Investment thesis

Our current investment thesis is:

- WWW has struggled to achieve consistent growth in the last decade, with its issues set to continue, lacking any material commercial improvement in our view.

- Two of its brands are performing well and have the potential to lift the group, but this remains uncertain.

- Margins have also deteriorated, with high competition making it difficult for WWW to win this back easily.

- These factors leave the business unattractive relative to its peers, likely trading at a premium to its fair value.

Company description

Wolverine World Wide, Inc. (NYSE:WWW) is a global designer, manufacturer, and marketer of quality footwear, apparel, and accessories. Headquartered in Michigan, USA, the company owns several well-known brands, including Merrell, Hush Puppies, Saucony, Sperry, and Wolverine, catering to various consumer segments.

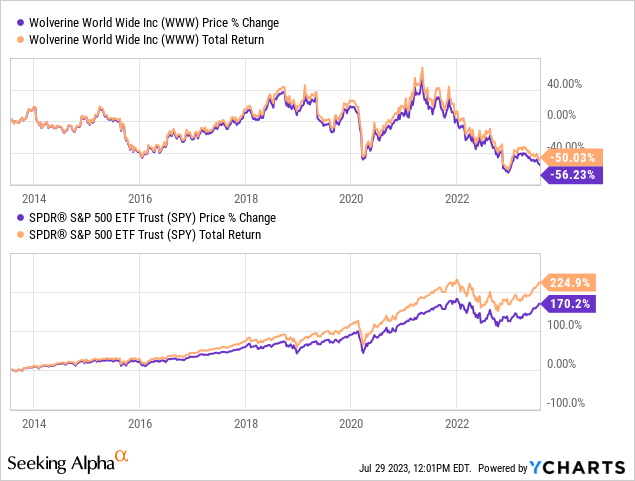

Share price

WWW’s share price has significantly declined in the last 18 months, losing 56% of its value. The wider market has struggled during this time but not remotely to the same degree. WWW has struggled with commercial improvement, leaving the business struggling.

Financial analysis

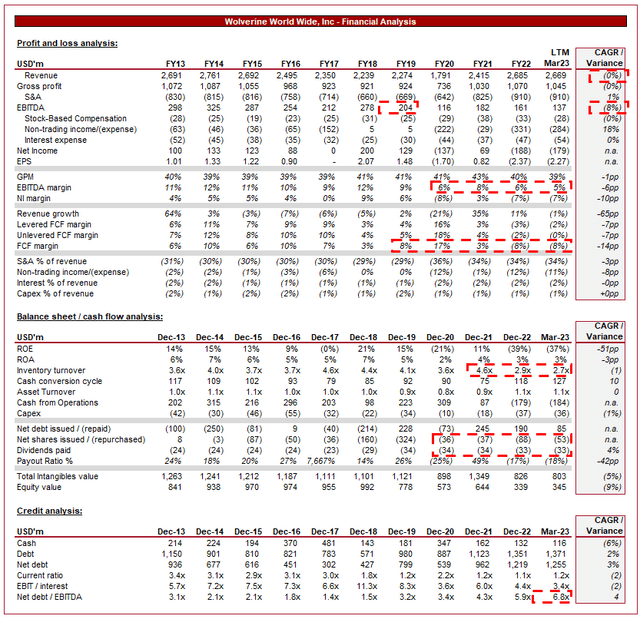

WWW Financials (Capital IQ)

Presented above is WWW’s financial performance for the last decade.

Revenue & Commercial Factors

WWW revenue has been flat over the historical period, with 5 fiscal years of negative and positive growth. The key issue here is consistency, with growth varying wildly YoY.

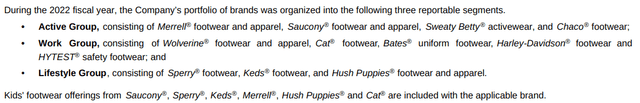

Business Model

WWW operates on a multi-brand, multi-channel business model. The company designs and develops innovative and comfortable footwear products across different lifestyle categories, targeting both consumers and professionals. WWW buckets these brands into 3 categories.

