Weyco Group (NASDAQ:WEYS) recently reported an impressive increase in the operating margins driven by increases in the selling price of products. I believe that management was sufficiently smart to increase prices while having lower operating expenses increases. Even if these price dynamics are temporary, I believe that WEYS may also see stock price increases driven by improvements in the profitability of the e-commerce activities. In any case, with many decades in business, I believe that despite potential risks from failed commercialization, failed merger integration, or brand destruction, I see significant upside potential in the stock valuation.

Weyco Reported Impressive Quarterly Earnings Increase

Weyco Group and its subsidiaries are dedicated to a single product line: the design and distribution of footwear. Although its production is targeted primarily at men’s footwear, the company also has product lines for children and women.

Some of the most recognized brands to which the products of this company are distributed are Florsheim, Nunn Bush, Stacy Adams, BOGS, Rafters, and Forsake. These brands play a fundamental role in the scope and scale of the business, as they are the reference names for their quality standards and customer loyalty.

The last of these brands, Forsake, was acquired by Weyco during 2021, allowing its positioning within the e-commerce markets in the United States. Weyco does not manufacture or own manufacturing facilities for its products. The company distributes footwear that enters from the Chinese and Indian markets, and negotiations are currently underway to import products from Cambodia, Vietnam, and the Dominican Republic. Within Wayco’s 60 suppliers, each of the top two accounted for more than 10% of the company’s purchases in the last year. Purchase prices remain historically stable, offering a large profit margin for the company in subsequent distribution.

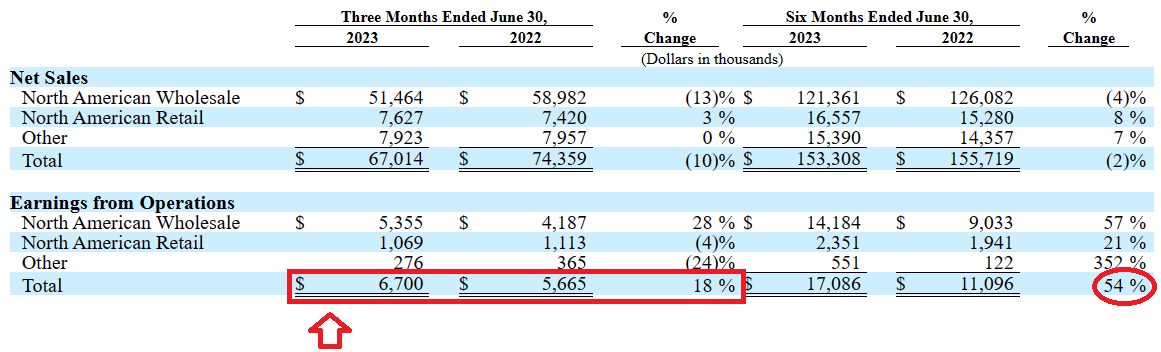

Operations are segmented into two areas, Wholesale and retail, both within the United States. Although the company also maintains active operations in Australia, South Africa, and South Asia, these represent a smaller percentage of the company’s operating results. Within these two segments, wholesale at the local level represented 81% and 79% in the last two years, while at the international level, it represented 9% and 11% respectively. Retail trade in the United States represented 10% and 12% respectively for the aforementioned years. I believe that it is a great time to review Weyco’s activities, mainly after the recent quarterly report. In the last quarter, the company reported a meaningful decrease in the North American Wholesale business segment, which made total quarterly sales decline close to 10% as compared to the same period in 2022. With that, I believe that the most appealing factor is that Weyco showed an increase in earnings from operations of close to 18%. In the six months ended June 30, 2023, total earnings showed an impressive increase of 54% as compared to the same period in 2022.

