Receive free Indian business & finance updates

We’ll send you a myFT Daily Digest email rounding up the latest Indian business & finance news every morning.

Investors are piling into India’s so-called shadow banking sector, which has been buoyed by consumer demand for credit in one of the world’s fastest-growing economies even as concerns remain about risky loans.

US investor Bain Capital in July bought a majority stake in tycoon Gautam Adani’s shadow banking business comprising Adani Capital and Adani Housing Finance, pledging $170mn in debt and equity to expand the enterprise.

Reliance Industries, India’s biggest company by market value, plans to soon list its own shadow bank, Jio Financial Services. The company has signalled its ambitions beyond lending, announcing a deal with BlackRock, the world’s largest money manager, to each invest $150mn in an asset management venture. Small business lender SBFC is also seeking to raise about $200mn in an initial public offering, according to bankers.

Offering regulated bank-like services such as loans, but without taking deposits, India’s thousands of shadow banks have been crucial in fuelling economic growth, lending to customers that banks cannot — or will not — serve because they are considered higher risk.

Now Indian shadow banks, whose risky loans sparked a crisis in 2018, have been rewarded by the economy’s post-pandemic upswing. Consumers are borrowing more — the amount of personal loans made by conventional banks increased 19.2 per cent to Rs41.4tn ($500bn) in the 12 months to May, according to the latest central bank data.

Lending by banks to shadow banks is rising even faster — up 27.6 per cent year-on-year in May to Rs13.4tn. The central bank does not release monthly data on loans by shadow banks, but has said their personal lending rose 31.3 per cent in March compared with the same month of 2022.

In 2018, banks and mutual funds throttled credit lines to shadow banks after the collapse of Infrastructure Leasing & Financial Services. The resulting credit crunch hit small businesses hard and prompted a wave of regulation.

Stronger balance sheets, stricter rules and an improving economy are encouraging investors to take another look at shadow banks. “After multiple mini crises, negative narratives . . . and investor apathy, the industry is turning,” wrote Morgan Stanley in a note about non-bank financial companies last month.

Tej Shah, fund manager at Mumbai-based Marcellus Investment Managers, said growth in housing finance and mortgages, as well as consumer credit, “is quite structural in nature . . . and growth is quite steady despite all the disasters that have happened on the shadow banking side over the past few years”.

“These are products for which there is a real need,” Shah added.

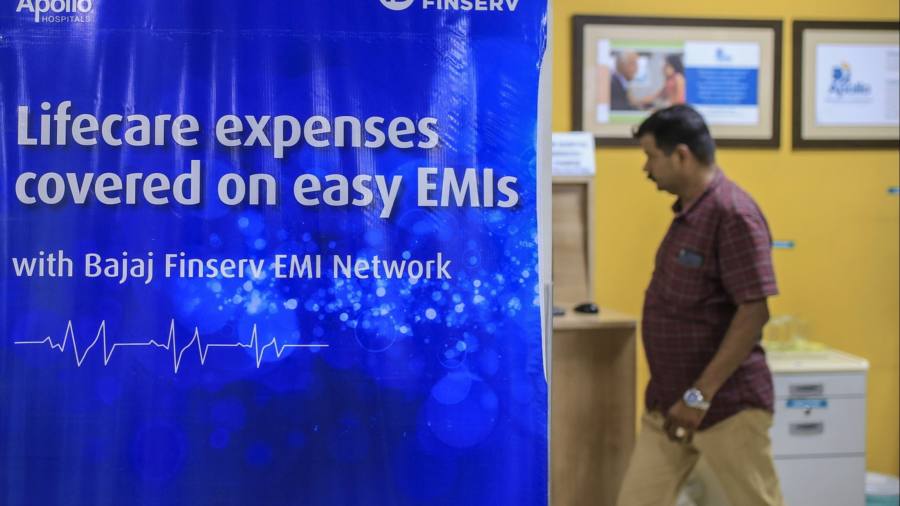

The biggest listed shadow bank is Bajaj Finance, which started as a financing unit for customers buying Bajaj’s scooters. It branched out into consumer lending, helping middle-class consumers buy appliances such as fridges and phones. Bajaj Finance now manages assets worth Rs2.7tn, with a market capitalisation of more than $50bn.

“Today we issue close to 120,000 loans a day and over 200,000-250,000 insurance policies per day,” said Sanjiv Bajaj, chair of holding company Bajaj Finserv.

During the three months ending June 30, Bajaj booked its highest number of new loans in a quarter — 9.9mn, compared with 7.4mn the same period the year before. Its assets under management grew 32 per cent year on year.

Some analysts expect billionaire Reliance chair Mukesh Ambani’s newly spun-out shadow bank to disrupt the sector by using the trove of consumer data it gathers from Reliance’s Jio phone network to target potential borrowers.

Bajaj said there was room for competitors. “Is it a concern? No. Because we’re not a saturated market for financial services,” he said. “India is actually going to require 10 times its size in financial services over the next 20 years.” Bajaj estimated the potential market size for India’s financial services was “half a billion people”.

Foreign investors increasingly buy this outlook — almost 20 per cent of Bajaj Finance shares are held by overseas money managers, including a 3 per cent stake by the Singaporean government.

But risks may be building up. “We’re a little troubled about the level of leverage in the system,” Rajeev Jain, Bajaj Finance’s managing director, told analysts last month. “The amount of personal loan growth is troubling us.”

He added the company was taking “pre-emptive action” to mitigate the rising risk.

Sceptics wonder if tightened regulation on capital adequacy and disclosure as well as tougher rules for bigger shadow banks will provide better guardrails.

In its heyday, prior to 2018, shadow banks’ “growth was filled with very high-risk appetite”, said Siddharth Goel, director of Asia-Pacific non-bank financial institutions at Fitch Ratings. He pointed to previously “lax underwriting” by the shadow banks.

Many remain cautious this time around.

“In the retail sector there is a lot of debt being given now on an unsecured basis,” said one financial industry veteran. “The banking sector’s track record [on this] is a mixed bag.”

Read the full article here