REGENXBIO (NASDAQ:RGNX) is a prominent biotech specializing in the development, commercialization, and licensing of recombinant adeno-associated virus (rAAV) gene therapy. With a focus on advancing genetic medicines that address significant unmet medical needs, the company leverages its NAV Technology Platform to create gene therapy products that may provide life-altering benefits to patients suffering from a variety of genetic disorders.

Regenxbio has a significant advantage due to its wide range of internal and partnered programs. As they progress through clinical trials and demonstrate the efficacy and safety of their therapeutic solutions, the company’s potential for growth appears promising. That said, the inherent risks and uncertainties tied to the clinical development process and the regulatory landscape necessitate a cautious approach to evaluating the company’s prospects.

Financials

Regenxbio’s cash position, including cash, cash equivalents, and marketable securities, stood at $415.4 million as of June 30, 2023. This represents a notable decrease from $565.2 million at the end of the previous year. The main reason for this decline stems from funding ongoing operating activities during the first half of the year.

The company projects that its current cash balance will sustain its operations into 2025, excluding any milestone payments from its collaboration with AbbVie on ABBV-RGX-314. This projection appears to be a healthy indicator for short- to medium-term sustainability.

The cash burn rate, calculated from the decrease of $149.8 million over six months, translates to around $24.96 million per month. Given the current total loss rates, their cash would last approximately 16 to 17 months. This figure aligns with the guidance provided, considering other potential inflows.

Revenues have experienced a dip, settling at $20.0 million for Q2 2023 compared to $32.6 million during the same period last year. This decrease is chiefly linked to Zolgensma royalty revenues, which dropped from $28.4 million to $19.0 million in the second quarter.

R&D expenses slightly decreased to $59.9 million for Q2 2023, largely due to cost reimbursements for ABBV-RGX-314 under the eye care collaboration with AbbVie. However, this was partially offset by an increase in clinical trial expenses for other lead product candidates.

G&A expenses saw a rise to $23.7 million, mainly attributable to professional services and overhead costs. The combination of lower revenue and increased G&A expenses resulted in a net loss of $72.1 million for Q2 2023, compared to $68.2 million during the same period in 2022.

While there are challenges, such as the decline in Zolgensma royalty revenues and a slight increase in G&A expenses, the strategic collaborations and robust pipeline may offer avenues to offset these decreases in the medium to long term. The picture presented requires a careful balancing act and wise allocation of resources, aligned with the company’s long-term vision and the industry’s evolving landscape.

