Shares in apparel retailer, Abercrombie & Fitch (NYSE:ANF), popped over 20% following the release of Q2 results that soared past expectations.

This contrasts with several other retailers that have seen shares plummet in the other direction in recent days. Just yesterday, both DICK’S Sporting Goods (DKS) and Macy’s (M) had their worst days of the year following disappointing results. And today, Foot Locker (FL), added to the rout in their shares over the past year, dropping another 30%.

ANF is one surprising standout. YTD, the stock is up over 100%. And it’s up over 150% over the past year. It also crossed the $50/share mark for the first time since 2011.

Seeking Alpha – YTD Returns Of ANF Stock

The rise isn’t an unwarranted run higher. Q2 results showed that demand for their brands, especially their namesake, is robust and is likely to remain so moving forward. While the excitement is justified, I’d be hesitant buying into a furious rally that may be closer to the end than its start.

Abercrombie Q2 Results

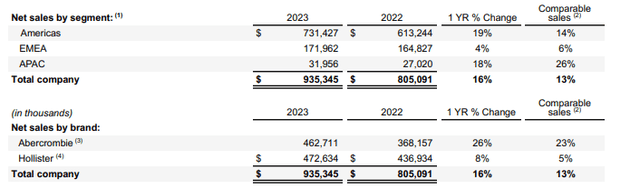

ANF grew quarterly sales by 16.1% YOY to +$935M, beating consensus estimates by +$91M. On a comparable store basis, sales were also up double-digits, at 13%.

Total sales growth was led by 19% YOY growth in the Americas and a 26% increase in their namesake brand. Sales were also up double-digits in the Asia-Pacific (“APAC”) region and a strong upper-single-digits in their Hollister brand.

ANF Q2FY23 Earnings Release – Snapshot Of Total Net Sales

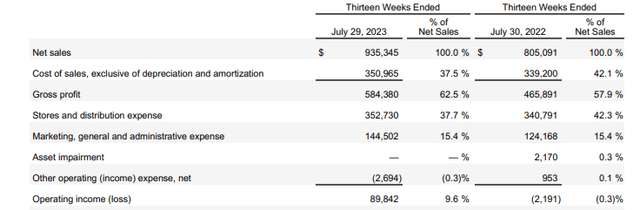

At the margins, ANF reported a gross profit and operating profit rate of 62.5% and 9.6%, respectively. This was driven in part by savings on freight from a gross perspective, as well as by savings at the operating level. Operating expenses as a percentage of sales, for example, were down 480 basis points (“bps”) from last year.

ANF Q2FY23 Earnings Release – Snapshot Of Total Operating Performance

Margin strength led to reported EPS of $1.10/share, which represented a sizeable beat of $0.95/share in consensus estimates.

Why Did ANF Stock Soar Following Results?

The significant beats on both the top and bottom lines were a significant aspect of the investor enthusiasm in the stock immediately following the release.

The sales strength in their namesake brand was especially noteworthy. The performance during the quarter marked the highest second quarter sales for the brand since 2011. The brand also achieved its 10th consecutive quarter of sales growth.

It wasn’t only strength in the namesake brand that investors were cheering. Following a 7% decline in Q1, the Hollister brand returned to growth in Q2. And it didn’t appear to struggle to get there. Sales were up 8%, surpassing expectations.

Inventory balances were also at more optimal levels during the quarter. The cleaner inventory count, down 30% from last year on top of a 20% decline last quarter, spared ANF from having to engage in any significant promotional activities.

The lack of promotions supported strong margin expansion. The gross profit rate, for example, was up 460bps YOY. And operating margins came in at 9.6%, more than double what they achieved in Q2 and far better than the essentially flat showing last year.

Investors were spared any negative commentary relating to theft (“shrink”). No news is certainly good news on this front.

What Is The Outlook For ANF Stock?

The all-around strength enabled the management team to provide positive revisions to full-year guidance. And this is really where the stock earned its post-release bump.

Instead of 2% to 4% growth in net sales that was provided in their Q1 release, ANF is now guiding for sales growth of 10%. In addition, their expectation for operating margins was bumped up to 8% to 9% from a previous outlook of 5% to 6%. And looking at Q3, total net sales are seen up in the low double-digits, with operating margins in-line with their full-year forecast.

The assumption rests heavily on their namesake brand, which is expected to be the primary sales driver, with complementary strength from Hollister. The 26% growth put out in Q2 certainly suggests the company is seeing strong customer receptivity to the brand, as noted by CEO, Fran Horowitz.

Is ANF Stock A Buy, Sell, Or Hold?

Abercrombie provided a lot to be excited about. While the strength in their namesake unit is one story that will be well-documented, the improvements seen in the Hollister brand are just as noteworthy. The return to growth in Q2 was impressive, considering the challenging macroeconomic environment for the teenage customer.

ANF’s broadened apparel offerings also appear to be providing a solid return on investment. In highlighting results, Horowitz pointed to sales of their office-related pants and dresses as an area of strength. Increased return-to-office mandates was one aspect of this. Aside from office attire, sales strength was also seen in their “weekend getaway” outfits. The more diversified offerings may enable further market share gains following gains in Q1.

The margin strength has also been impressive. Unlike others, profitability hasn’t taken a step back from product shrink. This comes even as two-thirds of their Hollister sales are occurring in-store. Margins are also expanding despite increased investments related to their 2025 strategic initiative.

Despite all that there is to cheer, I’d be hesitant to buy into the rally. The management team provided a significant positive revision in guidance, especially on the sales front. While certainly a positive, it naturally elevates expectations. If the outlook sours and ultimately results in a future earnings miss, ANF would likely be over-exposed to a sizeable giveback of their current gains.

Shares are up over 150% in the last year and are sitting at levels not seen since 2011. Their EV/EBIT multiple also sits at around 19x, well-above their five-year average of 13.5x. Though the outlook is positive, ANF is not a bargain for those seeking a discount. And for those seeking to catch the momentum higher, it may be best to wait for a better entry point.

Read the full article here