Source: 10-Q

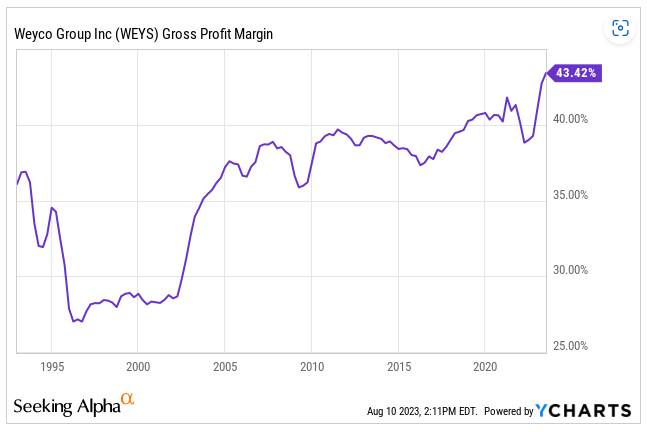

Considering previous increases in the gross profit margin and the recent quarterly earnings release, I believe that studying the valuation of Weyco makes sense.

Source: Ycharts

Balance Sheet

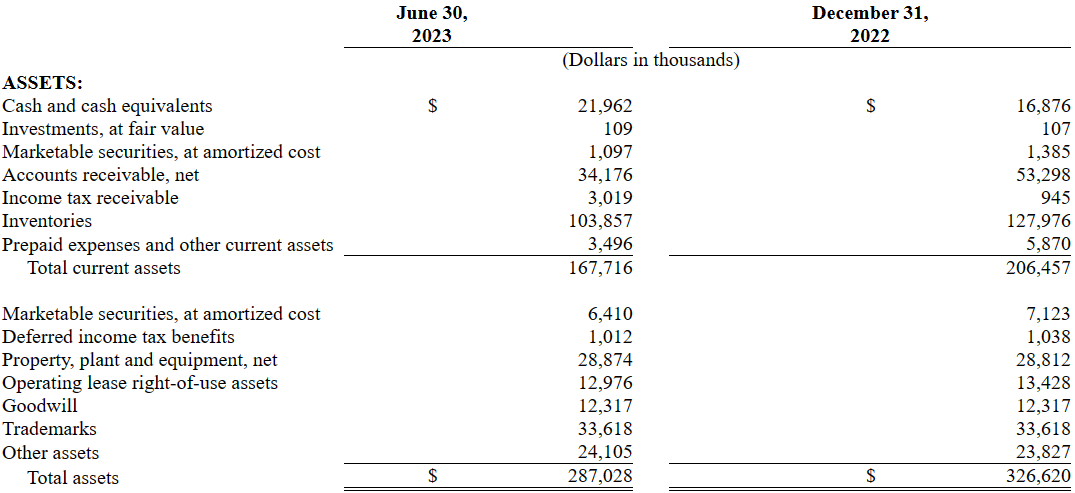

As of June 30, 2023, the company noted cash and cash equivalents worth $21 million, accounts receivable of about $34 million, income tax receivable of $3 million, inventories worth $103 million, and prepaid expenses and other current assets worth $3 million.

Weyco also reported property, plant, and equipment of $28 million, operating lease right-of-use assets close to $12 million, goodwill of about $12 million, trademarks of $33 million, and total assets of $287 million. The asset/liability ratio stands at close to 5x, so I believe that the balance sheet stands in a very good position.

