In the competitive landscape of the energy sector, there are a plethora of metrics by which to judge a company. However, for Energy Fuels (NYSE:UUUU), the spotlight is firmly on its asset value, particularly their inventory. As investors and market analysts look for signs of strength and resilience, the company’s tangible assets and their potential future worth are hard to ignore. However, the current market dynamics show minimal revenue relative to the assets they have and an unprofitable business due to elevated SG&A expenses. Based off of these challenges and potential upside, we list UUUU as a hold. Here’s a closer look at Energy Fuels.

Distinctive Strengths:

UUUU

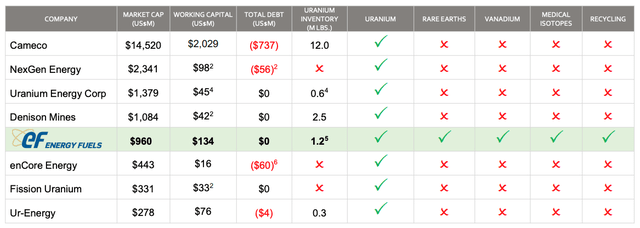

Energy Fuels is not just another name in the energy sector; its diverse product portfolio uniquely positions the company to tap into different market trends and demands. The company’s financial health is evident from its robust working capital of $134 million, coupled with the absence of any outstanding debt, ensuring agility in funding its operations and exploring new growth avenues.

Seeking Alpha

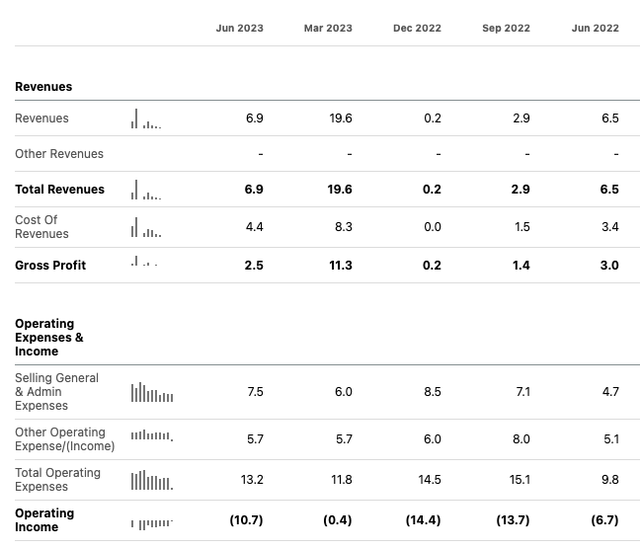

Energy Fuels, with its market cap currently hovering around the $1 billion mark, presents a perplexing financial narrative. The company’s revenues have been characterized by significant fluctuations within the range of $.2 Million and $19.6 Million per quarter. It’s not just the erratic nature of the revenues but also the minimal gross profits that deepen the conundrum. For a company of its size and valuation, one would anticipate steadier financials and larger financials. Instead, Energy Fuels finds itself in a position where its revenue story seems at odds with its market cap, and the gross profits don’t align with the expectations set by its billion-dollar stature.

In our opinion, the company’s valuation is purely buoyed by the assets management estimates at being worth approximately $1 billion. This includes a ready-to-go inventory which consists of 766,000 pounds of finished uranium, 900,000 pounds of finished vanadium, and 37 tons of rare earth carbon. In Q2 they sold 80,000 pounds of uranium for $4.3 Million or $54 per pound of uranium. Meaning that based off of that sale they have roughly $41 Million in Uranium and assuming a price of $11 per pound for the vanadium we see an additional $10 million. Management also highlighted that they have the ability to flex their Vanadium inventory IP to an additional 3 million pounds from their mill tailings solutions if needed. Based off of ready to go inventory, we estimate it to be worth ~$51 Million.

One of Energy Fuels’ standout features is its approach to infrastructure. By leveraging existing assets for new ventures, such as the Rare Earth Separation project, the company not only reduces costs but also accelerates project timelines. Their unique mill, capable of processing uranium, vanadium, and rare earths, combined with a phased production scaling strategy, speaks volumes of their preparedness for future market demands and their quest toward further vertical integration. Similar to MP, they are trying to “reshore” rare earth mineral production into the US and allied countries while simultaneously moving up the supply chain in to more finished product markets.

Inherent Risks and Challenges:

Like any significant player in a volatile market, Energy Fuels faces its set of challenges. The company’s profitability is heavily tethered to commodity prices, making it susceptible to market fluctuations. From a macro perspective, geopolitical disturbances, especially in uranium-abundant territories like Niger, have the potential to introduce turbulence in the supply chains and market dynamics. Such disruptions can have cascading impacts, reshaping pricing models and potentially unsettling established market equilibrium.

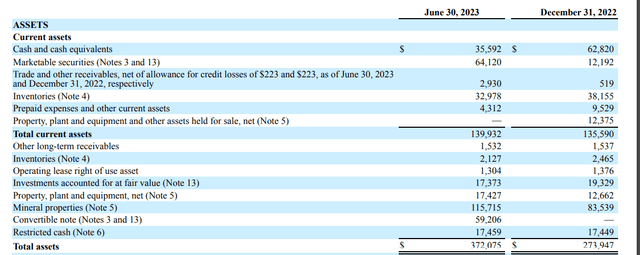

With UUUU having a such large operation, they will be able to potentially benefit significantly from any disturbances. Currently, the US portfolio alone can provide up to 2 million lbs of Uranium per year, with 3 additional plants having the potential to add another 4 million per year. For perspective, the US civilian plant usage was 40.5 million pounds in 2022. Meaning that, currently, UUUU alone could provide ~5% of the US’s total uranium needs. The challenge for UUUU is finding customers that are willing to accept that amount of Uranium. They recently announced that they signed a contract for a base delivery over the next 8 years of 3 million pounds of uranium or roughly 375,000 pounds per year. Which is ~10% of the capacity of their site. Also, while management mentioned $1 billion on their latest earnings call. The latest 10q only shows $372 million in assets on the books. While this level of discrepancy can be caused by a variety of reasons, we typically value companies more in line with what the books show vs what management says.

UUUU

In addition to this, as Energy Fuels shifts gears from a standby stance to active operations, the possibility of unexpected challenges or inefficiencies cannot be dismissed. One of the glaring areas of concern is the recent surge in G&A expenses. Though these are linked to expansion, it’s crucial to ensure they align with revenue growth. Lastly, with multiple projects in their portfolio, the risks associated with delays, unforeseen costs, or project setbacks are omnipresent.

Conclusion:

Energy Fuels presents itself as an enticing entity in the energy domain. As the sector continues its evolution, adaptable, strategically astute, and financially resilient companies like Energy Fuels are poised to potentially take the lead. For stakeholders and potential investors, a holistic understanding of both its strengths and challenges is crucial. At Scouting Stocks, we struggle to see upside potential from current prices. As we outlined in the beginning, much of the value here is in the assets that UUUU holds and not in the earnings of the company. With small and fluctuating revenue tied to commodities and with it being challenging for us to properly value UUUU’s assets, we struggle to be buyers at current multiples with an FWD P/E of 28+ and a price to book of 3.04. With the large inventory they have they will benefit greatly from any spikes in demand for their commodities which makes us interested in the company over the long term, and with a relatively low IV, this could be a potential options play for us in the future but as of right now we list UUUU as a hold.

Read the full article here