This article was coproduced with Dividend Sensei.

Investors have gotten much less excited recently.

The market is down 2% in the last three weeks, while Apple is down 7%. Only value stocks are doing well, up 2% to 3%.

I’m not here to try to tell you what stock to buy for the next three weeks to score a few % of the profit.

I’m here to give you reasonable and prudent high-yield ideas that could earn you hundreds of % profit over the years and change your and your family’s lives over decades.

Leggett & Platt, Incorporated (NYSE:LEG) is a 6.4%-yielding dividend king with a 52-year dividend growth streak. Its yield has only been higher during the Great Recession.

In other words, let me show you why it’s the best time in 14 years to buy Leggett and Platt in today’s silly market.

Leggett & Platt: One of The Best Ultra-Yield Dividend Kings You’ve Never Heard Of

Leggett and Platt was founded in 1883 in Carthage, Missouri.

LEG makes furniture, engineered components, and products for homes, offices, automobiles, and commercial aircraft. Think the seats for cars and aircraft plus furniture.

-

42% bedding

-

20% flooring

-

18% automotive

-

7% home furniture

-

5% work furniture

-

5% hydraulic cylinders

-

3% aerospace.

Of course, as with any industry, things are a lot more diverse than people initially imagined. LEG’s hydraulic cylinders, for example, are used by companies like Caterpillar (CAT) and the oil industry.

This 140-year-old company has survived and thrived through:

-

26 recessions

-

including 7 depressions

-

two World Wars

-

the Spanish flu that killed 5% of humanity

-

seven global pandemics

-

inflation as high as 22%

-

interest rates as high as 20%

-

over 23 bear markets

-

78 corrections.

This company began paying a dividend 56 years ago and has raised its dividend for 52 consecutive years.

Management says it has a long-term plan to grow at 6% to 9%, which, combined with the 6.4% yield today. This means 12% to 16% long-term returns are possible from this BBB-rated dividend king.

Historical Returns Since 1987

LEG’s average annual return of 13% is within the range management says to expect in the future.

Its historical returns tend to beat the S&P (SP500) slightly, but with a much higher yield and a much more dependable income stream.

Why Leggett & Platt Is A Potentially Good Ultra-Yield Choice Today

First, with a Leggett & Platt, Incorporated yield that’s at a 14-year high, we must address the issue of dividend safety.

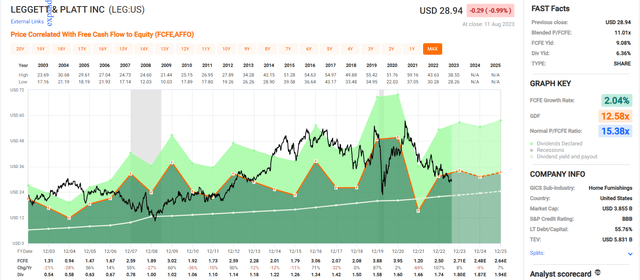

FAST Graphs, FactSet

LEG’s free cash flow (“FCF”) fell about 80% in 2021 due to Pandemic-related supply chain disruptions. But it was able to slash spending and fix those supply chains, enabling a strong recovery in free cash flow.

Free cash flow growth rate and payout ratios:

|

Year |

Free Cash Flow Per Share Growth |

Dividend Per Share Growth |

Free Cash Flow Payout Ratio |

|

2020 |

NA |

NA |

40.5% |

|

2021 |

-70% |

3.7% |

138.3% |

|

2022 |

108% |

4.8% |

69.6% |

|

2023 |

8% |

3.4% |

66.4% |

|

2024 |

-8% |

3.9% |

75.4% |

|

2025 |

6% |

3.7% |

73.5% |

|

2026 |

6% |

3.1% |

71.6% |

|

2027 |

5% |

4.0% |

70.7% |

(Sources: FAST Graphs, FactSet.)

LEG’s free cash flow can be volatile in any given year, but the company has the ability to maintain and keep growing the dividend at 3% to 4% even in lean years.

