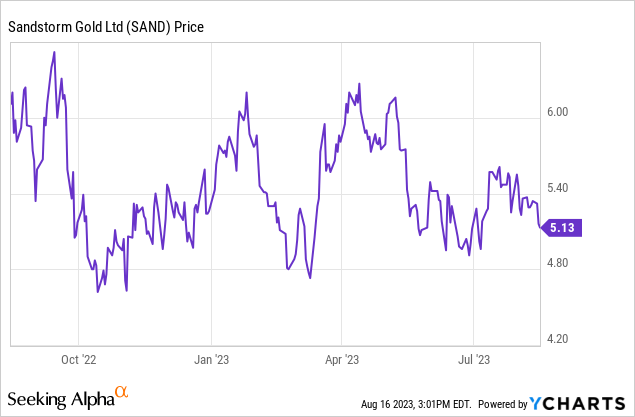

Sandstorm Gold Could Be in Trouble

YCharts

This is an update on Sandstorm Gold Ltd. (NYSE:SAND), a stock I previously recommended selling on May 9. Readers should also note that I’m a former shareholder (mostly between 2010-17) and have been following the company since its inception.

My reasoning for the sell call was based on the company’s consistent underperformance against its peers, driven by a series of what I feel have been strategic errors. These include a delay in the start of production at the Hod Maden gold mine, diluting investors to finance the Nomad Royalty acquisition, and taking on massive debts (at now high interest rates).

Since my SELL call, Sandstorm’s underperformance has continued, with the stock falling 14.81% compared to a 7.35% increase in the S&P 500.

The latest quarterly results for Sandstorm Gold highlights an ongoing pattern. Despite generating record revenue and cash flow, the company is failing to create per-share value for its shareholders.

Further complicating matters, Sandstorm’s substantial debt, largely incurred from the Nomad Royalty takeover, is putting the company in a precarious position. The situation is potentially exacerbated by the possibility of lower copper prices in 2023/24 – a factor that might negatively impact Sandstorm’s partner, Horizon Copper, in which the company holds a significant convertible debenture.

Q2 Results: Surface Looks Solid

At first glance, Sandstorm Gold’s Q2 2023 results seem strong, with several key highlights:

- Record revenue of $49.8 million, up from $36.0 million in Q2 2022.

- Gold production of 24,504 attributable gold equivalent ounces (up from 19,276 ounces in Q2 2022).

- Strong operating cash flow of $38 million (up from $21.9 million in Q2 2022).

- Low cash costs: Average cash cost per attributable gold equivalent ounce was $228, resulting in cash operating margins of $1,744 per ounce; this was an improvement from the $273 per ounce cost and $1,593 per ounce margin in Q2 2022.

- Positive net income of $2.7 million.

- Sandstorm also mentioned that it purchased and canceled approximately 2.8 million common shares under its share buyback program.

But Look Closer

Despite these positive figures, a deeper look reveals significant concerns:

Lower cash flow per share. The recent quarter’s net income per share was just a penny. While operating cash flow was $42 million, this translated to only $.14 per share. Comparatively, last June, the company generated $33 million in operating cash flow or $.16 per share, so on a per-share basis, it did not perform as well.

This is largely due to Sandstorm’s liberal approach in using its stock and taking on substantial debt to finance acquisitions of new streams and royalties.

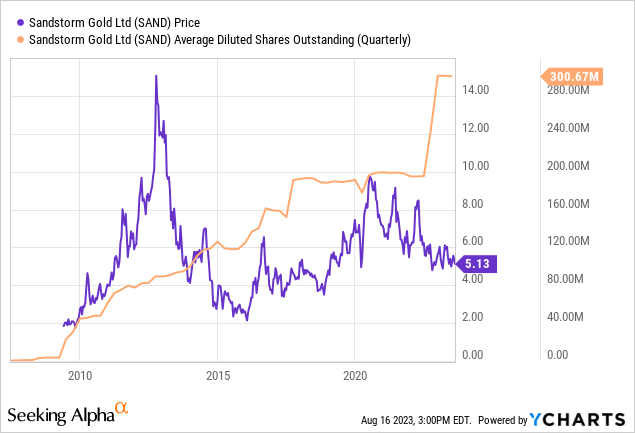

Share dilution. The company’s share count has ballooned from 205.7 million in Q2 2022 to 296.15 million in the recent quarter. Sandstorm says that it used funds from share capital to finance acquisitions of streams and royalties, and to pay down debt.

Since 2010, its share count has exploded from under 40 million to ~300 million as it largely tapped into the equity markets to help grow its business.

YCharts

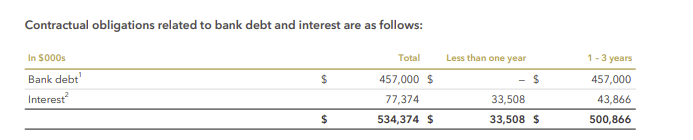

Debt risk. At the close of the recent quarter, the company was burdened with $457 million in bank debt, with a maturity date of Oct. 6, 2025, and only $25 million in accessible cash and short-term investments.

This is a key reason why I think the money spent on share buybacks this past quarter could be a big mistake.

Sandstorm Gold

While Sandstorm holds ~$239 million in other investments, most of this is not readily available or guaranteed to hold its value – such as the $149.1 million in a convertible debenture on Horizon Copper (OTCPK:RYTTF), a company it spun out.

Horizon’s small market cap ($49 million), and the potential for lower copper prices in the near term if the U.S. enters a recession, could put that investment at risk.

The terms of the bank debt also carry an unfavorable interest rate of SOFR (5.30%) plus 1.875%-3.5% per annum, or 7.175% – 8.80%. Sandstorm is getting hit hard by the rising interest rate environment.

Legal challenges. Adding to these financial concerns is a legal proceeding initiated against Sandstorm in a Brazilian court. The lawsuit involves roughly ~$8 million in severance claims owed to former employees of a Brazilian subsidiary company of the now-defunct Colossus Minerals.

Sandstorm says it plans to defend itself and says the case lacks merit. But I think it’s yet another layer of uncertainty that could impact the company’s financial stability and reputation among investors.

Trouble Brewing With A Key Asset?

Sandstorm’s largest contributing asset in Q2 was the Mercedes gold and silver mine, from which it receives specified quantities of gold and silver at particular percentages of the spot price.

Sandstorm gets 29,400 ounces of gold over 49 months @ 7.5% of spot price, and 100% of silver production @ 20% of spot price. It invested $60 million in total in the deal back in 2021.

However, this key asset has shown instability recently. The mine, owned and operated by Bear Creek Mining (OTCQX:BCEKF) – a junior miner valued at $60.2 million currently – faced delays in development during the first quarter of 2023, which negatively impacted its Q2 operations.

While Bear Creek says it is now focusing on cost reduction, the all-in sustaining costs were $1,670/oz last quarter, and only $4 million was produced in operating cash flow during Q1.

Bear Creek has implemented changes to mining methods, aiming to reduce costs by up to 20% throughout 2023, but the situation at Mercedes still reflects poorly on Sandstorm. Time will tell if this deal will work out, or if it’s another bust for Sandstorm.

Sandstorm Gold: It’s Still Not a Buy

Sandstorm Gold is not creating shareholder value. I believe it’s highly possible, if not likely, that given Sandstorm’s high debt, and uncertainty with key assets (namely, Mercedes), that it may tap into the equity markets yet again to raise money at some point in the future.

I believe that further dilution of shareholders may exacerbate the company’s challenges and lead to continued underperformance in the market. Therefore, I’m maintaining a SELL rating on Sandstorm Gold Ltd. stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here