With its recent acquisition of Fill-Rite in 2022, The Gorman-Rupp Company (NYSE:GRC) levered its balance sheet for the first time in over 10 years. This acquisition was made for $528 million, or $448 million after expected tax benefits from the transaction. Fill-Rite generated $140 million in revenue and $34.5 million in adjusted EBITDA in the 12 months ended March 31, 2022.

This acquisition was immediately accretive to EBITDA margins and boosted Gorman’s sales and earnings. Prior to this acquisition, Gorman’s backlog was on the rise but after the acquisition the backlog increased from $186 million at the end of 2021 to $267 million at the end of 2022. More recently the backlog has dropped from high at the end of 2022 to $249 million at the end of Q2 2023. Despite the drop, this is a historically large backlog for the company and would command a premium multiple if the market was convinced that this backlog is growing or stable at the very least.

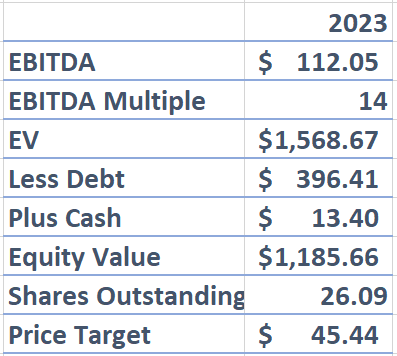

I believe that at today’s valuation, Gorman’s stock will rise to $45 by the end of the year based on my assumptions of 2023 financial results. In this article I’ll go into more detail about these assumptions, go into more detail about my estimate of Gorman’s value and provide an overview of Gorman’s operations and end markets.

Business Overview

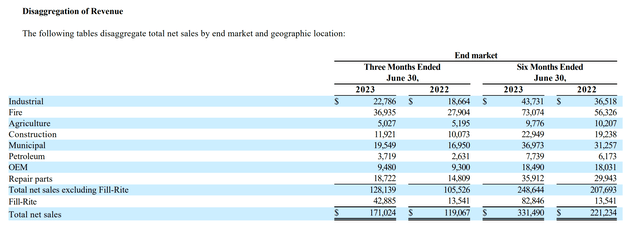

Gorman’s only operating segment houses the manufacture and sale of pumps and pump systems. Although there is no diversity in its operating segments, Gorman diversifies through the variety of end markets it sells its products in. These end markets are: Industrial, Fire, Agriculture, Construction, Municipal, Petroleum, OEM, Repair parts, and Fill-Rite (the latest acquisition). The chart below from the most recent 10-Q shows the breakdown of these segments by revenue at the end of Q2 2023.

Q2 2023 Revenue by End Market (Gorman-Rupp Q2 2023 10-Q)

This variety of end markets provides stability in sales because if one market is experiencing a downturn, a different one can pick up the slack. I recently covered Luxfer Holdings PLC (LXFR) which also sells products in a variety of end markets and this diversity provides a relative stability in sales over time. Due to this diversification, even in the 2008 financial crisis, Luxfer generated an operating profit and positive cash flow despite the fact that it sells commoditized products in industrial markets.

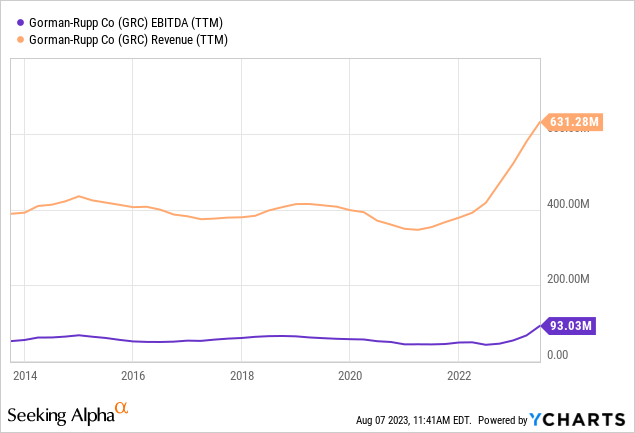

However, this also makes organic growth difficult for the same reason. From 2013 to 2021, Gorman’s revenue declined $391 million to $378 million. Luxfer’s revenue also declined from $481 million to $374 million in the same time period. This is quite common with diversified industrial companies and makes it difficult to grow without making acquisitions.

Gorman’s recent top and bottom line growth is mainly attributable to its acquisition of Fill-Rite, and less so to price and sales volume increases.

