Rapid Recap

As we headed into the earnings results, I wrote a bearish analysis where I said:

Atlassian Corporation (NASDAQ:TEAM) is priced at 38x forward non-GAAP operating income. Not this year’s, but next year’s. This is not a multiple that makes much sense, given that Atlassian’s growth rates are clearly slowing down.

Then, to further compound matters, Atlassian’s fastest growing business line, its cloud segment, holds weaker profit margins than its premise business.

Altogether, I believe that this stock provides a negative risk-reward. So, I’m asserting a sell rating on this stock.

While one part of me continues to believe that much of what I said was right, namely that Atlassian’s profitability continues to be unappetizing, I believe that’s probably in large part derived from my commitment and consistency biases, rather than from an accurate representation of the state of affairs.

Overall, there’s enough good news here for me to revise my sell rating on this stock upwards.

Why Atlassian? Why Now?

Atlassian is a collaboration and workflow company. During the pandemic, there’s a massive wave of IT departments seeking out any and all different sorts of software products. But now we are going through a period of digestion that has led customers to reconsider and more closely scrutinize deals.

As a reference point, Atlassian finished its prior fiscal year 2022, with 242,000 customers, while it now finished its fiscal 2023 with 7% more customers at 260,000 customers. This is an echo of everything that we’ll discuss here. Atlassian is able to put out a narrative of growth ahead, but when we look under the hood, the growth rates appear to be slowing down. Seeing a 7% y/y increase in customers is a further reminder that Atlassian’s fastest growth days are now in the rearview mirror.

All that being said, the biggest takeaway here is that Atlassian appears to be slowing down less than what investors previously expected.

Revenue Growth Rates Requires Significant Interpretation

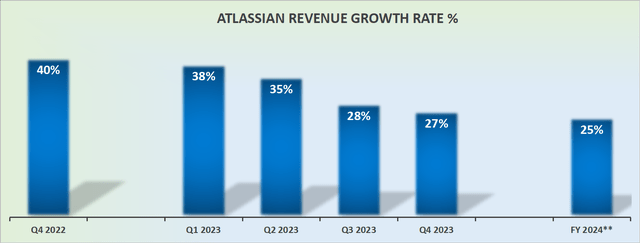

TEAM revenue growth rates

The biggest takeaway from the guidance, that got investors very excited about Atlassian is that its cloud business is expected to slow down its deceleration.

This means that Atlassian’s cloud business together with its on-premise data center business is still delivering reasonably compelling revenue growth rates, despite the challenging environment that I’ve already discussed above.

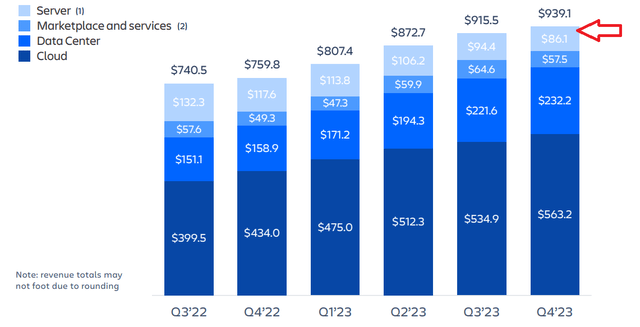

TEAM Q4 2023

However, Atlassian also makes it clear that as part of its push to grow its Cloud business, it will no longer provide support for its Server business, which means that its Server business will fall to zero by the end of the year.

All that being said, even though Atlassian’s Server operations go to zero, I’m inclined to believe that investors are eyeing up the organic growth rates from both Atlassian’s Cloud business and Data Center businesses and thinking that altogether Atlassian probably has what it takes to continue growing at around 25% into fiscal 2025 (ends June 2025).

Note, this estimate of mine is more aggressive than analysts’ own expectations, which are for around 20% CAGR in fiscal 2024.

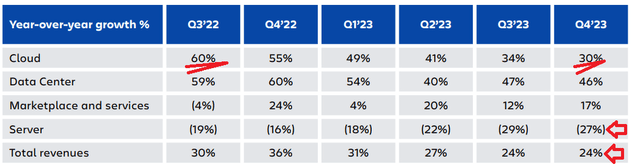

TEAM Q4 2023

To summarize what’s at play here:

There’s Atlassian’s Server business, which makes up 9% of its total revenues going to zero in twelve months.

And its cloud business saw its revenue growth rates go from 60% y/y in last year’s fiscal Q3 2022 growth, to 30% y/y in its latest quarter, fiscal Q4 2023. But it appears that looking beyond the current quarter, to the end of the fiscal 2024, this revenue growth rate may moderate their deceleration.

In Pursuit of Profits

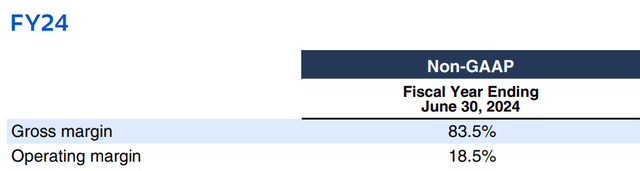

Atlassian’s non-GAAP gross margins finished fiscal 2023 at 85%. And looking ahead to fiscal 2024 its gross margins point to 83.5%, an approximately 150 basis points compression. Even if Atlassian is being conservative with its guidance, the fact remains that Atlassian is not pointing at this stage towards matching its profitability of fiscal 2023.

TEAM Q4 2023

Moving down the income statement Atlassian finished fiscal 2023 with non-GAAP operating profits of 20% and its guidance for the year ahead also appears to be compressing by 150 basis points y/y.

I have already made this reference higher up in the analysis. The more that Atlassian’s cloud business grows, the weaker Atlassian’s margins end up.

I’m less bearish on this stock. But there are still a lot of pesky details that keep me on the sidelines.

The Bottom Line

As I analyzed Atlassian Corporation’s earnings results, I initially took a bearish stance due to its high forward non-GAAP operating income multiple and slowing growth rates.

However, upon closer examination, I realized that my negative outlook might have been influenced by my biases.

Despite its unappetizing profitability, Atlassian’s collaboration and workflow business gained traction during the pandemic, attracting more customers. Although growth rates seem to be slowing down, the company is performing better than expected.

The revenue growth rates for its cloud business and on-premise data center business are still compelling, despite challenges. However, Atlassian’s decision to discontinue support for its Server business will impact its revenues.

Looking ahead, the cloud business might maintain a more moderate growth rate. While I am now less bearish on the stock, certain details make me cautious and keep me on the sidelines.

Read the full article here