Receive free Daniel Och updates

We’ll send you a myFT Daily Digest email rounding up the latest Daniel Och news every morning.

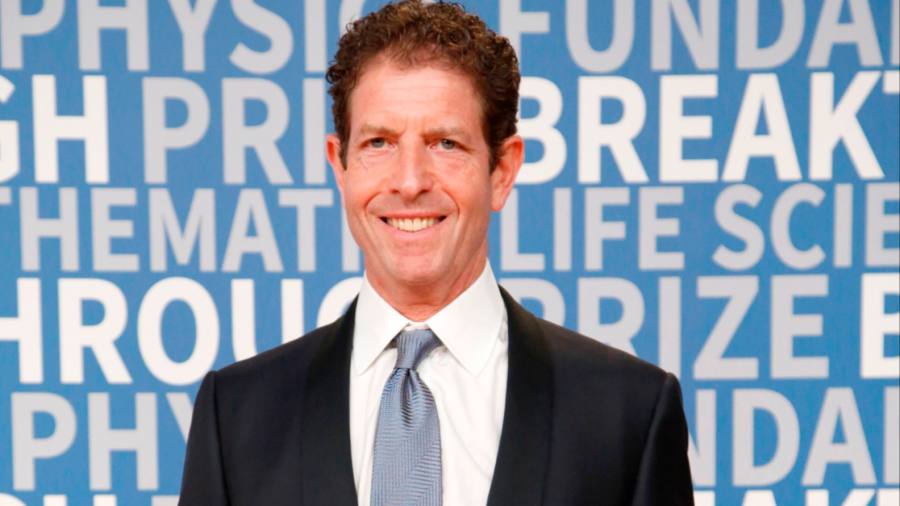

Dan Och became a billionaire by understanding the unsentimental finality of a trade. Now his feelings may be getting the better of him. On Wednesday, the prominent US investor sent a broadside to the board of Sculptor Capital Management — née Och-Ziff. He alleged that a July buyout price, which valued the fund manager at $639mn, represented “breaches of fiduciary duty”.

Och has quarrelled with Sculptor’s management for years. In particular, he objected to the $145mn chief executive pay package in 2021. A lawsuit he filed against the company was settled with an agreement to pursue a sale. The resulting deal is now the subject of his ire.

Sculptor has struggled for years. It has been a longtime zombie relative to its $12bn initial public offering valuation in 2007.

Och accuses the board of engineering a deal with the buyer, Rithm Capital, that paves the way for a smooth landing for the company’s top brass. US public companies are, however, difficult to steal, particularly ones facing the scrutiny that Sculptor does. Traders know public markets are almost always efficient. They expect Och, who owns 12.5 per cent of Sculptor, to be reminded of that cold reality.

The deal price represented a decent 31 per cent premium to Sculptor’s undisturbed stock price. Rithm’s shares have stayed flat, suggesting it secured no sweetheart deal. A majority of shareholders must vote in favour for the transaction to close, though existing management has agreed to use their 26 per cent stake in favour.

Even after a deal is signed, higher bids can arrive. Rithm’s effort to set a market clearing price is protected by a $22mn termination fee. Public companies are required to wring out the highest price for shareholders.

Filings will soon divulge in detail how the Rithm deal came together. Och can still sue later for damages even if the deal closes. But, as he knows, it is virtually impossible to prove one dissident is correct when almost everyone else has taken the other side of the trade.

Read the full article here