Verizon Communications, Inc. (NYSE:VZ) stock does not hold a position in my portfolio now but it will always hold a special place in my heart as it was the first-ever stock I purchased, around April 2011. I sold the stock long time ago and never got back in. I sometimes recall why I purchased the stock more than 12 years ago and each time, it gives me a chuckle. I thought the well-publicized news that iPhone was finally coming to Verizon would send the stock soaring immediately. I believe I can say with a high degree of confidence that I am a better student of the market now than I was 12 years ago. But then, every expert was once a beginner and I am still far from being an expert.

The stock was in the upper $30s when I made my first purchase in April 2011 and is now in the lower $30s. It is no secret that the stock has been struggling for a long time. As shown in the chart below, the stock is:

- 39% down in the last 5 years

- 27% down in the last year

- 17% down YTD

- 17% down in the last 6 months

VZ Chart (Seekingalpha.com)

While such sustained underperformance is painful for existing shareholders, it also gives new investors and existing shareholders an opportunity to buy shares cheaper. It appears like the Seeking Alpha analyst community is in unanimous agreement about this as 8 out of the last 10 Verizon articles have a buy/strong buy rating with two being holds. As much as I like to be a contrarian, this time, I happen to agree with the crowd. I believe Verizon is an attractive buy as long as the risks are acknowledged. I present a few sections below that are in favor of the stock and some that are not in favor of the stock so the readers can get a full picture, before offering my recommendation. Let us get into the details.

Best Among The Worst? It’s Still A Win

As the company proudly states on its website, Verizon has the longest current growth streak among U.S. telecommunication companies with a streak of 16 consecutive years. This could be a tongue in cheek dig at its closest competitor, AT&T (T), which had to cut its dividend in 2022 with the Warner Bros. Discovery, Inc. (WBD) spinoff.

But, can Verizon afford it through earnings and business strength or is it destined for a dividend cut as well? Let’s find out.

- Total shares outstanding: 4.204 billion

- Current quarterly dividend: 65.25 cents

- FCF required to cover quarterly dividend: $2.74 billion (that is, 4.204 times 65.25 cents)

- Verizon’s average quarterly FCF over the last 5 years: $1.716 billion, which looks disastrous on surface. However, in March 2021 quarter, Verizon paid $45 billion to Federal Communications Commissions [FCC], being the top bidder on 5G spectrum, which dented the company’s FCF that quarter and any average that includes that quarter

- Verizon’s average quarterly FCF over the trailing twelve months [TTM]: $3.091 billion, which is still tight at a payout ratio of 88% but is a lot better than the 5-year quarterly average

- Based on 2023’s forward EPS estimate of $4.72, Verizon has a payout ratio of 55%

Overall, I’d say the company can just about manage to pay its dividends for now. Free Cash Flow coverage is something to be monitoring with an eagle’s eye in the upcoming quarters.

8% Yield Approaching

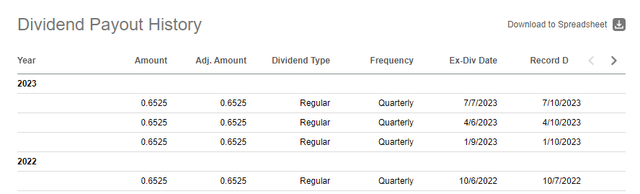

Verizon has now paid the same quarterly dividend of 65.25 cents/share as confirmed by Seeking Alpha below.

Verizon DG (Seekingalpha.com)

That means, going by the company’s history, Verizon is likely to announce its 17th consecutive dividend increase in less than 3 weeks. The 5-year dividend growth rate is an anemic 2% and using the same number, I predict the new quarterly dividend will be around 66.50 cents. This translates into an annual dividend of $2.66 for a current yield that would nudge past 8%.

As I explained in a recent article, a high-yielding stock (even without dividend growth) with stagnant stock price need not be such a terrible thing as long as the dividend is safe. Verizon’s dividend appears just about safe based on FCF and EPS as shown above. But it’s not all clear, far from it.

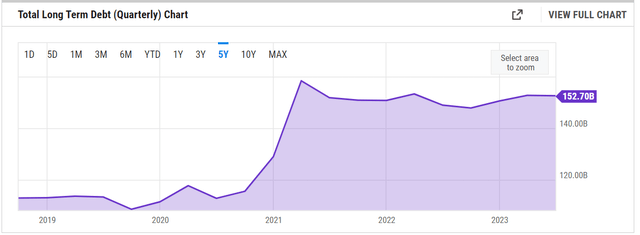

Debt Level and Interest Expense Are Concerning

It should surprise no one that a telecommunication company is high on debt. Despite that, Verizon’s 5-year trend is concerning as the company’s debt level has grown 36% as shown below.

