Dear fellow investors and friends,

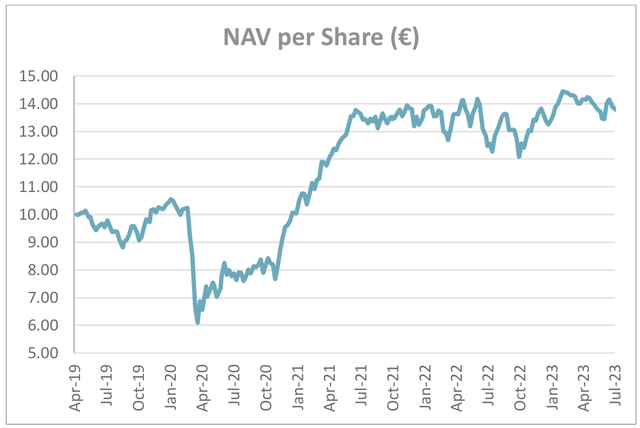

During the second quarter the fund lost 2.6% gross of fees[1]. We do not have a stated benchmark in our Key Investor Information Document (KIID) and therefore cannot comment on relative performance. We leave it up to you to decide. We note the above number appears below European and global benchmarks. Inception to quarter end return was 42.9% or 8.7% compounded annual return. Our last reported NAV at quarter ends 13.84 (30/06/2023), -2.3% from the closest reported NAV at the first quarter end of 14.16 (30/03/2023). We are extremely optimistic about our portfolio’s prospects and believe we will reach our compound return aspiration over time. Our fund’s composition is unlike any index, and we are unlikely to perform in a similar manner.

The second quarter of 2023 was not a particularly pleasant quarter. The market seemingly forgot the lessons of 2022 and dived into speculative stocks that claimed anything to do with artificial intelligence. It is amazing how investors seem to haphazardly jump from one speculative story to another. The worst part of this particular craze for us was the endless questions on conference calls and meetings where analysts seemed to be obliged to ask about every single company’s AI strategy, no matter the industry, and the CEO had to tell everyone that the company has been working on it for years and is ahead of the pack. Sure.

It is not obvious to us that there is significant money to be made investing in AI. It seems to us that AI will develop more slowly and over a much longer time horizon than those punting believe, and traditional competitive dynamics make it more than likely that most benefits will be copied and competed away, rather than accruing to medium term topline growth and margins. Identifying mispriced shares of the ultimate beneficiaries today seems a very tall task. Instead, we will stick with what we do best: looking for investments away from the pack, while keeping a keen eye on potential real disruption in our industries.

Needless to say, we owned no large cap tech and did not participate in their recent rally. We are okay with this. While a couple of these equities appeared to become reasonably valued for a brief period at the end of last year, the market quickly forgot the reasons they sold off in the first place and jumped on the next bandwagon.

May felt like a particularly bleak month for us. It appeared for a couple of weeks that absolutely nothing could go right. Some of the companies we own reported great earnings and decent outlooks, only to fall dramatically. Those that reported anything less than stellar got smashed. No one wanted to own small caps, European equities and anything that disappointed even a little bit. We had a couple bits of genuinely bad news too, which we note below. Overall, it was a gloomy month.

Around the end of May, things began to change, and June reminded us that good things happen to companies with low valuations that produce a lot of cash. Positive events occurred in several of our companies, including an announced strategic initiative in our largest position IGT, a partial tender offer in RHI Magnesita (OTC:RMGNF), and a takeover bid by the parent of Treasure ASA (OTC:TRSUF). While the portfolio didn’t perform particularly well during the quarter, under the hood these and several other very interesting developments took place which we think will help drive future returns.

US markets are again dearly valued. Inflation and interest rates outlooks are as always unknowns as is the future direction of the economy. The China recovery seems to be disappointing. We note several major profit warnings in the chemical industry. We don’t know the future but we are quite happy owning our portfolio of deeply discounted securities and are quite optimistic that this value will be realized in time.