Source: 10-Q

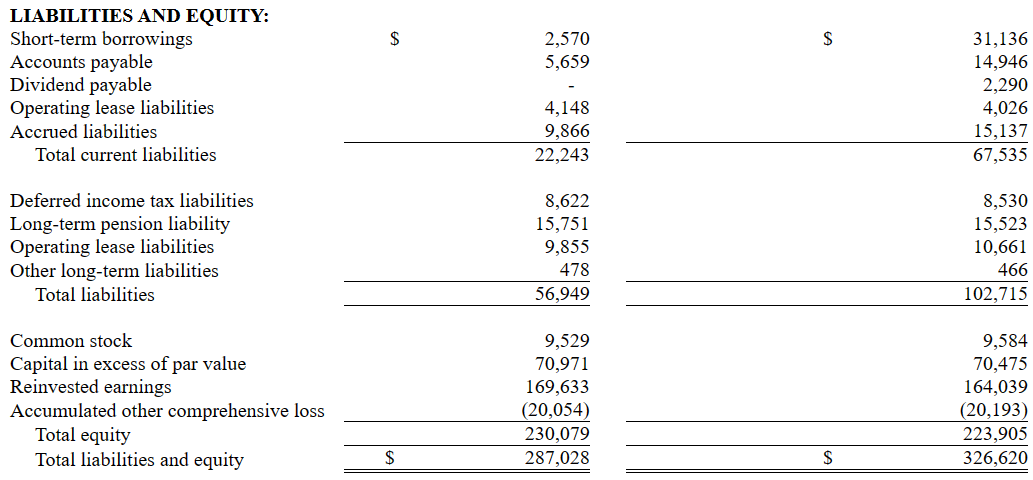

I really do not think that investors would be afraid of the total amount of liabilities. The list of liabilities includes short-term borrowings of $2 million, accounts payable worth $5 million, and total current liabilities of $22 million. Besides, with deferred income tax liabilities of about $8 million and long-term pension liability close to $15 million, total liabilities stood at $56 million.

Source: 10-Q

Competition

Competition in this sector is high, and is given by local distributors such as Wayco, international companies that occupy a portion of this market, and original manufacturers. Due to the variety of categories within the footwear offer, all the product lines of this company face high competition in many cases from companies with greater resources and recognition of their brands. This last factor is of great relevance due to the credibility of the products as well as their price and quality. The introduction of new designs that meet the preferences of its customers and the strategies that the company has to have its products in stores are other elements of competitiveness that can mean a differential for Wayco in relation to its competitors.

Financial Model: Further Increases In Selling Prices, Profitability Of Ecommerce Could Imply Significant Undervaluation

Our reading from the recent acquisition of Forsake is that the search for diversification in its product lines and the sales reach increased thanks to new digital channels. This factor, together with the ongoing transactions to import products from new markets such as Vietnam or Cambodia, shows Wayco’s desire to increase its presence in international markets. In my opinion, further inorganic growth and internationalization would most likely further improve the gross margin and FCF margin.

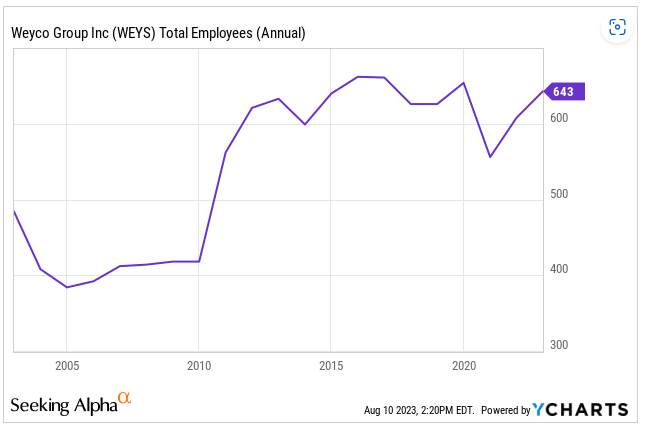

Brand recognition, price, quality, and service are mostly what Weyco has to improve in order to enhance FCF growth. With its own design department, operating since 1892, and new updates on a regular basis, Weyco appears to know well how to conduct its business model. In my view, further increase in the headcount would most likely interest investors out there. In this regard, it is worth mentioning that the number of employees increased from close to 400 in 2005 to around 643 in 2022.

Source: Ycharts

Besides, it is worth noting that increases in the selling price were more significant than the increase in costs. If the company can increase its selling prices even further, I would be expecting new increases in free cash flow. As a result, I believe that many analysts would increase the implied valuation of Weyco.

