We’re starting to see the foundations of the tech rally begin to crack. Earnings season is well underway, and though most companies have reported tremendous beats to guidance and expectations, Wall Street’s reactions have been relatively muted. The cause here: with valuations having soared since the start of the year, most stocks were already priced for perfection – and anything less than perfect got walloped post-earnings.

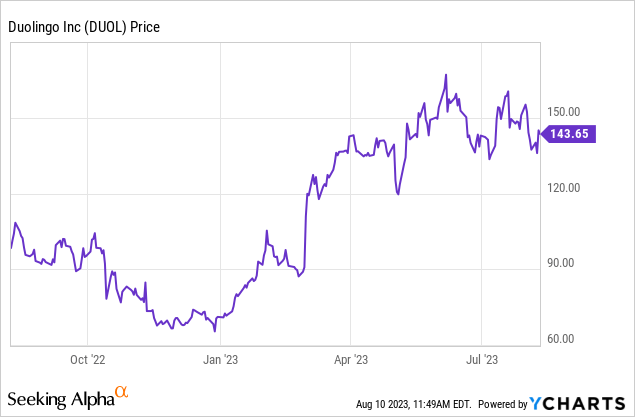

Duolingo (NASDAQ:DUOL) is a great example here. The language-learning app posted an admirable beat-and-raise quarter that saw acceleration in top-line metrics plus generous margin increases. Still, the stock is below June highs – though we can’t discount the fact that it has more than doubled year to date.

My outlook on Duolingo throughout the rest of the year remains bearish. In my personal view, the company has executed tremendously well against a tough backdrop. Even among general malaise in the subscription-services industry (with Netflix (NFLX) ending password-sharing and Disney (DIS) raising the prices of both Disney+ and Hulu), Duolingo has so far avoided any negative consequences (many including myself had feared that if consumers allocated more money toward streaming services, they would review their monthly expenses more carefully and cut out apps like Duolingo if not heavily used).

But looking ahead, I still have two primary concerns: a lack of real growth drivers plus a massive valuation.

Duolingo has succeeded recently in converting a lot of users into paid subscribers. It has put a lot of marketing behind the branding of its new subscription product, Super Duolingo, with a lot of new features like Explain My Answer that are intended to replicate what a human language tutor might be able to provide. But at the same time, will these AI features really drive non-subscribers off the proverbial couch? Can Duolingo succeed in continued subscriber retention once this hot summer travel season ends? The company has, to its credit, spent very little on user acquisition, preferring limited social media campaigns with tie-ins to current trending topics such as Barbie. It could re-allocate some of its margin gains back into user acquisition if growth slows down, but I am concerned that its period of organic growth will enter into a deceleration phase as it starts to lap tougher comps.

Second – we can’t ignore Duolingo’s ultra-premium valuation. At current share prices near $144, Duolingo trades at a market cap of $5.90 billion. After we net off the $678.7 million of cash on Duolingo’s most recent balance sheet, the company’s resulting enterprise value is $5.22 billion.

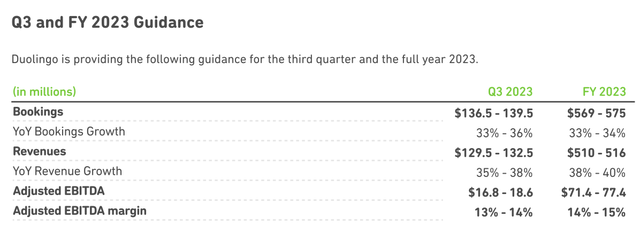

For the current fiscal year, Duolingo has boosted its full-year outlook to $510-$516 million (38-40% y/y growth), versus a prior outlook of 35-38% y/y growth – effectively making the old high end of its range its new low end.

Duolingo outlook (Duolingo Q2 earnings deck)

To what extent, however, is strength already priced into Duolingo’s stock? It sits at 10.2x EV/FY24 revenue based on the midpoint of its new guidance range, and if we play forward its multiples to FY24 where consensus is expecting $653.0 million in revenue (+27% y/y), its valuation still stands at 8.0x EV/FY24 revenue.

In my view, Duolingo will gradually see several points of revenue and bookings deceleration per quarter (as implied in its guidance), with risk of subscriber churn in the back half of the year very prevalent as macro conditions drag on and summer travel ends. I expect Duolingo to get pushed down to a ~7x FY24 revenue multiple by year-end, implying a $128 price target and ~12% downside from current levels.

The bottom line here: I think Duolingo has capped out its potential with its generous YTD rally. From here it’s mostly downside, and there is more risk than reward in investing in the stock at its current levels. Steer clear and invest elsewhere.

