“If you can reduce the time of training to half on a $5 billion data center, the savings is more than the cost of all of the chips. We are the lowest-cost solution in the world.” Jensen Huang, Nvidia CEO

Nvidia (NASDAQ:NVDA) has gone from a graphics card company focused on gaming to a firm at the center of multiple technological trends because of the efficiency the firm unlocked by pioneering parallel computing. While the firm’s chips are more expensive than the competition, their utility is so much higher that many are willing to wait months or longer. Chinese users even use degraded Nvidia GPU chips rather than subpar competitors.

The firm is the undisputed leader in AI chips, and despite a sky-high valuation and an incredible runup this year, the stock appears poised to beat earnings on Wednesday after the bell. There are a few key reasons why I think Nvidia can repeat something comparable to the fireworks achieved last quarter:

- Business spending is increasing as social interest in large language models has accelerated, and use has become more ubiquitous.

- Persistent pessimism and bearishness have been prevalent on Wall Street despite this year’s rally, which might lead some to underestimate data center demand.

- AMD has experienced some delays that might work to the advantage of Nvidia in earnings over the short term.

- Nvidia’s deep expertise and diverse industry specialization mean increased demand from somewhere like autos could help the firm beat expectations.

- Nvidia’s GPU revenue might exceed Intel and AMD’s CPU revenues for the first time in history, highlighting the increasing ubiquity of parallel computing to investors.

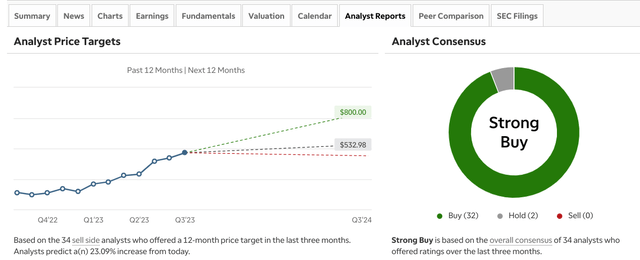

The company has been the most magnificent of the Magnificent Seven. Thus, it could be poised for a fall. But I think it’s more likely that the extreme sales momentum forecast last quarter is the beginning of a massive data center and computing transition that Nvidia is the lynchpin of. Like many Wall Street analysts, I expect their upcoming earnings report to be another prolific beat.

