Alibaba Group Holding Limited (NYSE:BABA) delivered a stronger than expected June quarter (fiscal Q1 2024), beating analyst consensus estimates with regards to both the top line and earnings. In the quarter, Alibaba’s total group revenue jumped 14% YoY, despite ongoing macro pressure, while operating income surged 70% YoY.

Following Alibaba’s strong quarterly report, leading investment banks including Citi and J.P Morgan have raised their target price for BABA stock. I too get more constructive on Alibaba’s share price momentum for the 2H 2023, as I see the June report as a catalyst for a likely rally: on the backdrop of supportive margins, I update my EPS assumptions for Alibaba through 2025; and I now calculate a fair implied valuation of $150.56.

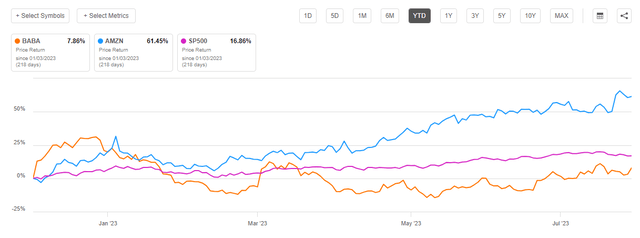

For reference, Alibaba shares have underperformed YTD vs. U.S. competitor Amazon (AMZN) and the broader stock market, as since January 2023, BABA shares are up only about 8%, as compared to a gain 61% and 17% for Amazon and S&P 500 (SP500), respectively.

Seeking Alpha

Alibaba’s June Quarter: Massive Earnings Beat

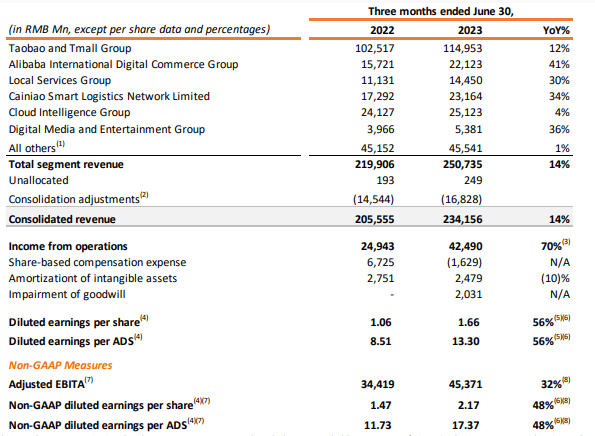

Alibaba reported a very strong Q1 FY 2024, beating analyst consensus estimates on both the top and bottom lines. During the period from April to end of June, China’s largest e-commerce conglomerate generated about RMB 250.7 billion of sales, which compares to RMB 219.9 billion for the same period one year earlier (12%), and to approximately RMB 225 billion estimated by analysts (according to data collected by Refinitiv).

With regard to profitability, Alibaba’s operating income jumped by 70% year over year vs. the comparable 2022 benchmark, to RMB 42.5 billion. Diluted EPS surged by 56%, to RMB 13.3 per ADS, beating analyst estimates by almost 30% (according to data collected by Refinitiv).

Alibaba Earnings Report

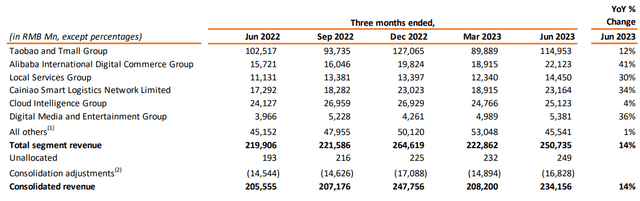

Alibaba’s strong June quarter was supported by all of the e-commerce giant’s operating segments, with only the cloud business disappointing. Alibaba’s core profit center, China e-commerce incl. Taobao and Tmall returned back to growth, achieving revenues of RMB 115 billion (12% YoY growth). Alibaba’s international e-commerce business posted a surprising 41% YoY top line expansion, reporting sales RMB 22 billion. The “local services group”, “Cainiao logistics” and “digital media” generated sales of RMB 14.4 billion (+30% YoY), RMB 23.2 billion ( +34% YoY) and RMB 5.4 billion ( +36% YoY), respectively.

Alibaba’s cloud business disappointed: Due to a lack/ slowdown of government-related cloud projects and infrastructure spending, the business unit only achieved a 4% YoY growth, with RMB 25.1 billion of sales. However, while the top line was disappointing, investors should consider that Alibaba’s cloud unit operating income (EBITDA) surged 106% on OPEX discipline.

