Note:

I have covered Vicinity Motor Corp. (NASDAQ:VEV) previously, so investors should view this as an update to my earlier articles on the company.

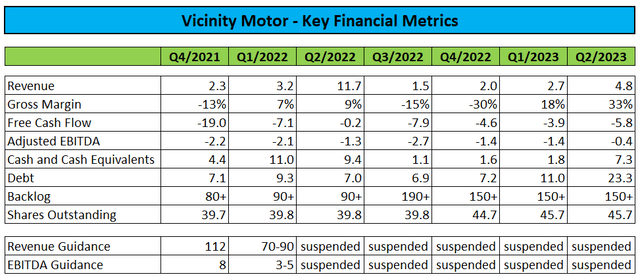

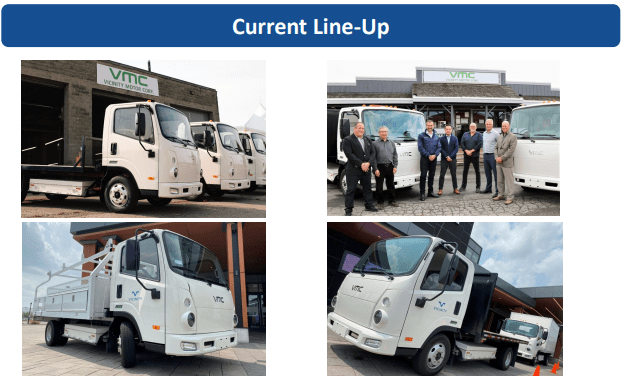

Earlier this week, small Canadian, BEV-focused bus and truck manufacturer Vicinity Motor Corp. or “Vicinity” reported improved second quarter results with revenues boosted by the delivery of 34 battery-electric VMC 1200 Class 3 trucks during the quarter.

Company Press Releases / Regulatory Filings

While gross margins benefited materially from a substantial reduction in warranty provisions, even adjusted numbers look decent (emphasis added by author):

The VMC 1200 carries a healthy margin profile with the year-round purchasing habits of the differentiated customer base helping to smooth the traditional uneven revenue of our established transit bus business. Overall gross margins for the quarter were 23%, after excluding positive warranty adjustments, which is higher than our historical averages for quarters with only bus sales.

Company Presentation

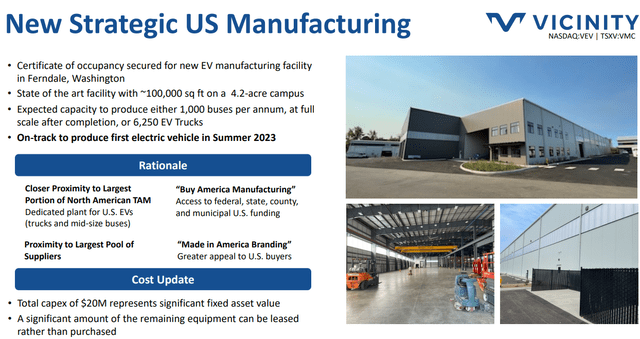

Following several quarters of delays, the company is now ramping up production of its new U.S. facility in Ferndale, Washington which is expected to result in further margin improvement down the road:

To support demand, our new U.S. manufacturing campus in Ferndale, Washington began production earlier this month. Although finishing the facility took longer than expected, doing it right and not rushing will allow us to more successfully tackle the fulfillment of our growing order backlog which, as of June 30th, exceeded US$150 million. The facility is designed to meet our current and future production needs for both buses and Class 3 VMC 1200 electric trucks. With a new $9.0 million credit facility for Ferndale with EDC, complementing a previous $30 million credit facility, we now have greater financial flexibility to invest in Vicinity’s next phase of growth.

Company Presentation

In addition, following recent supply chain improvements, the company has restarted delivery of transit buses to customers in the current quarter.

While Adjusted EBITDA came in close to break-even, cash usage remained elevated during the quarter due to unfavorable working capital movements.

As a result, the company’s debt obligations have increased to their highest levels in recent years with approximately $7.4 million in convertible notes scheduled to mature in early October.

After being poked on the issue during the questions-and-answers session of the conference call, management didn’t really have much to offer with this regard:

Poe Fratt

Okay. Dan, can you just talk about refinancing the debt that comes due in early in the fourth quarter? It looks like you might have gotten enough cash in the bank to pay that down with cash. But can you just highlight what’s going to go on with the refinancing of that debt? (…)

Dan Buckle

Sure. Yes, the debt that is coming due in October is on the horizon. We’ve started discussions on that debt and are determining what the best path is going to be there, whether we refinance it or pay it out or pay a portion of that. Hopefully, we have some news on that in the next coming month or so, or two months. (…)

On a more positive note, the company abstained from selling additional shares into the open market under its ATM-Program during the quarter.

Even better, management projected Vicinity to achieve positive Adjusted EBITDA in the second half of the year:

We believe we are well positioned for a high level of operational execution in 2023 with the fundamentals of our operations expected to further strengthen as we ramp deliveries throughout the year, allowing us to transition to positive adjusted EBITDA during our second half of 2023.

Bottom Line

Vicinity Motor reported improved quarterly results fueled by the delivery of 34 Class 3 all-electric VMC 1200 trucks with a solid margin profile.

With the new U.S. facility finally in the process of ramping production and considering the recent restart of transit bus deliveries, sales and profitability should increase materially in the second half of the year.

However, getting a new facility up and running isn’t an easy task and the company still needs to address the convertible debt maturity in October. In addition, higher production levels are likely to result in increased working capital requirements.

Given these issues, I am keeping my “Hold” rating for now but would consider upgrading the stock should Vicinity Motor manage to address short-term debt issues and execute successfully on the ramp-up of the Ferndale facility.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here