Past Financial Results

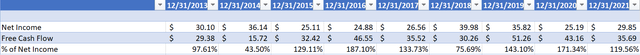

Along with declining revenue over the past decade, Gorman’s margins have not expanded thus earnings have fallen. Despite this, Gorman has increased its dividend paid each year since 2013 without taking on debt. This is mainly possible because Gorman’s free cash flow has been higher than its net income more often than not in this period.

Gorman-Rupp Net Income to Free Cash Flow Conversion (Created by Author)

Given Gorman’s history, it is most conservative to assume that there won’t be much organic growth going forward. After the Fill-Rite acquisition is fully incorporated into the business, both the top and bottom line growth should be more stagnant going forward.

However, since the Full-Rite acquisition, Gorman’s revenue increased 35% to $521 million and EBITDA increased 34% to $68.7 million in 2022. This growth has continued into 2023 as revenue grew 43% year over year and EBITDA grew 107% year over year in Q2 2023. As I mentioned above, much of this growth has been from the addition of Full-Rite results but Gorman has also benefitted from 3 prices increases that average between 4-5% each since the start of 2022, the general strength of the economy, and high spending on infrastructure related projects in the U.S.

This means that determining Gorman’s value makes it necessary to have an opinion on their ability to maintain these growth factors.

Valuation

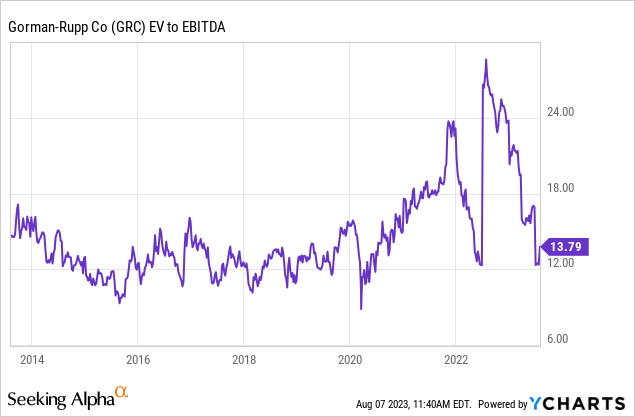

In my valuation, I am assuming Gorman grows its topline 25% in 2023 and has a 17% EBITDA margin. I believe Gorman will be able to maintain its growth through the end of the year as it continues to work through its backlog. I also believe that as long as Gorman’s backlog remains somewhat stable, the market should continue to apply at least a 14x EBITDA multiple, equal to the 10-year average multiple, to the enterprise.

I am also assuming that Gorman pays down about $15 million of its debt, has $13.4 million of cash on hand, and has 26.09 million shares outstanding by the end of the year. With these assumptions, my estimated price target for Gorman’s stock is about $45 per share by the end of the year, or about 35% higher than the current price of the stock.

Gorman-Rupp Value Estimate (Created by Author)

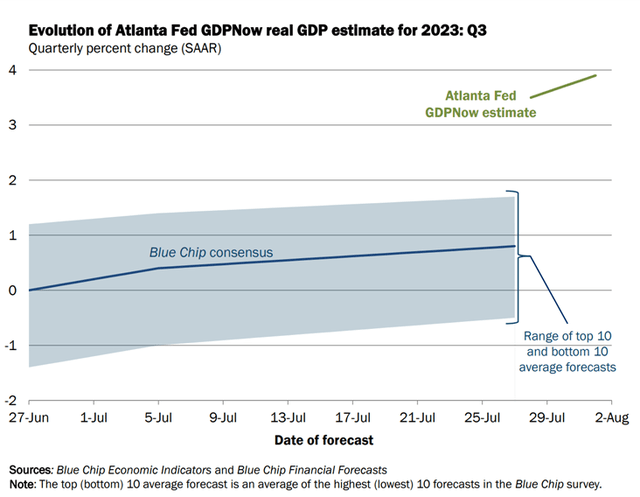

My optimism for the prospects of Gorman’s backlog stems from my belief that the end markets that Gorman operates in should continue to have strength through the end of the year and into 2024 as much of the recent economic data is pointing to sustained GDP growth through 2023.

The Atlanta Fed’s most recent real GDP estimate for Q3 2023 came in at a surprising 3.5%. Other economists such as J.P. Morgan’s U.S. chief economist are, no longer predicting a recession to occur in 2023. This does not guarantee that there will be no economic weakness in 2023 but if these estimates hold true Gorman’s backlog should be stable. This will especially be the case with end markets that are more sensitive to GDP such as the industrial, construction, petroleum, and OEM end markets which, including Fill-Rite sales, made up 28% of total sales in H1 2023.

