Hilton Grand Vacations (NYSE:HGV) is a timeshare company that engages in the marketing and selling of vacation ownership intervals, as well as the management of resorts in urban destinations. It operates through the Real Estate Sales and Financing, and Resort Operations, and Club Management segments. The company’s performance in Q2 2023 showcases its ability to adapt and grow in a challenging global market. Here, I will explore HGV’s financial trends, marketing efforts, inventory management, and future outlook.

Business upside

HGV has reported second quarter in 2023, reflecting growth and stability within expectation. Total revenues increased to $1,007M from $948M in the same quarter in 2022, affected by a net deferral of $6M this year. Total contract sales for the quarter amounted to $612M, and the member count reached 522,000, with Consolidated Net Owner Growth at 2.8% for the 12 months ending in June 2023. The net income also showed an uptrend, settling at $80M, up from $73M in 2022. Adjusted EBITDA for the quarter was $248M, a decline from $273M in 2022.

Key KPIs stay healthy while Japan is still not recovered

HGV’s resort destinations are displaying robust performance, even amid broader economic challenges. The 83% total occupancy rate for the second quarter is a commendable accomplishment, paired with an impressive 10% increase in arrivals for the rest of the year compared to the same time in 2022. Furthermore, the 21% growth in tour sales, largely driven by the promotion of new digital channels that grew buyers by 30% year-over-year, is noteworthy. New buyers now make up over 60% of these tours, marking a significant shift in HGV’s client engagement.

The Volume Per Guest (VPG), reported at $3,728, underscores the efficacy of HGV’s sales process. Although down from Q1’s $4,000, it is 17% higher than 2019 levels. The decline in VPG and the close rate due to the new tour mix are expected.

In terms of the Japanese market, momentum continues in domestic demand within Japan and the return of Japanese owners to Hawaii. However, full recovery is not anticipated until “well into 2024,” acknowledging the prolonged impact of current global challenges.

It is still unclear how effective are the new tour sales

As HGV’s management increases incentives and marketing investments into tours, there’s a considerable risk that many of these expenditures may be wasted. Timeshares are a specialized market, appealing to a specific audience that has the time, commitment, money, and a genuine passion for resort experiences. With HGV’s previously shared data indicating that buyers’ average net worth exceeds $1.2M, it’s evident that the pool of potential owners is relatively limited. This fact partially explains why growth in the number of owners has been consistently modest.

There are even online tutorials designed to guide individuals through tour presentations without succumbing to the allure of purchasing. Consequently, questions arise concerning whether HGV’s aggressive push for new owners aligns with the natural state and demand of the market. The company’s ambitious approach might not be in alignment with the growth of the customer base.

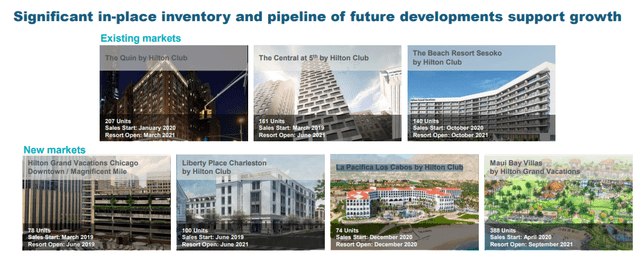

HGV has enough assets in place

Following the acquisition of Diamond, HGV now estimates approximately $11B+ worth of sales in their inventory, with 39% of those stemming from capital-efficient just-in-time or fee-for-service inventory. With the company projecting $1.2B in inventory available for sale, a substantial backlog of inventory is ready for future sales. Additionally, there is a significant amount of in-place inventory and a pipeline that’s ready to be activated. Thus, HGV finds itself in an advantageous position to generate long-term free cash flow, particularly as it has emerged from its capital expenditure (CAPEX) investment cycle.

HGV inventory (HGV presentation)

Bottom Line

HGV’s robust business model stands out for its durability, predictability, and long-term profitability. There are minimal risks to the company’s revenue streams, thanks to the high lifetime value per sale. With 40% of adjusted EBITDA coming from recurring sources, such as club membership fees, property management fees, and financing fees, there is a stable foundation for automatic collections from customers.

In addition to its financial stability, HGV also presents significant opportunities for share buybacks. In May, management approved a $500M repurchase program. During the second quarter, the company repurchased 2.7 million shares for $121M, leaving $522M available for future buybacks. Given that the capital investment cycle has been completed, these buybacks appear to be an excellent way to reward shareholders, especially as owner growth may be gradual.

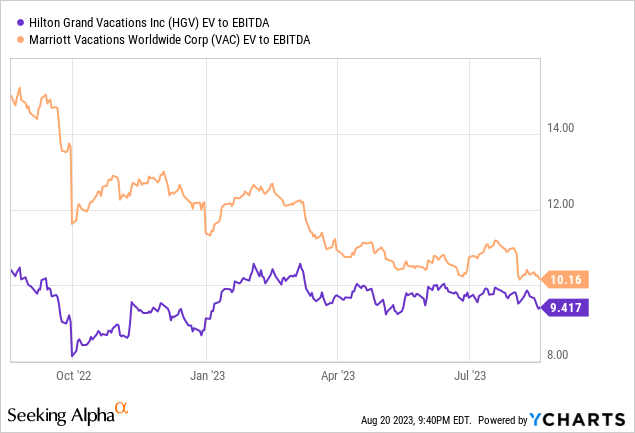

Currently, the 2023 guidance for Adjusted EBITDA is set to fall within the range of $1,090M to $1,120M. The EV/EBITDA multiple stands at around 9.4x, which is lower than that of Marriott Vacations Worldwide Corp. (VAC). Overall, HGV’s stock seems undervalued, considering the robust buyback program and an expected growth rate slightly above GDP.

Read the full article here