Investment Summary

Orion S.A. (NYSE:OEC) has made a name for itself as a manufacturer and seller of carbon black products. The operations span across the world and this has made OEC able to establish a solid customer base from which it can rely on and deliver strong earnings growth to investors. In the specialty carbon market, it has gained a leading position and holds a solid share of the market in the global rubber carbon market too.

The focus on generating strong FCF for the business and transforming that into shareholder returns seems to be where OEC is heading. Between 2023 and 2025 the target is to achieve around $400 – $500 million in FCF. The recent announcement of $50 million in share buybacks is setting the tone for OEC to become a shareholder-friendly company that is also able to impressively grow both the top and bottom line from a dominant market position. Quickly looking at the valuation it sits at a p/e of just under 9 and in comparison to a sector that trades closer to 14 you are getting a very good discount here it seems. The discount doesn’t seem well deserved, as OEC continues to grow and boast a solid balance sheet. I am optimistic about the outlook for the company and will be rating them a buy as a result.

Carbon Market Continues To Grow

The history of OEC dates back to 1862 when it was founded. These days the company focuses on two key markets, the rubber carbon black, and the specialty carbon market. In the second one, it has a dominant position but holds the third position in the first one too. As for the actual offerings or products that OEC has, they can be described as post-treated specialty carbon black grades for both polymers and coatings.

Segments (Investor Presentation)

The revenues mix for OEC is not perfect. Around 70% of the revenues come from the rubber carbon market. Growth in this market isn’t exactly explosive, as it’s expected to generate a CAGR of 3% between 2018 and 2028. As for the performance of OEC going forward, I think the appeal comes from the discount the company receives and that more and more shareholder-friendly practices are being put in place.

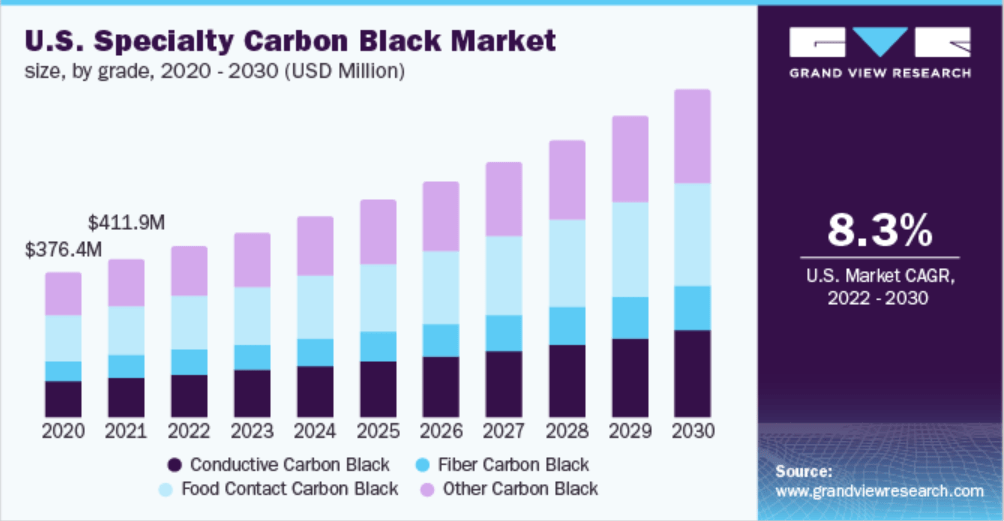

Market Outlook (grandviewresearch)

Where I get more excited is the fact that the market where OEC holds the first place is expected to grow very rapidly over the coming years instead. The US market for specialty carbon is estimated to grow around 8.3% annually in the next 7 years at least. Historically, this market seems to have been slightly volatile and goes in cycles. What has kept OEC still in a good spot here though is the fact that a solid revenue mix has helped offset some of the lower sales volumes.

