Investment thesis

Our current investment thesis is:

- Ross Stores is a highly attractive business, owing to its consistently strong distributions, earnings growth, and scope for strong future returns through strong financials.

- Underpinning this is a quality commercial profile. The business has two strong brands, a broad variety of desirable products, healthy store growth, and a lucrative demographic that visits stores regularly. Our expectation is for these factors to drive shareholder value in the coming years.

- The primary factor we believe that will allow ROST to outperform is the impact of economic conditions, softening the financial improvement of millions of households, contributing to growth in the number of potential customers.

- Although ROST is facing near-term concerns with an erosion of margins, we expect improvement as inflationary pressures decline and growth improves. Further, its strong demand has allowed ROST to grow its store count consistently, allowing for economies of scale.

- We believe ROST is an attractive proposition relative to its peers, also, as its less susceptible to industry cyclicality and trends, such as e-commerce, as well as performing well financially.

Company description

Ross Stores, Inc. (NASDAQ:ROST) is a leading off-price retailer in the United States, offering a wide range of brand-name and designer apparel, footwear, accessories, and home goods.

Headquartered in Dublin, California, the company operates through two main store banners: Ross Dress for Less and dd’s DISCOUNTS.

Ross Dress for Less focuses on offering discounted brand-name apparel, home décor, and accessories. dd’s DISCOUNTS offers a more extensive assortment of off-price merchandise, including apparel, home goods, toys, and more.

Share price

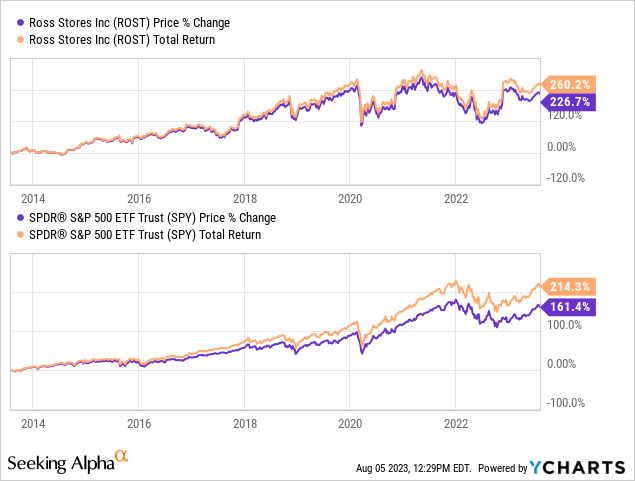

ROST’s share price has performed exceptionally well in the last decade, noticeably outperforming the wider stock market. This performance has been driven by financial improvement during this period, alongside industry tailwinds and good Management.

Financial analysis

Ross Stores’ financials (Capital IQ)

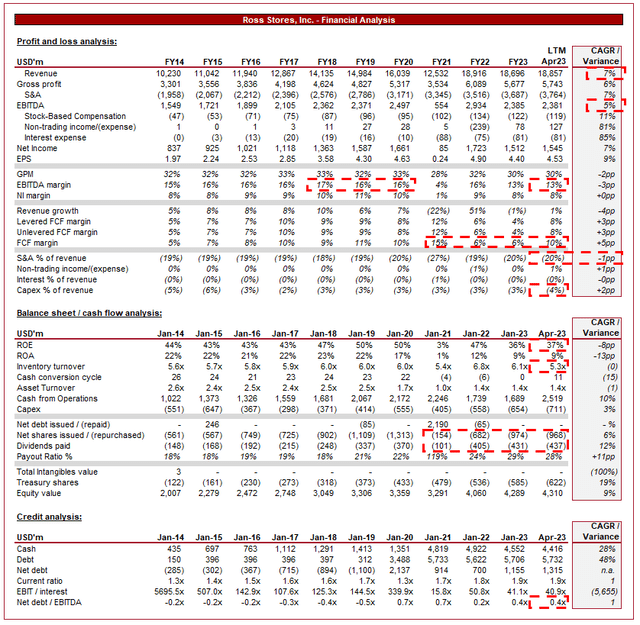

Presented above is ROST’s financial performance in the last decade.

Revenue & Commercial Factors

ROST’s revenue has grown at an impressive CAGR of 7% in the last 10 years, with consistent growth in the lead-up to the pandemic. From this point, growth has slowed in line with market conditions.

Business Model

Ross Stores follows an off-price business model, purchasing merchandise from manufacturers and retailers at discounted prices and then passing the savings to customers. The company relies on a flexible and opportunistic buying strategy to offer compelling bargains to consumers.

Commercial quality

The diversity of offering two brands in “Ross Dress for Less” and “dd’s DISCOUNTS”, as well as its wide variety of products is highly important. This allows the business to widen its target market and demographic (dd’s performs well with younger, ethnically diverse individuals), increasing its total addressable market. Further, this diversification reduces the company’s exposure to any single segment, such as Home, reducing the impact of cyclicality or a reduction in segment-specific demand.

