Introduction

Karuna Therapeutics (NASDAQ:KRTX) develops innovative treatments for psychiatric and neurological disorders. Their investigational drug, KarXT, targets schizophrenia and Alzheimer’s-related psychosis with a unique mechanism, differing from dopaminergic or serotonergic pathways, offering a potential new treatment option.

In my previous analysis of Karuna Therapeutics, I highlighted the potential of their antipsychotic drug, KarXT, to address schizophrenia’s treatment needs. The drug targets the cholinergic system, potentially treating both positive and negative schizophrenia symptoms with a better side effect profile. Although the Phase 3 EMERGENT-3 trial showed positive results, high TEAE rates and discontinuation rates raised concerns. I viewed KarXT as a promising investment due to its market potential and clinical results, but stressed caution given the need for more data and research. While the drug’s prospects were high, the EMERGENT-3 data, in my opinion, did not fully differentiate KarXT from existing treatments, leading to my “Hold” recommendation for Karuna.

The following article discusses Karuna Therapeutics’ development of KarXT, a drug targeting schizophrenia and Alzheimer’s-related psychosis. Analyzing the company’s financial health and upcoming clinical trial results, I recommend a “Buy” investment stance.

Q2 2023 Earnings

Looking at Karuna’s most recent earnings report, the company faced a net loss of $103.2M in the second quarter of 2023, a spike from the previous year’s $64.9M. This rise is largely attributed to increased expenses in research and development, particularly for KarXT clinical programs, NDA activities, and rises in employee numbers and stock-based compensation. Specifically, R&D expenses grew from $52.5M in the previous year to $92.5M this quarter. General and administrative expenses also saw a jump from $17.8M to $27.4M, influenced by pre-commercialization activities and similar rises in staffing and stock compensation. Positively, Karuna finished the quarter with a robust $1.4B in cash and equivalents, up from $1.1B at the end of 2022, strengthened by a successful public offering in March 2023. This capital is projected to sustain the company’s operations until the end of 2026.

Liquidity & Cash Runway

Turning to Karuna Therapeutics’ balance sheet, as of June 30, 2023, the company holds cash and cash equivalents of $263.6M, investment securities available-for-sale amounting to $1.17B, and other short-term investments totaling $2M. In aggregate, these liquid assets sum up to approximately $1.436B. Based on the company’s net cash used in operating activities over the six months ending on June 30, 2023, which stands at $164.8M, the average monthly net burn is around $27.5M. When dividing the combined liquid assets by this monthly net burn, the cash runway is estimated at roughly 52 months. Reviewing the overall financial position, Karuna Therapeutics appears to have strong liquidity given the sizable cash and investment balances. Furthermore, with total liabilities at just $52.5M, the company has minimal debt. However, considering the continual operational net loss, Karuna might need additional financing to maintain its operations in the long term.

Valuation, Growth, & Momentum

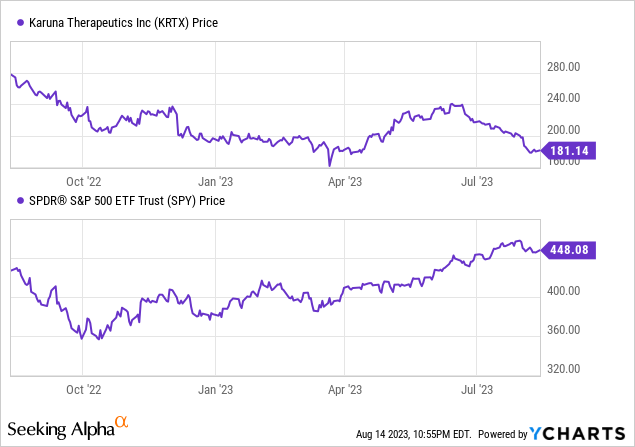

According to Seeking Alpha data: Karuna’s capital structure demonstrates a significant cash position relative to its market capitalization, with minimal debt. The enterprise value stands at $5.35B. In terms of valuation, with metrics like P/E being not meaningful due to negative earnings, reliance is on high multiples like EV/Sales at 889.25. The company showcases an impressive growth trajectory, as earnings estimates reflect a YoY increase of 1.75% in 2024 and a dramatic 48.88% in 2025. Sales projections indicate a drastic rise of 1,953.80% in 2024 followed by a substantial 309.47% in 2025, highlighting high investor expectations for regulatory approval and quick market adoption. However, stock momentum appears weak, with a one-year decline of 31.24% in comparison to the S&P 500’s gain of 6.10%.

KarXT: Karuna’s Novel Advancement in Schizophrenia and Alzheimer’s Therapy

Karuna Therapeutics leads in advancing drug candidates for psychiatric and neurological disorders, chiefly via KarXT, an oral M1/M4 muscarinic agonist.

For schizophrenia:

- KarXT is currently in Phase 3 trials, indicating a promising outlook for its market introduction. Its capacity to function both as a standalone and supplementary therapy broadens its therapeutic potential.

