Topline

Shares of Nvidia opened Tuesday at their highest level on record, while investors pile into the freshly minted trillion-dollar company as it translates the artificial intelligence boom into stock gains far greater than any of its peers.

Key Facts

Nvidia stock jumped as much as 3% to $481.87, building on its 8% gain Monday and coming in just above its all-time high of $480.88.

The rally comes a day before the chipmaker will reveal its performance last quarter, when analysts project Nvidia’s profits to more than quadruple year-over-year thanks to an expected doubling of sales in its AI segment, according to FactSet data.

Nvidia shares are now up a whopping 315% since last October: No other S&P 500 company has gained more than 128% over the stretch.

Still, other stocks directly or partially exposed to AI have far outperformed the broader market this year, as Meta (up 142%), Tesla (up 92%), Palo Alto Networks (up 72%), Advanced Micro Devices (up 67%), Amazon (up 61%), Salesforce (up 58%), Adobe (up 56%) and Arista Networks (up 53%) are all among the S&P’s top 20 performers in 2023, easily topping the median 3% year-to-date return for stocks listed on the index.

Despite the stupendous spike, many think Nvidia stock still has further room for growth: Analysts’ average price target of $538, as tracked by FactSet, implies 12% upside.

Rosenblatt analyst Hans Mosesmann, whose $800 target for Nvidia is the highest on Wall Street, wrote last week the company “stands in a league of its own when it comes to software and AI solutions;” his rating pegs Nvidia’s proper valuation at $2 trillion, which would make it the fourth-largest company in the world after only Apple, Microsoft and Saudi Aramco.

Big Number

$890 billion. That’s how much market capitalization Nvidia has gained over the last 10 months. That tops the combined valuation of the U.S.’ largest bank JPMorgan Chase and brick-and-mortar retailer Walmart.

Surprising Fact

Though sales are growing, Nvidia’s surging stock comes as its relative value grows at historic levels. The firm’s price-to-earnings ratio, which tracks share price to trailing 12-month earnings, exploded from roughly 50 to nearly 250 since last fall. The median P/E ratio for all S&P companies is about 25.

Crucial Quote

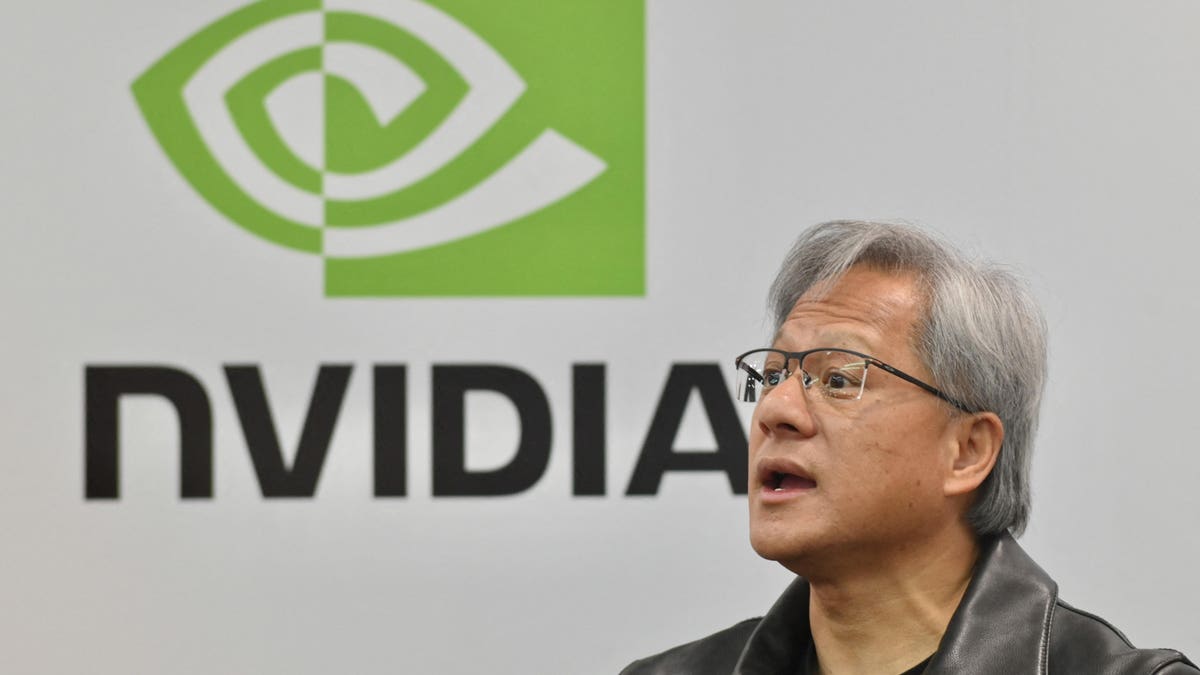

Nvidia’s billionaire CEO Jensen Huang is the “godfather of AI,” Wedbush analyst Dan Ives proclaimed in a recent note. Huang’s net worth has surged from about $14 billion to $43 billion this year, according to Forbes’ calculations.

Read the full article here