Atlanta Fed 2023 Real GDP Estimate (Atlanta Fed)

Gorman’s most recent 10-Q points out some of the reasons for higher sales growth in Q2 and H1 2023. The sections reads:

In addition to the increase at Fill-Rite, sales increased $22.6 million, or 21.4%, due to an increase in volume as well as the impact of two pricing increases taken in 2022 and an annual price increase in January 2023. The Company’s two price increases in 2022, as well as the price increase in 2023 averaged between 4.0% – 5.0%. Sales increased $9.0 million in the fire suppression market primarily from increased domestic commercial construction, $4.1 million in the industrial market and $3.9 million in the repair market due to strengthening in the broader industrial economy, $2.6 million in the municipal market due to domestic flood control and wastewater projects related to increased infrastructure investment, $1.9 million in the construction market due to strong overall conditions including infrastructure related projects, $1.1 million in the petroleum market due to increased demand for larger petroleum transfer pumps, and $0.2 million in the OEM market. Partially offsetting these increases was a sales decrease of $0.2 million in the agriculture market primarily driven by weather conditions, where increased snowfall runoff and rain have slowed demand.

At least through the end of the year, I believe the factors listed above will remain strong. Gorman’s prospects become more murky beyond this period as it becomes difficult to predict GDP growth further into the future and because Gorman has a recent history of no organic growth. Due to this, I believe Gorman investors should consider trimming or selling their position if the stock reaches or gets close to my $45 price target by the end of the year.

Risks

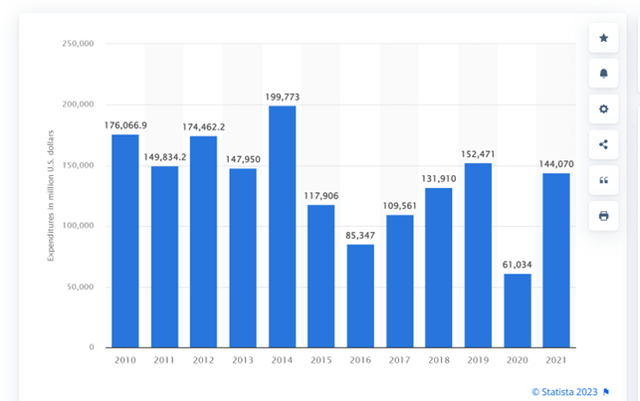

The main risk of an investment in Gorman is economic, as economic weakness has hurt its financial results and stock in the past. For example, sales dropped to $406 million 2015 from $436 million in 2014 primarily due to lower sales in the construction market due to a large decline in oil and gas drilling domestically and internationally. This decline in spending can be seen from the reduced oil and gas capex outlays in 2015 and 2016.

Oil and Gas Industry Capex (Statista)

Sales in the municipal end market also dropped in 2015 due to reduced demand for large volume pumps for wastewater and water supply projects, sales declined in the agriculture end market due to lower domestic farm income, and sales fell in the OEM market due to less demand for pumps with military applications.

This combined weakness in the variety of end markets led to not only reduced sales and earnings in 2015 compared to 2014, but also a sharp decline in Gorman’s backlog from $160 million at the end of 2014 to $117 million at the end of 2015 as reduced demand in many end markets meant the backlog was not replenished as products were delivered over the course of 2015.

All of this caused the stock to drop about 30% from its peak in 2014 to its trough in 2015. Gorman was still profitable and paid a dividend despite this weakness but investors should understand that economic conditions in industrial end markets play a large role in Gorman’s stock performance year to year. If the forecasts calling for increased economic strength throughout the remainder of the year are wrong, Gorman’s sales and backlog will decline, and the stock will decline with them.

Gorman’s current leverage could exasperate this potential weakness as interest expenses would consume the already reduced earnings. The company would also have less ability to pay down its debt which would make the debt a burden for a longer period of time. This makes it even more important for investors to consider economic conditions when making an investment in Gorman’s equity.

Final Thoughts

Gorman’s recent acquisition of Fill-Rite could juice returns for investors due to the leverage taken on in order to make the acquisition. I estimate that its equity will trade at $45 per share by the end of the year given current economic trends and how these trends will affect the end markets that Gorman sells its products in. This price target is based on my estimate of $112 million of EBITDA in 2023 and an EBITDA multiple of 14. This multiple is in line with the average of the past 10 years and I believe investors will be willing to pay this due to my belief that Gorman’s backlog will remain stable in 2023.

Read the full article here