Investment Thesis

Splunk (NASDAQ:SPLK), the data analytics company, provides insights and analysis from large datasets.

It delivers a resounding set of results. Before we go further, keep in mind that Splunk reported its fiscal Q2 2024 results, not to be confused with calendar 2023.

Splunk is not a high-growth business. My investment thesis has never been about that. I’m an inflection investor.

As such, I’m seeking a change in the underlying story, from where investors’ expectations are, to where I believe the company is able to move towards.

Accordingly, here’s why I argue that Splunk offers investors a good risk-reward and why paying 17x forward free cash flow for Splunk makes it attractive.

Rapid Recap

In my previous bullish analysis of Splunk, I concluded by declaring,

[…] given Splunk’s upwards revising profitability profile, it looks very likely that in a few quarters’ time, Splunk will be on a run rate of $1 billion in free cash flow.

This would put the big data company at around 17x forward free cash flow. A fraction of the price of Datadog.

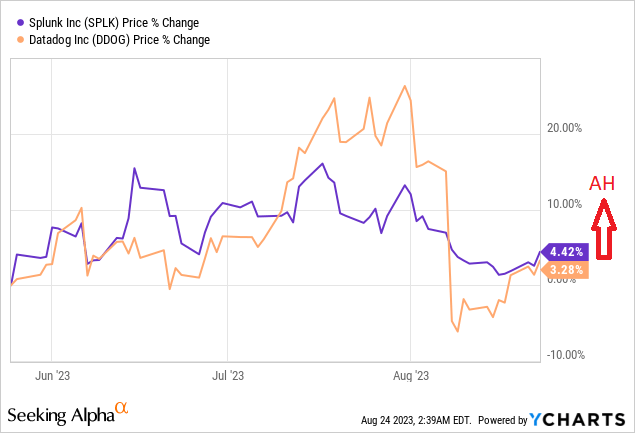

SPLK vs DDOG performance, After Hours jump

Once again, we can see that rhetoric can take a business so far for so long. After a while, valuations start to matter.

Why Splunk?

Splunk helps organizations make sense of their data by collecting, analyzing, and providing valuable insights from it, especially in the realms of operational intelligence. It’s like a data detective that uncovers hidden patterns and issues within massive datasets.

During the earnings call, we heard more details about Splunk AI Assistant, a generative AI-powered tool, that simplifies Splunk’s search processing language (SPL) by enabling natural language queries.

Also heard about Splunk’s continuous progress in security and observability, where it introduced various products and features to provide unified experiences for security, IT, and engineering teams.

Splunk is evidently seeking to regain its former glory and recoup some of the limelight it lost to Datadog (DDOG) over the past three years.

Splunk and Datadog are both technology companies that provide solutions for monitoring and analyzing data in IT, but they have distinct differences.

Splunk is known for its versatile platform that specializes in data analytics, security, and observability. It helps organizations analyze and gain insights from vast amounts of data, making it valuable in operational intelligence. Splunk’s strength lies in its flexibility to handle various data types and its ability to provide deep insights into system and application performance.

On the other hand, Datadog is primarily focused on cloud-based monitoring and analytics. It excels in monitoring the performance of cloud-native applications.

One key difference between the two is their scope: Splunk is more comprehensive, handling a broader range of data sources, while Datadog is more specialized, catering to cloud-based monitoring specifically.

Another distinction is their user interfaces: Splunk is known for its powerful but complex interface, while Datadog offers a more user-friendly.

While both Splunk and Datadog offer valuable monitoring and analytics solutions, Splunk is a robust platform suitable for various observability data types. Datadog, on the other hand, specializes in cloud-based monitoring.

Splunk’s Guidance Takes Investors By Surprise

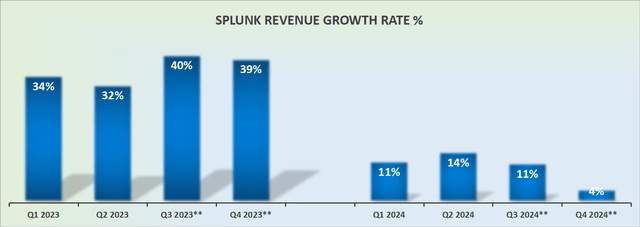

SPLK revenue growth rates

Splunk is not the fastest-growing business. I believe this is important to emphasize. But the message that is even more important to take home is that its hybrid portfolio of both cloud and non-cloud revenues is still growing.