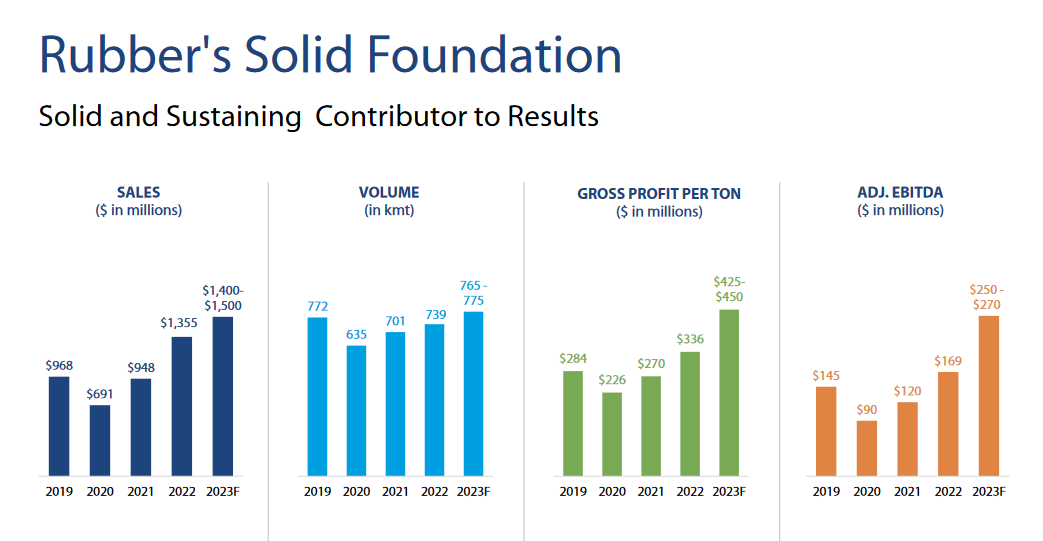

Fundamentals (Investor Presentation)

Despite some short-term headwinds, I think that the foundation and market conditions for OEC are still very much in their favor. The company is experiencing increased gross profits per ton, a factor as demand rises and shortages will continue. The war in Ukraine has caused turmoil across many markets and the rubber carbon too.

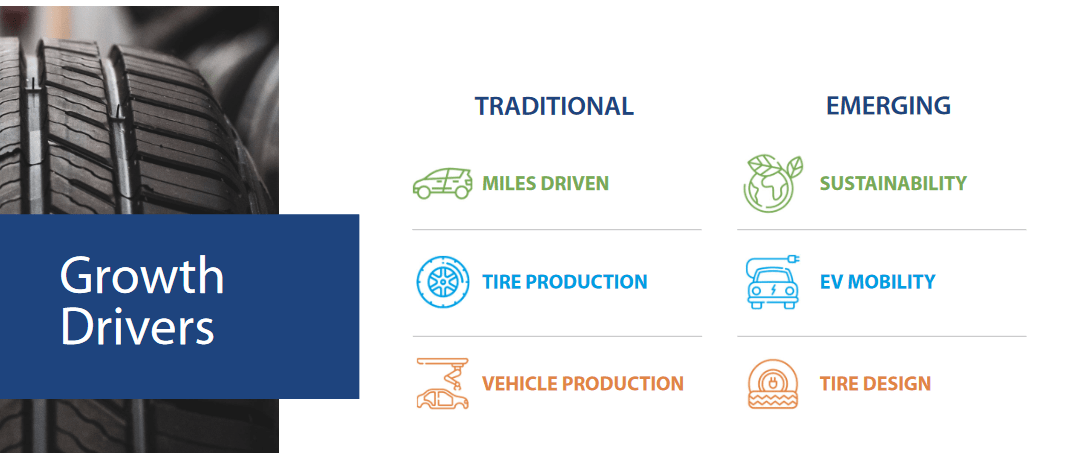

Growth Drivers (Investor Presentation)

Some of the key drivers for growth regarding OEC going forward come from that people are still driving long distances and demand for new vehicles seems to be everlasting. This ultimately benefits OEC a lot as demand is persistent even through downturns. As for which markets seems to offer the most demand, we need to look towards Brazil and North America. These are two different markets that OEC is present in and will likely see stronger shipments and volumes in the coming several years.

