The market for lidar, a key technology for self-driving cars, is maturing, making it possible for investors to start to differentiate between the companies and their stocks.

Thursday,

Ouster

(ticker: OUST) reported a second-quarter adjusted loss of $24 million before interest, taxes, depreciation, and amortization. That was roughly in line with what Wall Street expected, as were the lidar company’s sales of $19.4 million. Both numbers are roughly in line with Wall Street estimates.

For the current quarter, management expects sales of $20 million to $22 million, compared with the slightly under $22 million Wall Street expected.

Shares were down 1% in after-hours trading shortly after results were released. That could be because investors’ expectations were rising in recent weeks. Coming into earnings, shares were up about 23% over the past three months while the

S&P 500

and

Nasdaq Composite

added 8% and 11%, respectively.

Year-over-year comparisons aren’t meaningful for the company since it merged with lidar producer Velodyne, in February. “It’s the second record quarter in a row,” CEO Angus Pacala told Barron’s. “I’m thrilled with the momentum built with the merger.”

Results look fine. Typically, an in-line quarter with reasonable guidance isn’t anything to write home about, but the numbers are noteworthy in the lidar business.

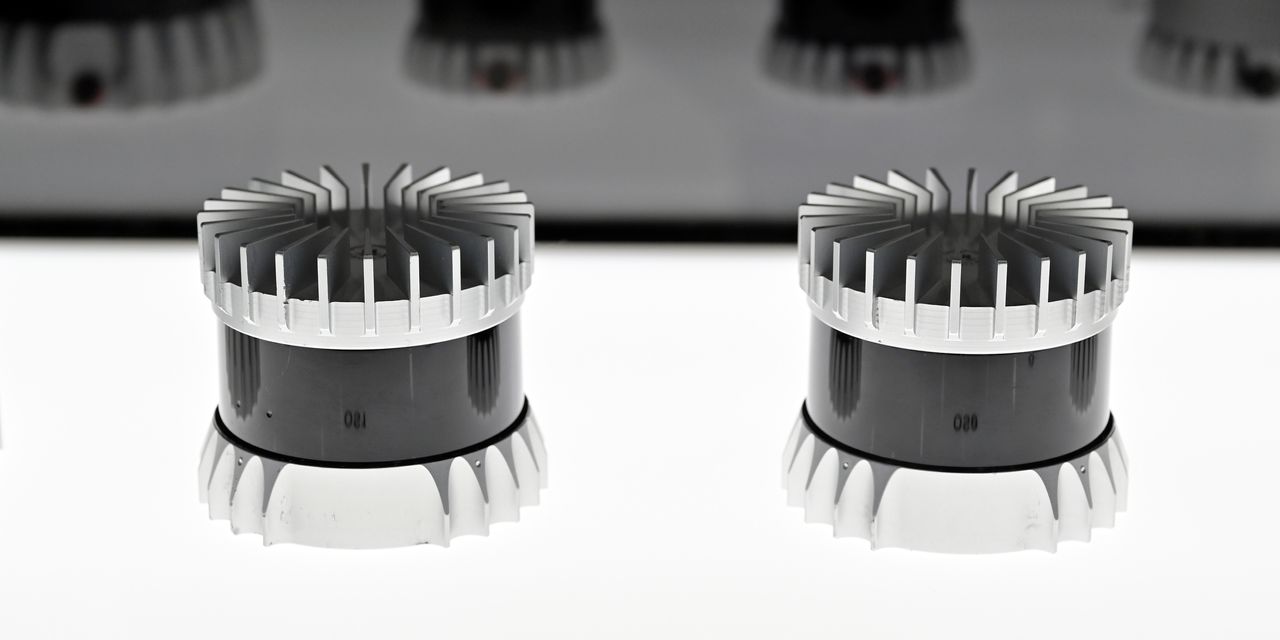

Lidar is essentially laser-based radar that can give a car a set of eyes, allowing for advanced driver-assistance features. Along with the automotive market,

Ouster

sells to industrial, automation, and smart-infrastructure customers.

Lidar peers

AEye

(LIDR) and

Aeva Technologies

(AEVA) both reported second-quarter revenue of less than $1 million.

Innoviz Technologies

(INVZ) reported less than $2 million in second-quarter sales. For the full year, Wall Street projects those three Lidar producers will generate about $25 million in sales, with 64% coming from Innoviz. When the trio was raising money via mergers with special-purpose acquisition companies a few years ago, their combined projection for 2023 sales was $132 million. They were off by more than 80%.

It has been slower going than expected for Ouster, too. Analysts project the company will generate about $83 million in 2023 sales, while in the 2020-2021 time frame, Velodyne and Outer expected to generate about $735 million in combined 2023 sales.

They were way off too, but $83 million in sales is significant. Among early-stage lidar start-ups, only

Luminar Technologies (LAZR) is expected to generate more. Wall Street

projects it will generate 2023 sales of $85 million.

When Luminar was raising money in 2020, it projected $124 million in 2023 sales.

Luminar stock has been rewarded for its sales and conservative projections with a market capitalization of about $2.3 billion. Ouster and Innoviz come in at roughly $200 million and $315 million, respectively. Aeva and

AEye

have market caps of about $230 million and $57 million.

Luminar has about 74% of the total market cap of the group. Luminar and Ouster have about 87% of the total revenue generated by the group. Both companies will try to press their leads over peers in the coming quarters.

“There’s no rule that everybody has to win,” says Pacala. Not everyone will.

Write to Al Root at [email protected]

Read the full article here