I covered Cogent Biosciences, Inc. (NASDAQ:COGT) in 2022, and I said that in a year, we will know more about the potential of this single-molecule company. Well, that year is “nigh,” so we should be able to figure out more.

Cogent is developing lead asset bezuclastinib, a KIT inhibitor, in various indications. There are numerous other KIT inhibitors in the market, so bezuclastinib needs to make a major effort distinguishing itself from its peers.

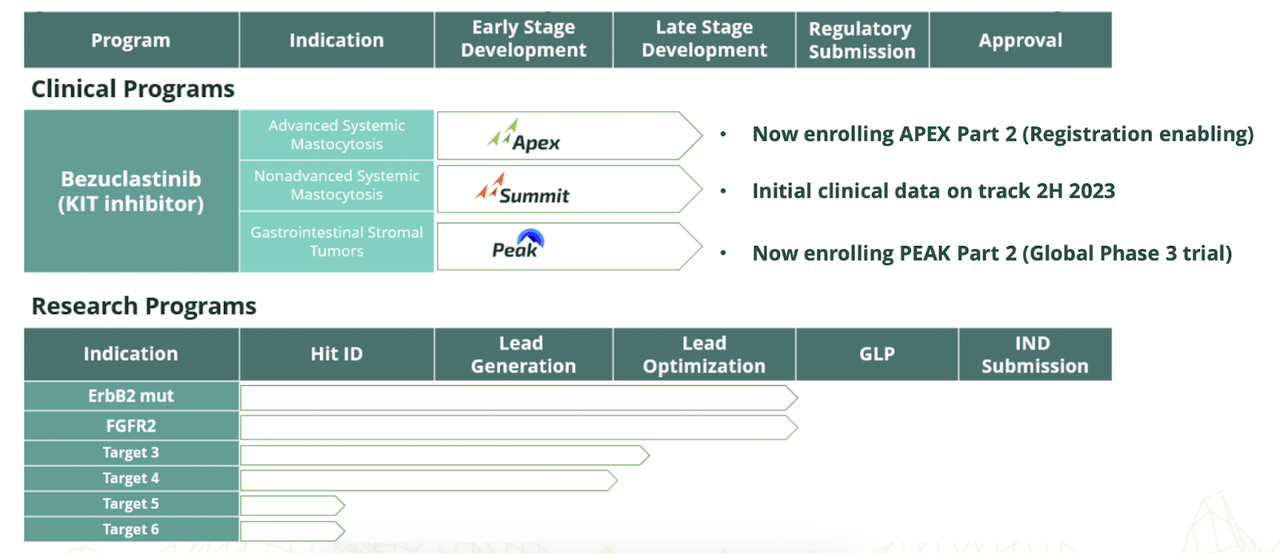

Here’s the entire pipeline:

COGT PIPELINE (COGT WEBSITE)

Cogent used to be a “deadbeat” company called Unum when, in 2020, it acquired this molecule from a privately held company, did a reverse split, and changed to Cogent. In an earlier trial in over 50 patients, bezuclastinib demonstrated anti-tumor activity in patients with advanced solid tumors including gastrointestinal stromal tumors (“GIST”). A confirmed objective response rate (“ORR”) of twenty percent was seen in these patients, including two partial responses and one complete response. There was an mPFS of 12 months. Cogent is taking bezuclastinib through a phase 3 trial called PEAK targeting GIST [ clinical update from lead-in portion of Phase 3 PEAK trial in 1H23]. There are two arms in this large, 426-patient trial, bezuclastinib plus sunitinib versus sunitinib alone. The trial is slated to topline in July 2025.

Besides this program, the company also has bezuclastinib being tested in varieties of mastocytosis. Last year, we saw them publish positive interim data from a phase 2 trial called APEX in Systemic Mastocytosis. This is where we left off last year, and the thrust of my coverage was that, given the vastly differentiated anti-KIT market, bezuclastinib needed to differentiate itself strongly for the company to have a “jus existentiae.” It’s been over a year now, the stock is up 30% now after more than doubling a few months earlier, so it’s time to see what’s going on with Cogent.

In November last year, the company presented updated clinical data for bezuclastinib in advanced systemic mastocytosis (AdvSM) at the American Society of Hematology Annual Meeting. Data from the Apex trial showed the following:

– 89% ORR in TKI-therapy naïve patients; 73% ORR in all evaluable patients with 27-week median follow-up

– Rapid and deep responses seen including first confirmed CR at 20 weeks; 77% of patients with at least 2 cycles of treatment had complete clearance of bone marrow mast cell aggregates

– Favorable safety and tolerability profile with no related cognitive effects or reported intracranial bleeding events

According to Needham’s Ami Fadia, this data demonstrated that bezuclastinib can do better than Blueprint’s Ayvakit, which is approved for AdvSM and GIST. The former can do better than the latter with similar safety in NonAdvSM and similar safety but better efficacy in AdvSM. Ayvakit generated $29mn in that quarter (Q3 2022), while Needham expects bezuclastinib 2030 sales to be upwards of $1.2bn. [ the NonAdvSM trial is called Summit, with initial clinical data in 2H23 from Phase 2 SUMMIT trial in NonAdvSM patients].

At ASCO this year in June, the company presented updated lead-in data from the ongoing phase 3 PEAK trial. Data showed:

55% Disease Control Rate (DCR) in heavily pre-treated GIST patients, including 100% DCR and 17% overall response rate (ORR) in efficacy evaluable 2nd-line GIST patients; data immature to estimate progression free survival (PFS)

Combination of bezuclastinib and sunitinib is well-tolerated and consistent with published sunitinib monotherapy safety profile

These ORR figures are very competitive compared to avapritinib, regorafenib or sunitinib, although they are not superlatively better. Also, the data is from just 39 patients, so they have a long way to go.

The company will present updated data from this trial, as well as from the Summit trial, in 2H2023.

Financials

COGT has a market cap of $1.04bn and a cash balance of $350mn. In June, the company raised $150mn in a secondary offering. Research and development expenses were $38.9 million for the second quarter of 2023, while General and administrative expenses were $8.2 million. At that rate, the company has a cash runway of 7-8 quarters, or into 2025.

10% of the company is held by the retail public, while 70% is held by institutions. Key holders are Venrock, RA Capital and others. There is very little insider activity, but the couple that there are, are buys.

Bottom Line

I am starting to like Cogent Biosciences, Inc. as an investment. Their KIT inhibitor is beginning to differentiate itself adequately, and although they raised large amounts of cash twice in the last 12 months, the market’s upbeat reaction to the dilution shows that people are beginning to take notice. I think a small pilot at the current prices is not a bad idea at all.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Read the full article here