Risks

The volatility of carbon black prices introduces a notable dimension of risk that can potentially trigger periods of underperformance, ultimately impacting profitability and eroding pricing power. This dynamic poses the risk of creating substantial challenges for the company’s FCF dynamics, potentially constraining its capacity to execute ongoing expansion initiatives or embark on new ventures promptly.

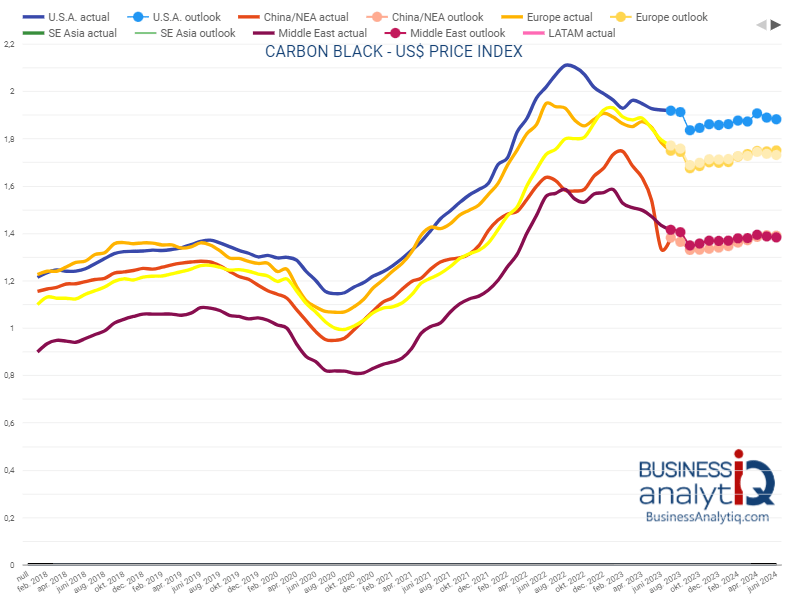

Carbon Black (businessanaltyiq)

Carbon black, as a key input material, operates within a market environment known for its susceptibility to supply-demand imbalances and external factors, such as changes in global energy prices. Fluctuations in the pricing of carbon black can reverberate through the entire value chain, affecting the company’s cost structure and, subsequently, its profit margins. In the event of a sustained price hike in carbon black, the company might encounter difficulties in fully passing on these cost increases to customers, leading to potential margin compression and challenges in maintaining its pricing power.

Financials

Looking at the financials of OEC, there has been some decent progress in the last few quarters.

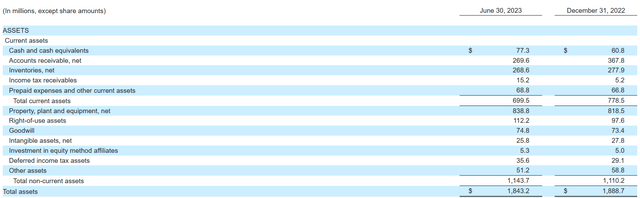

Asset Base (Earnings Report)

The cash position for example has been increasing to $77 million, up from $60 million back in December 2022. This has further set up OEC in a sound position to potentially make acquisitions in the future. In terms of its effect on paying down debt, it would cover a little over 10% at least of it. That isn’t necessarily the best position to be in, but given that the FCF is increasing and set to be between $400 – $500 million between 2023 and 2025 I’d say there isn’t too much to worry about here in reality.

Valuation & Wrap Up

OEC has developed into a solid state where they can leverage the FCF they have and project to have into a shareholder-friendly company that could be buying back shares at impressive rates.

Stock Price (Seeking Alpha)

Apart from this, the valuation of the company is also very appealing, as it’s quite a fair bit below the sector. Despite being a leader in some markets, it doesn’t seem to get the valuation for it. I think this opens up the possibility for investment, hence the buy rating I have. A 39% earnings discount to the materials sector is very good, and a 16% discount in terms of p/FCF is also enhancing the buy case here.

Read the full article here