Q2 download

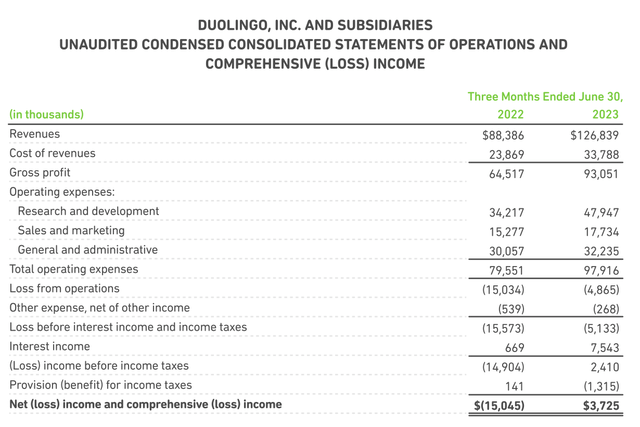

That being said, we will acknowledge the strength of Duolingo’s most recent results. The Q2 earnings summary is shown below:

Duolingo Q2 results (Duolingo Q2 earnings deck)

Revenue grew 43% y/y to $126.8 million, beating Wall Street’s expectations of $123.7 million (+40% y/y) by a three-point margin. Growth also accelerated one point versus 42% y/y in Q1, in part driven by softening FX headwinds.

From a user standpoint, daily active users grew 62% y/y to 21.4 million, at the same growth pace as in Q1 and a 900k sequential add in the quarter. Paid subscribers, meanwhile, added 400k quarter-over-quarter and rose to 5.2 million, up 59% y/y.

Duolingo user metrics (Duolingo Q2 earnings deck)

Platform bookings also grew 41% y/y to $137.5 million, eclipsing revenue on a nominal basis. Also of note is the fact that in-app purchases, though relatively small (total “other” revenue of $8.8 million represented only 7% of the company total), grew more than 100% y/y.

Here is commentary from CEO Luis Von Ahn’s remarks on the Q2 earnings call, detailing the company’s subscriber acquisition trends and strategy:

We delight our learners who tell their friends and family about us, which drives our organic word-of-mouth growth. Add to that, our unique and efficient, though at times unhinged, approach to marketing, and you get a brand that has become synonymous with language learning. And that creates opportunities for us to be part of cultural moments, like you saw this past month, when we were referenced in the Barbie movie. I should mention that this was an inbound request to us. We didn’t seek out being in the film, which I think is a reflection on the strength of our brand.

Over the past 8 quarters, we’ve seen very strong DAU growth, and that growth has been high-quality and has been broad based with users coming from all regions of the world. The U.S. continues to grow nicely, and some of our fastest growth have come from the wealthier European countries. This growth not only validates the huge addressable market of language learners, but because of the power of our freemium business model, which I’ve discussed in previous shareholder letters, strong user growth drives strong financial performance.

We attract free users primarily through word of mouth. We delight them through product improvements driven by experimenting and optimizing the app, and then we convert them to paid subscribers. This playbook for growing subscribers has worked exceptionally well.”

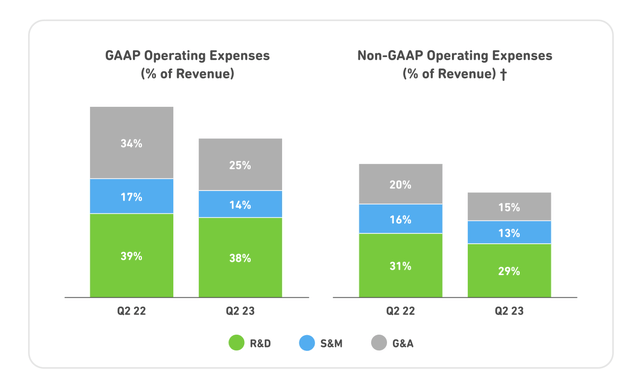

From a cost perspective, Duolingo also managed to bring down sales and marketing costs by 3 points as a percentage of revenue, and generate and administrative costs by 5 points:

Duolingo opex rends (Duolingo Q2 earnings deck)

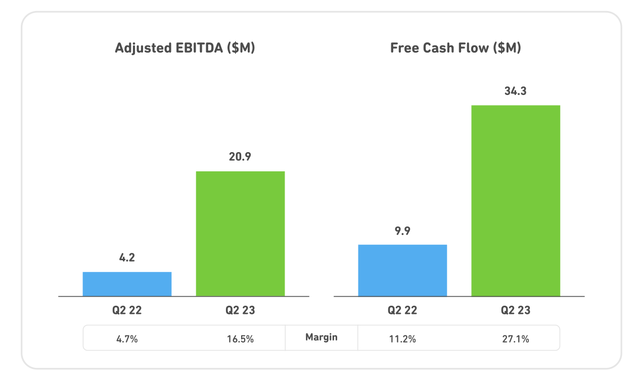

Adjusted EBITDA grew substantially to $20.9 million, representing a 16.5% adjusted EBITDA margin and more than ten points of leverage y/y, while free cash flow in Q2 more than tripled to $34.3 million.

Duolingo margins (Duolingo Q2 earnings deck)

Key takeaways

High quality at a high price – Duolingo has always been this style of investment, though I think with markets shaking off all-time highs, the risk is now greater. Avoid this stock and invest elsewhere.

Read the full article here