Introduction

Arrowhead Pharmaceuticals (NASDAQ:ARWR) is a clinical-stage biotechnology company that harnesses RNA interference to develop treatments for difficult diseases by silencing causative genes through advanced RNA chemistries and delivery methods.

In my past analysis of Arrowhead, I highlighted their stellar financial performance in Q1 2023, a compelling RNAi therapeutic pipeline, and beneficial strategic partnerships. The company seemed undervalued compared to its peers. Given its innovation, strong finances, and key collaborations, I advised a “Strong Buy” recommendation, noting its potential to significantly enhance investment portfolios in biopharmaceuticals.

The following article evaluates Arrowhead’s recent financial performance, innovations in RNA interference, therapeutic developments, partnerships, and investment outlook. While promising in areas, financial concerns necessitate a cautious investment approach.

Fiscal Q3 Earnings

Looking at Arrowhead’s most recent earnings report, revenue for the fiscal third quarter of 2023 was $15.8 million, a decrease from $32.4 million in the same period of 2022. Operating expenses consisted of $94.8 million in research and development, up from $72.2 million in 2022, and general and administrative expenses of $23.8 million, which is down from $33.1 million in the previous year. Total operating expenses rose to $118.5 million from $105.3 million in 2022. This led to an operating loss of $102.7 million. After accounting for interest and other expenses, the net loss attributable to Arrowhead stood at $102.9 million, compared to a net loss of $72 million in 2022.

Cash Runway & Liquidity

As of June 30, 2023, Arrowhead has total cash and short-term investments amounting to $451.7 million ($105.3 million in cash and cash equivalents and $346.4 million in short-term investments). The operating loss over the last nine months is $96.7 million, which equates to an annual loss (extrapolated over 12 months) of approximately $128.9 million. Using these figures, Arrowhead’s cash runway is calculated to be 3.5 years ($451.7 million divided by $128.9 million).

Analyzing the balance sheet, the company’s overall liquidity appears healthy, with substantial current assets. There’s been an increase in total current assets from September 2022 to June 2023. However, the company has acquired a substantial new long-term liability related to the sale of future royalties, amounting to $263.1 million. Given the healthy cash runway, there isn’t an immediate need for additional financing based on the current burn rate. However, with significant long-term liabilities, the company must be vigilant about its operational performance and expenditure patterns to ensure continued liquidity.

Valuation, Growth, & Momentum

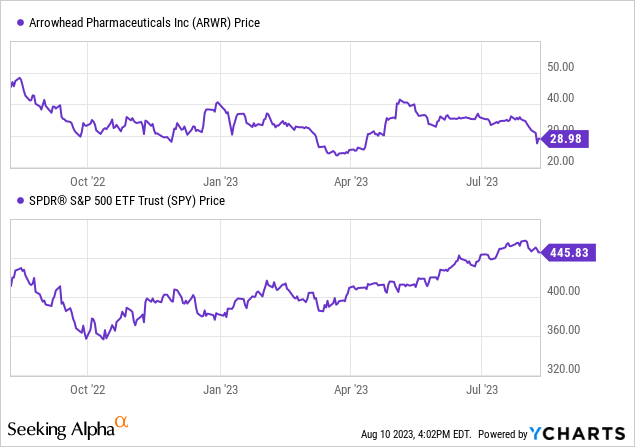

According to Seeking Alpha data: Arrowhead’s capital structure reveals a market cap of $3.11B and an enterprise value of $2.76B. With $451.70M in cash and $82.73M in total debt, it presents a relatively healthy liquidity position. Due to Arrowhead being a clinical-stage biotech, the valuation grades are weak, with non-standard P/E ratios being not meaningful and a high Price/Book ratio at 8.52. Forward earnings estimates indicate negative EPS growth, declining sales in 2024, but a rebound in 2025. Notably, all recent earnings revisions have been upward, signifying potential underestimated earnings in the future. Growth-wise, Arrowhead scored well, boasting a 3-year CAGR for revenue at 27.49%. Lastly, in terms of stock momentum, Arrowhead underperformed against the S&P500 over the past year with a decline of 36.17%.

Growth Initiatives

Arrowhead’s management discussed their recent advancements and plans during their earnings call:

- Pulmonary Initiatives: Arrowhead has seen positive early results from rodent studies on their pulmonary candidates, notably ARO-MMP7 and ARO-RAGE, with no observed adverse effects even at the highest tested doses. These results indicate a significant de-risking event for their pulmonary franchise. They aim to receive full rat and monkey chronic GLP tox data for these candidates in the coming months.

