The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

European-listed ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 41.4 billion in July, while the proportion of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was 81.5%.

Volume breakdown

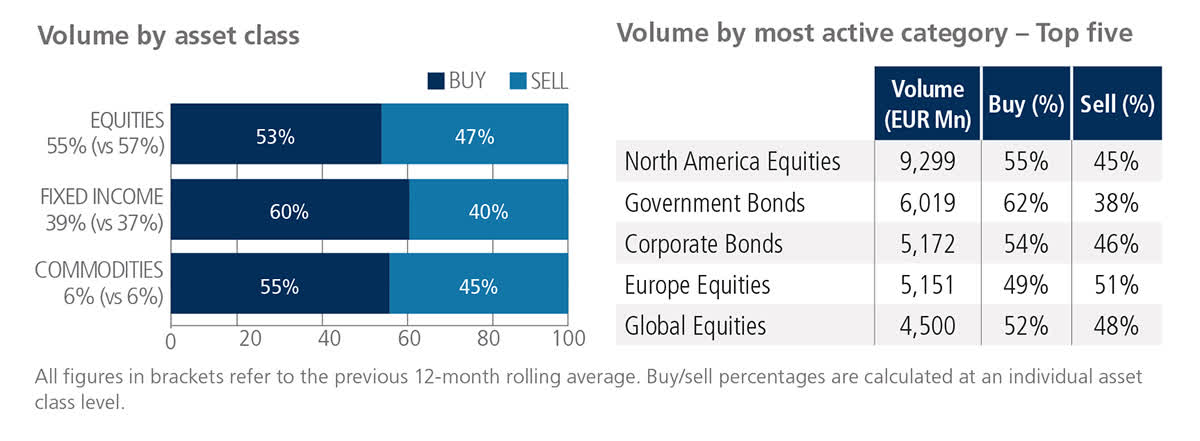

All ETF asset classes saw net buying in July, particularly fixed income products, where ‘buys’ outperformed ‘sells’ by 20 percentage points. Trading activity in the asset class increased to 39% of the overall platform flow, beating the previous 12-month rolling average by two percentage points.

North America Equities was once again the most actively-traded ETF category during the month, with Government and Corporate Bonds ranked in second and third place, respectively.

Top ten by traded notional volume

Fixed income funds dominated July’s top ten list by traded notional volume, with the iShares Core Corporate Bond UCITS ETF moving up two places from June to be ranked first.

U.S.-listed ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in July amounted to USD 54.5 billion.

Volume breakdown

As a percentage of total notional value, equities accounted for 57% and fixed income for 36%, with the remainder comprising commodity and specialty ETFs.

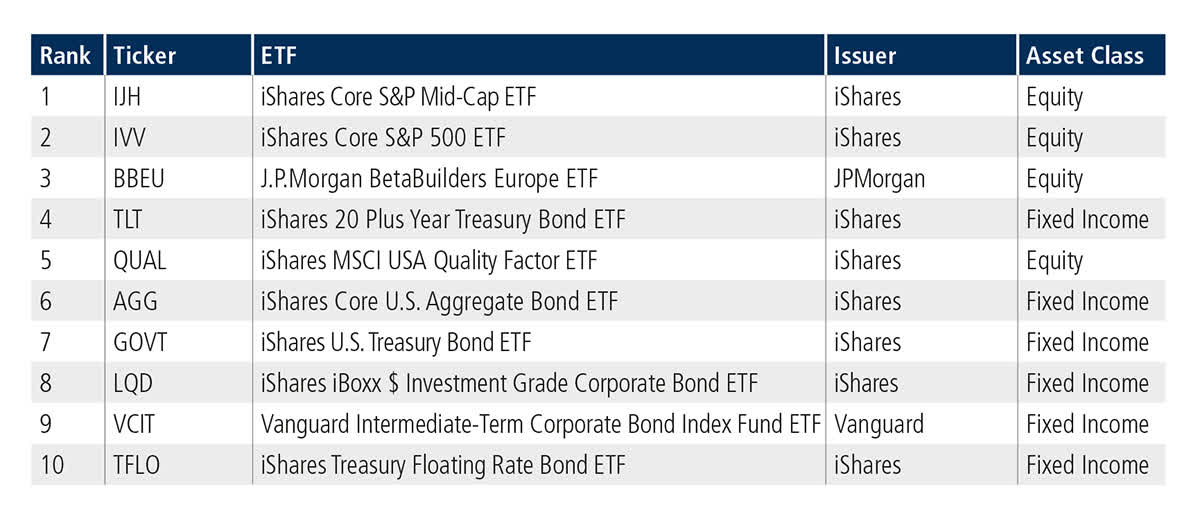

Top ten by traded notional volumeEquity products held four out of the top five spots in July’s list of most heavily-traded ETFs by notional volume. In first place, the iShares Core S&P Mid-Cap ETF (IJH) last featured in the top ten in August 2021.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here