Brands (WWW)

The multi-brand approach is critical in our view for two key reasons. The fashion industry is large with varying segments and so multiple brands allow a business to reach a broader customer base. This is illustrated by the company’s three reporting segments. Secondly, the industry is notoriously incredibly competitive due to changing consumer tastes/trends. As a result of this, operating several brands allows for diversification benefits, de-risking the group if a single brand struggles.

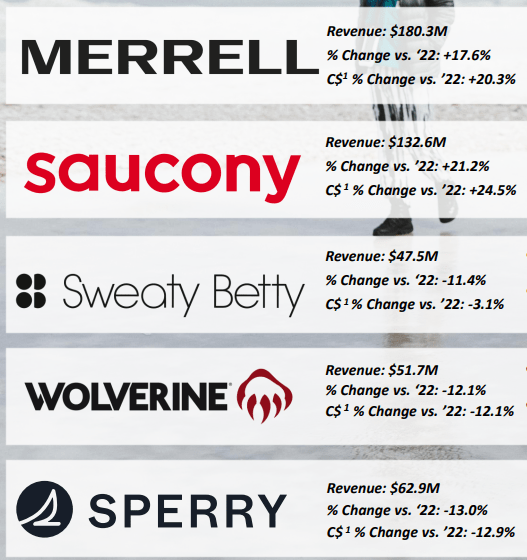

The benefit of this diversification is reflected in its Q1 results, with Merrell and Saucony offsetting the wider group. The strength in Merrell and Saucony was driven by industry tailwinds, with strong growth in the running and hiking segments. This is driven by increased awareness of the health and wellbeing benefits of exercising. We expect this trend to continue in the coming years. Compounding this is a genuinely good range of products, allowing for market share growth.

Brand growth (Wolverine World Wide)

WWW’s brands are known for their modern designs, diverse product ranges, and proprietary technologies that prioritize both comfort and performance. The Company ensures high-quality materials and craftsmanship in the production of its footwear, using both in-house facilities and third-party manufacturers. Our concern is that this does not feel sufficient in today’s market.

The industry has become significantly more competitive, primarily due to two main factors. Firstly, the rise of e-commerce has given consumers significantly more choices, and through a convenient channel, allowing for products and prices to be compared easily. Secondly, with supply chains increasingly centered in the far east, we have seen the rise of low-cost options for consumers, diluting WWW’s value proposition.

Our view is that there is value with WWW’s brand but most of them are in a position to achieve healthy sustainable growth when facing substantial pressure, which is currently the case. The value proposition for consumers is just not high enough. Most recently, the business incurred an impairment to GW charge of $428.7m, relating to the Sweaty Betty (acquired in FY21) and Sperry brands. WWW feels like a combination of mediocre brands.

Footwear Industry

WWW faces competition from other footwear companies and lifestyle brands. Key competitors include NIKE (NKE), adidas (OTCQX:ADDYY), Skechers (SKX), V.F. Corporation (VFC), Crocs (CROX), On Holding (ONON), Deckers Outdoor (DECK), and Under Armour (UA).

Increasing focus on the direct-to-consumer (DTC) channel is a key strategy for many in the industry. This allows businesses to reduce reliance on the wholesale channel, which can leave brands susceptible to changing inventory levels. Further, it improves sales economics by cutting out the retailer. 26% of its current sales are through the DTC channel, leaving substantial scope for improvement.

Athleisure wear is a growing segment where performance products, such as footwear, are designed to be versatile. There is growing demand for such products, as consumers blend the use of their apparel. Brands have seen increased growth when leaning into this trend, and we believe it is partially the reason for the strong growth achieved by Saucony and Merrell (in addition to the wider growth in athletics wear).

Growth can be supported through international expansion, allowing the business to utilize its brands to expand its target market. This has occurred where possible in the West, such as in the UK, but we see scope to push this further into emerging markets. WWW operates several affordable brands which will work well as a Western offering.

Economic & External Consideration

Current Economic Conditions are defined by high Inflation and elevated interest rates, creating uncertainty around the movement of both. We believe this is impacting the business in the following way:

- Consumer Spending. These two factors are placing significant pressure on the finances of consumers, leading to reduced discretionary spending. WWW is feeling this, with flat LTM revenue and growth and a Y/Y decline in Q1 (2.5%).

