Nate Chastain, the ex-head of product at NFT platform OpenSea, has been sentenced to three months in prison for profiting tens of thousands of dollars through insider trading of assets showcased on the platform’s homepage.

Chastain, formerly responsible for putting prominent NFTs on OpenSea, was found guilty of fraud and money laundering in May.

He could be sentenced to up to 20 years for each offense as he was convicted in a federal court in New York, marking the conclusion of what prosecutors called the inaugural high-profile case of NFT insider trading.

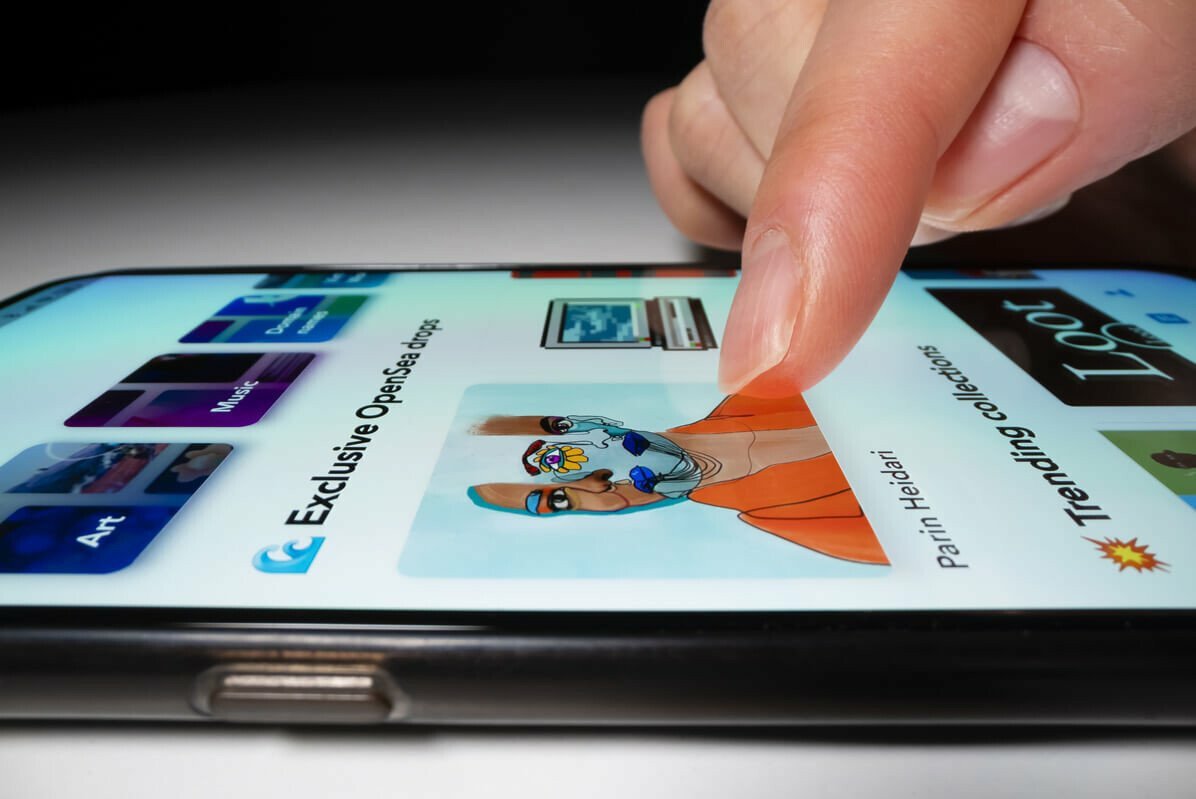

Arrested last June, Chastain earned over $50,000 by trading at least 45 NFTs he knew would be featured on OpenSea’s homepage.

According to the DOJ’s statement following his arrest, he masked his transactions using anonymous wallets and OpenSea accounts to buy and sell upcoming NFTs.

Chastain’s lawyers claimed the case should be dropped because NFTs, distinct digital tokens representing asset ownership like digital art, aren’t considered securities, and Chastain used non-confidential information. The judge disagreed, allowing the case to proceed to trial.

However, his actions had already been exposed on CryptoTwitter.

Before being charged, Twitter users had connected “burner” wallets to Chastain, funneling Ethereum from NFT sales back to his primary wallet.

Notably, his main wallet held a CryptoPunk NFT that served as his Twitter profile picture.

At the time, authorities said it was the first-ever insider trading scheme involving digital assets. He’s since been ordered to return his ill-gotten gains.

Insider Trading Scandal at OpenSea Leads to Arrest and Resignation: NFT Market Impacted

Insider trading involves trading securities using undisclosed information for personal gain, prioritizing profits over responsibilities to one’s employer or the public.

Chastain was arrested after leaving OpenSea in 2021. He was asked to resign by the company for violating its obligations to its community following an investigation.

Back then, OpenSea was the top NFT sales platform. According to his attorneys, Chastain’s equity in the firm, valued at millions, has been forfeited.

Chastain received a shorter sentence than the approximately two-year term recommended by prosecutors, who referenced a prior insider trading case involving Coinbase. The judge justified the leniency due to Chastain’s limited trade profits.

The NFT market peaked at around $40 billion during the offense period.

“Today’s sentence should serve as a warning to other corporate insiders that insider trading—in any marketplace—will not be tolerated,” U.S. Attorney Damian Williams said in a statement on Monday.

According to the DOJ, Chastain will face another three months of home confinement and three years of supervised release after his prison term.

The stated Coinbase insider trading case involved Ishan Wahi, an ex-product manager at crypto platform Coinbase, who was sentenced in May to a two-year prison term for two counts of wire fraud conspiracy.

Wahi and his brother and friend exploited their insider information about upcoming token listings to gain from the “Coinbase effect.”

Following the charges by the DOJ, the Securities and Exchange Commission (SEC) accused Wahi of breaking securities laws in a different case.

These allegations were resolved in May after Wahi admitted guilt in a scheme that yielded $1.1 million in unlawful profits.

Read the full article here