ROST’s stores create a unique shopping experience for their customers through the “treasure hunt” concept. The ever-changing assortment and limited quantities of products create a sense of excitement and urgency, encouraging customers to make impulsive purchases and regularly visit stores (Core customers visit an incredible 2-3 times per month). This has allowed the company to outperform per location.

70% of ROST’s customers are female, shopping for themselves or other family members (Source: Investor presentation). This is a highly lucrative demographic to target, as women make up the majority of the US population and control or influence 85% of consumer spending. For this reason, ROST is disproportionately exposed to growth and consumption resilience, further compounding the quality of its revenue profile.

Further, ROST maintains a lean operating model with efficient inventory management and cost controls. The company’s quick inventory turnover, which is driven by the off-price model, and low-cost structure enable it to maintain attractive price points and healthy profit margins. Additionally, the company’s stores are sterile, operating large locations with self-service. This further reduces costs and is an area consumers are willing to forego for low prices.

Operationally, ROST employs a centralized buying and distribution model, which allows it to leverage economies of scale and negotiate better deals with suppliers. This model is similar to what is utilized by its peers but with differentiation in the quality and quantity of products sourced. This streamlined approach enables the company to respond quickly to market trends and deliver fresh merchandise to stores regularly.

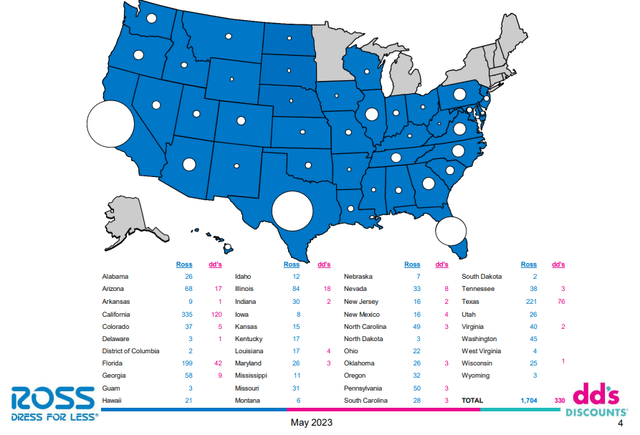

In conjunction with this strong business model, growth has been driven by store count. Over the last decade, ROST has significantly expanded its store footprint and entered new markets. The company’s expansion into underserved areas and strategic store placement (reaching key demographics) contributed to strong sales growth.

ROSS DD’S reach (ROST)

A key weakness many have suggested is the rise of e-commerce and the “death of the department store”. We are not convinced. The ROST model does not work great online, due to availability and stock levels of products. Further, consumers are more than willing to visit ROST stores due to the value proposition discussed above (low prices, treasure hunting experience). For this reason, we believe ROST will remain surprisingly robust against this pressure, allowing continued store growth while many of its peers close down (19 stores opened and no closures in the most recent quarter).

This will allow the business to continually secure prime real estate, with a focus on locations with high traffic, broad income levels (Want a bargain vs. need a bargain), and strong co-tenancies.

Ross Stores competes with other off-price retailers and discount stores, including TJX Companies (T.J. Maxx, Marshalls) (TJX), Burlington Stores (BURL), Target Corporation (Target’s off-price section) (TGT), as well as more traditional fashion retailers such as Kohl’s (KSS), Nordstrom (JWN), Macy’s Inc. (M), and Dillard’s (DDS).

The Opportunity

Our investment thesis is based on the idea that we will see a continued deterioration/stagnation in consumers’ financial position relative to economic development.

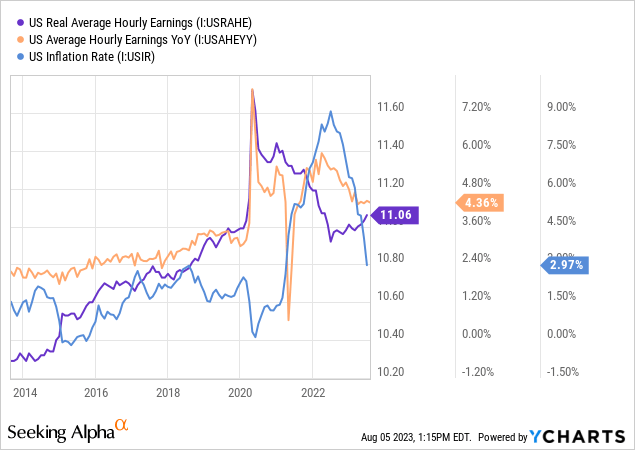

Firstly, current economic conditions are negatively impacting households. With heightened inflation and elevated interest rates, individuals have experienced an attack on finances as living costs rise, with wage inflation unable to keep up. This is encouraging a reduction in discretionary spending, as well as trading down (lower priced alternatives).