That’s not to say that a 70% long-term payout ratio is an ideal situation for a cyclical company.

S&P wants to see 60% or less payout ratios, and LEG’s generosity with its dividend is one of the reasons that it revised the LEG outlook to negative in March 2023.

That means that there is a 33% chance that LEG gets downgraded from BBB to BBB-, still an investment grade rating, but the lowest investment-grade rating a company can have.

It means the difference between a 7.5% 30-year bankruptcy risk today and a potential 11% risk should LEG’s balance sheet weaken anymore.

LEG has nearly $900 million in liquidity right now, and its leverage ratio (debt/EBITDA) is coming down at a slow but steady rate, from 3.7 in the last year to an estimated 3.5 in the next year.

Rating agencies want to see corporations like this with 3X or less leverage ratios and 8+ interest coverage ratios.

At the moment, LEG’s rising borrowing costs have pushed the interest coverage ratio to 4.2, one of the reasons for S&P’s downward revision.

According to bond investors, LEG has $300 million in bonds maturing in 2024, specifically November, the recession year. After that, there are no maturities until 2027.

I wouldn’t worry too much about that maturing bond because the company currently has $272 million in cash and is expected to retain $83 million in post-dividend free cash flow.

-

$355 million in current and projected cash vs. $300 million bond repayment.

All of LEG’s debt is unsecured for maximum financial flexibility. It can always use secured debt to finance itself and preserve the dividend if it ever runs into a pickle during a recession.

LEG has a long and short-term credit revolver for $1.2 billion in borrowing power and about $1.5 billion in total liquidity if needed.

Do you know how much the company spends per year on growth? $115 million.

The current cash is nearly enough to fund two-year growth capex plans. The total liquidity is enough to run the company for about 13 years.

LEG’s cash priorities are:

-

fund organic growth

-

fund the dividend

-

fund M&A

-

fund buybacks.

Those are the priorities you want to see from a relatively safe 6.4% yielding dividend growth legend like this.

Management targets 6% to 9% growth, or about 13.8% long-term midrange returns.

Compare that to the 0.7% yielding Nasdaq (COMP.IND), whose 13.5% historical returns are the best of any historical index.

How would you like to own a dividend king with a 52-year dividend growth streak yielding almost ten times more than the Nasdaq, whose management thinks they can beat in the future?

How can LEG possibly achieve such growth and returns? Because the U.S. bedding industry combined with the addressable market in automotive alone is $31 billion per year! LEG has $5 billion in sales, and it is the #1 name in its industry.

It’s the industry leader, so it’s become a dividend king. Yet, there are so many worlds left for it to conquer and so much market share to gain that you could enjoy 12% to 16% returns for decades to come!

Valuation: A Good Company At A Wonderful Price

-

DK Quality Score: 73% medium-risk 11/13 speculative dividend king (turnaround stock)

-

DK Safety Score: 70% (3% risk of a cut in severe recession)

-

Historical Fair Value: $44.26

-

Current Price: $28.51 (10.3X cash-adjusted earnings)

-

Discount: 36%

-

DK Rating: potential speculative strong buy.

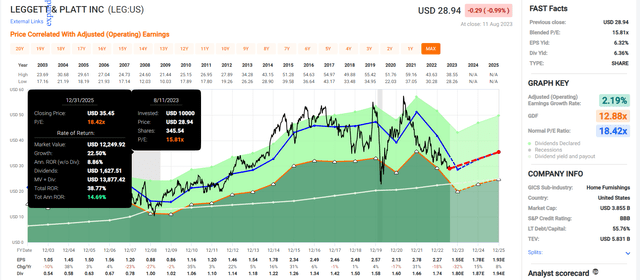

Leggett & Platt 2025 Consensus Total Return Potential

FAST Graphs, FactSet

LEG is currently trading at a 15% discount to what private equity funds are paying for private companies. You’re getting a better deal than the “smart money” that’s trying to earn 12% to 20% annual returns.

