Investment Thesis

I expect Nexstar Media Group to see upside from here, owing to continued Distribution Revenue growth as well as an anticipated recovery in Core and Political Advertising Revenue.

In a previous article back in May, I made the argument that Nexstar Media Group (NASDAQ:NXST) could see further upside going forward, on the basis of a strong rebound in Distribution revenue as well as an attractive P/E ratio.

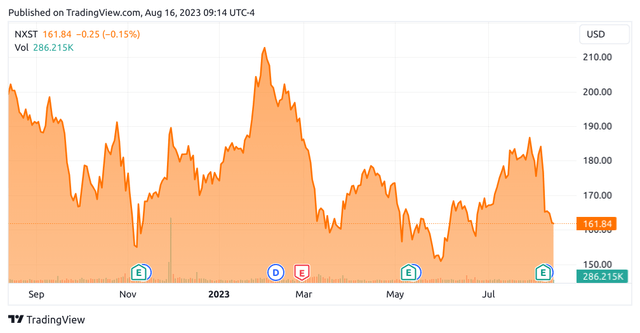

Since then, the stock has ascended to a price of $161.84 at the time of writing:

TradingView.com

The purpose of this article is to assess whether Nexstar Media Group has the ability to see continued growth from here taking recent performance into consideration.

Performance

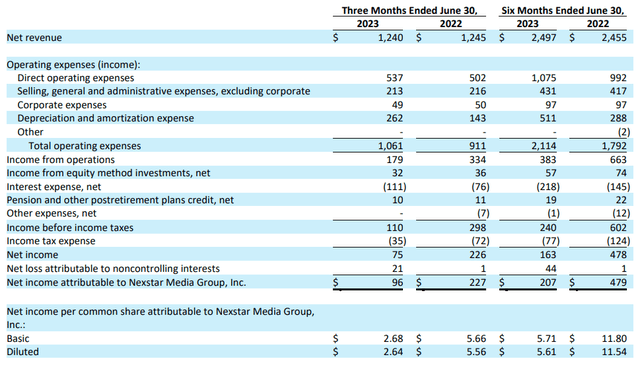

When looking at the most recent earnings results for Nexstar Media Group, we can see that while net revenue remained at virtually the same level since June 2022 – diluted net income per share saw a substantial drop from $5.56 in June 2022 to $2.64 in June 2023.

Nexstar Media Group: Q2 2023 Earnings Release

This was due to both higher operating expenses as well as higher interest expenses reducing net income available to Nexstar.

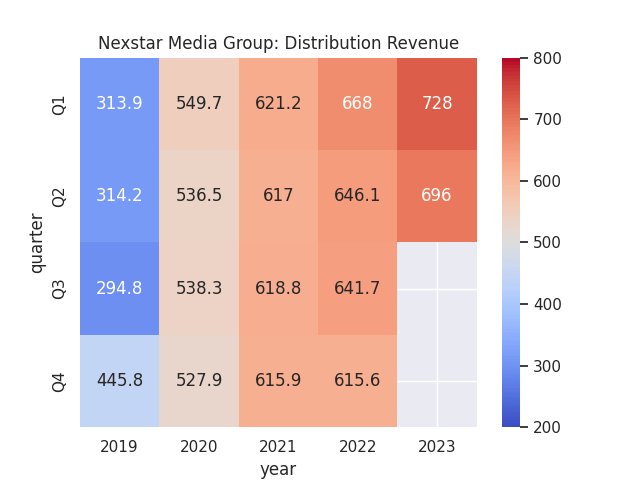

Moreover, when looking at distribution revenue specifically – we can see that the $696 million recorded for Q2 is still significantly higher than that of the same quarter last year – yet lower than the $728 million recorded for Q1 2023.

Figures sourced from historical Nexstar Media Group quarterly reports (Q1 2020 to the present). Heatmap generated by author using Python’s seaborn library.

Growth since Q2 2022 has been driven by both the renewal of The CW Network as well as growth in virtual MVPD revenue and the renewal of distribution agreements in 2022 with improved terms, and which represent more than half of the subscriber base for Nexstar.

Across other segments, Core Advertising revenue saw a slight drop by 2.2% to $404 million from $413 million in the same quarter last year, while Political Advertising saw a sharp drop from $87 million to $9 million over the same period. However, this was expected for the latter segment – as given the absence of any major political elections in the United States for 2023 – Political Advertising revenue is markedly lower than would usually be the case during periods of heightened election activity.

My Perspective

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, the fact that distribution revenue has continued to grow from that of last year and the company has managed to renew existing distribution agreements on improved terms is quite encouraging – as this allows a buffer against the decline that we have been seeing across the Core Advertising and Political Advertising segments.

With regard to such segments, Political Advertising is expected to see substantial growth heading into 2024 in preparation for the U.S. Presidential Election later that year. As for Core Advertising, continued softness across the national advertising segment was the primary reason for the decline in Core Advertising revenue from the same quarter in the previous year.

This largely reflects uncertainty in economic conditions – companies are more reluctant to increase their advertising budgets in a climate where demand may yet fall and ROI on campaigns will thus be lessened. With that being said, leading ad-buying firm Magna reported that the market is still expected to see a record high of $326 billion for 2023, as a result of continued strong growth in digital advertising across mobile and social media.

However, the company also cautions that growth across traditional media outlets such as print, TV and radio – with local television in particular forecasted to see a 21% decline for this year.

Risks and Looking Forward

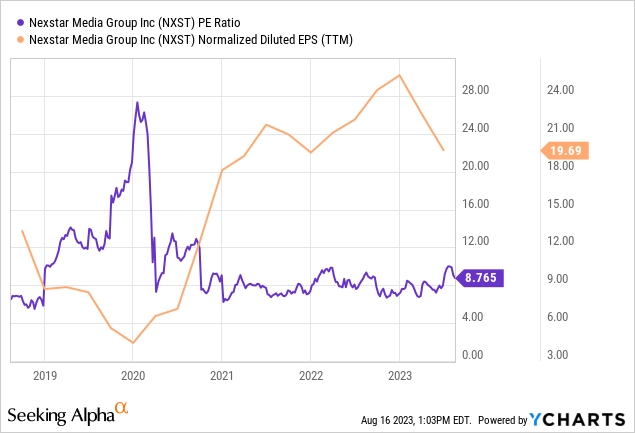

From an earnings standpoint, we can see that while the P/E ratio has continued to remain near five-year lows, earnings per share has declined from highs seen earlier this year – reflecting higher expenses and lack of growth in net revenue – due to a drop in Core and Political Advertising revenue.

ycharts.com

In terms of the potential risks to Nexstar Media Group at this time, the continued threat of digital advertising to traditional media outlets such as television could pose a competitive threat to Nexstar Media Group, and it might be possible that growth in Core and Political Advertising may be more modest than in previous years going forward.

With that being said, it is my own view that the decline across these segments is more a reflection of uncertainty on the part of advertisers as well as a quiet year on the political front. I take the view that the upcoming U.S. Presidential Elections next year will be a major driver of advertising revenue and demand for traditional channels including television will see a substantial increase.

Conclusion

To conclude, Nexstar Media Group has seen continued growth across Distribution Revenue – its largest segment. While 2023 has been a quiet year on the political front and advertisers have been more cautious with budgets – I take the view that 2024 will be a significantly different environment given the election year and I would expect a significant rebound in both Core and Political Advertising revenue.

For these reasons, I continue to maintain a bullish view on Nexstar Media Group.

Read the full article here