Note:

I have previously covered Diamond Offshore Drilling, Inc. (NYSE:DO), so investors should view this as an update to my earlier articles on the company.

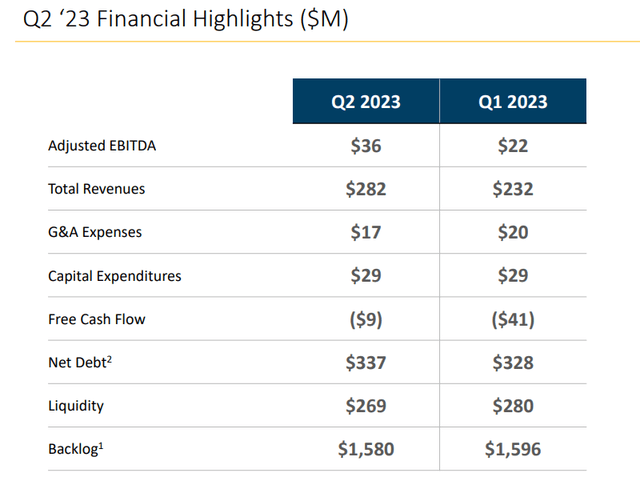

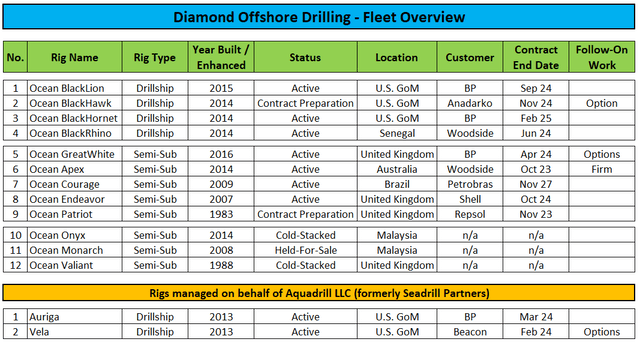

Two weeks ago, leading offshore driller Diamond Offshore Drilling (“Diamond Offshore”) reported better-than-expected second quarter 2023 results but according to statements made by management on the conference call, the outperformance was largely the result of an early termination fee recognized for the semi-submersible rig Ocean Patriot.

Company Presentation

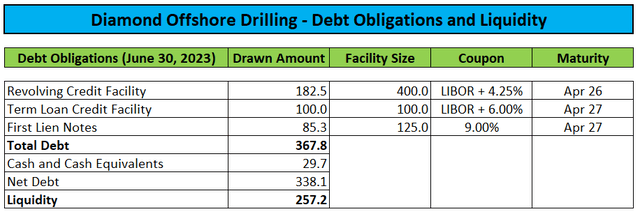

Even at improved revenue and EBITDA levels, free cash flow for the quarter remained negative thus resulting in lower liquidity and higher net debt relative to Q1.

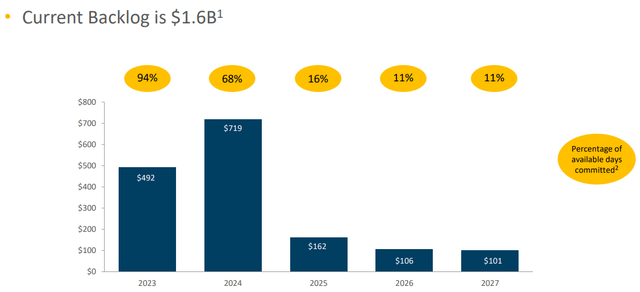

Backlog at the end of Q2 was stated at $1.58 billion, down slightly from 1.60 billion at the end of the first quarter but investors should note that this number includes approximately $184 million related to managed drillships “Auriga” and “Vela.” With rig owner Aquadrill LLC recently having been acquired by former parent Seadrill (SDRL), both management contracts are unlikely to be extended beyond their present term.

Company Presentation

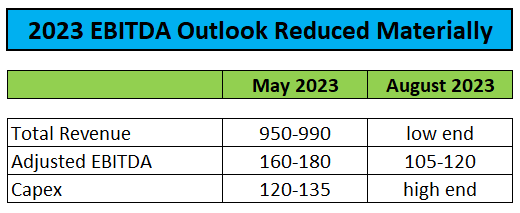

Surprisingly, the company abstained from reiterating or updating its full-year outlook in the earnings presentation but after taking a closer look at the conference call transcript, it becomes quite clear that Diamond Offshore will miss its previous 2023 expectations by a mile (emphasis added by author):

Looking ahead to the third quarter, we expect contract drilling revenue, excluding reimbursables, of $205 million to $215 million. The reduction in revenue compared to the second quarter is largely activity driven with the Blackhawk, Courage and Patriot being off contract as they prepare for their next contracts.