Gross margins for the quarter improved as a result of selling price increases implemented in 2022 to address higher costs. For the six months ended June 30, wholesale gross earnings were 37.7% of net sales in 2023 compared to 31.7% of net sales in 2022. The increase in gross margins for the year-to-date period was due to higher selling prices and lower inbound freight costs. Source: 10-Q

With that about the increase in selling prices, it is also worth noting that Weyco is learning a lot about the e-commerce business, which may offer better profitability in the coming years. In this regard, I believe that investors may want to have a look at the following lines.

The six-month earnings increase was primarily due to higher sales and improved profitability of our e-commerce businesses this year. Source: 10-Q

I also think that the company may receive more attention from market participants as soon as they learn about the stock repurchases made in the recent quarter. The company is using part of its CFO to repurchase its own shares, which may enhance the demand for the stock, and push the price up.

During the first six months of 2023, we generated $43.6 million of cash from operations. We used funds to pay down $28.6 million on our line of credit, to pay $6.9 million in dividends, and to repurchase $2.1 million of our common stock. We also had $1.4 million of capital expenditures during the period. Source: 10-Q

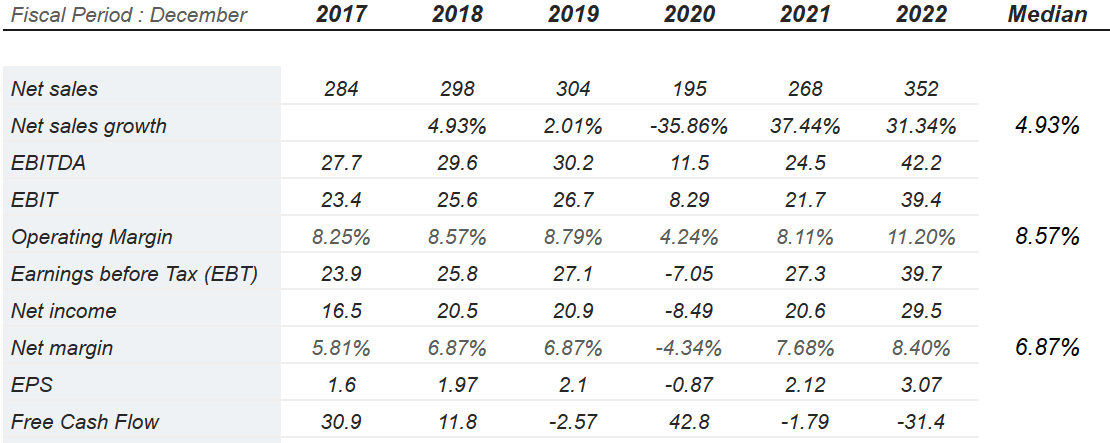

I studied a bit the numbers delivered in the past to understand what may make sense in the future. From 2018 to 2022, the median net sales growth stood at 4.9%, with operating margin close to 8.57% and net margin of about 6%. The FCF was positive in 2020, 2018, and 2017, however I believe that studying carefully the cash flow statement reveals that FCF may be larger than initially expected. For the calculation of the FCF in the future, I avoided pension expenses, pension settlement charges, bad debt expenses, and other items that I do not think are relevant for the calculation of the FCF. I do not think that they are periodic events, but most likely extraordinary.