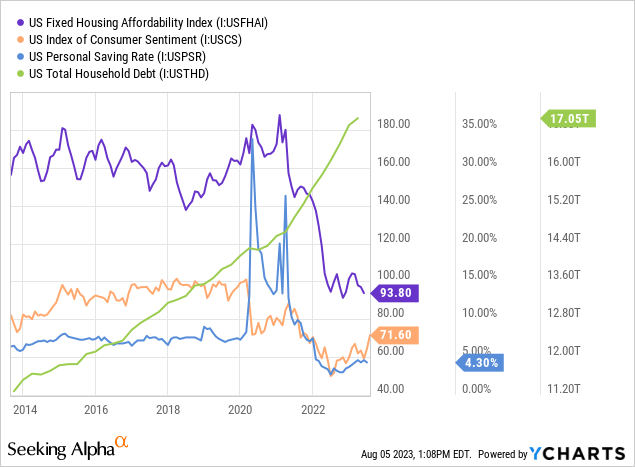

Furthermore, housing affordability has declined below 100 for the first time in the last 10 years, a stark development that suggests many across the US are unable to afford housing (The USFHA index is defined as: “Measures the degree to which a typical family can afford the monthly mortgage payments on a typical home. Value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home.”) This implies pressure to find cheaper accommodation, transitioning more American into a rent trap, and likely leading to reduced spending.

An individual facing financial issues is understandably going to reduce savings, or even utilized saved wealth to meet financial obligations, while potentially increasing debt if savings are not sufficient. Unsurprisingly, the US has experienced a noticeable reduction in the Personal Saving Rate and a rapid increase in the US Total Household Debt levels (which overarchingly has been on an upward trend post-GFC, suggesting a societal reliance on debt to fund lifestyles).

Overall, Consumers are in a tough spot, as illustrated by Consumer Sentiment, which despite bouncing back from a decade low, remains at an unhealthy level. These factors will inevitably have a far-reaching impact in the coming years, similar to the higher rates of poverty and widening of the income/wealth gap between the top and bottom following the GFC.

Although ROST targets a wide variety of consumers, its key demographic is low-income individuals. This demographic, as well as the income bracket above, is being hit disproportionately harmed by the factors we have just discussed.

Although this analysis implies a reduction in spending by its core demographic, which we do believe is the case (despite successive quarters of growth), we expect this target demographic to increase in size, with the net impact being greater demand for ROST’s offering over the medium term.

Competitive position

ROST’s value proposition resonated with consumers seeking affordable fashion and home goods without compromising on quality. As disposable income comes under threat, many shoppers will turn to off-price retailers like Ross Stores to stretch their budgets.

ROST has developed a loyal customer base through effective marketing and word-of-mouth advertising. Positive customer experiences and the perception of “finding a great deal” helped build brand loyalty and attract new customers. This has allowed the business to create one truly leading brand, and another which is consistently developing not far behind.

Margins

Returning to our financial and commercial analysis, ROST’s margins have generally been on an upward trajectory, owing to a degree of economies of scale captured despite the tough competition.

In recent quarters, however, the business has seen erosion. This has been caused by inflationary pressures and softer demand, contributing to a decline in GPM. We do not consider this concerning yet, as the degree to which it has declined leaves scope for a bounce back once market conditions improve. The key is to ensure this does not degrade further.

Balance sheet & Cash Flows

ROST’s inventory turnover has dipped below 6x, implying a degree of slowdown not expected. This will act as a drag on cash flows but not overly so, so long as Management can get this level back above 5.7x quickly.

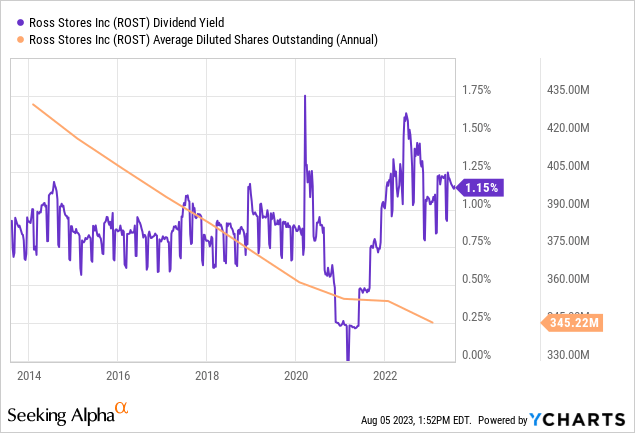

ROST is conservatively financed, with little debt despite its rapid growth. This has allowed the business to aggressively distribute to shareholders, with a dividend growth rate of 12% and consistent buybacks.

