Written by Nick Ackerman, co-produced by Stanford Chemist.

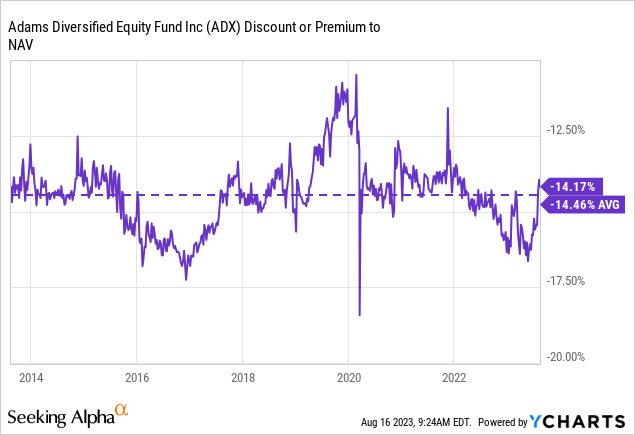

One of the main features of a closed-end fund is the fact that it can trade at discounts and premiums relative to their net asset value per share. The general idea is that a larger discount is relatively more attractive, and when a fund is trading at a premium, it isn’t so appealing. That being said, there is much more than the absolute discount or premium of a fund to make a determining factor. A fund can be at a large discount but still not be appealing.

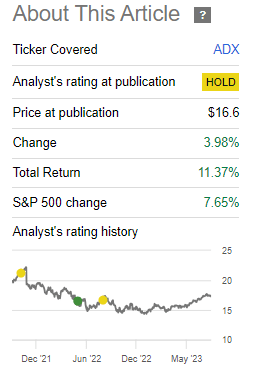

One of those examples currently is the Adams Diversified Equity Fund (NYSE:ADX). The fund sports a 14.2% discount. However, the fund is consistently trading at a deep discount and relatively speaking, it’s looking a bit pricey currently with the 1-year z-score of 2.02. The fund can still be fine to hold over the long term, and the discount could potentially be narrowed if an activist really pushed the fund. However, given the fairly sizeable $2.4 billion in managed assets, activists haven’t seemed too enthusiastic about pushing this fund to make some changes.

The fund generally follows similar performance to the broader S&P 500 Index. That being said, since our last update roughly a year ago, on a total return basis, the fund has outperformed the broader market.

ADX Performance Since Prior Update (Seeking Alpha)

The Basics

- 1-Year Z-score: 2.02

- Discount: 14.17%

- Distribution Yield: 1.16% (not counting the regular year-end “special”)

- Expense Ratio: 0.62%

- Leverage: N/A

- Managed Assets: $2.4 billion

- Structure: Perpetual

ADX’s investment objective is simply; “long-term capital appreciation.” The investment policy is quite straightforward as well. They intend to meet this objective by “investing primarily in large U.S. companies.” They also add that they “seek to deliver superior returns over time by investing in a broadly diversified equity portfolio. The Fund invests in a blend of high-quality, large-cap companies.”

Their “distinguishing characteristics,” as they say in their own words, are “internally managed closed-end equity fund with exposure to a broadly-diversified, sector-neutral, large-cap equity portfolio. Committed to an annual distribution rate of at least 6%.”

The fund’s expense ratio is rather low in the world of CEFs, with the industry average at 1.12%. The fund also isn’t leveraged, so there isn’t anything we have to worry about in terms of greater volatility or higher expenses due to rising leverage costs.

Performance – Deep Discount, Still A Hold

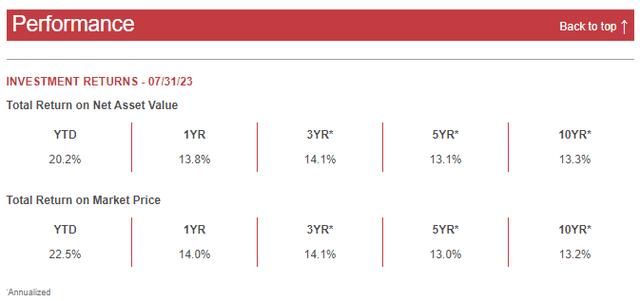

Over the long term, the fund has generally provided some fairly attractive results. This is to be expected as we know equities, as measured by the S&P 500, have done well as most of the last decade, we’ve been in a bull market mode.