Source: Market Screener

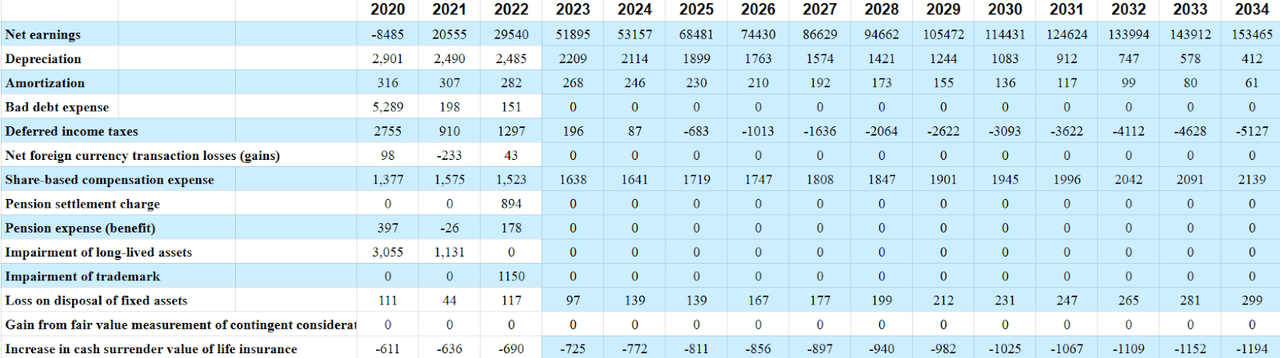

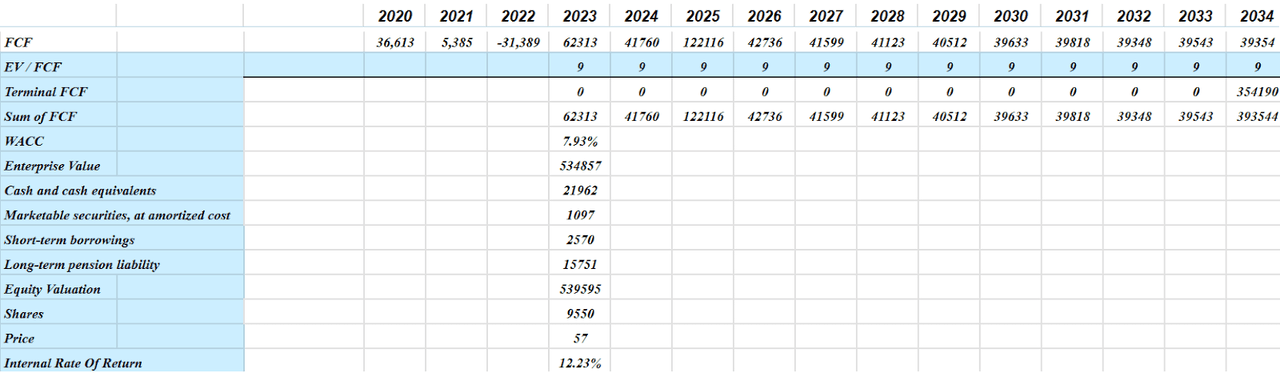

My model of future cash flow includes 2034 net earnings close to $47 million, with changes in accounts receivable of -$20 million, changes in inventories of $332 million, and prepaid expenses and other assets of -$18 million.

Source: Cash Flow Model

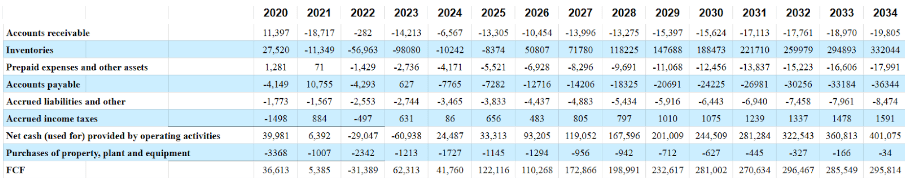

Besides, with 2034 changes in accounts payable of -$37 million, changes in accrued liabilities close to -$9 million, and accrued income taxes of $1 million, I obtained CFO of $294 million. Finally, if we include purchases of property, plant, and equipment of -$1 million, the implied 2034 FCF would be about $39 million.