As a reminder, we are shareholders of Treasure ASA, a listed holding company in Norway whose only asset is a 11% stake in Korean listed company Hyundai Glovis (086280 KS), which we mentioned in our fourth quarter 2020 letter. We like the company due to the double discount as we believe Glovis is around 80-100% undervalued. On the 7th of June 2023, parent company, Wallenius Wilhelmsen Holding (78% owner) made an offer for the minority at NOK20 per share at a rather miserly 10% premium to the previous day and a 30% discount to the prevailing price of the Glovis shares. We wrote a letter to the independent board members stating the obvious: we have undisputable valuation reference in the listed shares (which we believe to be undervalued). They came back with muted response but at least had hired local broker Pareto to perform an independent analysis. This report agreed that the offer was insufficient. Subsequently, Glovis shares have appreciated by 17.6% further increasing the discount. We believe a fair price would be a small discount to the prevailing Glovis share so that holders could reinvest on the same economic terms or receive pro-rata shares of Glovis. We believe that other shareholders share the same view hence we are willing to wait for a better offer. At quarter end, the discount was 37.4% leaving us with roughly 60% upside to the prevailing Glovis price and over 200% to our estimated fair value.

We saw several opportunities in special situations during the quarter and added three of them, which we believe will help drive fund returns in the coming quarters. We also added a significant position in the recent IPO of Lottomatica SpA which we outline later in this letter.

We exited three positions including our long-held stake in MTU Aero Engines (OTCPK:MTUAF). We purchased the shares during the COVID drawdown at an extremely attractive price. While we believe it is a long-term compounder and still has some modest upside, we decided to move the capital to more compelling opportunities. We sold our investment in iHeartmedia (IHRT) after a grueling holding period. The company’s leverage gave us significant upside yet also a high-risk profile. We positioned it accordingly, but it remained a volatile position. The company’s growing podcast business and operating leverage would have given us the cash flows necessary to delever to produce substantial returns. However, the company suffered a couple of self-inflicted wounds including changing their selling strategy in the midst of a downturn in advertising and not hedging their floating rate debt. This absorbed their cash flows and now with a limited runway to pay off debt before maturities in 2026 and 2027 we think the risk of permanent impairment is too high. We decided to take the loss and reinvest the proceeds in more compelling opportunities with lower risk. The third sale was a tiny position that arose from a spin-off, which appreciated rapidly whilst we were expecting a decline in which we could have added to the position.

At quarter-end our portfolio had more than 113% upside to our estimated NAV and was trading at a weighted average P/E of 7.5x, FCF/EV yield of 19% and a return on tangible capital of 33%.

|

Contributors |

Detractors |

||

|

International Game Technologies |

106 bps |

Esprinet |

-125 bps |

|

RHI Magnesita |

76 bps |

Undisclosed |

-70 bps |

|

Undisclosed |

51 bps |

LNA Sante |

-57 bps |

|

C. Uyemura |

47 bps |

OCI |

-53 bps |

|

Var Energi |

30 bps |

Melco International |

-48 bps |

The top contributor during the quarter was International Game Technology (+19% +106 bps), the Italian-American lottery and gaming machine technology provider, introduced in our first quarter 2020 letter. In May the company reported first quarter results slightly above expectations and reiterated full year guidance. Nevertheless, the stock fell and remained weak for the remainder of the month. In June the board announced that it was exploring alternatives for the Global Gaming and PlayDigital businesses, including a possible sale, merger or spin-off of the units. The stock then rallied on hopes the sum of the parts might be unlocked. The most relevant transaction for a lottery business was when Brookfield purchased Scientific Games’ smaller lottery business during the third quarter of 2021 paying around 13x trailing EV/EBITDA. We also note that French lottery La Française des Jeux (FDJ FP) trades at around 10x forward EV/EBITDA. Gaming peers such as Light and Wonder and Aristocrat trade at 9x and 12x EV/EBITDA respectively. IGT before the announcement was trading at 7x EV/EBITDA. We believe that breaking the business into two parts would unlock significant value. We still see significant upside on a cashflow basis and even more in a breakup scenario despite the recent rally.

The second largest contributor was RHI Magnesita (+28.5% +76 bps), the AustrianBrazilian refractories company, introduced in our second quarter 2019 letter. In early May the company gave a brief trading update that whilst volumes were falling earnings were improving due to lower cost inflation and price increases. The stock traded poorly afterwards. In very late May, Ignite Luxembourg Holdings, an entity indirectly managed by the private equity fund Rhône Capital, made a tender offer for 20% of RHI shares at a 39% premium to the previous days close and included the €1 dividend due to be paid. Rhône subsequently raised the amount they would buy to 29.9% of the shares. Given that insiders control more than 40% of the shares, and assuming they do not sell, the bid is for roughly half of the free float shares. We do not know exactly why a Private Equity firm would want a 30% stake when there is a controlling shareholder, though they would have an equally sized holding if the tender goes through. However, it does clearly indicate how undervalued RHI is. If Rhone thinks that offering a 39% premium for the shares makes sense, they must clearly see significantly more upside from there. We agree.