Pipeline

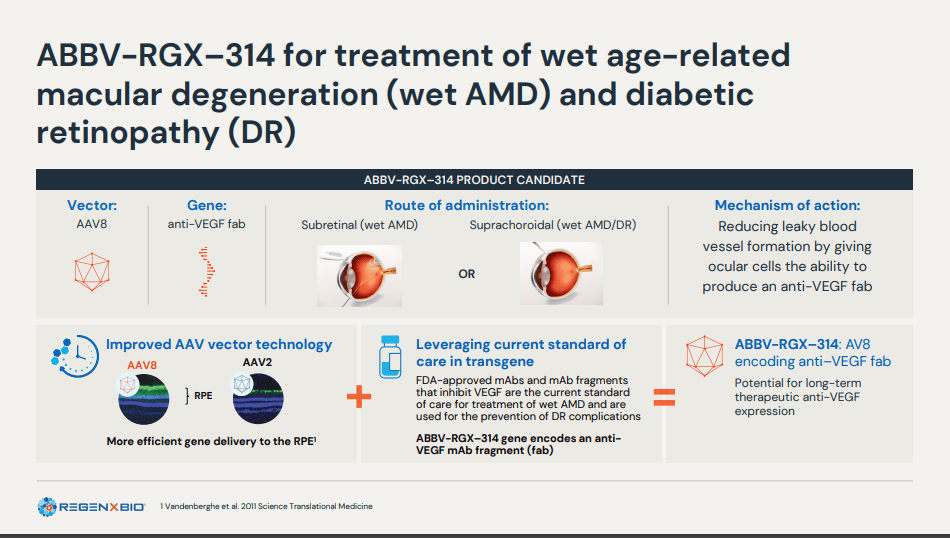

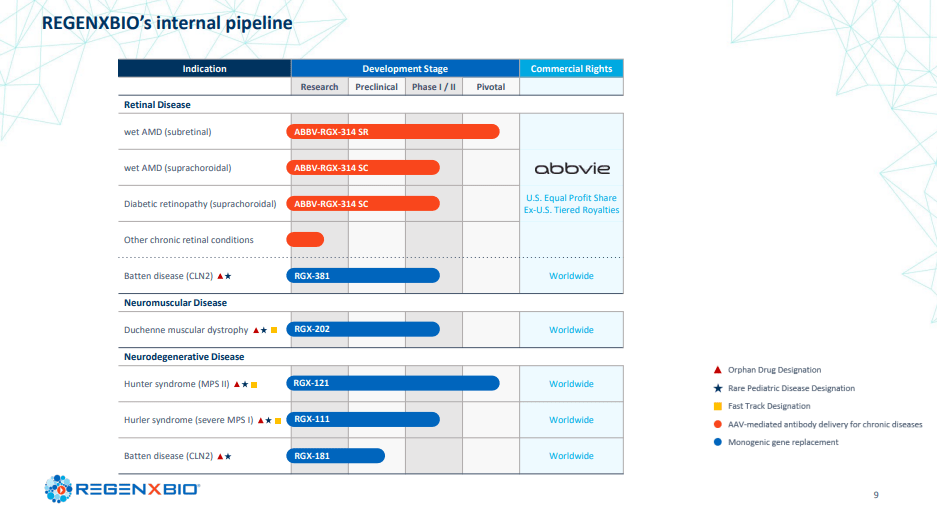

ABBV-RGX-314 is being developed as a one-time gene therapy for the treatment of chronic retinal diseases like wet age-related macular degeneration (wet AMD) and diabetic retinopathy (DR). The therapy uses an AAV8 vector to deliver a gene encoding a monoclonal antibody fragment that binds and inhibits vascular endothelial growth factor (VEGF), reducing abnormal blood vessel growth and leakage in the retina. The treatment can be administered either through subretinal injection or suprachoroidal injection. It shows great potential in preventing vision loss and enhancing visual acuity in affected patients. However, one concern is that the subretinal injection requires surgical intervention, which might limit its appeal in its current form.

ir.regenxbio.com

Turning to muscle diseases, RGX-202 is specifically designed to target Duchenne muscular dystrophy (DMD), a rare and progressive genetic disorder causing muscle weakness and degeneration. Using an AAV9 vector, RGX-202 aims to deliver a gene encoding a modified version of dystrophin, a protein that is crucial for muscle function and stability. While the therapy shows promise in improving muscle strength and function, the process of developing and proving the efficacy of modified dystrophin carries inherent risks, particularly given the severity and progressive nature of DMD.

RGX-121 is being advanced as a one-time gene therapy for the treatment of mucopolysaccharidosis type II (MPS II), a rare and life-threatening genetic disorder that affects multiple organs and systems. Using an AAV9 vector, RGX-121 provides a functional copy of the iduronate-2-sulfatase (I2S) gene, which is responsible for breaking down complex sugars that accumulate in tissues and organs in MPS II patients, causing damage and dysfunction. However, the intracerebroventricular (ICV) injection method employed to bypass the blood-brain barrier and deliver RGX-121 directly to the central nervous system might pose technical challenges and risks that could potentially limit its broad adoption.