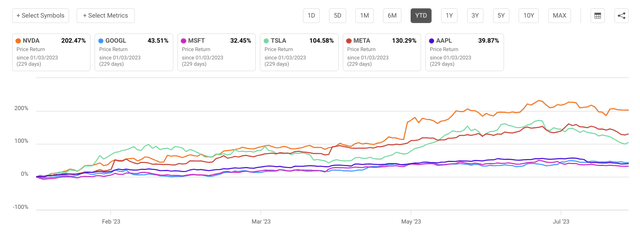

Seeking Alpha

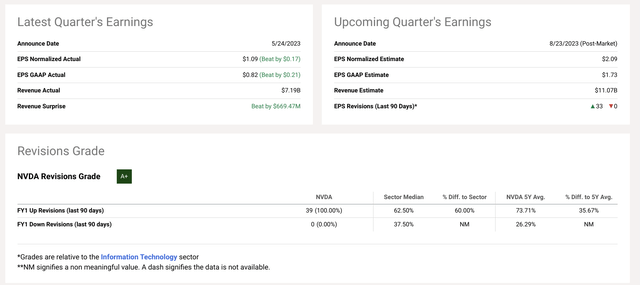

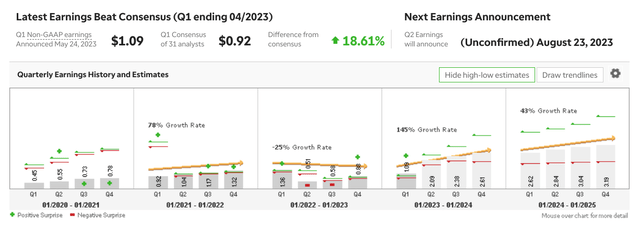

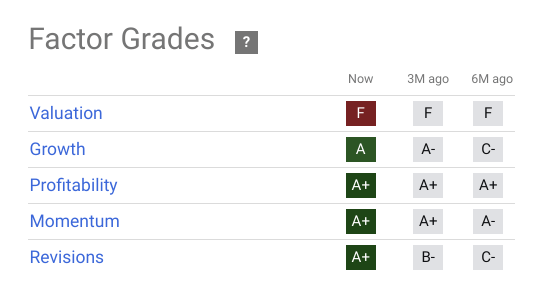

After three consecutive down weeks in the market, Nvidia’s following earnings report is particularly crucial. It is a major test of the AI-driven beat it had last quarter, and if the firm is even to beat and raise this quarter as well, the rest of the Technology sector and the Nasdaq will likely experience a relief rally. But most indications are suggesting the firm will beat. Revisions, for example, have been 100% to the upside, as you can see below.

Seeking Alpha

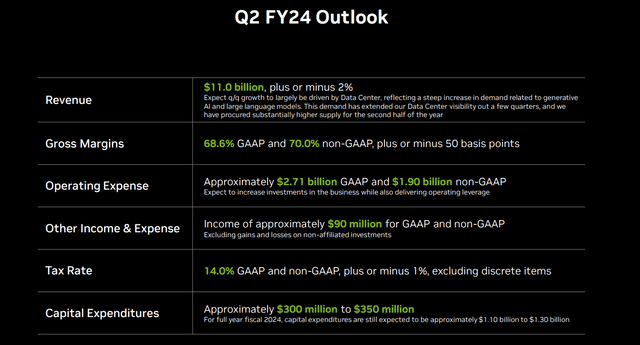

While the revenue and earnings beats were significant last quarter, what gained the attention of investors was the incredible differential between what the company guided and what Wall Street expected: $7 billion versus $11 billion. However, the momentum of demand and the rapidly increasing interest in AI suggest that demand is just starting its acceleration, opening the door for further potential strength and future earnings blowouts.

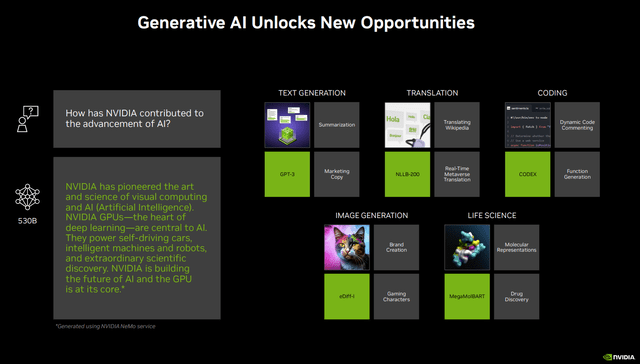

Nvidia Company Reports

Despite the constant skepticism of detractors, the stock’s earnings report last quarter was quite extraordinary. It signified that the company can dictate prices to anyone or any firm that needs its chips for AI functionality. It also signified that Nvidia is a prime beneficiary of AI spending and thus will benefit from the AI hype. The firm is the genuine picks and shovels play to the emerging technological revolution that has captured the markets’ attention.

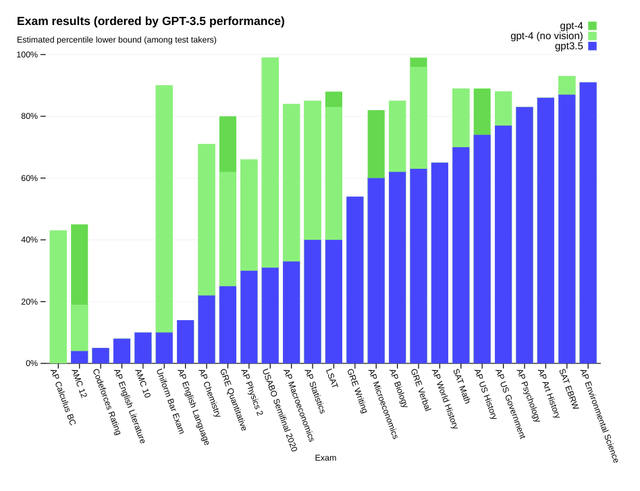

OpenAI

The data center acceleration, partially occurring due to the Large Language Model boom, could continue vexing analysts and lead to more demand for Nvidia’s wares than consensus expects. While most of the spending in data centers is currently on traditional computing, more and more will migrate to the accelerated computing that Nvidia dominates. And this process may have been accelerated by snowballing attention to AI.