Alibaba Earnings Report

The Alibaba Equity Story

In my opinion, Alibaba’s June quarter reporting beautifully highlights the core thesis of the BABA’s equity story – strong free cash flow with growing payout potential for shareholders.

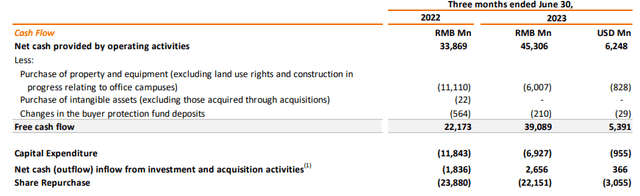

During the 3 months leading to June 30th, Alibaba generated about RMB 39 billion of free cash flow (“FCF”), on RMB 45.3 billion of cash provided by operating activities. On an annualized basis, Alibaba’s FCF swells to RMB 181.2 billion, as compared to an enterprise value of RMB 1.6 trillion – suggesting an FCF/ EV ratio of approximately x11. Taking the inverse of this ratio would imply a shareholder yield of close to 9%.

Now, investors should consider that the 9% yield is a “no-growth” metric. Needless to say, reflecting on Alibaba’s latest earnings report, a no growth assumption is not very reasonable; In fact, I argue a 2-3% growth premium top-up to the 9% would be advised.

Alibaba Earnings Report

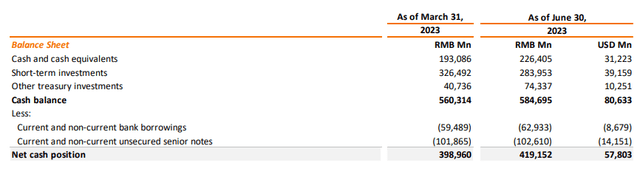

Alibaba’s equity story of strong free cash flow is supported by attractive payouts to owners. In the June quarter, Alibaba repurchased close to RMB 22 billion worth of equity, reflecting an annualized payout vs. market capitalization of about 5-6%. With that frame of reference, I think it is important to understand that not only is Alibaba’s already attractive payout sustainable, but also poised for upside: As compared to the group’s free cash flow, the payout ratio is only about 50%, despite the company’s RMB 419 billion net cash position (2.6x Net Cash to FCF).

Alibaba Earnings Report

Valuation Update: Raise TP

Anchored on a strong June quarter, and a growth rebound for Alibaba’s China e-commerce business, I update my EPS expectations for Alibaba through 2025: I now model that Alibaba’s EPS in FY 2023 will likely expand to somewhere between $9.5 and $10.25. Moreover, I also raise my EPS expectations for 2024 and 2025, to $11.2 and 12.10, respectively.

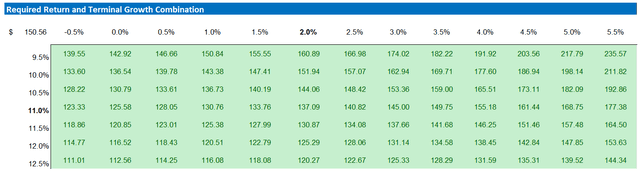

I continue to anchor on a 4% terminal growth rate (one percentage point higher than estimated nominal global GDP growth) and I maintain the 11.25%, cost of equity (reflecting a very conservative risk premium).

Given the EPS updates as highlighted below, I now calculate a fair implied share price of $150.56.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Below is also the updated sensitivity table.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Risks

My primary concern for investing in Alibaba relates to the regulatory pressure that China’s tech and internet giants have faced in recent months/ years. Of course, if this ongoing regulatory scrutiny persists, Alibaba’s valuation might need to be adjusted with a considerable risk discount. That said, however, it is worth noting that the most intense phase of the regulatory clampdown in China has passed.

In addition to regulatory concerns, I would also like to highlight that the volatility of Alibaba’s stock price is strongly swayed by the prevailing sentiment of investors towards Chinese ADRs. This implies that even if the underlying business fundamentals of the company remain stable, BABA stock may fluctuate based on how investors perceive the risks associated with Chinese investments.

Conclusion

On the backdrop of a strong earnings report for the June quarter, I’m confident to reiterate my bullish thesis on Alibaba. Overall, I continue to argue that Alibaba stock looks deeply discounted vs. the company’s financials/ fundamentals, especially considering a strong FCF paired with the potential of a growing payout potential for shareholders.

Given updated EPS estimates, a 4% terminal YoY growth rate and a 11.25% cost of equity, I now calculate a fair implied share price for Alibaba Group Holding Limited equal to $150.56. Reiterate “Buy” rating.

.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here