ir.regenxbio.com

Regenxbio’s Investor Day: RGX-314 Updates

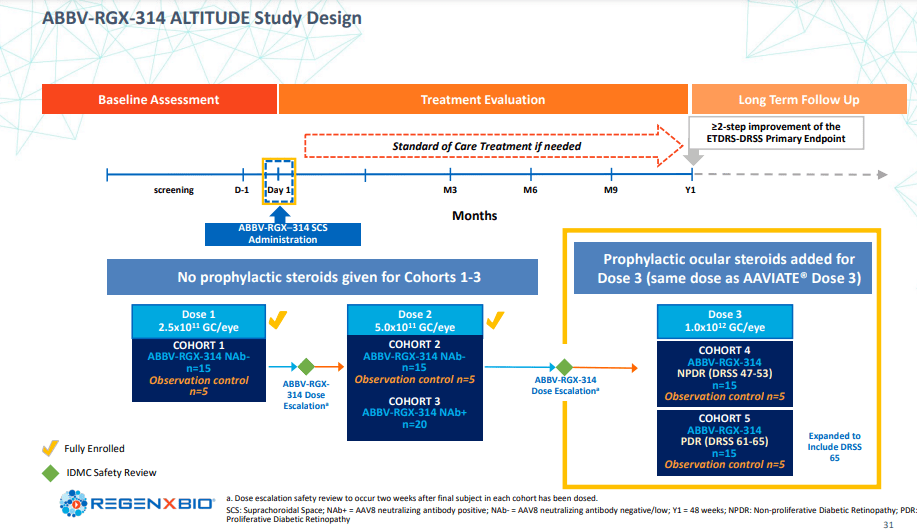

Regenxbio’s latest Investor Day brought to the table a handful of noteworthy updates. A significant highlight is related to ABBV-RGX-314, the promising one-time AAV therapy developed in partnership with AbbVie, for the treatment of wet AMD, DR, and other chronic retinal conditions. Interim data from the Phase II AAVIATE & ALTITUDE trials revealed that patients who received dose level 3 of ABBV-RGX-314 had zero cases of intraocular inflammation., which underlines a promising safety profile and potential for future efficacy.

For wet AMD, all patients in Cohort 6 of the AAVIATE trial reported no drug-related serious adverse events, further reinforcing the therapy’s tolerability. Additionally, a significant reduction in the occurrence of mild to moderate intraocular inflammation was observed following a short-course of ocular steroid prophylaxis. Full 6-month results from these cohorts are eagerly awaited and are expected to be reported at the Hawaiian Eye and Retina meeting in January 2024.

Similarly, In the Phase II ALTITUDE trial, ABBV-RGX-314 showcased a remarkable clean safety profile when used to treat DR, as there were no reported cases of intraocular inflammation. These interim results amplify the potential of this innovative gene therapy for retinal conditions, with additional data expected at the American Academy of Ophthalmology meeting in November 2023.

ir.regenxbio.com

Moving to the Duchenne Program, the interim safety data from the Phase I/II AFFINITY DUCHENNE trial involving RGX-202 reports a well-tolerated profile in dosed patients, paving the way for continued patient recruitment and clinical progress. This therapy, harnessing the NAV AAV8 vector to deliver a novel microdystrophin, could potentially offer an innovative solution for the debilitating muscular dystrophy. Further interim data from this trial are to be shared at the World Muscle Society Congress in October 2023.

An exciting update is the announcement of a new exon-skipping program for Duchenne. Preclinical studies with the hDMDdel52/mdx mouse model demonstrated remarkable exon 53 skipping efficiency, restoring high levels of near full-length dystrophin. This shows potential to address a significant subset of Duchenne patients whose DMD gene mutations are amenable to exon skipping. With IND application-enabling studies in the pipeline, this new candidate could provide a novel therapeutic avenue for Duchenne patients by 2025.