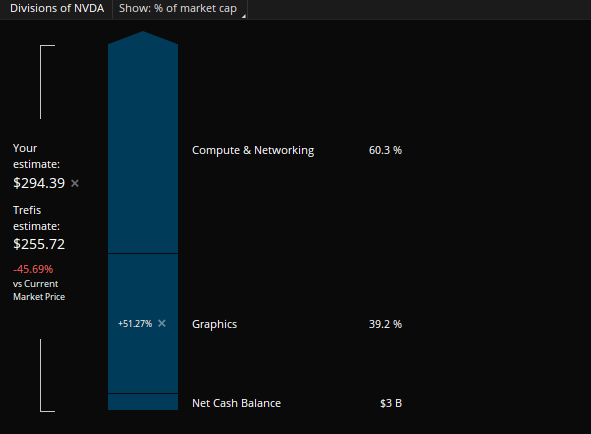

ThinkOrSwim

As you can see, Nvidia’s largest segment is what benefits from the data center spending. As this comprises the bulk of revenue, the upside surprises in areas like data center spending can have outsized impacts on revenue, especially since this side of the business isn’t as constrained by the inherent capacity limitations on the Graphics side.

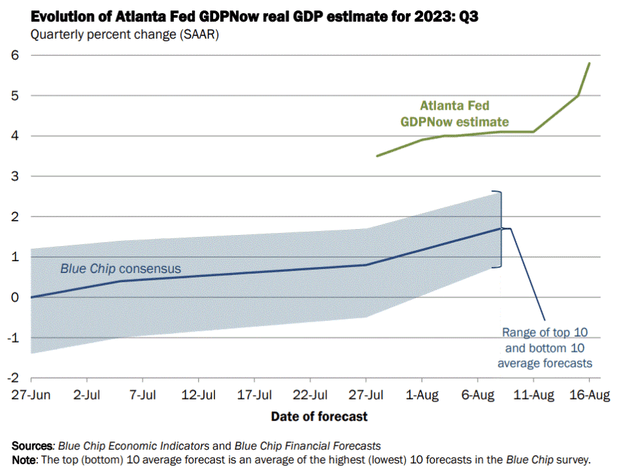

Furthermore, recent GDP strength was marked by business investment accelerating to its fastest pace in 6 quarters. This suggests there could be strength in data center demand beyond the dramatic guidance rise last quarter. It gets even more interesting if you consider that the Atlanta FedNow GDP Tracker also forecasts 5.8% economic growth next quarter. The persistent economic strength and increasing business confidence bode well for Nvidia’s upcoming report.

Atlanta Fed GDP Tracker

When you think of the immense splash the Generative AI has made, you must consider that it is all impossible without Nvidia’s hardware. Furthermore, given its incredible pricing power for its coveted AI chips, which price multiples above regular graphics chips, the firm has more flexibility on supply issues than many competitors in the capital-intensive semiconductor industry.

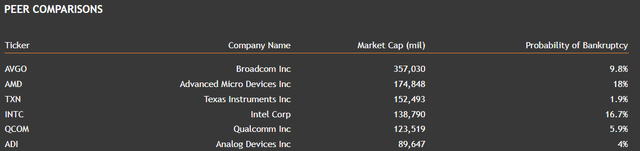

valueinvesting.io

Another aspect of Nvidia that may prove helpful relative to peers is that it has entered the trillion-dollar club. The firm has fantastic financial strength relative to peers. At a .9% probability of bankruptcy, this firm has an even lower chance of insolvency than Texas Instruments (TXN). Nvidia’s primary competitor in AI chips, AMD, is 20 times more likely to go bankrupt than the world’s fifth most valuable firm.