The third significant contributor was an undisclosed Greek food producer (+25.6% +51 bps). The company suffered last year from raw material, energy and transport cost inflation. We believe these headwinds are set to reverse this year, while the strong shift of consumers to private label is expected to further support the recovery. The company has been growing steadily with a five-year CAGR of 17%, as they expanded their geographic footprint and gained market share. The management plans to further increase production capacity to meet the growing demand.

The fourth largest contributor was C Uyemura (OTCPK:CUYRF, +16% +47 bps), the Japanese chemicals supplier to the printed circuit board industry, which we introduced in our second quarter 2021 letter. In May the company reported full year numbers which were better than guidance and updated their three-year business plan including a weaker 2023/24 fiscal year. The shares moved higher in June, which we can possibly ascribe to the anticipation of a pickup in demand, a weaker yen, potential subsidies to the semiconductor industry and/or a general gain in the Japanese market. In fact, the company gained +26.6% in yen terms as yen depreciated 8.3% versus the Euro during the quarter.

The fifth contributor was Var Energi (+16.3% +30 bps), the Norwegian Oil and Gas operator. VAR continued to generate cash supported by improved production efficiency, stable oil and gas volumes and high realized prices. VAR obtained an average realized price of $116 per boe in the quarter mainly through fixed price contacts, covering the next three quarters, and flexible gas sales agreements.During the quarter, management announced the acquisition of all the operations of Neptune Energy Norge in Norway for a cash consideration of $2.3 billion, while ENI will acquire all remaining operations for $2.6 billion, excluding Germany. Ownership 0f 12 producing assets, three of which are operated by Neptune Norway and seven by Equinor, adds 67 kboepd of daily production and 265mmboe of 2P reserves to VARs portfolio and this coupled with several near- and mid-term growth opportunities makes it attractive. Combined figures show a production of 281 kboepd oil in the first quarter of 2023 and reserves of 1.3 billion boe. VAR is on track to deliver a 50% production increase by 2025. VAR distributed USD 270 million dividend in the quarter and expects to distribute approximately 30% of aftertax cash from operations by year-end.

The top detractor was Esprinet (-35.6% -125 bps), the Italian electronics distributor, introduced in our fourth quarter 2019 letter. Esprinet reported a first quarter in line with expectations, although displaying weaker year over year performance, due primarily to a weakness in PCs, mobiles and TVs as consumer demand fell and a subsidy ended. Full year guidance came in a bit below our expectations, but the potential remains for year-over-year growth if the second half improves somewhat. However, the real pain came from an unexpected tax dispute settlement. Whilst we knew there was some small amount of tax litigation taking place, as with most Italian companies, we were caught rather unprepared for the size of the potential penalties. From our understanding, in 2013-2017 the company sold ~<1% of revenues to customers without VAT as these customers were declared re-exporters. The tax authorities, in retrospect, decided these customers could not be classified as re-exporters and so VAT should have been collected. Esprinet claims to have done everything they should have according to the law but the government disagrees and has filed suit. Although Esprinet management believes they should win the case, the tax authorities have demanded an upfront payment of all potential liabilities and penalties pending the court’s decision. Given the judicial process in Italy this could be anywhere from 5-10 years. The total payment would be €220 million, which given Eprinet’s size is a very large amount to be tied up for that time frame, especially given current interest rates. Instead, the company decided to settle the case for about 14% of the total and be allowed to pay it over five years. As this is about 10% of the market capitalization of the company, the shares were hard hit, though the discounted cash flow over that period is much less. We are flabbergasted that Italian tax authorities are allowed to bully a company into such a settlement, which seems reminiscent of a protection racket rather than a fair fiscal regime in a developed country.

The second largest detractor was an undisclosed microcap which fell as they revised their previous estimates for the prior year and delayed their filings. The company is going through growth pains and apparently does not have the accounting controls that a publicly listed company requires. The error was a simple bookkeeping mistake. That it took the auditors to identify it shows a weakness of their financial department and CFO. The entrepreneur is well aware of this and is taking corrective actions, but it does dent his credibility. We are willing to give him the benefit of the doubt for now but will keep a sharp eye on his pick for new CFO and other key positions that require changing. We still believe the risk/reward is very attractive.

