Investment briefing

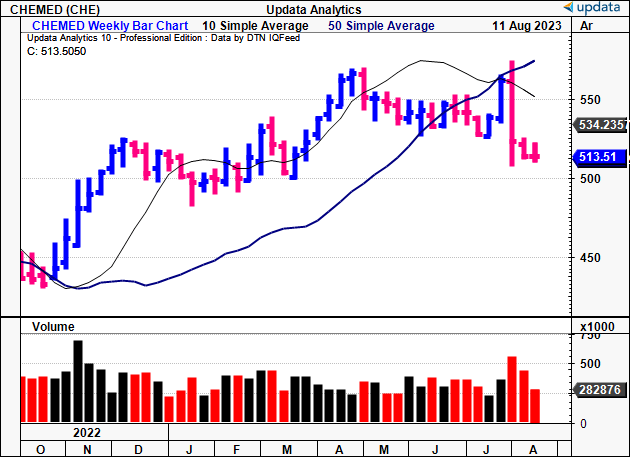

The equity stock of Chemed Corporation (NYSE:CHE) has rolled over since its impressive run in FY’22—’23 and there are now several updates to discuss. Chief among these are the company’s latest numbers for Q2 FY’23, and a detailed appraisal of its economic characteristics. In my last publication, I outlined the buy thesis in extensive detail, so I’ll be running through the more specific points in this profile of CHE.

CHE still offers tremendous value to unlock risk capital provided it can demonstrate 1) avenues to deploy surplus capital and/or 2) evidenced top-line growth above the market’s estimates. On valuation factors, I reiterate the company a buy into FY’24. But there are risks to the thesis that must be considered as well. These are discussed extensively here today. I would encourage investors to keep these in mind. Net-net, reiterate buy, retaining $10Bn estimated market value by FY’24, ~29% upside potential.

Figure 1.

Data: Updata

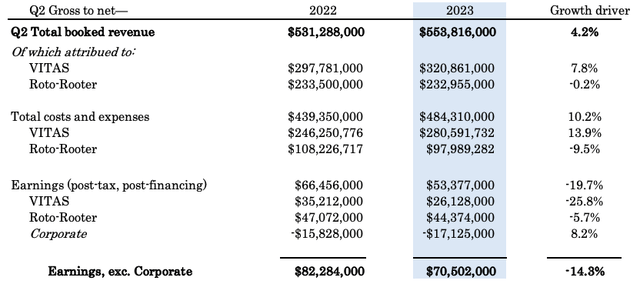

Deconstructing CHE’s Q2 numbers

As a reminder, CHE’s portfolio is broken into two segments—VITAS and Roto-Rooter. An informed appraisal is therefore required on each.

1. VITAS Q2 figures

Starting with VITAS’ Q2 numbers, it clipped revenues of $321mm, up 7.8% YoY. Growth was underlined by favourable unit economics, chiefly:

- A 6.2% increase in days of care

- Total admissions reached up ~600bps to 15,611. This comes to an avg. $20,562 per admission for the quarter.

- Average length of patient stay at 99.5 days, reasonable improvement from 108 days in Q2 last year, and slightly ahead sequentially from Q1 FY’23 (99.9 days).

- As such, avg. revenue per patient per day was up 1.78% to $197.02. Critically, this growth was evident across all the relevant segments, including routine home care and high acuity care, with average reimbursements of $172.91 and $1,031.5, respectively.

VITAS’ value equation involves 1) increasing total admissions, 2) reducing length of patient stay to promote admission turnover, thus 3) increasing the average revenue and profit per stay and per patient day. Hence, improvements in each of these metrics are conducive to the segment’s contribution margin and valuation shifting higher in my view.

One point that needs mentioning is on the Q2 gross profit—it tightened by ~100bps YoY due to the CMS re-implementing Medicare sequestration. This was largely expected. It came to ~32% for the quarter, and VITAS (58% of Q2 portfolio revenue) clipped $280.6mm in OpEx and $26.2mm in earnings for the quarter, down 26% YoY.

Figure 2.

Data: Author, CHE SEC Filings

2. Robo-rooter down YoY

Shifting focus to the Roto-Rooter business, it printed revenue of $233mm, down ~20bps YoY. The segment continues to be a drag on aggregate performance. Critically, commercial revenues within Roto-Rooter’s branch operations exhibited growth—$55.5mm in total, a 1.3% increase YoY. Notably, the growth pattern on this was mixed: Drain cleaning revenue decreased by 3%, plumbing increased by 5.4%, excavation expanded by 2.9%, and water restoration came up by 9.7%. In contrast, Roto-Rooter’s residential revenue faced a modest decline of 1.1% YoY.