ADX Annualized Performance (Adams Funds)

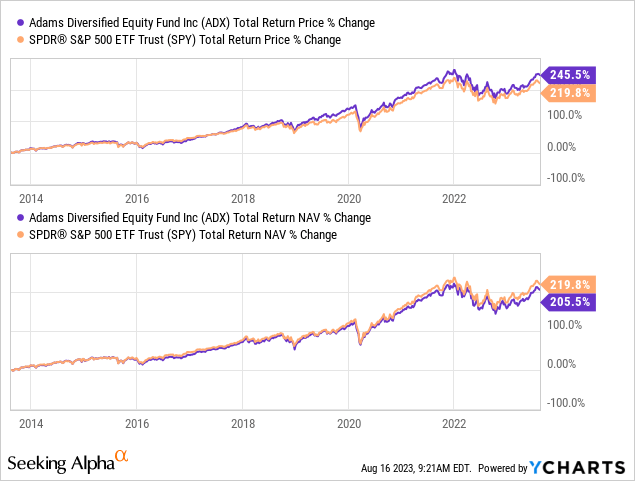

The chart below shows us just how similar ADX and the broader market have performed over the last decade. In this case, we are using the investible SPDR S&P 500 ETF (SPY) as the measuring stick.

YCharts

One way to benefit from investing in a plain equity CEF such as ADX to get a leg up would be the fund’s discount which could be worth exploiting. However, as we mentioned, if we are looking at the current discount relative to the last year, then we aren’t looking at an appealing option worth investing in today.

This holds true even when we look at the last decade’s average. The fund is trading right near its average. There were also certain periods where the fund’s discount narrowed even further, but those were fairly shortly lived events. Generally speaking, this discount doesn’t represent a time to buy, nor does it represent a time to have to worry about it being expensive either. Which is why it goes in the camp of getting a ‘Hold’ rating.

YCharts

Distribution – Managed 6% Minimum

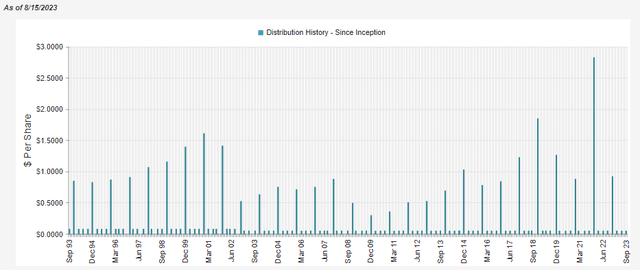

One other feature CEFs often have is a level distribution policy where you generally know what to expect from month to month or quarter to quarter. In this case, ADX implements its distribution strategy in a bit more unusual manner. In fact, I believe this is one of the reasons why the fund consistently trades at such deep discounts in the first place. The fund currently pays a regular quarterly distribution of $0.05 and then, at year-end, will top it off to meet its minimum 6% policy.

ADX Distribution History (CEFConnect)

While it might not be appealing to income investors, it does make sense how they implement it. As a regulated investment company or RIC, they are required to pay out almost all of their income or gains at year-end. If it isn’t year-end, then they don’t know exactly what will be required yet. Therefore, they simply wait until year-end to know if they have to go above the 6% and to what level they’ll be distributing above that amount based on portfolio moves throughout the year.

It also puts them in a position where in really strong years for the market, they can reward shareholders. If things are weaker such as they were last year or through the global financial crisis, then they can come in closer to their stated 6% policy. 2022’s distribution came to 6.3%, while 2021 was at 15.7%, to give some color.

