The reality of persistently higher long-term interest rates continues to weigh on the stock market. The major averages slunk further from their recent highs this past week, led by the so-called Magnificent Seven.

The end is near for the stock market’s 2023 rally, such as it has been, says Doug Peta, chief U.S. strategist at BCA Research. He doesn’t see that as being caused so much by the course of interest rates as by the other key variable in the investment equation—corporate earnings.

At the end of last year, expectations were “bombed out,” he said in an interview. The bar for corporate earnings was set low to top dismal forecasts. Now, the bar is being raised for more sanguine estimates in the coming year, he explains. So, investors are setting themselves up to be disappointed from here on, after having been pleasantly surprised on the upside in first-half 2023.

Putting numbers to those impressions, Peta says investors came into the year expecting earnings for

S&P 500

companies at about $190-$195 per share. Instead, actual results are beating those forecasts by about 11%, with consensus full-year estimates for 2023 being marked up to about $219.

That earnings growth is being extrapolated into next year, with consensus forecasts for calendar 2024 at a heady $246. To be sure, analysts’ earnings forecasts that far ahead really are guesswork, based on what assumed revenue and expenses they plug into their spreadsheets. Not to cast aspersions, but earnings estimates this far ahead are fraught with uncertainty.

Peta sees those forecasts falling short. Just as it was difficult to disappoint the downbeat expectations of the first half of this year, it will be hard to surprise on the upside for 2024. His top-down forecast “conservatively” calls for a drop of about 5% next year to about $210 in S&P 500 per share earnings.

That would put the big-cap benchmark comfortably above 20 times earnings for the coming calendar year. Rising interest rates ought to put pressure on that price/earnings ratio. Lower earnings and reduced P/Es aren’t a formula for higher stock prices—especially as we head into the most fraught time of the year, September and October.

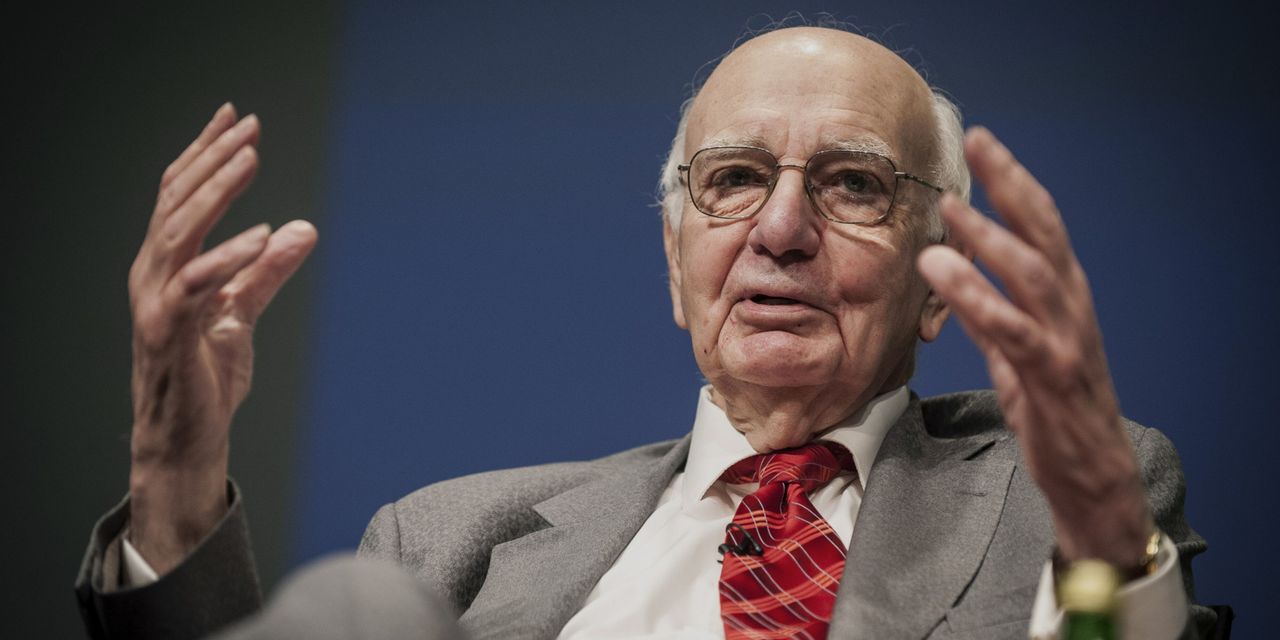

For the coming week, all eyes will be on Jackson Hole, Wyo., the site of the Fed’s annual big-think confab. It should be recalled that the site was originally chosen to lure Paul Volcker, then the central bank’s chief, for his favorite avocation, fly fishing. It would be a shock if Powell departs from the staunch anti-inflationary stance for which Volcker is revered.

Write to Randall W. Forsyth at [email protected]

Read the full article here