Wednesday’s Bloomberg headline: “Powell to map final steps in inflation fight at Jackson Hole.” Memo to Fed: the fight is over. You won.

Central bankers meeting this week in Jackson Hole likely will be talking about everything but what matters the most: the balance between the supply and the demand for money. Incredibly, our central bankers have failed to notice the monetary elephant in their living room for the past 3+ years.

I’ve been writing extensively about money in the Covid era since October 2020. As I noted back then, strong growth in M2 in 2020 was driven by a huge increase in money demand. That’s why rapid M2 growth wasn’t inflationary in the beginning.

Inflation didn’t start showing up until 2021, when Covid fears began to ease and the economy began to get back on its feet. Rising confidence meant that people no longer needed to hold tons of money in their bank accounts.

Declining money demand at a time of abundant M2 unleashed a wave of inflation. It wasn’t until a year later – March ’22 – that the Fed (very belatedly) took steps to bolster the demand for money by raising short-term interest rates.

Sharply higher interest rates over the past 16 months have had their intended effect: the public has become much more willing to hold on to the huge excess of M2, even as excess M2 has been declining. Falling inflation is the result. Money supply and money demand have moved back into rough balance.

Contrary to all the hand-wringing in the press (e.g., will the Fed need to crush the economy in order to bring inflation down?), and as I’ve been arguing for months, inflation has all but disappeared, even as the economy has remained healthy throughout the tightening process.

There is still plenty of money in the economy. This tightening cycle has been very different from past episodes, because this time the Fed has not had to shrink the supply of bank reserves.

As a result, there is still plenty of liquidity in the market. Swap and credit spreads are correspondingly low, and that implies little or no risk of a recession for the foreseeable future.

Markets are on edge, worrying that the Fed will need to keep rates very high for a long time to come. Those fears are misplaced. It won’t be long until both the market and the Fed realize that lower interest rates have become the big story.

Some updated charts that incorporate the latest M2 release for July:

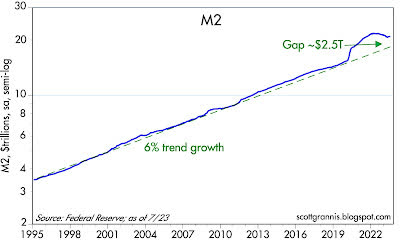

Chart #1

As Chart #1 shows, the M2 money supply continues to follow a path back to its long-term trend (6% per year since 1995). The “gap” between M2 today and where it would have been in a more normal world has fallen by half since its peak in late 2021.

Excess M2 supply is declining at the same as M2 demand has increased thanks to aggressive Fed rate hikes. This implies reduced inflation pressures – which is exactly what we have been seeing.

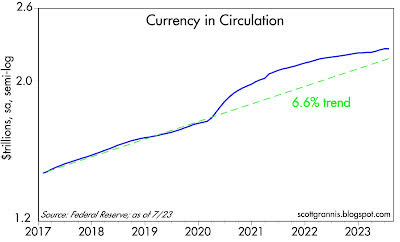

Chart #2

Chart #2 shows the amount of US currency in circulation (this includes all the $100 bills circulating in Argentina, as well as in other countries with unstable currencies).

Currency in circulation is an excellent measure of money demand, since unwanted currency is easily converted into interest-bearing deposits at any bank.

People hold currency only if they want to hold it. Slow growth in currency is telling us that the demand for money is easing – but not collapsing. According to this chart, currency in circulation is only about $70 billion higher than it might have been had the Covid shutdowns and massive government spending not occurred (the 6% trend line has been in place since 1995).

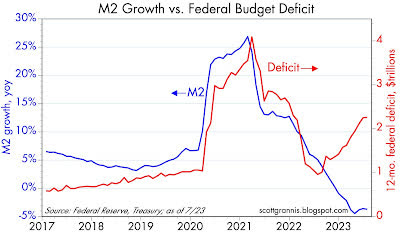

Chart #3

Chart #3 compares the growth rate of M2 to the level of the federal budget deficit. It’s quite clear from this chart that $6 trillion of government “stimulus” spending was monetized. It’s also clear that even as the deficit has again been rising, M2 continues to shrink.

Rising deficits do not pose a risk of rising inflation this time around – at least so far. Rising deficits are being caused almost exclusively by excessive government spending, and that is the problem going forward. Government spending squanders the economy’s scarce resources and saps the economy of energy by weakening productivity growth.

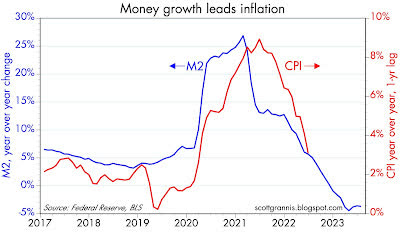

Chart #4

Chart #4 compares the growth of M2 to the rate of inflation according to the CPI. Note that CPI has been shifted to the left (“lagged”) by one year. Thus, changes in M2 growth are reflected in changes in inflation about one year later. Slowing growth in M2 is beating a path to lower inflation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here