Risks in The Gene Therapy Programs

Starting with the retinal program, ABBV-RGX-314, while the initial data is promising, the therapy’s long-term safety and efficacy remain under investigation. The NAV AAV8 vector used to deliver the gene encoding for the therapeutic antibody fragment inhibiting VEGF could face issues of neutralizing antibodies, which may affect the therapy’s effectiveness.

Furthermore, a key concern could be the potential for adverse ocular events. The inflammation noted in early cohorts of the AAVIATE trial underlines this risk. Although a short course of prophylactic steroids was able to minimize the inflammation in later cohorts, whether this strategy would consistently work in the larger patient population is yet to be determined.

Moving on to the Duchenne program, RGX-202 , a crucial risk here is whether this microdystrophin can effectively mimic the function of the full-length dystrophin in patients. The full-length dystrophin plays a crucial role in maintaining muscle cell integrity, and if the microdystrophin fails to replicate its function adequately, the therapy may not deliver the anticipated clinical benefits

The recently announced exon-skipping program targeting DMD also has its share of potential risks. While preclinical models showed high exon 53 skipping efficiency and restoration of near full-length dystrophin, it’s not guaranteed this will translate effectively in human subjects. Moreover, as exon-skipping therapies work by modifying the RNA transcription process, unexpected off-target effects or complications could emerge.

In all these programs, another overarching risk is the possibility of patients developing an immune response against the AAV vectors used for gene delivery, which could limit the effectiveness of the therapy or even potentially lead to safety issues.

Competitors

For the treatment of chronic retinal diseases such as wet-AMD and DR, one of the major competitors for Regenxbio’s ABBV-RGX-314 is Novartis’s Beovu (brolucizumab) (NVS). Beovu is an anti-VEGF injection that is FDA-approved for the treatment of wet AMD. While it has shown promising results in terms of improving vision and reducing retinal fluid, it requires repeated injections and is not a one-time therapy like ABBV-RGX-314. Moreover, Beovu has been associated with rare but severe inflammatory events, raising potential safety concerns.

In terms of gene therapies for the treatment of wet AMD, Adverum Biotechnologies (ADVM) is developing Ixo-vec, a one-time intravitreal injection. However, unlike ABBV-RGX-314, ADVM-022 has shown intraocular inflammation in clinical trials, an adverse effect that Regenxbio seems to have mitigated with its use of short-course prophylactic steroids.

In the DMD space, Sarepta Therapeutics (SRPT) has a prominent presence with its exon-skipping drugs Exondys 51 and Vyondys 53, both approved by the FDA. However, these therapies only cater to a subset of DMD patients, those with a mutation amenable to exon 51 or 53 skipping. Also, these are not curative treatments but aim to slow disease progression.

Pfizer (PFE) is developing PF-06939926, a gene therapy for DMD that, similar to RGX-202, delivers a shortened version of the dystrophin gene. While the therapy has shown promise in early-stage clinical trials, its delivery method, which involves intravenous infusion, has been associated with side effects such as nausea and vomiting. Furthermore, its efficacy has been somewhat variable, indicating potential challenges in its path to market approval.

Valuation and Outlook

Examining the price-to-cash-flow ratio of 7.45 for Regenxbio, a figure notably superior to the sector’s average of 16.36, we find the first indication that the market is yet to fully appreciate the company’s financial position. By assessing the underlying growth dynamics, including a favorable market position and well-calibrated financial management, it’s clear that this disparity in the P/CF ratio offers a more attractive entry point than the industry standard. The seemingly modest valuation, far from being a sign of a problem, reflects a prudent market approach that doesn’t overstate future expectations.

While some investors may perceive this valuation as a sign of underperformance or impending struggle, a closer inspection of Regenxbio’s strategic initiatives in context with its current market cap of $778 million offers a more nuanced view. The company’s valuation doesn’t merely reflect current performance but also includes a measured appreciation of long-term growth potential. It is this combination of present stability and future prospects that provides a balanced investment opportunity, avoiding excessive speculation while recognizing real growth potential.

Read the full article here