The third largest detractor was LNA Sante (-13.8% -57 bps), the French nursing home and healthcare facilities operator, which we introduced in our fourth quarter 2022 letter. Revenues from nursing homes in France, other healthcare activities and the international business segment all increased, posting a combined organic growth of

6.9%. The occupancy rate has fully recovered to pre-pandemic levels and currently stands at 97%, excluding home hospitalization, significantly higher than the two closest peers. Management expects growth to accelerate in the coming quarters and tariff renegotiations to gradually alleviate margin pressure. Management reiterated an organic growth target of 6% and sales target of €725 million for 2023. We continue to believe that LNA faces short-term rather than structural challenges, hence offers significant upside potential.

The fourth largest detractor was OCI (OTC:OCINF, -20.4% -53 bps), the Dutch nitrogen fertilizer and methanol producer, introduced in our second quarter 2019 letter and further updated in our fourth quarter 2021 letter. After a stellar 2022, the market for ammonia and urea softened sharply in the first and second quarter of 2023, as gas prices fell quickly, also causing hedging losses and lowering the cost curve. Lower input costs have also driven some capacity back into to the market, with a subsequent impact on margin outlook. We had lowered our exposure substantially but were caught off-guard by the rapid volume weakness in the agricultural market despite most fundamentals remaining quite strong. We remain structurally positive on ammonia, urea, DEF and methanol markets and believe OCI’s assets to be undervalued.

The fifth significant detractor was Melco International (OTCPK:MDEVF, -20.6% -48 bps), the holding company of a Macau casino operator. Melco continued to see improving momentum into April and Golden Week in May, with mass market table games drop and mass gross gaming revenue during the Golden Week period exceeding the same period in 2019. First quarter 2023 recovery was 70% versus 2019 but management expects to fully recover by June 2023. Overall visits in Macau are down versus pre-Covid levels but improving on a week-by-week basis with premium mass visitations already above preCovid levels. Deleveraging remains the top priority for management. The leverage and the weaker than expected Chinese recovery are probably behind the recent share price performance. However, Macau GGR recovery paves the way for strong fundamentals going froward.

Lottomatica SpA (LTMC IM)

Lottomatica was formed through the merger of Gamenet, a player in the Italian gaming machines market, and IGT’s Italian B2C operation, which completed in 2021. We happen to know both businesses very well as we held Gamenet (see our Q2 2019 Investor letter) until it was taken private and continue to hold IGT (see our Q1 2020 Investor letter) today. The company recently went public during a challenging time, which presented an opportunity to acquire a stake at an attractive price. Lottomatica’s recession resistant model coupled with a strong market share in a consolidated growth market in an advanced regulatory regime combined with a low valuation creates significant potential upside with an attractive risk profile.

Lottomatica is a leading Italian gaming company that offers a variety of online games, such as casino, poker, bingo, and sports betting. Additionally, the company operates a franchised retail distribution network for sports betting and gaming. Online represents 46% of the group’s EBITDA in 2022 and includes iSports, iGaming and other online products. Sports Franchise represents 20% of EBITDA, with the segment covering products such as sports, virtual and horse racing betting. Gaming Franchise represents 34% of EBITDA and involves the direct management of gaming halls and concessionary activities for VLTs [2] and AWPs[3]

The Italian gaming market is the largest in Europe with over €20 billion in gross gaming revenues with Lottomatica being the leading operator. The market is expected to grow at 6-7% over the next four to five years mainly powered by the double-digit growth in online and iGaming verticals while offline is expected to grow at low-single-digits. Whilst the online penetration in Italy grew from 14% in 2019 to 28% in 2022, it remains well behind other developed markets such as the UK, France and the Nordics at 65%, 47% and 85% respectively. The company is leading the online gaming market in Italy hence is expected to be a beneficiary of this transition.

Lottomatica’s risks include single country risk for macro and regulation, and uncertainty around the concession renewal framework. However, we feel we are compensated for these risk as the stock trades at a free cash flow yield of above 10% on 2023 and >14% on 2025 numbers with a strong tailwind from market transition to online gaming, defensive characteristics and leverage below 2.0x, with think the market will slowly recognize the value of the business once regulatory uncertainties fade away.

We end with a quote from our Gamenet write up in our Q2 2019 letter.