- Diversified Approach: Management believes in building a diversified business rather than relying on one or two major drugs. The goal is to mitigate risks associated with the unpredictability of biology.

- TRiM Platform: Arrowhead’s TRiM platform is designed to target multiple cell types, enabling treatments to precisely target diseases. The platform also aids in moving rapidly from idea to clinical studies.

- 2025 Initiative: Arrowhead aims to have 20 clinical stage or marketed products by 2025. They believe a larger pipeline is key to mitigating balance sheet risk.

- Partnering Strategy: Over the past six years, Arrowhead has garnered nearly $1 billion through partnerships. They have recently earned milestone payments through collaborations with GSK and Takeda.

- Future Outlook: Arrowhead anticipates initiating the NDA process for ARO-APOC3 next year after completing enrollment in the Phase III PALISADE study. They also plan to begin Phase 3 studies for severe hypertriglyceridemia and mixed dyslipidemia. Additionally, two new programs, ARO-DUX4 and ARO-SOD1, targeting skeletal muscle and the central nervous system respectively, have been introduced. Management is optimistic about potential CNS and skeletal muscle franchises and aims to further expand the reach of their technology.

In summary, Arrowhead is aggressively pursuing a diversified strategy, emphasizing de-risking, expanding their therapeutic reach, and collaborating effectively.

My Analysis & Recommendation

Arrowhead Pharmaceuticals’ journey with RNA interference showcases an ambitious vision of tackling stubborn diseases, and their strides in recent quarters have confirmed their prowess. While the firm’s financial performance in Q1 2023 shone brightly, the recent Q2 earnings report painted a slightly more subdued picture. A significant drop in revenue coupled with an escalating operational loss raised eyebrows. But a deeper dive reveals that the company is on a solid financial footing, with a substantial cash runway of 3.5 years. This, combined with their healthy liquidity position, despite a significant long-term liability, suggests a level of financial stability conducive to supporting growth initiatives.

However, potential investors should approach with caution. Arrowhead’s stock momentum has lagged behind the S&P500, with a concerning dip of 36.17% over the past year. The company’s valuation grades, although weak, show some light with all recent earnings revisions heading upward. This perhaps indicates the market’s anticipation of future underestimated earnings, and the 3-year CAGR for revenue stands out, highlighting an impressive growth trajectory assuming their partnerships and drugs bear fruit.

Delving into the company’s strategies and advancements, there’s ample reason for optimism. The promising early results from rodent studies on pulmonary candidates and the encouraging ARO-RAGE clinical data signal potential therapeutic breakthroughs on the horizon. Furthermore, the company’s dedication to building a diversified business, their rapid transition from concepts to clinical studies via the TRiM platform, and their ambitious 2025 initiative all point towards a robust strategy. Their rich history of profitable partnerships, amassing nearly $1 billion, and their forward-looking plans with the likes of GSK and Takeda add another feather to their cap.

So, where does this leave potential investors? While there are undeniable financial and operational challenges, Arrowhead’s visionary strategy and significant collaborations signal vast potential. The key will be their ability to maintain financial discipline while ensuring their R&D efforts translate into tangible therapeutic successes. I am moving from my earlier “Strong Buy” recommendation to a more cautious “Buy” stance. Those with a high risk tolerance and long-term outlook might find Arrowhead an attractive proposition, but vigilance over their future earnings reports and clinical results in the coming weeks and months will be paramount.

Risks to Thesis

When the facts change, I change my mind.

While I maintain a “Buy” recommendation for Arrowhead Pharmaceuticals, there are inherent risks to consider. First, the significant drop in recent revenue raises concerns about the company’s ability to maintain financial health. Second, Arrowhead’s underperformance against the S&P500 might indicate broader market skepticism or external factors impacting its sector. The company’s negative EBIT and Net Income margins also pose a risk, suggesting challenges (e.g. time) in converting operational activities to profitability. Additionally, biopharmaceuticals inherently face regulatory hurdles, potential unsuccessful clinical trials, and rapid technological shifts which can impact investments. It’s crucial for investors to continuously monitor these factors and adjust their positions accordingly.

Read the full article here