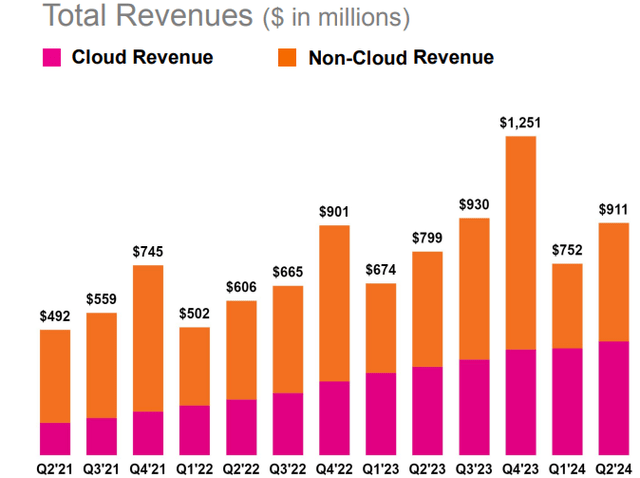

SPLK fiscal Q2 2024

The fact that Splunk’s cloud business is growing is not surprising. After all, it’s not difficult to uproot your on-premise customers to your cloud offering. That’s just cannibalizing your user base and taking from the left pocket to put in the right pocket.

But what is noteworthy is the increase in non-cloud revenues from Q1 2024 into Q2 2024. Why is this important? Because Splunk’s non-cloud business is significantly more profitable. Even if in the long run there’s a secular transition to the cloud, there are still free cash flows to be made from the on-premise business. And this takes us to the next section.

Free Cash Flow Profile Jumps

Looking ahead, Splunk guides for non-GAAP operating margin between 21% and 21.5%, up 300 basis points from previous guidance. But the real icing on the cake is that Splunk anticipates free cash flow of $855 million to $875 million for fiscal year ’24, nearly doubling fiscal year ’23 levels.

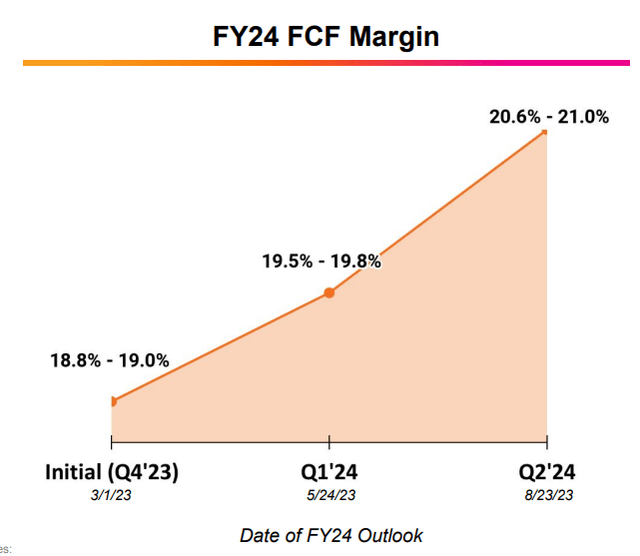

SPLK Fiscal Q2 2024

The graphic shows the progression in free cash flow margin guidance that Splunk has made since the start of 2023. While countless other data monitoring companies are struggling to match the expectations they had at the start of 2023, Splunk is actually rapidly increasing its free cash flow guidance.

This reinforces my contention from my previous analysis. It’s only a matter of a few quarters before Splunk is able to annualize $1 billion in free cash flow.

Splunk is still, even now, being priced at approximately 17x forward free cash flows. I stand by my investment thesis, this is a really cheap multiple for a company that is clearly turning around its operations, and determined to reignite its growth profile.

The Bottom Line

In my analysis of Splunk’s Q2 2024 results, I see that Splunk, a data analytics company, is not focused on high growth but rather on inflection points in its story.

Splunk’s core strength lies in helping organizations extract valuable insights from large datasets.

During their earnings call, they highlighted their Splunk AI Assistant, a generative AI-powered tool for simplified data queries. They are making strides in security and observability, aiming to regain the spotlight lost to Datadog over the past years.

Splunk’s Q2 results show growth in both cloud and non-cloud revenues, with continued progress on its more profitable non-cloud business.

The company’s free cash flow is on an impressive upward trajectory, which makes Splunk’s stock, priced at approximately 17x forward free cash flow, an attractive investment opportunity given Splunk’s determination to reignite its growth prospects.

Read the full article here