Outlook

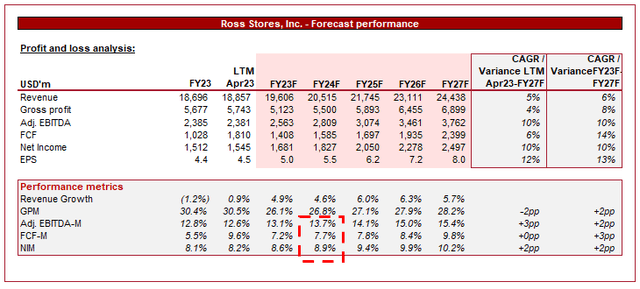

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a continuation of its strong growth, with a 6% rate into FY27F. In conjunction with this, margins are expected to gradually improve toward ROST’s prior levels. We think the margin assessment is slightly conservative.

In the near term, analysts are forecasting 4.9% growth in FY23F, an impressive level given the clear concerns about demand. This is an illustration of ROST’s resilience to economic conditions. The business is far less cyclical than one would expect.

Both assessments are reasonable and in line with our views.

Industry analysis

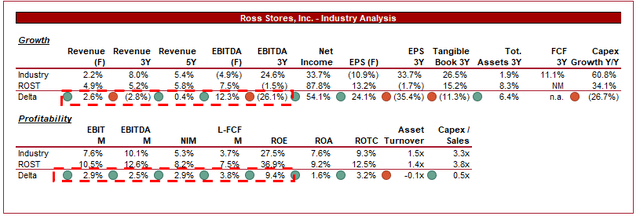

Apparel Retail Stocks (Seeking Alpha)

Presented above is a comparison of ROST’s growth and profitability to the average of its industry, as defined by Seeking Alpha (25 companies).

ROST performs well relative to its peers in our view. Growth is better than the average, primarily due to a combination of store growth and the commercial factors discussed above.

ROST’s true strength is in its margins, which are noticeably higher than the peer group. Importantly, it has a much higher ROE/ROTC, a key indicator for outperformance.

Based on the financial characteristics alone, we believe ROST warrants a premium valuation relative to its peers.

Valuation

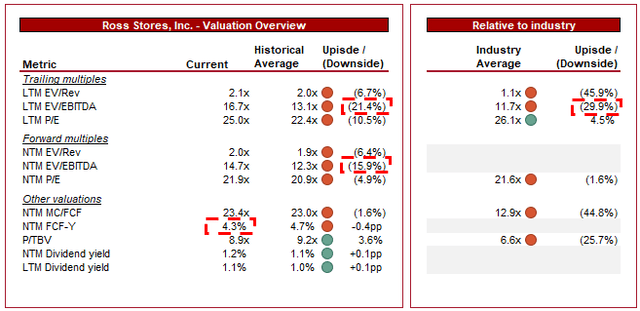

Valuation (Capital IQ)

ROST is currently trading at 17x LTM EBITDA and 15x NTM EBITDA. This is a premium to its historical average.

Our view is that ROST’s current position justifies a premium to its historical level, owing to its significantly larger scale, market share growth, industry tailwinds, resilient financial performance, and larger distributions.

As previously mentioned, a premium to its peers is also justified. On the financials alone, a 30% premium on an EBITDA level is slightly rich. This said, when you factor in its commercial attractiveness, we believe this is fair.

The key consideration is ROST’s resilience. The retail/fashion industry is incredibly competitive and cyclical. Both these factors are impacting ROST but to a far lesser degree, as illustrated by its growth and margin resilience, which is superior to similarly mature businesses. We have previously analyzed Kohls, Nordstrom, and Dillard’s, observing a weakness in their commercial position contributing to a consistent decline in relevancy.

Key risks with our thesis

The risks to our current thesis are:

- Margin improvement execution. Our thesis assumes ROST will achieve gradual improvement as inflationary pressures subside, despite the risk of a continued slide.

- Store expansion. Our assumption is that growth will be materially supported by new locations as previously achieved. This means continued opportunities in lucrative locations present themselves to Management.

Final thoughts

ROST is an incredibly attractive business that we think is a buy despite near-term economic weakness. The company has developed a strong reputation for selling highly desirable products at a discount, garnering a loyal following nationally. Underpinning this is operational excellence, a lucrative demographic, and high store growth. The two-brand approach gives the business greater optionality for growth, as well as expansion within its core expertise (efficient operations and sourcing of desirable products).

Our primary thesis is based on the continued growth of its key demographic, driven by economic weakness and an uneven allocation of wealth.

From a financial perspective, ROST stacks up well relative to its peers, with good growth and leading margins. The ability to generate improvement over the historical period is evidence the best is yet to come.

Read the full article here