Moving down the roto-rooter P&L, gross margin reached 52.3%, down 89bps YoY, on adj. EBITDA of $65.9m—down 4.5%. This was reflected in the adj. EBITDA margin compressing ~130bps YoY 28.3%.

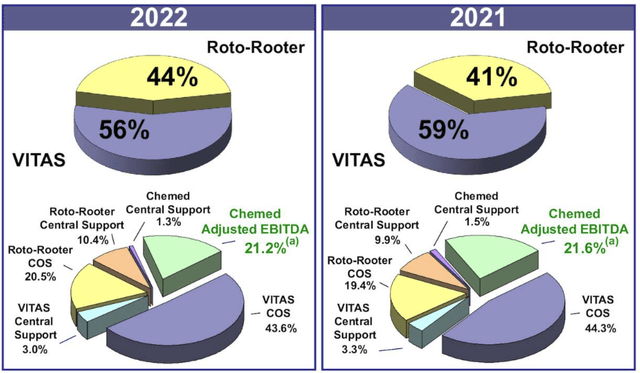

Figure 3. CHE full segment contributions, full-year, 2021 to 2022. This will be helpful in comparing the company’s FY’23 numbers.

Data: CHE Q2 FY’23 Investor Presentation

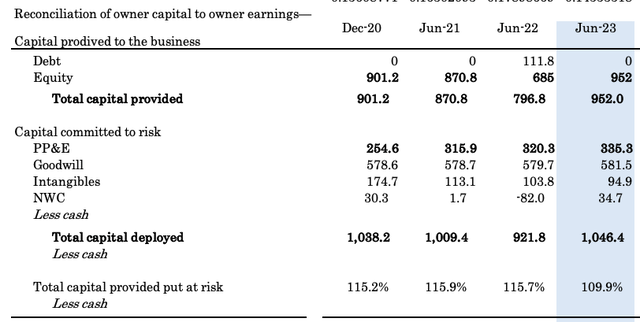

Reconciliation of owner capital to owner earnings

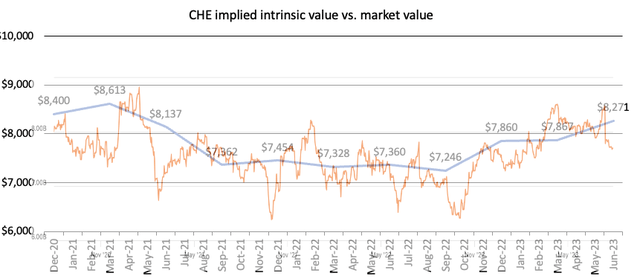

Analysis of CHE’s financials isn’t enough to discern the investment value in my informed opinion. The company has ~$1Bn of investor capital tied up in its operations and pays an annual $1.50/share dividend (0.31% forward yield as I write). Of this amount, it has $335mm put to work in tangible assets, ~$95mm in intangibles, and $35mm in working capital. The rest is tied to the capital charge on its recorded goodwill.

Figure 4.

Data: Author, CHE SEC Filings

Breaking down the economics on the cash CHE has put into its business growth, the following points are relevant:

- It has cycled back ~$0.70 in gross for every $1 in invested capital each quarter (TTM basis). This is quite attractive and demonstrates high gross capital productivity.

- It produced $240mm in trailing post-tax earnings on the $1Bn in capital at risk last quarter, down from $262mm in 2020 on roughly the same base.

- Critically, as it committed funds to new capital (net $53mm last quarter), it spun off $186mm in cash to its shareholders (TTM values), slightly off the $290mm last year, dividends included.

- It tells me the firm recycled 22% of earnings last period to grow the business by 7.8% at the top line, but this hasn’t yet pulled through to the shareholder level. This could be a tailwind moving forward once these investments start yielding additional earnings.

Figure 5.

Data: Author, CHE SEC Filings

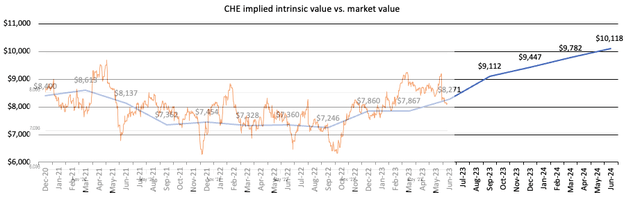

The company is actually tremendously profitable and has deployed capital at ~23—32% over the last 2 years on TTM values. At my required rate of return of 12% (long-term market averages), this is constructive.

