Receive free Purdue Pharma LP updates

We’ll send you a myFT Daily Digest email rounding up the latest Purdue Pharma LP news every morning.

The Supreme Court has put on hold Purdue Pharma’s $6bn bankruptcy settlement that would shield members of the Sackler family who own the company from future lawsuits linked to the US opioid crisis.

On Thursday the court granted a request to stay a decision from the US Court of Appeals for the Second Circuit in May, that found the settlement could protect parties not in bankruptcy from future liability in certain situations.

The Supreme Court said it would now consider the question of whether the bankruptcy code authorises such a move, known as “third-party releases”. It will hear oral arguments in December.

The decision represents a blow to members of the Sackler family who had sought to turn a page on their legal woes and agree a financial settlement that protects them against future opioid claims.

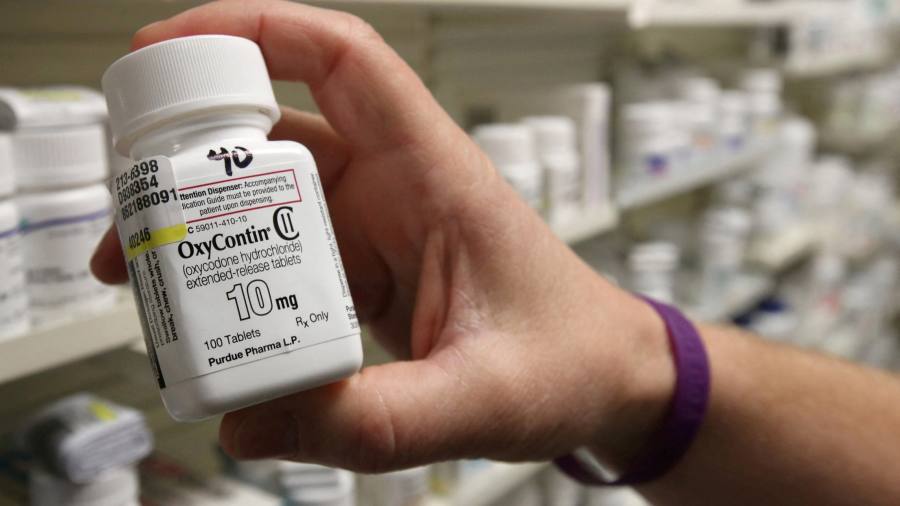

Purdue Pharma, which made the powerful painkiller OxyContin, filed for Chapter 11 bankruptcy in New York in 2019 amid a wave of litigation over its role in the opioid crisis that has killed almost 1mn people in the US. However, members of the Sackler family who own the company never filed for bankruptcy.

Third-party releases have become controversial in US bankruptcy cases, and federal appeals courts have split on whether bankruptcy law allows them.

The Department of Justice had asked the Supreme Court to delay Purdue’s multibillion-dollar settlement, arguing that it abuses legal protections that are meant for debtors in “financial distress”, rather than rich people who are not in bankruptcy.

Last week Purdue asked the Supreme Court to reject the request by the DoJ, arguing that it would take “billions of dollars out of opioid abatement programmes that are sorely needed” and deprive victims of any “meaningful recovery”.

Members of the Sackler family initially agreed to pay $4.5bn under Purdue’s bankruptcy settlement, which a bankruptcy judge approved in 2021. A federal judge set it aside later that year.

The Sacklers then agreed to increase their financial contribution from $4.5bn to $6bn, winning support from several dissident victims’ groups and states that had opposed the original deal. Opponents of the original settlement pointed to analysis presented in the bankruptcy court that showed the Sackler family members who own Purdue had taken more than $10bn out of the company between 2008 and 2017.

Samir Parikh, a bankruptcy law professor at Lewis & Clark Law School, said the Supreme Court has in the past reviewed fundamental bankruptcy practices and found them unconstitutional or inconsistent with the law.

“This could be one those instances,” he said. “But losing non-consensual third-party releases would be detrimental to victim recoveries. Remember, the Purdue victims approved the plan with the releases because it enabled a meaningful recovery on a relatively short timeline. Without the releases, those victims are going to be thrown into a far more chaotic scenario.”

A spokesman for the family of the late Mortimer Sackler declined to comment, while the family of the late Raymond Sackler did not immediately reply to a request for comment.

Read the full article here