Whilst many value investors would not invest in a recent IPO, especially one owned by private equity (the asymmetric information fear), we find they sometimes present interesting opportunities. PE makes most of its return from levering up quality businesses with strong cash flows. We, too, like to own businesses with strong cash flows – we just prefer lower debt and well-invested assets. Since PE funds have a limited lifetime, it is often possible to buy toward the end of a fund’s life cycle – when the fund can be thought of as something of a forced seller. This can lead to interesting valuations for potential buyers. PE can rarely sell its entire stake in the IPO and thus has an interest in the share price not collapsing soon after it. The IPO proceeds are often used to pay down debt and as the financials under PE ownership often look unappealing, few quant funds or other statistical investors tend to be interested. The management teams often have sizable stakes, which we like and gives us some comfort they will invest properly in the business. PE also has reputational risks and may not want to taint their next deal. We feel these can be interesting special situations.

As stated in our previous letter, we are currently not charging a management fee until the fund reaches a larger size. The founder’s class management fee will then be only 1% of assets. We do not charge entry or exit commissions despite our KIID saying it is theoretically possible.

Our focus is and remains on the portfolio, but we do need to grow our assets to a sustainable level. Please feel free to share this letter with any potential investors.

We now have a commercial agreement with Cobas Asset Management to distribute our fund in Spain. You can now open an account and place orders with them. For more information, please contact them via phone or email. In the future, we hope it will be possible via their website. You can reach the Cobas team at +34 91 755 68 00 or [email protected]

Our fund can be invested through both European international central securities depositories: Euroclear and its FundSettle clearing platform and Clearstream through the Vestima fund clearing platform. Our fund is registered for distribution in the UK, Spain and Luxembourg including for retail distribution.

Currently the following financial institutions in Spain are distributors: Renta 4 (you may need to contact them – it is not offered on the website yet), Ironia, Lombard Odier, Banco Alcala as well as many other institutions working through the main platforms in which the fund is available upon request: Allfunds Bank and Inversis.

In the UK we are offered on the AJ Bell low-cost platform ajbell.co.uk and can be part of an ISA or pension.

Our fund is also available on SwissQuote swissquote.com where almost any nationality (ex-USA) can open an account without local Swiss taxes being an issue.

If you have any issues finding our fund or you wish to get more information about us and our process, please contact us at [email protected]

Our fund is being offered as part of a Spanish pension value-orientated fund of funds. If interested in investing in a Spanish pension scheme, please contact us.

We thank you for your ongoing support. We continue to believe this is a great time to be a value investor and are very excited about the medium-term prospects for the current portfolio.

Yours faithfully,

Palm Harbour Capital

Footnotes[1] Our NAV is calculated weekly by FundPartner Solutions, a subsidiary of Pictet & Cie and does not align with monthly or quarterly reporting. The gross return stated is net of taxes and fees but before fund expenses, which are currently running at approximately 15 bps per quarter at current AUM. We project this to decline significantly as AUM grows. Please see our comment on management fees. [2] VLT: Video Lottery Terminals [3] AWPs: Amusement with Prizes This information is being communicated by Palm Harbour Capital LLP which is authorised and regulated by the Financial Conduct Authority. This material is for information only and does not constitute an offer or recommendation to buy or sell any investment or subscribe to any investment management or advisory service. In relation to the United Kingdom, this information is only directed at, and may only be distributed to, persons who are “investment professionals” (being persons having professional experience in matters relating to investments) defined under Articles 19 & 49 of Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 & Articles 14 & 22 of the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemption) Order 2001 and/or such other persons as are permitted to receive this document under The Financial Services and Markets Act 2000. Any investment, and investment activity or controlled activity, to which this information relates is available only to such persons and will be engaged in only with such persons. Persons that do not have professional experience should not rely or act upon this information unless they are persons to whom any of paragraphs (2)(a) to (d) of article 49 apply to whom distribution of this information may otherwise lawfully be made. With investment, your capital is at risk and the value of an investment and the income from it can go up as well as down, it may be affected by exchange rate variations and you may not get back the amount invested. Past performance is not necessarily a guide to future performance and where past performance is quoted gross then investment management charges as well as transaction charges should be taken into consideration, as these will affect your returns. Any tax allowances or thresholds mentioned are based on personal circumstances and current legislation, which is subject to change. We do not represent that this information, including any third-party information, is accurate or complete and it should not be relied upon as such. Opinions expressed herein reflect the opinion of Palm Harbour Capital LLP and are subject to change without notice. No part of this document may be reproduced in any manner without the written permission of Palm Harbour Capital LLP; however recipients may pass on this document but only to others falling within this category. This information should be read in conjunction with the relevant fund documentation which may include the fund’s prospectus, simplified prospectus or supplement documentation and if you are unsure if any of the products and portfolios featured are the right choice for you, please seek independent financial advice provided by regulated third parties. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here