You’ll often see the common advice that younger investors should ignore high yielding assets and instead, put their cash into growth oriented stocks. While I generally agree from a total return perspective, I think it’s important to determine what the overall goal of your portfolio is.

Me personally, I aim for a hybrid approach between total return but also capturing some income. The psychology of seeing dividends hit my account do wonders for my motivation to continue aggressively building my investment accounts.

In the case of Eagle Point Credit (NYSE:ECC), the yield is too juicy to ignore. A 17% yield that is covered by a strong cash flow as well as a diverse credit portfolio in this high-interest rate environment, make this an attractive candidate for me. Here we will discuss why I think ECC should be considered.

Overview

Eagle Point Credit is a Closed-End Fund invested in Collateralized Loan Obligations (CLOs). CLOs securitize corporate loans. Securitization entails splitting loans for sale. Instead of a single investor owning a loan, a batch of similar loans are grouped together and sold in segments investors, divided into “tranches” by seniority to suit varying risk profiles. As borrowers repay, senior tranches are prioritized, followed by junior tranches, with the “equity” tranche receiving remaining funds. I like ECC because following this structure, a majority of their loan structure is classified as senior secured debt which adds a layer of security to the fund.

The Market ECC Operates In

From shopping at Albertsons (ACI) or picking up a Whopper sandwich from your local Burger King, the average person rarely thanks about the source of the money fueling these companies’ operations and services. Firms like ECC operate in an area parallel to banks.

ECC’s Investor Presentation

These loans are bundled and held by private or retail investors, making it accessible to own a piece of the economy by investing in these portfolios.

ECC’s Investor Presentation

We can also see that ECC has a well-diversified industry mix of underlying obligators. Leading with 11.5% of Tech, followed closely by 7.4% in Media and 5.8% in Healthcare. The top 10 loan obligators exposure has also seen some shuffling since last year to strengthen the sense of diversity. In Q1 of 2023, the top 10 obligators accounted for 6.27% of their total portfolio. As of the latest report, Q2’s number sits at 5.68% so they are treading in the right direction in terms of industry exposure. I would personally love to see an even more diverse set of obligators and if that were to happen, I would feel more comfortable making this a larger part of my portfolio.

Q2 Results – Strong Cash Flow Supports Dividend

During the latest Q2 earnings call, it opened strong with the following statement:

Our recurring cash flow in the second quarter was 27% larger than our recurring cash flows in the first quarter. We also continue to proactively manage our CLO equity portfolio by taking advantage of attractive secondary market opportunities. CLO equity investments purchased during the second quarter, had a weighted average effective yield of 20.8%. And as of quarter end, our CLO equity portfolio had a weighted average remaining reinvestment period of 2.7 years. As we have stated in the past, we believe keeping our weighted average remaining reinvestment period as long as possible is one of our best defenses against future market volatility. – Thomas Majewski

For the second quarter of 2023, the company recorded net investment income, net of realized losses of approximately $3 million or $0.05 per share. This compares to NII and realized losses of $0.32 per share in the first quarter of 2023 and NII and realized gains of $0.43 per share for the quarter ending June 30, 2022. – Kenneth Onorio

Despite mixed news, steady cash flow covers upcoming distributions so there is no concerns about a dividend reduction. In fact, ECC has already announced supplemental dividends through December. The positive news includes $53.7 million in recurring cash flows during the quarter, easily supporting the next 3 months of $0.16 distributions. $30 million in net capital was also deployed into new CLO investments which should contribute to a more profitable future.

While the mentioned net investment income decline quarter-over-quarter due to realized losses isn’t a good thing, the focus on recurring cash distributions from CLOs is key. It’s important to note that losses of $0.05 per share is a significant decrease from the prior quarter’s $0.32 per share loss. Although, let’s also note that this is a significant different from June 2022 where there were realized gains of $0.43 per share. This is something we plan to keep an eye on.

Risks

As I previously mentioned, I like ECC because the majority of their loan portfolio is structured with senior secured loans. This means that if the market were to collapse, there is a greater chance of ECC recovering their loan balances.

ECC’s Investor Presentation

Historical data shows us that senior secured loans have a recovery rate just shy of 70%. While this is suitable for me, it’s important for you to gauge what your own personal risk tolerance is. In the event of economic headwinds, the outcome may be different from what the data shows us.

According to ECC’s latest Q2 Investor Presentation, their portfolio consists of primarily senior secured loans that have an average B-rated classification. Anything rated under BBB is referred to as “Junk Bonds”. Forward looking, I would stay away if you are concerned about any strong downward headwinds.

Valuation

Closed End Funds need to be viewed differently than more traditional funds. They are unique because the price can be drastically different from what the underlying NAV is (Net Asset Value). Therefore, in terms of valuation it is very difficult to determine what’s a fair price.

Instead, we can see take a look at the historical data and look at the trend between the NAV and price action and determine what an attractive entry point would be.

CEF Connect

We can see that over a 5-year period, the price has always traded at a premium to NAV. This can happen for a variety of reasons: the management team has a great track record or it can be related to the holdings within the fund for example.

CEF Connect

The price is currently trading around the 52 week average premium so in my opinion, I feel comfortable adding shares at these levels. I think the recent downward price movement over the last few weeks have created an ample buying opportunity.

Limited Upside But High Total Return

It may be strange to recommend a stock that has very little upside movement. We can’t forget though that the dividend yield is currently 17% and supplemental dividends payments have already been confirmed throughout the remainder of the year. Announcing 3 months worth of supplemental payments is another reassuring metric to show that cash flow is strong for Eagle Point Credit.

Whether your returns are through distributions or capital appreciation, that is for you to decide. An investment like ECC is not suitable for the “traditional” investor as most of the return is coming through the high distribution. I personally love receiving a steady cash flow from my investments but maybe income is not a priority for you.

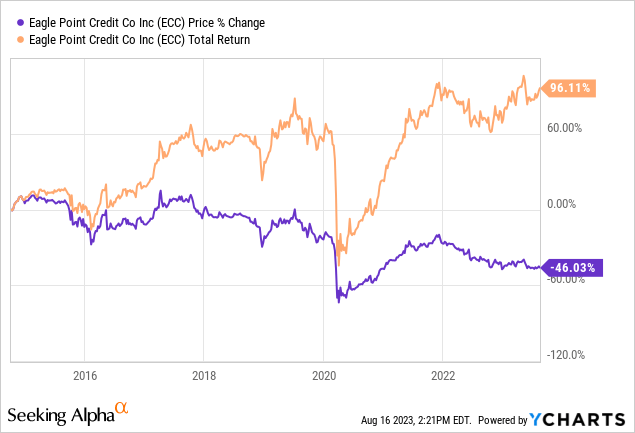

While the price may have declined substantially over the approximate 10 year period, we can see that your total return is over 96% over the same period because of the high distributions.

As long as the distributions can be covered, I will remain holding so that I can collect and reinvest a portion of the dividends received.

Conclusion

In conclusion, Eagle Point Credit presents a compelling investment opportunity through its focus on CLOs and the securitization of corporate loans. The senior secured nature of ECC’s loan portfolio adds a layer of security, and their diversified industry mix enhances stability. Despite some mixed quarterly results, ECC’s strong cash flow continues to support dividends, and the company’s proactive approach to managing CLO equity investments bodes well for its future profitability. While ECC’s stock price may not exhibit substantial upside, its impressive 17% dividend yield, supplemented by additional confirmed payments, makes it an attractive option for income-focused investors.

Read the full article here