Nvidia’s Technological Dominance Repeatedly Shows Up In Earnings

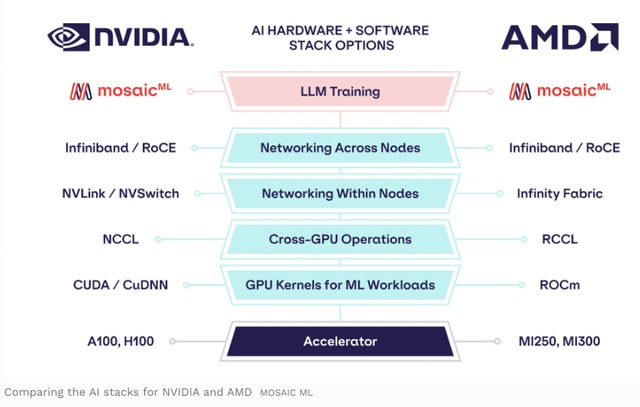

“The thing that we understood is that this is a reinvention of how computing is done. And we built everything from the ground up, from the processor all the way up to the end.” – Jensen Huang, CEO of Nvidia

Artificial intelligence applications are increasingly becoming more versatile and widespread, and many core functionalities are impossible without Nvidia’s chips. Facial recognition, image recognition, and feeding the Large Language Models at the heart of Chat GPT’s success are all core functionalities that Nvidia’s chips enable. And the extreme demand for those core functionalities drives bumper demand and earnings growth.

TD Ameritrade

While other major Tech companies with significant AI capabilities have produced chips for the advanced processing at the heart of cognitive technology, Nvidia’s are preferred by practitioners. It has also fostered a fantastic community of synergistic AI tools, researchers, and capabilities, making it the premier destination for AI. The consumer is voting with their wallets, which has led to Nvidia gaining a 70% market share in AI chips and an even larger one in training generative AI models.

ThinkOrSwim

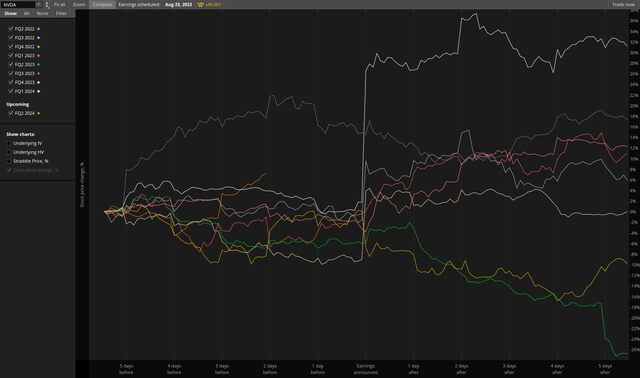

In the last five years, Nvidia has only twice missed Wall Street’s revenue expectations. But it is important to remember that this stock is still a live wire. It has a beta of 1.8 and can get quite volatile after earnings reports, as you see above. However, you’ll also notice that it was positive after earnings six out of the last eight earnings reports.

TD Ameritrade

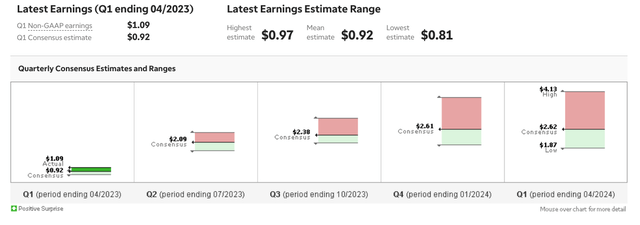

So, this increasingly prodigious commercial lead that Nvidia has achieved is repeatedly showing up in earnings reports. I believe the firm will likely be toward the higher end of earnings estimates for the next two years. I am particularly encouraged by the recent comments of Cowen & Co. analyst Mathew Ramsey, who called Nvidia’s $11 billion quarterly guidance correct last time. He has raised his estimates for Q2 revenue to $12 billion, even further above the figure that ignited a mini Tech bull market last time.

TD Ameritrade

KeyBanc also boosted its price target recently. As did Citi. Analysts have been tripping over each other to raise this quarter, which could foretell folly. However, I think sell-side analysts are catching up to a company that consistently delivers and has incredibly synergistic product offerings, making rapid growth and burgeoning demand hard for analysts to keep up with. The synergy and network effects being created are making it analyst harder to keep up with growth.