- Recent findings from the 2023 EMERGENT program have not only validated significant clinical score enhancements but also highlighted KarXT’s potential to revolutionize treatment. Particularly noteworthy is its ability to enhance cognitive function in patients, setting it apart in the schizophrenia treatment domain.

- With the EMERGENT-5 trial having concluded its participant enrollment and results from both EMERGENT-4 and -5 anticipated in 2024, there’s a swift momentum in clinical research progression.

- Upcoming data from the Phase 1b blood pressure trial may further reinforce KarXT’s safety reputation.

- Given its projected NDA submission in 2023 and a potential launch in 2024, KarXT, upon receiving FDA approval, is positioned to fill a substantial market void.

- Moreover, the expected ARISE trial results by the end of 2024 might further elevate investor trust, especially if KarXT demonstrates efficacy alongside current antipsychotics.

Karuna Therapeutics is gearing up for a potential KarXT launch for schizophrenia by late 2024, pending regulatory approval. They’ve recently initiated dialogues with the FDA about their New Drug Application (NDA), targeting a September submission. This will encapsulate clinical findings from EMERGENT-1 through -3 and the enduring safety information from EMERGENT-4 and -5. The company is set to collate and organize this extensive data for their submission. Safety details from current studies, such as the recent results from EMERGENT-4, -5, and the Phase 1b ABPM trial, will be integrated. They are also expanding clinical trial venues for the ARISE program, with results projected for the subsequent year. Should KarXT receive approval for schizophrenia, its launch as a novel supplementary treatment by 2025 could signify a significant leap in psychiatric care.

For Alzheimer’s disease-related psychosis:

- The ongoing ADEPT-1 trial, together with the forthcoming ADEPT-2 trial, exemplifies Karuna’s dedication to confronting this challenging facet of Alzheimer’s. Considering the scarcity of effective treatments for Alzheimer’s psychosis, the introduction of KarXT could be transformative.

- Outcomes from ADEPT-1 and -2, projected for 2025, might significantly modify the Alzheimer’s treatment approach if they’re positive.

- The commencement of the ADEPT-3 open-label extension trial in 2023 further emphasizes Karuna’s commitment to understanding KarXT’s prolonged advantages and safety.

My Analysis & Recommendation

In assessing the viability of Karuna Therapeutics and its trailblazing drug candidate, KarXT, several indicators suggest promise. While financial metrics, like the significant Q2 net loss, raise eyebrows, they’re largely due to increased R&D investments and strategic operational expansions – expected expenses for a company on the cusp of a major product launch. The company’s robust liquidity position, with cash reserves expected to sustain operations until 2026, speaks volumes about its financial prudence and forward-thinking approach.

KarXT’s potential to treat both schizophrenia and Alzheimer’s-related psychosis is profound. Upcoming results from EMERGENT-4, -5, and the Phase 1b ABPM trial are eagerly anticipated, with positive outcomes possibly heralding KarXT as a revolutionary treatment in the psychiatric domain. If approved, KarXT’s market entry could be transformative, addressing significant unmet needs and driving significant revenue.

However, like any investment in the pharmaceutical sector, there’s inherent risk. Clinical results, regulatory approvals, and market reception can all influence KarXT’s ultimate success. Given the promising projections and Seeking Alpha data, expectations for the company’s growth trajectory in 2024 and 2025 are substantial, but stock momentum, as evidenced by the one-year decline, highlights the need for investor vigilance.

In the coming months and years, investors should closely watch for key data readouts, particularly from the EMERGENT and ADEPT programs, which could provide clarity on KarXT’s differentiation and competitive edge in the marketplace.

In conclusion, considering Karuna Therapeutics’ solid liquidity position, promising clinical prospects, and the anticipated differentiation of KarXT, I’m adjusting my investment recommendation to “Buy”. This decision is rooted in confidence that the upcoming key data readouts could offer a distinctive advantage, making Karuna Therapeutics an attractive proposition for forward-looking investors.

Risks to Thesis

When the facts change, I change my mind.

While I’m bullish on Karuna Therapeutics, it’s imperative to highlight potential risks:

-

Clinical Trials: The success of KarXT hinges on favorable clinical trial results. Any adverse outcomes or unforeseen side effects in the upcoming trials could jeopardize its approval and market potential.

-

Regulatory Approval: Even with promising trial data, FDA approval isn’t guaranteed. Unexpected regulatory hurdles or delays could stall KarXT’s market entry and impact revenue projections.

-

Market Reception: Once launched, KarXT’s success depends on its market reception. Challenges in pricing, adoption, or competition from other treatments could constrain sales growth.

-

Operational Expenses: Karuna’s recent surge in R&D and operational costs, if not matched with timely revenue generation post-KarXT launch, could strain the company’s robust liquidity position.

Read the full article here