VZ Debt (YCharts.com)

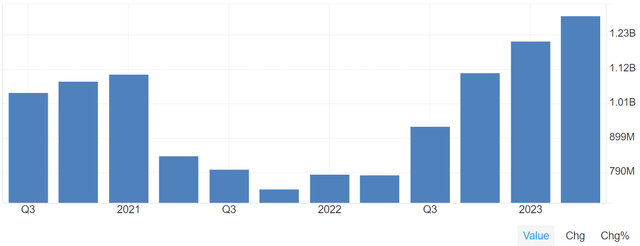

As weak as the stock has been, Verizon is still a strong company with little to no risk of bankruptcy. In such cases, it is not the actual debt-level that should concern investors but the interest expense on debt that the company incurs each quarter. Verizon’s interest expense on debt increased 63% from the $785 million in Q2 2022 to $1.28 billion in Q2 2023. This wasn’t a single quarter phenomenon as the steady increase in each quarter YoY is apparent as shown in the chart below.

Verizon’s debt is greater than the company’s market-cap at present and that is always a danger sign irrespective of cash on hand, which isn’t impressive for Verizon anyway.

VZ Interest Expense on Debt (tradingeconomics.com)

AT&T all over again?

That Verizon has been working on media and content partnerships is nothing new. But the recent news that Verizon is showing interest over a potential strategic partnership with EPSN on sports broadcast could be construed as the company not really know what to do next. AT&T burned itself and its investors by trying to be the jack of all trades and taking on more debt than any company can possibly handle. However, since the WBD spin off, AT&T has been operating a little bit more efficiently as a telecom company first and foremost. As a result/part of this disciplined strategy, AT&T’s debt level has remained while the company’s FCF has improved considerably.

In short, Verizon’s biggest risk factor is taking on more debt, ala AT&T of the recent past. This has a direct impact on many tangible and intangible aspects of the business including expenses and focus.

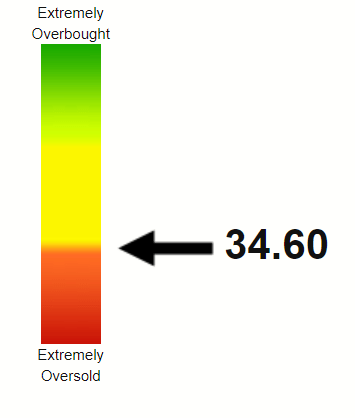

Technical Indicators

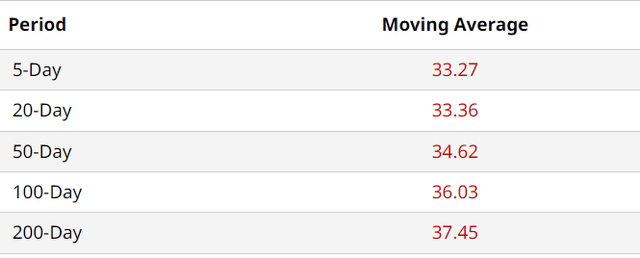

It should come as no surprise that the stock is weak technically as well with its Relative Strength Index [RSI] approaching the textbook oversold level of 30. The 200-Day moving average is more than 12% away from the current price and with no immediate catalyst, the odds of the stock reclaiming the $37 are low. I expect the stock to form a solid base in the upper $30s given the approaching 8% yield level.

VZ RSI (Stockrsi.com) VZ Moving Avgs (Barchart.com)

Conclusion

Verizon Communications Inc. stock has its characteristics and it is unlikely to change. But what can be changed profitably is your expectations from the stock. If you are looking for growth here, you are barking up the wrong tree. Telecomm pricing has, unfortunately, been a race to the bottom and consumers are the biggest winners. However, if you are looking a high-yielding stock with reasonable safe dividend, there are not many stocks that can challenge Verizon. The stock has also been range bound for many years and this can be taken advantage of, at times like the present where the stock is trading near its 52 week lows.

As much as the competitors have beaten up each other when it comes to pricing, they’ve also ensured that consumers cannot go without their phone. Here are some statistics to close out the article:

- 47% of Americans admit they are addicted (Tongue in cheek, I’d say just 47% of Americans are honest).

- The average American checks his/her phone 352 times a day. That is almost as many days in a year

- and many more in that link

- And I’d conclude with my favorite one: the feature that was intended to reduce our distraction, silencing the phone, actually ends up increase our usage.

Additional Disclaimer: If I did not have a large allocation to AT&T, I’d be buying Verizon here.

Read the full article here