN price could be incredibly undervalued in retrospect, given substantial upside appears in a prolonged copper-shortage scenario. Plus, a lower dollar may help both copper and gold to outline all-time highs priced in our local currency over the next 12 months. For my money, it is quite difficult to find a similar risk/reward resource setup in a business friendly, politically stable jurisdiction. If you are searching for intelligent copper/gold exposure for 2024-25, Western Copper is a top investment choice.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here