Risks And Where I Could Be Wrong

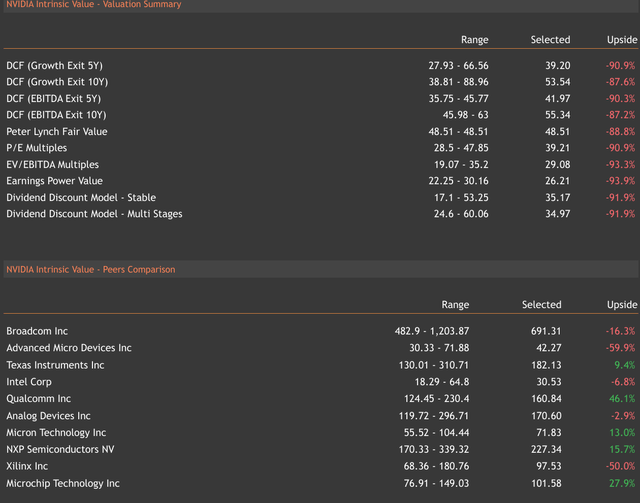

This is not to say that there are not ample risks with Nvidia at such a stretched valuation. And I would say the primary risk for this stock is valuation risk, which can be very pronounced during market periods of intense uncertainty. One of the reasons I am bullish on Nvidia is that I assume the Fed hiking cycle is over. If I am incorrect and long-term rates continue increasing instead of declining, I think Nvidia will likely see downside price action.

valueinvesting.io

When you value Nvidia on both an intrinsic and a relative basis, it shows that it is highly overvalued. Of course, after such an incredible quarter as the one that preceded this upcoming report, expectations are exceptionally high. Recent reports from some of Nvidia’s key suppliers were somewhat of a double-edged sword.

Taiwan Semiconductor Corporation reported strong AI chip demand, while other areas experienced cyclical weakness. However, the burgeoning demand may outstrip the capacity of critical suppliers. If this does end up occurring, it could constrain Nvidia’s guidance. If Nvidia issued disappointing guidance and the Fed talked more challenging than I expected, you could see severe carnage in the stock. Of course, geopolitical competition could be a headache as well.

Forbes

Nvidia’s H100 chip used for AI is costly, but it is also so superior that customers are willing to wait for it. If there is a technological breakthrough in AI chips at another competitor, it could prove a headwind. Still, even this would likely be mitigated by the breadth of services, software, and labor-saving libraries Nvidia has, in addition to its superior hardware.

And, of course, there’s always the risk that Nvidia does well on earnings, but the rest of the market goes down because of a significant macro risk. Geopolitical risks, re-emerging inflation, or a major credit/banking event could result in a declining broader market and widespread risk-off sentiment. Since Nvidia has a higher beta than the market, it would suffer in an outsized way.

Conclusion: On Top Of A Cloud

I AM NOT MOVED when I see many value-oriented investors insisting that Nvidia has to collapse in price; when I see the sell-side analysts tripping over themselves to upgrade their price targets on the eve of an earnings report, I pay attention, though. I pay even closer attention if it is a company with as distinguished and awe-inspiring a record as Nvidia.

Nvidia Company Reports

The generative AI revolution is just starting, and the demand dynamics that led to the unprecedented revenue raise in May haven’t changed. If anything, they’ve accelerated, and it seems likely a virtuous cycle that likely means demand for Nvidia’s chips, software, and services will exceed expectations in the upcoming earnings report.

But the incredible thing about Nvidia is that once the generative AI rush has passed, another breakthrough with its chips could lead to the next rush. Maybe a breakthrough in autonomous driving will lead to a boom in demand from somewhere else. I also think Nvidia capitalizes on recent stumbles by its primary competitor, (AMD), which could contribute to its beating estimates. Valuation concerns are always a source of legitimate risk, but I always like to say listen to Professor Price and certainly don’t lecture him!

Nvidia has strong factor grades, except in valuation (Seeking Alpha)

GPU-accelerated data centers are expanding dramatically in the cloud. Nvidia has some competitors in AI, but all of those competitors buy Nvidia’s chips. This is where I think the excessive strength will be found in the firm’s earnings this week. This company is a technological titan, and wherever AI takes the human race, Nvidia’s chips will be the essential fuel powering the journey.

Read the full article here