LEG is guiding for 12% to 16% returns and is trading at a price that even private equity would love.

Risk Profile: Why Leggett & Platt Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Risk Profile Summary

-

Economic cyclicality risk: normal cyclicality of sales in recessions

-

Interest rate risk: 4% average borrowing costs and rising

-

M&A risk: ill-timed acquisition funded with debt before a recession could put the dividend streak at risk

-

Disruption risk: if one of LEG’s large segments gets significantly disrupted (such as by driverless cars), this could impact sales.

-

Supply Chain Disruption Risk: such as disruption to steel supply or due to weather-related events in the 18 countries it operates in

-

Currency Risk: 35% of sales outside the US

-

Cyber-security risk: hackers could hold the company’s facilities hostage

-

Regulatory risks: New carbon regulations and potential future M&A deals being blocked

-

Litigation risk: $11 million set aside for legal costs but costs might be many times that, which would have to be borrowed or come out of free cash flow, putting pressure on the dividend’s safety.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

-

S&P has spent over 20 years perfecting their risk model

-

Which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

-

50% of metrics are industry-specific

-

This risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

LEG Scores 54th Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

-

supply chain management

-

crisis management

-

cyber-security

-

privacy protection

-

efficiency

-

R&D efficiency

-

innovation management

-

labor relations

-

talent retention

-

worker training/skills improvement

-

customer relationship management

-

climate strategy adaptation

-

corporate governance

-

brand management.

LEG’s Long-Term Risk Management Is The 318th Best In The Master List (36th Percentile In The Master List)

|

Classification |

S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

|

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL |

100 |

Exceptional (Top 80 companies in the world) |

Very Low Risk |

|

Strong ESG Stocks |

86 |

Very Good |

Very Low Risk |

|

Foreign Dividend Stocks |

77 |

Good, Bordering On Very Good |

Low Risk |

|

Ultra SWANs |

74 |

Good |

Low Risk |

|

Dividend Aristocrats |

67 |

Above-Average (Bordering On Good) |

Low Risk |

|

Low Volatility Stocks |

65 |

Above-Average |

Low Risk |

|

Master List average |

61 |

Above-Average |

Low Risk |

|

Dividend Kings |

60 |

Above-Average |

Low Risk |

|

Hyper-Growth stocks |

59 |

Average, Bordering On Above-Average |

Medium Risk |

|

Dividend Champions |

55 |

Average |

Medium Risk |

|

Leggett & Platt |

53 |

Average |

Medium Risk |

|

Monthly Dividend Stocks |

41 |

Average |

Medium Risk |

(Source: DK Research Terminal)

LEG’s risk-management consensus is in the bottom 32% of the world’s highest quality companies and similar to that of such other blue-chips as

-

Brown-Forman Corporation (BF.B): Ultra SWAN dividend aristocrat

-

NextEra Energy (NEE): Ultra SWAN dividend aristocrat

-

Dover Corporation (DOV): Ultra SWAN dividend king

-

Automatic Data Processing (ADP): Ultra SWAN dividend aristocrat

-

PPG Industries (PPG): Ultra SWAN dividend king.

The bottom line is that all companies have risks, and LEG is average at managing theirs, according to S&P.

How We Monitor LEG’s Risk Profile

-

4 analysts,

-

one credit rating agencies

-

five experts who collectively know this business better than anyone other than management

“When the facts change, I change my mind. What do you do, sir?”

– John Maynard Keynes.

There are no sacred cows. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: It’s The Best Time In Years For This 6.4%-Yielding Dividend King

Even when the market is irrationally overpriced, something wonderful is always on sale.

If you’re looking for the power of a deeply undervalued ultra-yield dividend king, consider Leggett & Platt.

With the highest yield in 14 years, a valuation that’s 15% lower than what billionaire hedge fund managers are getting, and a 52-year dividend growth streak to its credit, BBB-rated Leggett & Platt is one of the smartest ultra-yield aristocrats you can buy today.

Read the full article here