- Costs. Rising inflation has contributed to increased production and operational costs, causing an erosion of margins. GPM has declined 2% since FY21, with EBITDA-M down 3%.

WWW is due to announce earnings in the coming days. We are not overly confident currently, although believe there is scope for outperformance due to the strength shown by Saucony and Merrell. Based on consumer spending continuing to decline, the downward trajectory of the business QoQ, and Q1 turning negative, we currently forecast high HSD/LDD revenue growth. Analysts are currently guiding a substantial (18)% decline, likely due to wholesale demand in conjunction with the points mentioned.

Margins

WWW’s margins have declined over the historical period, predating the impact of the pandemic. This has been driven by a decline in its competitive position, as well as a change in product mix. WWW is struggling to cost-effectively acquire sales, and we do not believe this pressure will fall away in the near term.

Balance sheet & Cash Flows

WWW is quite heavily indebted, with an ND/EBITDA ratio of 7x. Much of this lease liability and when excluded, the business has a bank-defined leverage ratio of 3x. Two of its key debt facilities are variable (although the business pays a blended fixed rate at 5% via a swap), leaving the company in an uncomfortable position. This will mean cash flow is directed toward repayments in the coming years.

Inventory turnover remains materially below its pre-pandemic levels, with CCC increasing by over 30 days. This is acting as a material drag on cash flows, forcing the business to spend cash to operate the business. This further compounds what is a poor position.

Industry analysis

Footwear (Seeking Alpha)

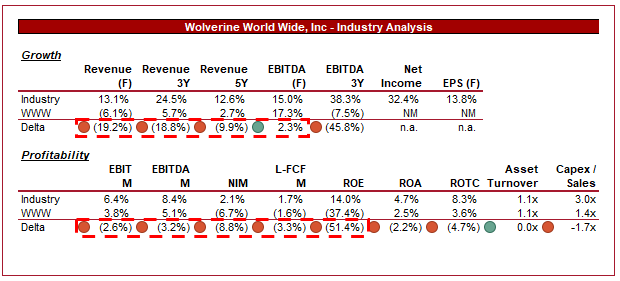

Presented above is a comparison of WWW’s growth and profitability to the average of its industry, as defined by Seeking Alpha (9 companies).

WWW performs extremely poorly when compared to its peers. The business is growing at a significantly reduced level while operating with lower margins. Our view is that the growth trajectory will not materially change, nor will its margins. This leaves the business inherently unattractive within this industry.

Valuation

Valuation (Capital IQ)

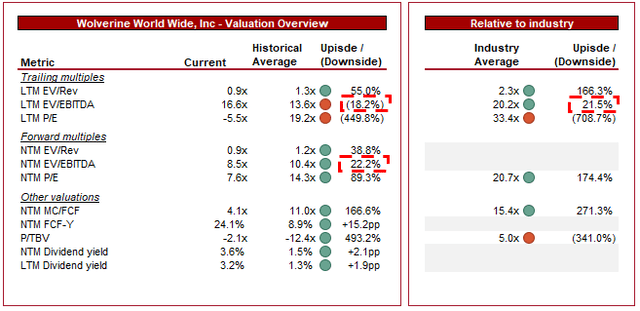

WWW is currently trading at 17x LTM EBITDA and 9x NTM EBITDA. This is a discount to its historical average on an NTM basis.

A discount to its historical average looks reasonable, as the business has seen a deterioration in its profitability, struggles with achieving consistent growth across brands, and slowing near-term growth. A discount to its peer group average is also justified, owing to its poor growth and profitability.

The size of the discounts implies further downside in our view, as the business has seen a large deterioration in performance. This said, the strong performance by Saucony and Merrell does mean there is potential here.

Final thoughts

WWW is a mediocre business. It owns several valuable brands, none of which are world-beaters. The business has faced issues with achieving consistent growth across this portfolio, and we expect the struggles to continue.

WWW’s financial performance has deteriorated to a level where it is completely unattractive relative to peers, with its valuation somewhat reflecting this. Although we are leaning toward a sell rating, the strength shown by two of its brands implies caution, as they could help improve the business given their size in the coming 12-24 months.

Read the full article here