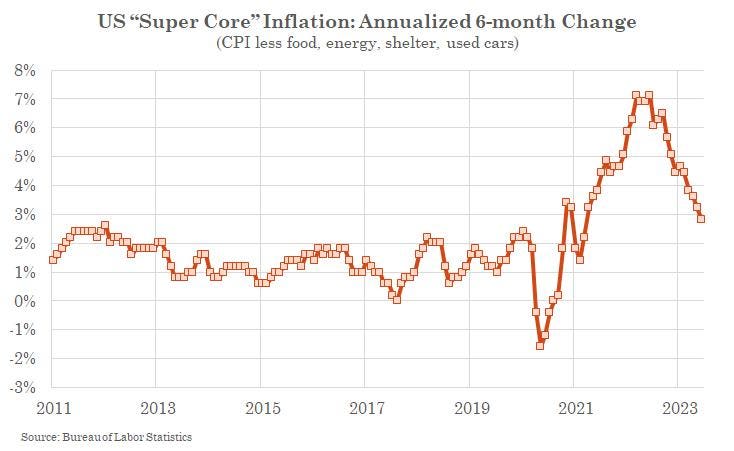

Inflation is finally falling. Twist the numbers the right way, like I’ve done below, and you can almost see the finish line.

In the aftermath of SVB’s

VB

However, I also said that long-term inflation risk remained high and now I’ve got good company.

Well known HSBC

HBA

There is more to King’s book than these tests. He explains why inflation serves as a stealth tax hitting society in uneven and unfair ways. He also reminds us that central bank independence is relatively new and fragile. Governments and central banks are irresistibly pulled back toward each other over time, a process he calls the Burton-Taylor effect after the twice married Hollywood couple.

Listen to our conversation on Top Traders Unplugged and read on to see where we stand now on his tests.

Test 1: Have there been institutional changes that lead to an inflationary bias?

Answer: Yes.

Since central bank independence is relatively new, it’s jealously guarded. That’s sensible, but has the side effect of causing central bankers to stay mostly quiet about the inflationary effects of large government deficits. This matters a lot because deficits are set to grow much larger in the coming decade.

Next is the Fed’s 2020 change to targeting an average inflation rate of 2%, rather than viewing 2% as an upper limit. In our conversation King said this “required a pre-commitment not to raise interest rates in the event that inflation were to move above target” because some inflation above 2% was necessary to offset the below 2% inflation we had previously experienced. Thus the Fed felt unable to move quickly when inflation started to rise and now faces a longer struggle to bring it down.

Finally there is quantitative easing (QE), which the Fed introduced during the GFC. QE means bond yields are no longer freely determined in the market. In the Carvilleian days of yore rising bond yields provided a signal to central banks that inflation concerns were growing. King likens QE to “dismantling the inflation early warning system”, again increasing the chances they will be slow to react to inflation pressures.

Test 2: Are there signs of monetary excess?

Answer: Maybe.

The graph below shows the value and change in US bank deposits and money market holdings – a measure of money supply known as M2. Money supply skyrocketed during the pandemic and remains 8% above its pre-Covid trend. In King’s mind that stock of extra money continues to be potential inflationary kindling.

But look at the graph on the right. That shows the steep fall I referenced earlier. If the fall continues then this test might eventually flip to no but right now the jury is still out.

Test 3: Is Inflation Risk Being Trivialized?

Answer: Trivialized is a bit strong, but under-appreciated? For sure.

My favorite graph in King’s book shows the actual UK inflation rate along with the Bank of England’s expected inflation in two years’ time. I’ve reproduced a version of it below using US data.

The black line shows what the Fed was expecting inflation to be in two years’ time, while the blue line shows actual inflation. Despite massive changes in financial conditions and big swings in inflation, the Fed barely changed its medium-term inflation forecasts.

Is inflation risk being trivialized? That seems a bit strong, but there is certainly evidence of over confidence in its ability to bring inflation down.

Test 4: Have supply-side conditions changed for the worse?

Answer: Yes.

This is the least controversial test. Sure, things have improved since the worst period of global trade disruption. But looking out longer-term there are (at least) three major structural inflationary trends:

- Demographics. Populations are ageing faster than pretty much anyone predicted. That pushes prices higher because retirees buy goods and services but don’t supply them. Therefore, as the older, non-working portion of the population gets larger, inflation pressure grows.

- (De)Globalization. Wages were held in check for decades by the integration of China, Vietnam and Eastern Europe into the global labor force. That’s over. Worse (from an inflation perspective at least) it’s going to partially reverse, putting upward pressure on labor costs as the ability to outsource to cheaper foreign locations is constrained.

- Energy Transition. Transitioning to renewables adds to inflationary pressure because fossil fuel and its supporting infrastructure is still a cheaper way to deliver energy.

King’s tests are important and intuitive starting points for understanding inflation risk. In the coming days I’ll add to this by explaining how the unintended consequences of fighting deflation over the last few decades makes fighting inflation now more challenging.

And…for you optimists…the next Ideas Lab podcast will feature technology expert Mark Mills who thinks I’m wrong. Inflation, he believes, is about to be solved by a burst in productivity created by a convergence of advances in information, machines and materials.

Read the full article here