CHE’s capital productivity strengths lie in its capital intensity and turnover rather than margin effects. You can see below the invested capital turnover for each period is ≥2x, whereas its post-tax margins are thin at ~11-13% over the last 2-3 years, illustrating this point. This should be factored in, and I’ll be looking to CHE’s sales growth extensively going forward.

In particular, management guide to ~10% revenue growth in FY’23, calling for $2.337Bn at the top line. Note, 9.5% of this is expected to fall on VITAS’ shoulders.

Taking the TTM numbers, this could post $256mm in post-tax income, otherwise 24% return on capital deployed and 2.3x capital turnover (as of the Q2 capital charge).

Figure 6.

Data: Author, CHE SEC Filings

Valuation

You’re asked to pay 25x forward earnings and ~17x forward EBITDA for CHE today. These are premiums, but evidence of what investors are willing to pay for the company’s future expectations. The company has also created $8 in book value for every $1 in market value. This fits the broad picture discussed here. You have a company that produces high rates of return on the cash it has tied up in the business, thus, the market recognizes the value of its asset base.

A firm can compound its intrinsic value at the function of its return on capital investments, and the amount of cash it deploys at these rates. Consequently, it needs 1) profitable investments to allocate to, and 2) more importantly, actual opportunities to invest in. Without the opportunities to deploy cash to grow the business, a corporation should at least return the surplus capital to shareholders by way of dividends or buybacks. CHE bought $13mm of its own shares back last quarter, and the dividend payout is just 7.73% of earnings. This is the key risk to my valuation estimates—that the lack of reinvestment into the business, earnings growth, and thin capital returns may hinder the market’s perception on the company.

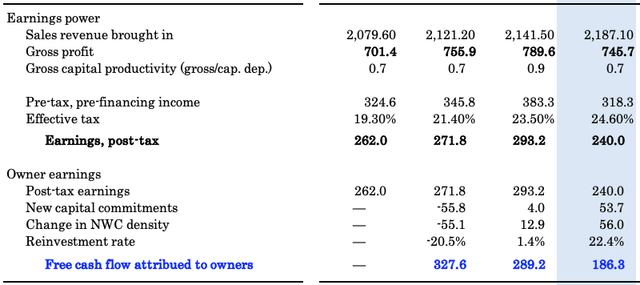

CHE has therefore traded in-line with my estimated fair value range over this time [Figure 7]. I’ve got the company priced at $8.2Bn on its latest numbers, or $551/share at the time of writing. The stock is therefore trading below the estimate of fair value.

Figure 7.

Data: Author, Seeking Alpha

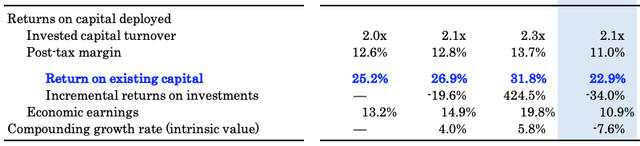

In the last CHE publication, I outlined the case for CHE to get to $10Bn in market value, ~$700/share. I had this by H2 FY’23, but its recent numbers have me pushing this out over the next 12 months or so. I am still eyeing this target and you can see the path represented graphically below.

Figure 8.

Data: Author, Seeking Alpha

In short

The analysis of CHE’s numbers and the economic characteristics warrant a reiterated buy rating in my view. For one, the returns on existing capital are tremendously attractive, pushing back >20% in trailing return each period. Its VITAS segment is also showing promise and continues to grow on a cumulative basis. The stock is defensible as well and has buyers at most levels of the 12-month price range. However, the key risks are as follows:

- The returns on capital outlined stem from capital turnover and thus rely on sales growth to add value. If CHE can’t achieve that at a reasonable cadence, the value-add might not be accretive to shareholder value.

- If there’s no opportunities to deploy the additional capital, CHE should at least up its dividend or buybacks (dividend especially).

- The market pays attention to these factors, and thus sentiment may be compressed if CHE can’t evidence a set of growth levers moving forward.

It is not a growth company, that’s for sure—but it needs to continue providing investors a catalyst to buy the stock, that is the risk I’m getting at here. Nevertheless, based on the bullish points raised here, plus my valuation estimates into the coming 12 months, I am reiterating CHE a buy, but watching this position very closely. Net-net, reiterate buy.

Read the full article here