Source: Cash Flow Model

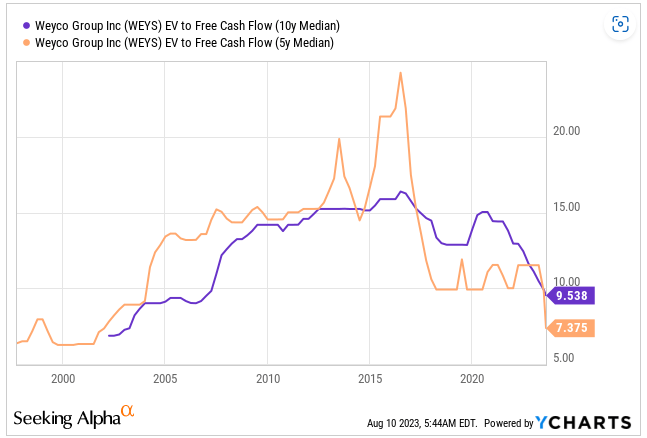

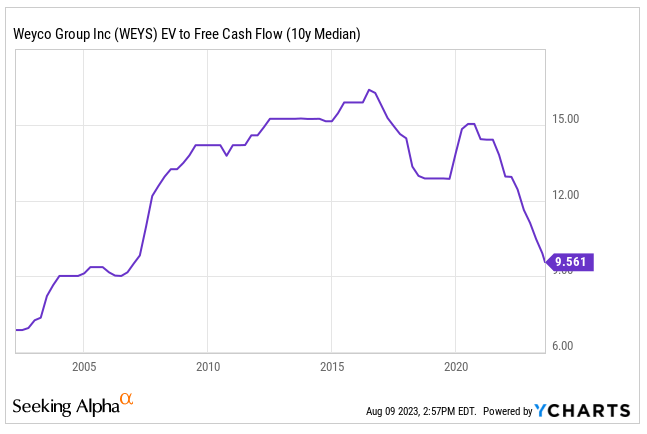

In the past, the EV/10 Years FCF and EV/5 Years FCF stood at close to 7x-20x, so I believe that assuming an EV/FCF of about 9x is conservative. If we also include a WACC of 7.93%, the implied enterprise value would stand at $534 million.

Source: Ycharts Source: Ycharts

Adding cash and cash equivalents close to $21 million and marketable securities, at amortized cost of $1 million, and subtracting short-term borrowings close to $2 million and long-term pension liability of $15 million, the implied equity valuation would be $539 million. Finally, the implied price would be about $57 per share, and the internal rate of return would be 12.2%.

Source: Cash Flow Model

Risks

Due to the nature of its business, Weyco depends directly on the supply of products by its suppliers, and any disruption in relations with these suppliers would generate complications at the operational level. In addition, a cut in the supply chain, import conflicts, or increase in fuel prices are risk factors for the company. Furthermore, the suppliers do not maintain contractual obligations with Weyco, which is a great risk in this regard.

Another great challenge at present is the integration of its acquisition businesses, mainly Forsake, as well as future acquisitions that are part of its expansion strategy.

In the context of rising inflation and the volatility in the global and local economy, retail markets are undergoing consolidation with a few companies occupying large market shares. This is a current risk factor in the scope of the company’s potential customers. In the same sense, changes in customer preferences or the inability of the company to offer designs that respond to fashion trends can also generate a significant decrease in sales and a considerable loss in operating costs.

In addition, Weyco’s inability to comply with its social and environmental programs could make the company less attractive for future investors.

Conclusion

Weyco Group appears to be making good money thanks to increasing selling prices at a higher level than the operating expenses. I do not think that we may see many more double digit increases in operating margins in the future. However, if management is smart, the FCF margins may remain elevated for some time. If we also take into account improvements in the profitability of the e-commerce activities and headcount increases, I think that the free cash flow will most likely trend higher. Even considering potential risks from failed brand development, failed acquisitions, or expansionary strategies, I believe that Weyco could trade at a higher price mark.

Read the full article here