Receive free Hedge funds updates

We’ll send you a myFT Daily Digest email rounding up the latest Hedge funds news every morning.

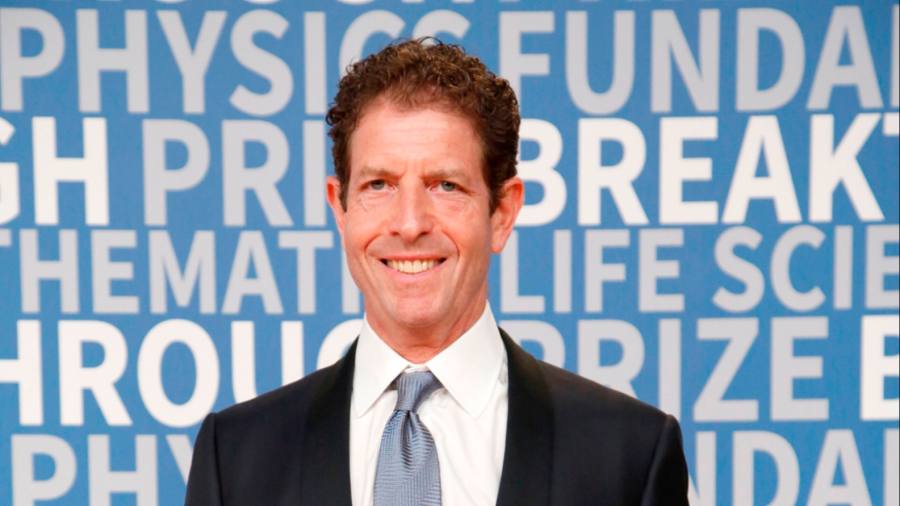

Daniel Och, the founder of Sculptor Capital Management and one of its largest shareholders, has come out against the hedge fund’s sale to Rithm Capital for $639mn, saying the deal undervalues the business.

The billionaire investor, who owns a 12.5 per cent stake in Sculptor, made public his position on the pending transaction in a letter sent to the board of directors on Wednesday.

“We believe that the transaction with Rithm substantially undervalues the company and penalises all shareholders for the board of director’s breaches of fiduciary duty and the lack of proper oversight that has repeatedly destroyed shareholder value,” he wrote in a letter also signed by other former executives.

The letter reignites the feud between Och and Sculptor’s management, which reached a boiling point last year when the two became enmeshed in a legal battle. Och had challenged the board on its decision to pay chief executive Jimmy Levin more than $145mn in 2021 despite what the investor said was “a period of less than mediocre performance”.

Sculptor and Och settled the lawsuit last year and the firm launched a sale process using a special board committee. The committee, which included Och, unanimously agreed to sell Sculptor in a move that was thought to put an end to the dispute.

Yet Wednesday’s letter revealed frustration at how the sales process had been run. Och alleged other potential bidders had been excluded and were still interested in making a higher offer for Sculptor than the $11.15 per class A share agreed by Rithm. Sculptor’s shares were up 0.9 per cent at $11.02 on Wednesday afternoon.

Rithm’s offer represented an 18 per cent premium to the fund’s closing price before the deal was announced, but is still a fraction of the $12bn valuation at which Sculptor, then named Och-Ziff Capital Management, listed in 2007.

Shares in Sculptor have declined significantly over the past few years. When still named Och-Ziff, the firm revealed it was under federal investigation into bribery in at least five African countries including Libya and the Democratic Republic of Congo. Och-Ziff paid $413mn to US authorities in 2016 to settle the charges and Och handed over reins to the firm two years later.

Wednesday’s letter from Och and other former executives said that they had been working with Rithm to try and change the terms of the deal, but had so far been unsuccessful. “Absent material changes to the proposed transaction, we will vigorously oppose this transaction,” the letter said.

Read the full article here