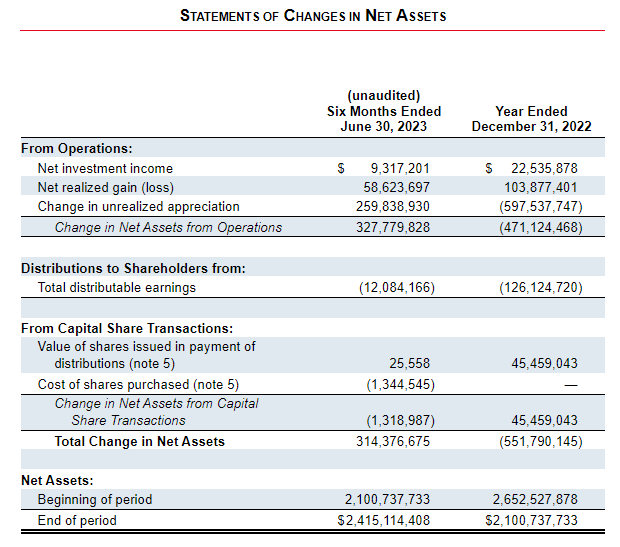

From their latest semi-annual report, capital gains are looking pretty healthy this year.

ADX Semi-Annual Report (Adams Funds)

This shows us that they paid out roughly $12.084 million in the first half of the year, but the majority of that was covered by the $9.3 in income the fund generated. They then realized $58.6+ million in capital gains that will be utilized to fund their year-end payout.

They provide quarterly financial statements, so Q3 is usually the best report to look at if you are trying to take a stab at how much the year-end special will be. It gives us one more whole quarter to see if realized gains are trending higher or staying flat.

ADX’s Portfolio

Despite being a fund that basically follows along with the S&P 500, one might be surprised at just how much turnover the portfolio runs. In the last six-month report, turnover came in at an annualized 81.5%. A year ago, they were also fairly active, as turnover came in at an annualized 77.6%. The five years prior to that turnover averaged 62%.

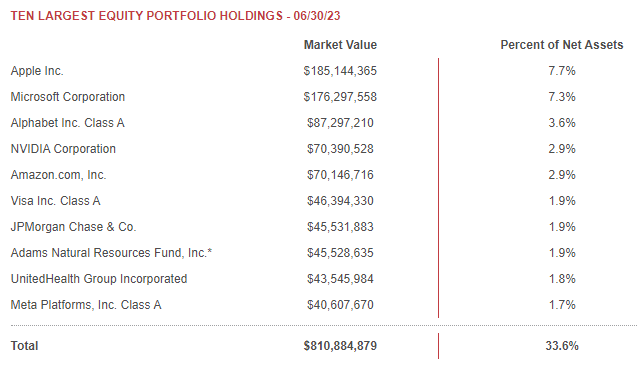

Despite all of that, the fund’s largest holdings don’t generally have too many surprises. The largest positions are those that are also the largest position in the S&P 500.

ADX Top Ten Holdings (Adams Funds)

Apple (AAPL) and Microsoft (MSFT) flipped places compared to last year, but the weightings were 6.3% and 7.5%, respectively, meaning they were still overweight positions relative to the rest of the portfolio. For the S&P 500 Index, as of August 15th, 2023, AAPL is at a weighting of 7.08%, and MSFT is at 6.46%.

The larger weighting for ADX in these two names makes sense because ADX carries a total of 93 holdings. So, generally speaking, ADX is mostly mirroring the S&P 500 Index through a sampling strategy. At the same time, they are doing a lot of buying and selling to create the types of elevated turnover ratios we are seeing.

A few of the differences between ADX and the Index are holdings in Visa (V), JPMorgan (JPM) and Adams Natural Resources Fund (PEO). Those holdings replace Alphabet Class C holding (GOOG), Berkshire Hathaway Class B (BRK.B) and Tesla (TSLA) as represented in the S&P 500. PEO might be a particularly interesting one as that’s the fund sponsors other CEF. PEO is heavily concentrated on integrated energy companies; however, it’s also carrying a fair bit in exploration and production companies as well.

Conclusion

ADX is a fairly plain equity fund. It generally performs similarly to the S&P 500 Index, which mirrors several of its largest holdings, but ADX does so with a much smaller total number of holdings. At the same time, the fund offers a higher annual managed distribution plan than SPY does. The fund also trades at a deep discount, which can make it appealing. However, the relative discount shows that it isn’t cheap and instead makes it a ‘Hold’ at this time rather than an attractive deal.

Read the full article here