Combined with these rigs transitioning to new contracts and the timing of the Patriot termination fee, we have four non-recurring discrete events that impact our projected third-quarter results relative to our prior expectations.

First, the Apex spending more days in the shipyard than anticipated, resulting in additional costs, less revenue earning days in the quarter, as well as the shift of higher revenue earning days from 2023 into 2024. Next, the expectation that the Courage will complete its current contract and begin its new contract preparation activities earlier in the quarter than originally anticipated.

In addition, non-productive time for the two managed rigs resulting in the loss of a portion of our managed rig margin, and finally, just over two weeks of non-productive time for the BlackLion that concluded in July.

As a result, our EBITDA for the third quarter is anticipated to be just above breakeven.

Consequently, management reduced full-year Adjusted EBITDA expectations substantially while guiding for revenues at the low end of the previously provided range while capex is likely to come in at the high end:

Company Presentation / Conference Call Transcript

Quite frankly, I am surprised by the magnitude of the projected miss on Adjusted EBITDA. As a result, free cash flow is likely to remain negative in the second half of the year.

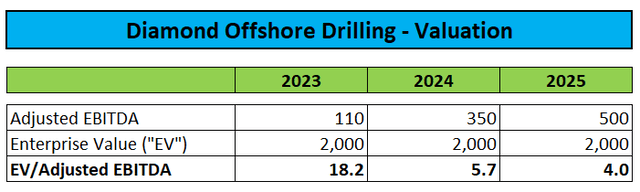

That said, with higher average dayrates and substantially lower special periodic survey requirements, 2024 is going to be a very different story as also outlined by management on the call (emphasis added by author):

The average dayrate in our 2024 backlog is $321,000 per day. These compares favorably with the $285,000 per day, average dayrate earned year-to-date in 2023. A large contributor to the overall increase in average dayrate is the BlackHawk contract we recently secured.

The increase in dayrate combined with the operating cost reduction from working in the Gulf of Mexico, will result in rig level EBITDA for the BlackHawk of approximately $100 million in 2024 as compared to less than $10 million in EBITDA in 2023.

The combination of overall contract coverage and higher average dayrate across the fleet gives us great visibility into what is expected to be significant growth in EBITDA and cash flow generation in 2024. With upside potential from two drill ships and three semi-summersables with re-contracting opportunities in 2024.

Further, with only two planned out-of-service periods for SPSs in 2024, as compared to our 5 shipyard stays during 2023, we expect only 100 days out-of-service in 2024 versus almost 450 days out-of-service in 2023. This operational continuity gives us the foundation for stronger and more consistent financial performance in 2024.

Based on my estimates, I would expect Diamond Offshore to generate Adjusted EBITDA of approximately $350 million next year and $500 million in 2025.

Author’s Estimates

Assigning a 2025 EV/EBITDA multiple of 6x would result in a $24 price target for the shares and this does even account for anticipated lower net debt levels starting next year.

However, very limited analyst coverage in combination with the largely unnoticed guide down on the conference call, is likely to result in Q3 results underperforming the one-analyst estimate by a very wide margin in November thus potentially triggering an initial sell-off in the shares.

Given ongoing, strong industry conditions, I would consider this a great chance for investors to get exposure to Diamond Offshore Drilling, particularly with the overall financial condition of the company anticipated to improve substantially next year thus potentially paving the way for a refinancing of the company’s restrictive debt taken on upon emergence from bankruptcy in 2021.

Regulatory Filings

In addition, Diamond Offshore still has three cold-stacked semi-submersible rigs but based on statements made during the questions-and-answers session of the conference call, only the Ocean Onyx appears to be suited for a potential near-term reactivation while Ocean Monarch is currently held for sale and Ocean Valiant is likely to remain stacked for the time being.

Fleet Status Report

By 2025, Diamond Offshore should have worked through all of its remaining low-margin legacy contracts and priced options thus allowing for the company’s full earnings potential to unfold.

Risks

Not surprisingly, offshore drilling stocks remain heavily correlated to oil prices so any sustained downmove in the commodity would almost certainly result in Diamond Offshore Drilling’s shares taking a hit.

Bottom Line

Adjusted for one-time items, Diamond Offshore Drilling reported second quarter results largely in line with expectations.

However, management projected second half and full-year results to fall well short of expectations due to a host of minor issues expected to culminate in a big Q3 miss.

With revised guidance not yet reflected in analyst expectations, I wouldn’t be surprised to see shares selling off following the release of the company’s third quarter results in November.

Given this issue and considering the disappointing guidance for the remainder of the year, I would advise against chasing the shares near current multi-year highs.

However, given ongoing, strong industry conditions, I would consider using any major weakness to initiate or add to existing positions.

Read the full article here